LISTEN TO STORY

WATCH STORY

By: Staff Writer

February 17, Colombo (LNW): The Vehicle Importers Association of Sri Lanka (VIASL) has strongly criticised recent statements by Deputy Minister Dr Anil Jayantha, cautioning that proposed adjustments to the Social Security Contribution Levy (SSCL) could significantly inflate the tax burden on imported vehicles.

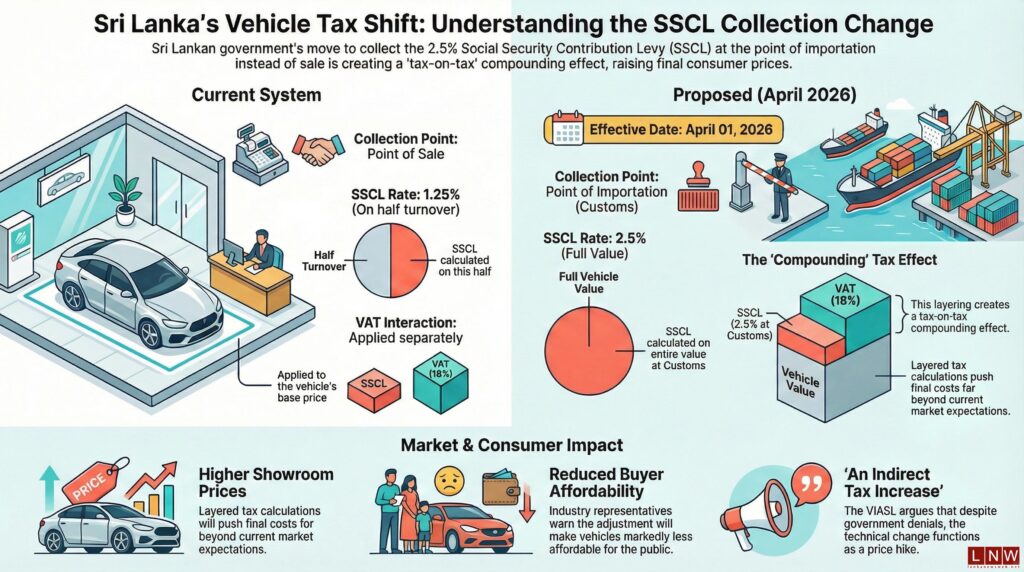

The controversy centres on the Government’s plan to alter the point at which the 2.5 per cent SSCL is collected. At present, the levy is effectively reduced to 1.25 per cent, as it is calculated on half of a company’s turnover under Inland Revenue regulations and applied at the point of sale. Under the proposed system, however, the full 2.5 per cent would be charged upfront at the time of importation.

Industry representatives argue that the change would have a compounding effect. Because the SSCL paid at Customs would be incorporated into the taxable value of the vehicle, it would subsequently be subject to 18 per cent Value Added Tax (VAT). According to the Association, this layered calculation would push up the final cost of vehicles far beyond what consumers might expect.

In a statement, the VIASL maintained that while the Government insists no fresh tax has been introduced, the practical outcome of the revised collection method amounts to an indirect increase. “The broader implications have not been clearly communicated to the public,” the Association said, warning that both importers and buyers could face unexpectedly higher prices.

Interestingly, the Association acknowledged that it had previously proposed collecting SSCL at the point of import in order to prevent one-off personal importers from circumventing the levy. However, it contends that the current proposal goes further than anticipated by altering the calculation base and thereby amplifying the overall tax impact.

Dr Jayantha, addressing the media earlier, dismissed suggestions of a new tax as unfounded, describing such claims as attempts by certain market players to create unnecessary alarm. He reiterated that the Government’s intention is merely to streamline the collection mechanism rather than impose additional fiscal measures.

Nonetheless, with the revised system scheduled to take effect from April 01, 2026, importers warn that the cumulative effect of SSCL and VAT could markedly raise the total customs duty payable on vehicles. They caution that the adjustment, though technical in appearance, may ultimately translate into higher showroom prices and reduced affordability for prospective buyers.