By: A Special Correspondent

August 28, Colombo (LNW): A contentious issue has recently emerged surrounding the importation of BYD electric vehicles into Sri Lanka, with allegations surfacing that these vehicles were cleared through Customs by paying significantly reduced taxes.

The central allegation concerns the misrepresentation of motor capacity for the purpose of tax calculation. Specifically, it has been claimed that certain vehicles, originally manufactured with a motor capacity of 150 kilowatts, were declared as having only 100 kilowatts when presented to Sri Lanka Customs. This alleged understatement has reportedly led to a tax shortfall of approximately Rs. 3.6 million per vehicle.

John Keells CG Auto (Pvt) Ltd., the official importer of BYD vehicles into Sri Lanka, responded by asserting that, although the vehicles are indeed manufactured with 150 kW motors, the output is electronically limited to 100 kW via firmware adjustments made by the manufacturer. Therefore, they argue, no misrepresentation has occurred.

The issue initially came to light with the BYD ATTO 3 model, but it was later alleged that the same discrepancy applies to several other BYD models as well.

Sri Lanka Customs, however, has taken a firm stance on the matter. Officials have stated that, under the existing legal framework, they are only concerned with the actual motor capacity installed in the vehicle, regardless of whether the power output is artificially limited through software or firmware.

Based on this interpretation, Customs detained 991 BYD vehicles at the port and formed a technical committee, with assistance from the University of Moratuwa, to independently verify the motor capacities of the vehicles in question.

In response to the impasse, John Keells CG Auto (Pvt) Ltd. filed legal action seeking the release of the detained vehicles. The case is currently ongoing. Meanwhile, an agreement was reached before the court to allow the temporary release of the vehicles upon the provision of a bank guarantee equivalent to the disputed tax amount — approximately Rs. 3.6 billion.

The incident sparked significant discussion across traditional media and social media platforms, particularly among stakeholders with an interest in electric vehicles. The importer’s representatives argued that the Customs Department should have accepted the motor output value provided by the vehicle manufacturer, and calculated taxes based on the reduced, firmware-limited output. They contend that the appointment of a technical committee to inspect motor capacity was unnecessary.

Conversely, critics of the importer’s position emphasised that Sri Lankan regulations clearly stipulate that taxes are to be calculated based on motor capacity as physically installed in the vehicle. According to them, relying solely on manufacturer-provided figures, particularly when subject to modification via software, could open the door to widespread tax evasion.

The broader context of this dispute is significant. Vehicle imports were banned in Sri Lanka for several years due to economic constraints, but the ban was lifted on 31 January 2025. The legal framework governing this change was established by Gazette Notification No. 2421/43, issued on the same date.

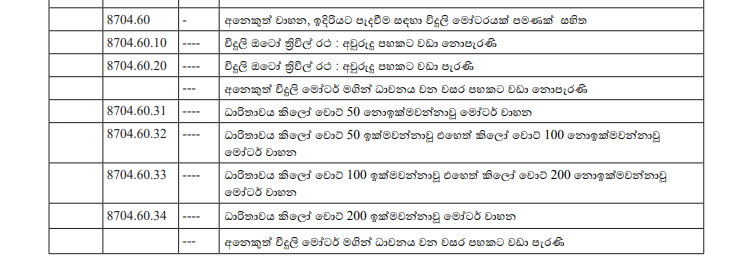

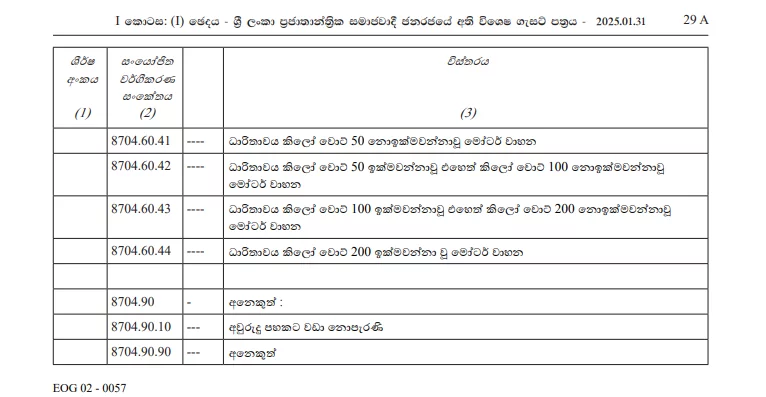

Under this Gazette, imported vehicles are classified under HS code 8704.60, described as “Other vehicles, powered only by an electric motor.” The tax structure is tiered based on motor capacity, with specific categories such as:

“Motor vehicles with a capacity exceeding 50 kilowatts but not exceeding 100 kilowatts” and

“Motor vehicles with a capacity exceeding 100 kilowatts but not exceeding 200 kilowatts,” among others.

It is evident that the law refers explicitly to “motor vehicles” and defines taxation based on motor capacity — not on modifiable power output or software-limited performance. The term “electric vehicles” is not used within the relevant regulatory text, and no provision exists to consider reductions in motor output achieved through firmware alterations. Accordingly, Customs’ decision to appoint a technical committee to ascertain actual motor capacity appears consistent with the law.

Arguments about how these vehicles are treated in other jurisdictions, such as Singapore or Nepal, are immaterial to the Sri Lankan regulatory context. The only relevant consideration remains the actual motor capacity of the vehicles as physically installed.

Given the nation’s current economic goals, the rationale behind lifting the import ban was to generate much-needed tax revenue in rupees. This revenue is vital to achieving long-term financial stability and supporting public welfare initiatives. If vehicles are allowed to bypass the intended tax structure by citing software limitations, the primary objective of reopening vehicle imports — that is, substantial revenue collection — would be undermined.

Ultimately, this situation involves billions of rupees in potential tax revenue — revenue that is essential not just for fiscal planning, but for the broader economic wellbeing of the Sri Lankan people.