Article’s Background

This article provides highlights on central bank operations on money printing during 1st 8 months of 2024. Earlier, I have been releasing articles on monetary operations (Read it here).

Therefore, I redesigned this article to provide an overall assessment of monetary operations and monetary policy focusing on domestic price stability being the primary goal of the central bank.

Key observations and recommendations are as follows.

- Money printing operations are ad-hoc actions to provide reserves to banks and to purchase proceeds of govt. foreign loans.

- Re-dollarization of the monetary system on govt. foreign loans-based foreign reserve is evident.

- Data do not support the flexible inflation target story of the monetary policy.

- Therefore, the next government must seriously assess whether this is the model of money printing and monetary system the country needs to support the recovery from the present economic crisis and development of the economy and living standards by mobilizing sector-wise domestic resources to generate a foreign currency surplus.

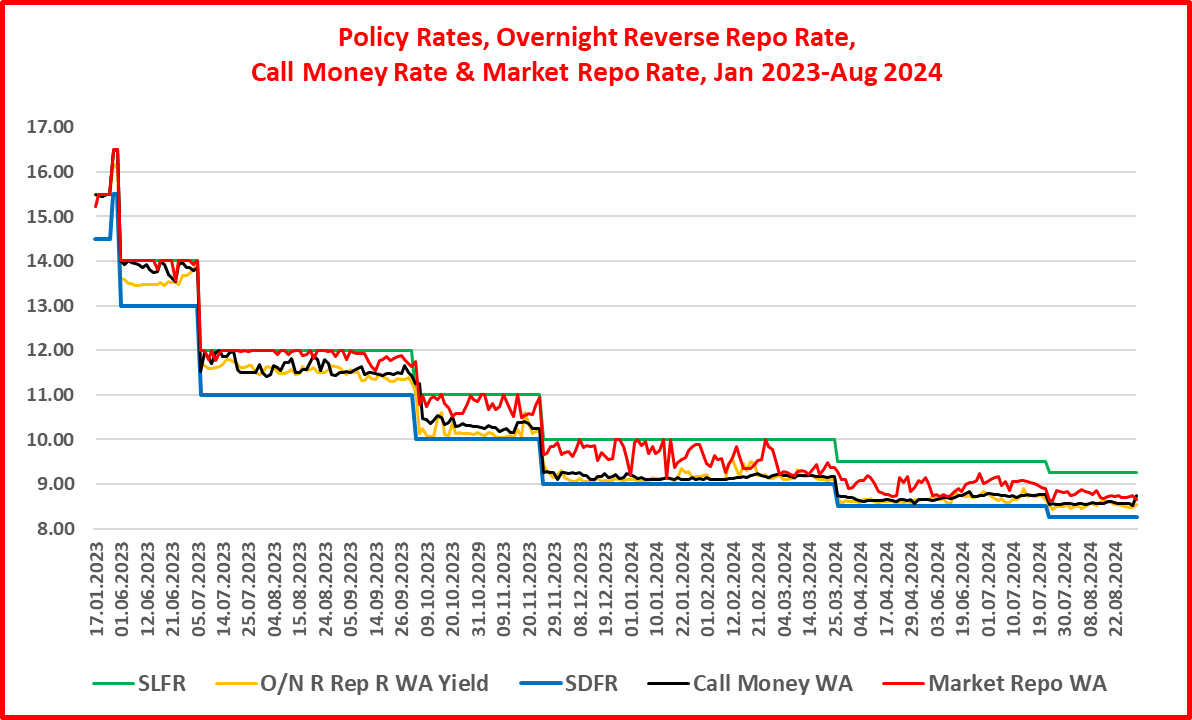

Policy interest rates

Policy rates were cut twice by a total of 75 bps, i.e., standing deposit facility rate (SDFR) to 8.25% and standing lending facility rate (SLFR) to 9.25%. Accordingly, the CB injected further reserves to the economy on the top of the prevailing excess liquidity. The latest policy rate cut of 25 bps is the 6th cut in the preset rate cutting cycle that commenced in May 2023 (so far a total of 7.25%).

Statutory reserves

Reserve ratio remained at 2% since August 2023 reduced from 4%. However, SRR is not an active instrument of monetary operations.

