This article is an update of the article series on CB’s monetary policy operations to cover the year 2023. The article

- provides highlights on money printing operations and resulting money market outcomes favourable to wholesale money dealers,

- covers only domestic monetary operations as CB’s foreign currency operations also are captured in domestic monetary operations which are designed to neutralize the impact of foreign currency operations on the domestic currency liquidity at levels desirable to the CB, and

- raises serious concerns over the appropriateness and governance of the present monetary policy model to recover the economy from the bankruptcy caused by the monetary policy itself.

However, the policy story of inflation control by the monetary policy operations was not covered in the article as it is only a fictitious and tribal economic concept not proved by real world data in any country. If central banks were capable of controlling inflation as enumerated, the world should not have been pushed into three-decades high and persistent inflationary pressures since the beginning of 2022.

As monetary operations are responsible for providing a stable and sufficient monetary sector to suit real sector needs of the economy, it is the duty of the general public to question whether such monetary operations have performed their public duty. Therefore, this article also provides a guidance in this regard.

Monetary Operation Instruments – 2023

The main monetary operation instruments used in 2023 are listed below.

- Policy interest rates (SDFR and SLFR)

This is the policy rates corridor which is expected to limit the variability of overnight inter-bank interest rates. Therefore, policy rates are the prices charged on printing of money from the air in computers at zero variable cost.

- Money printing

Standing facilities, reverse repo lending, intra-day liquidity facility and direct/primary purchase of Treasury bills are the major printing operations. As they change the supply of reserves, the CB can manipulate their prices/interest rates to influence inter-bank interest rates.

- Statutory Reserve Ratio (SRR)

This is the regulatory instrument used to affect the flow of usable reserves of banks and thereby inter-bank interest rates.

Monetary Operation Highlights – 2023

- Policy interest rates

- Policy interest rates were raised by 1% to 15.5%-16.5% in March and then reduced four times in total of 6.5% to 9%-10% from the end of May.

- The Monetary Policy Board (MPB) at the last meeting held on 23 November has signaled a pause in the policy rates cut cycle in view of the space available for market interest rates to decline further.

- However, policy rates-based monetary policy model has collapsed from 16 January 2023 as the CB has severely restricted financial facilities offered at policy rates.

- It is hard to understand why the CB charges such high interest rates on just printing of money from the air without any variable cost. The confusion goes mad as the central bank of Turkey raised its policy rate to 42.5% last month while it is 133% in Argentina.

- Standing facilities

- These are overnight facilities provided to keep the variability of overnight inter-bank interest rates within the policy rates corridor. However, as the CB has capped these facilities from 16 January, the fixed policy rates corridor-based policy model has been dormant.

- Caps are the restrictions on the deposit facility (SDF) to five times/days a month and the lending facility (SLF) to 90% of the SRR for each bank. This is nothing but rationing of the supply at controlled prices. Therefore, standing facilities have failed to serve their job.

- As such, the facilities window has been highly irregular and dormant not showing any meaningful monetary policy purpose.

- Reverse repos

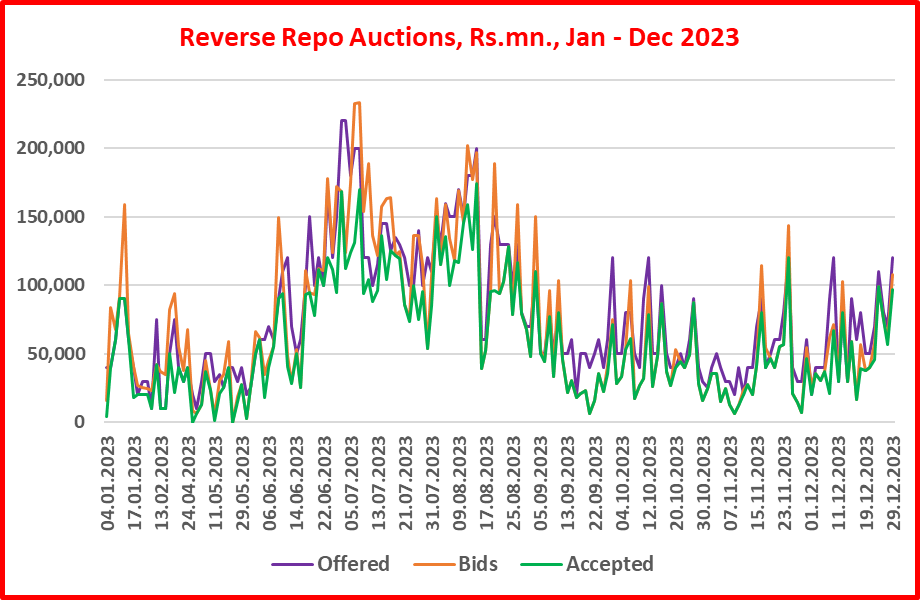

- As standing facilities have not been available to neutralize inter-bank rates, the CB has been abundantly using reverse repo auctions to supply reserves to the banking system in order to serve the job of policy interest rates. In this regard, both overnight and term reverse repos up to a term around 89 days have been offered whereas three auctions have been conducted in some days.

