This article is to reveal the documentary proof of the policy irregularity in the Treasury bill issuance on 31 May.

Irregularity in T bill issuances on 31 May

- In my blog article on June 7, I revealed a policy irregularity in issuance of T bills worth Rs. 200 bn at the auction held on 31 May and a resulting loss of at least 2.5% on the issuance to public funds. A total of Rs. 200 bn against the offered Rs. 160 bn was accepted.

- The loss occurred as the Tender Board determined to keep the weighted average yield rates on all three maturities of T bills at same levels of the previous week’s issuance .

- The loss occurred as the Tender Board did not reduce yield rates although information was available with members of the Tender Board that policy interest rates would be cut by 2.5% (from 16.5% to 14%) by the Monetary Board in the same day after noon consequent to drastic disinflation trend reported.

- As a result, the loss was accumulated at several subsequent issuances although yield rates were reduced in lags to policy rates cut.

- This policy irregularity helped dealers to make an insider profit at a loss to public funds.

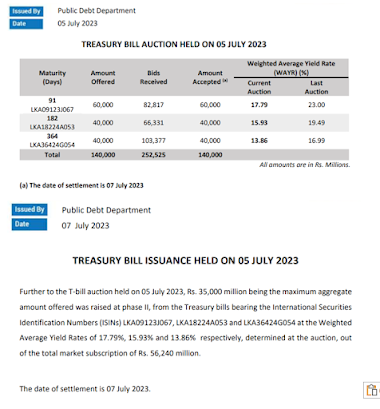

T bill issuance on 5 July

- Rs. 175 bn was accepted against Rs. 140 bn announced as fiscal conditions were tight.

- 27 June, policy rates decision by the Monetary Board was advanced to 6 July from 13 July announced earlier. However, the decision had been further advanced to 5 July abruptly without any notice to the public. Speculations were everywhere that another significant policy rate cut would be implemented due to faster disinflation path. Inflation had fallen to 12% in June from 25.2% in May (disinflation more than doubled). I released a blog article on 4 July speculating at least a 5% policy rates cut, given favourable macroeconomic developments in numbers.

- Accordingly, policy rates were cut by another 2% to 12% on 5 July.

- As the Tender Board had the inside information on the monetary policy decision to be taken (date earlier announced to be on 6 July), yield rates at this T bill issuance were significantly reduced by 3%-5% across the three maturities, i.e., more than the policy rate cut announced. Therefore, the Tender Board as required in its mandate used prevailing circumstances and information to make the issuance decision.

Concluding Remarks

- Circumstances relating to both T bill issuances were same.

- The Tender Board decision to reduce yield rates on 5 July proves beyond doubt that its decision on 31 May for not reducing yield rate was a material irregularity causing an avoidable loss to public funds.

- Criminal proceedings instituted against the CB Governor and several officials in relation to T bond auctions held on 27 February 2015, 29 March 2016 and 31 March 2016 were based on such losses to public funds alleged due to the issuance of bonds in excess of the offered amount despite consideration of circumstances prevailing on tight fiscal conditions and rising interest rates as a direct result of the monetary policy tightening (policy rates hike and absorption of market liquidity through repo auctions). Present CB Governor and several high ranking officials are in the state witness list.

- Circumstances prevailing on T bill issuance on 31 May were the very tight fiscal conditions well-known and the relaxed monetary policy (policy rates cut on the table and injection of liquidity to the market through reverse repo auctions).

- Therefore, the Tender Board not reducing yield rates despite prevailing circumstances while accepting bids in excess of the announced amount at the auction held on 31 May is a proven irregularity of criminal nature as it has caused an avoidable accumulated loss to public funds (i.e., discounts given to dealers) similar to losses alleged on the three T bond auctions stated above.

Therefore, it is the public duty of audit, supervisory and law enforcement authorities to investigate into T bill issuances from May and July 2023 and to institute criminal proceedings on the avoidable loss on T bill issuance on 31 May. The media reported that a complaint has already been lodged with the Bribery Commission.

Public concerns also are raised on CB’s domestic debt management unsustainability caused by issuances of T bills and bonds at yield rates around 25% to 32% since April 2022 amounting to a gross total around Rs. 15 tn.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Source: Economy Forward