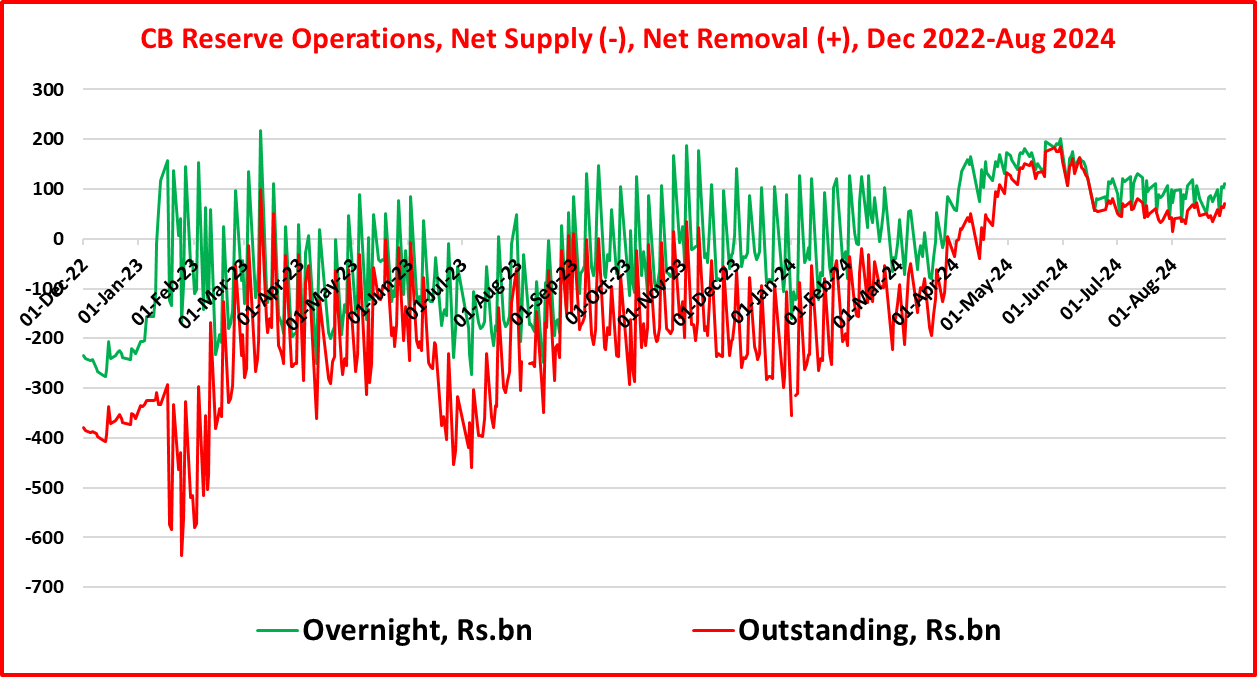

Injection of fresh reserves

Since early 2023 reverse repo auctions have been the major source. Accordingly, a total of 197 auctions injected nearly Rs. 6 trillion on auction of Rs. 7.3 trillion through open market operations (OMO). The intra-day interest free reserves borrowed from the CB immensely facilitate the use of reserves without affecting market interest rates. However, the CB does not release daily information. According to the CB’s Market Operations Report, the daily average for the first half of the year is Rs. 412.3 bn.

Therefore, standing lending facility, despite it being the key monetary policy variable, has become dormant so far during the year. With the removal of monthly limit on the access to standing deposit facility window, banks have increasingly used the window to park their excess reserves daily at the CB for risk free interest income.

However, overall domestic OMO has resulted in a removal of reserves from the banking system as shown by the positive liquidity or reserve position on overnight as well as outstanding basis. This means that the overall bank reserve position is not commensurate with the present policy rates cutting cycle.

Inter-bank overnight market

OMO has been carried out to drive inter-bank overnight lending rates closer to the lower bound of policy rates corridor. The reverse repo auctions have been the major conduit used for this purpose while keeping the role of standing lending window almost dormant. Therefore, the rationale for the preferred level of inter-bank overnight lending rate and underlying money printing is highly questionable.

Foreign currency operations

In general, the core of reserves are the CB credit to the government and purchase of foreign currency proceeds on foreign loans to the government. However, since last September foreign loans have become the key source of CB’s foreign currency operations as the credit to government has been suspended.