- Altogether, 257 auctions with an average of Rs. 54 bn. have attracted an average bidding of Rs. 49 bn with acceptance of an average of Rs. 40 bn. Therefore, data show abundance of offers due to erroneous calculation of the bank demand for reserves.

- Given the role envisaged from policy interest rates and standing facilities to target the overnight inter-bank rates, the use of reverse repos to play the same role is highly questionable, especially the criteria, rationale and internal controls used to offer and accept various reverse repos (from overnight to 89 days) and to determine their rates.

- For example, the offer of overnight reverse repo rates well below the SLFR despite both facilities are on same terms cannot be explained in economics or finance. As a result, banks have pocketed a profit margin of 40-95 basis points (59 basis points on average) on overnight reverse repos which is a loss to public funds caused by the policy error. Total overnight reverse repos accepted being Rs. 7,389 bn in 2023, the loss is around Rs. 12 bn. Further, overnight reverse repo rates are lower than call money rates too in contrast to inter-bank market repo rates prevailing above call money rates.

- In addition, the offer of 7-day reverse repos at SLFR or below does not support the monetary policy in any economics. Accordingly, a loss to public funds exists on total 7-day reverse repos offered amounting to Rs. 1,470 bn. in 2023.

- Statutory Reserve Ratio

- A SRR cut by 2% to 2% on 08 August was effected to free nearly Rs. 200 bn of reserves to commercial banks. However, its impact on inter-bank interest rates is not recognizable.

- The CB’s intension at that time was to drive market interest rates down. However, its failure is evident from subsequent policy rates cuts by 2% in two times and the issuance of monetary order on 25 August requiring banks to reduce interest rates on all credit products.

- Purchase of Treasury bills

- Up to the restructuring of CB credit (provisional advances and Treasury bills) to the government on 21 September, the CB’s direct subscription to Treasury bill issuances has been the key source to supply reserves to the economy through monetary financing of the budget deficit.

- Its key objective has been to control Treasury bill yield rates in line with monetary policy requirements. The Treasury portfolio of the CB is the good indicator of the magnitude of this monetary intervention.

- The spike of the Treasury portfolio on 21 September is due to the conversion of provisional advances of Rs. 344 bn into government securities (Treasury bills and bonds). However, the recent reduction in portfolio by about Rs. 100 bn seems to be the prematurely redemption of Treasury bills through proceeds of new borrowing from the Treasury bill market although restructured Treasury bills worth Rs. 220.8 bn are due to mature during 2024.

- It is noted that, if not for this source of money printing, the non-availability of adequate monetary reserves would have severely depressed the economy because the CB does not have a safer clientele for lending of reserves in such magnitudes in the present monetary system. Therefore, the CB has to find a new mechanism to supply reserves to banks and the economy when those restructured Treasury bills and bonds mounting to Rs. 2,713 bn mature from 2024 through 2038.

- Alternatively, the new CB legislation can be amended to permit lending to the government in line with monetary principles followed by other central banks including central banks in developed countries. Therefore, political authorities have to assess future macroeconomic risks underlying the new CB legislation before the second round of the present economic crisis touches down, given chronic issues confronted in present recovery efforts.

- Intra-day liquidity facility

- Banks and primary dealers extensively use this facility provided by the CB free of interest repayable within the day to fund their daily liquidity requirements. However, information is not publicly available over the use of facility.

- Its significant quantum is evident from 2022 data. Accordingly, a daily amount of nearly Rs. 658 bn has been used.

- Overall money printing/reserve supply

- Overall position of reserve supply operations through standing facilities and trade of government securities (reverse repos and outright sale) has been highly volatile. Up to September, this mode of reserve supply has been limited due to abundant supply of reserves through CB’s direct purchase of Treasury bills. Therefore, the CB has to expand this mode aggressively as the option of lending to the government has been severely restricted by new legislation and IMF.

- Reserve supply operations do not go with the policy rates story. For example, the rate cutting cycle has to go with rising supply of reserves to drive market interest rates down. However, data show a contradiction as reserves supplied on both overnight basis and outstanding/accumulated basis have declined significantly towards the end of the year. Therefore, the governance underlying monetary operations is highly questionable.

Money Market Outcomes – 2023

- Inter-bank overnight market (Call money and repos)

- The macroeconomic objective of the monetary operations is to stabilize overnight inter-bank interest rates (operating target) within the policy rates corridor. However, some pattern in this direction is seen only from August, but no stability is observed. Further, market repo borrowing rate remaining closer to the SLFR but above unsecured call money rate is a principal issue. Therefore, a clear market aberration is observed due to non-existence of an effective policy rates corridor as a result of capped standing facilities. This raises a concern as to what the present monetary policy model and its macroeconomic role are.