As a result, CB’s foreign reserve increased by US$ 1,260 bn to US$ 5,652 bn at the end of July. This has led to a BOP surplus of US$ 1,823 bn resulting an injection of fresh reserves around Rs. 555 bn on CB’s foreign currency operations. Accordingly, the exchange rate has declined 7.4% by the end of August in this year. The currency appreciation could have been greater if the CB had allowed the inflow of new foreign debt to be traded in the market.

Weekly Treasury bill auctions

The CB’s key conduit of driving money market interest rates in line with monetary policy needs is the setting of yields of weekly auctions of Treasury bills. Yields have dropped to the policy rates corridor in May and June where yields showed an upward movement in July and August.

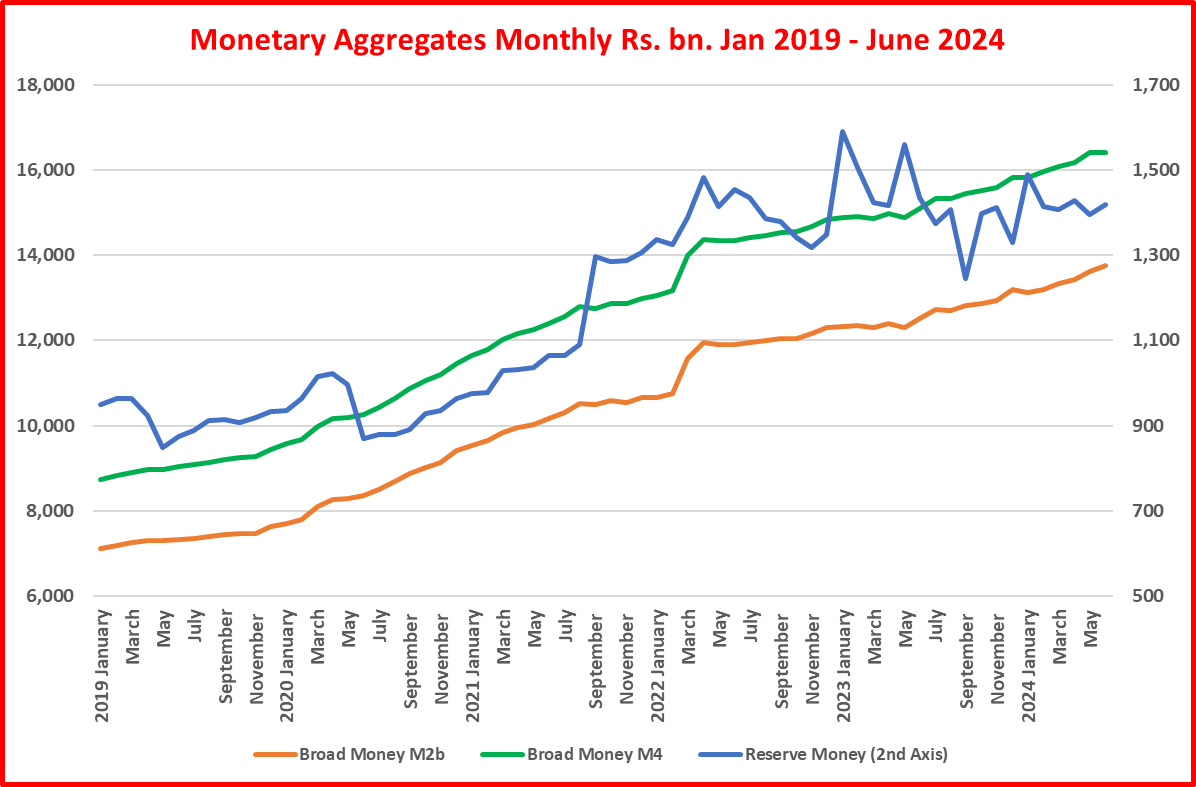

Monetary aggregates

Irrespective of the monetary policy cycles, money supply has consistently grown at varying rates, generating the new liquidity to fuel the aggregate demand expansion. Irregular declines in reserve money shows that markets have economized reserves to fund the monetary expansion in 2024 so far. Therefore, the irregularity of changes in reserve money is a serious concern over the stability of the money and financial system.