- Call money volume has been low mostly below Rs. 10 bn without any trend or stability. Although the same is largely true for inter-bank repo borrowing, irregular spikes are observed as banks have opted to resolve urgent liquidity issues through repos. These banks may be financially weak banks which do not get access to call money due to issues in inter-bank trust. This could be the reason why repo rates remain closer to the SLFR above the call money rate since September.

- The low activity in the inter-bank market is a reflection of weak lending conditions in the economy due to the rising bed of non-performing loans and severe macroeconomic contraction. The low profile of inter-bank market activity also indicates the ineffectiveness of the present monetary policy model that targets the inter-bank market for so-called policy transmission across the economy.

- Treasury bill market

- Treasury bill market has been the clear victim of the monetary operations as it is the main conduit used by the CB to supply reserves while controlling yield rates in line with monetary policy requirements. This is due to the high magnitude and activity of this market as compared to the very low key of the inter-bank market which is the CB’s officially operating target of the monetary policy. Therefore, the de-facto operating target of the monetary policy has been the Treasury bill market. This has not only hampered the financial market development and inclusion but also prevented the fiscal discipline pushing the government eventually to default and bankruptcy.

- It is clearly evident how the CB conducts public auctions to manipulate yield rates to support monetary policy cycles. The yield rates significantly were pushed and kept over-shoot above the policy interest rates during the monetary tightening cycle. In contrast, they are kept flat during the easing cycle which does not have a valid monetary policy story other than monetary insider acts. The reluctance to reduce yield rates during last four months is not explainable. In fact, the CB kept yield rates unchanged on 31 May knowing the first policy rate cut of 2.5% same day causing nearly Rs. 5 bn loss to public funds. The acceptance of bids well beyond the amounts announced for auctions and post-auction placement window also have pushed yield rates up unnecessarily. As a result, the cost to the government due to manipulated yield rates is seen largely instrumental in the present plight of the unsustainability of both debt service and tax income.

- Risks in terms of cost and rollover are seen significant as the majority of issuances involves in shorter-tenure bills, especially 91D maturity.

- Therefore, it is high time that the government takes over the debt management function to ensure its fiscal independence as the CB has miserably failed it causing the debt unsustainability and default. In an insightful analysis, the accounting-based monetary policy that has used government short-term foreign debt, especially international sovereign bonds, development bonds and currency swaps, to finance the import dependent economy is responsible for the present economic crisis.

Monetary Operations in Figures – 2023

The Table below presents selected quarterly statistics of monetary operations and money market outcomes in 2023 for further analysis by readers.

Concerns, Recommendations and Way Forward

- Highlights and information presented above raise questions as to who benefits from the present model of monetary operations and what its role is for the bankrupt economy.

- Its only benefit is the supply of reserves to wholesale money dealers through reverse repo auctions abundantly arranged to cover up their lapses in liquidity management in the guise of banking/financial stability. Instead, the stability has to come from bank business model risk management and macroeconomic fundamentals. That is why banks confront contagious panics from time to time in front of central banks despite so-called prudent monetary and supervisory policies.

- Given discernible irregularities, an investigation is necessary on policy governance and internal controls relating to auctions of Treasury bills and reverse repos with special emphasis on determination of Treasury bill yield rates and reverse repo rates as Treasury bill yield rates have been kept inflated while reverse repo rates have been kept down.

- In modern monetary economies, macroeconomic recovery and sustainability are possible only through a wider credit insurance and distribution-based monetary policy model as evident from all developed countries in their historic development path. Therefore, Sri Lanka cannot expect any trickle down effects from the present money dealer-based supply of reserves for the recovery from the bankruptcy. Its only outcome will be the further concentration of economic benefits among those who are blessed with low-risk credit created by banks while pushing the majority of the public into the poverty in the current context of the macroeconomic management system.

- Nowadays habit of many national leaders and economists is to plant various stories of macroeconomic recovery and prosperity models. However, nobody reveals or proposes how those models are financed as they don’t bring own funds for the purpose. Therefore, nobody seems to understand the urgent need for reform required to the credit creation and delivery system in line with modern monetary and supply side economics. Instead, every body talks about more and more laws and regulations because they don’t have any idea of how laws and regulations suppress markets and hamper the recovery.

- The short analysis above shows that the present monetary operation policy in Sri Lanka is nothing more than a day job of a set of CB bureaucrats subject to several governance concerns. Therefore, the general public cannot expect any benefits from CB’s monetary operations in the new year 2024 and beyond.

Therefore, it is proposed that relevant policy-making authorities seriously consider innovating the country’s monetary system to fund the recovery of the economy across the sectors and activities if they are really interested in the recovery and humanity at least during their generation.

However, despite all highlights, concerns and recommendations presented above, the CB Annual Report for the year 2023 will state that the prudent and forward-looking monetary policy along with policy measures implemented by the government in 2023 have stabilized the economy and brought down inflation to a lower single digit which will facilitate the recovery of the economy in the medium-term under the IMF financial programme.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Source: Economy Forward