In the CB’s monetary policy, the foreign reserve or the purchase of govt. foreign debt has now surpassed the govt. domestic credit to print money which was the opposite during the crisis period 2022 and 2023. The suspension of CB credit to the government since September 2023 is a major contributory factor. However, nearly Rs. 2.5 trillion of face value of such credit (nearly 45.7% of CB assets) remains in the monetary system.

OMO irregularity and loss to public funds

At many auctions, overnight reverse repos have been offered at interest rates lower than SLFR although both instruments are of same credit quality and terms. The interest loss to the CB is around Rs. 9.6 bn for the 1st 8 months of 2024 and Rs. 20.3 bn from January 2023.

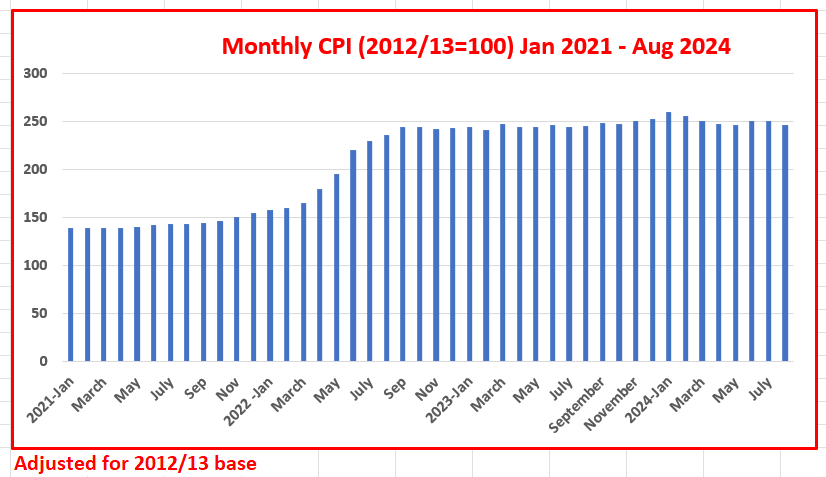

Maintenance of domestic price stability

CB’s objective for the domestic price stability is the quarterly average of the percentage increase of the Colombo Consumer Price Index (CPI) targeted at 5% with a margin of plus or minus 2% which is termed as the flexible inflation target. Accordingly, the inflation target used for the monetary policy is the quarterly average of CPI inflation within 3%-7%.Therefore, this is only an statistical exercise which has nothing to do with domestic price stability for maintenance of the cost of living or stable prices. A few relevant comments are as follows.

- Consumer prices remain at elevated levels significantly above the pre-inflation period. Therefore, the significant disinflation path of the headline inflation to 0.5% in August is an illusion of the domestic price stability. Despite the significant policy rates cutting cycle, the annual inflation also tends to fall below zero. Therefore, the CB’s inflation target has been violated for the past five months below the lower bound of 3%.

- If the CB’s monetary policy concept is right, inflation will be significantly negative in the near future when the full transmission of recent policy rate cuts is felt on the aggregate demand and prices. This will be a gross violation of the monetary policy requirements. However, to get consumer prices back to pre-inflationary cost of living period to ensure the price stability in the real economy requires further policy rate cuts closer to zero bound.

- Overall, data connected with money printing, money supply and prices as highlighted above are not consistent with movements of inflation although the CB states that the monetary policy is exclusively data dependent. Therefore, the flexible inflation target story of the current monetary policy framework is not a viable proposition for Sri Lanka.

Overall remarks

- Highlights made above show that money printing operations are ad-hoc actions to provide reserves to banks and to purchase proceeds of govt. foreign loans.

- The shift of money printing from domestic credit to the government to the purchase of foreign loans as shown by the CB’s assets structure is the evidence for the re-dollarization of the country’s monetary system after the foreign currency and default crisis in 2022. This is an early signal of another economic and currency crisis in few years to come.

- Therefore, the new government to be elected with the next President after 21 September must seriously assess whether this is the model of money printing and monetary system the country needs to recover and develop the economy and living standards by mobilizing sector-wise domestic resources to generate a foreign currency surplus.

Otherwise, this country will continue to be trapped in loan-based dollarization without funding for the development of the real sector.

This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Source: Economy Forward