For the first time in history, Sri Lanka yesterday (12) declared it will temporarily default on its foreign debt services in its inability to repayment.

Commenting on the situation, Governor of the Central Bank of Sri Lanka (CBSL) Nandalal Weerasinghe told media that Sri Lanka has completely lost its capacity to foreign debt repayment. He added that the plug has been pulled in the event that there is a debt due on April 18 and the consequences could be worse if it was not repaid without prior notice.

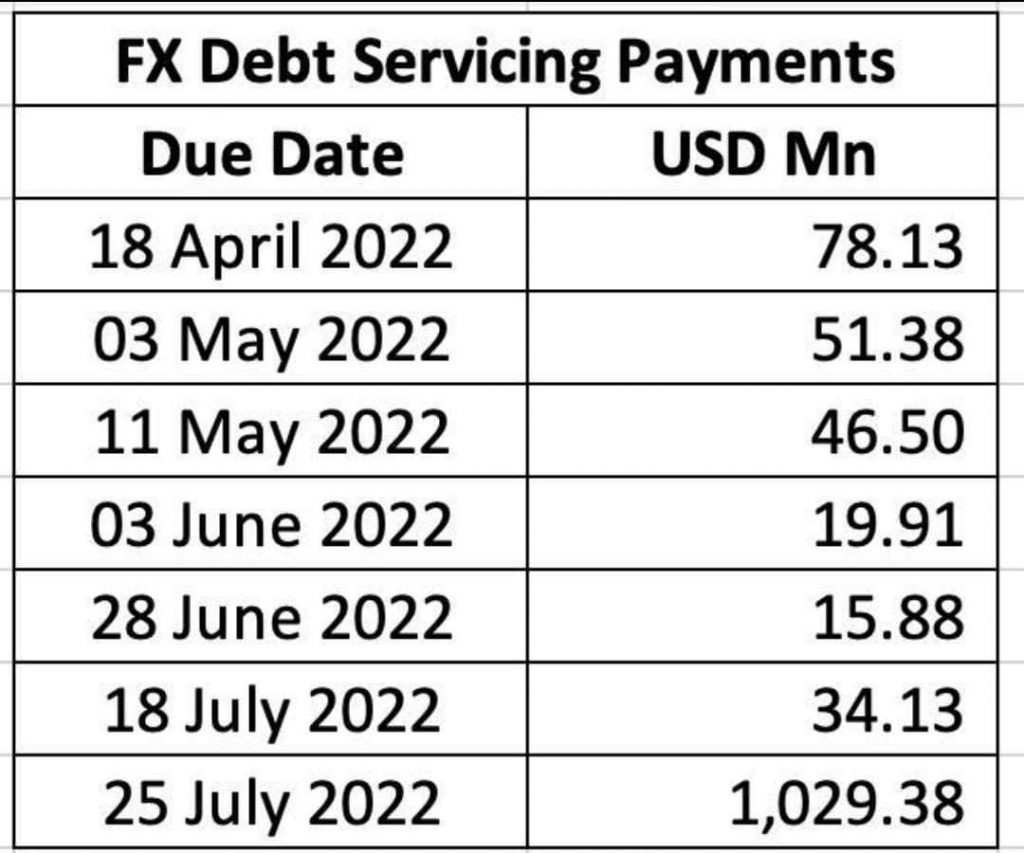

Further investigation into the event revealed that the so-called debt due on April 18 is a repayment of only US$ 78 million, behind which five instalments of, even more surprisingly, a lower value are due. A debt of heavy weight US$ 1029.38 is due on July 25.

There is no argument to the truth that US$ 78 million is a huge amount. Nevertheless, Sri Lanka is a state of twenty two million people and not one man’s business deal, considered of which there is still space for the argument that an amount of that value shall not influence such a far-fetched decision to declare debt default. Simply put, US$ 78 million does not even satisfy a week’s fuel supply to the country.

Sri Lanka has been repaying its foreign debt instalments in the manner of obtaining more debt over the recent period at least at a step behind the curtain of shame. But now that a ‘debt default’ has been announced, Sri Lanka has turned itself into an astronaut’s vessel being subjugated to self-destruct in the middle of deep space. In layman’s terms, Sri Lanka has unofficially announced itself bankrupt.

Economists of Opposition like MP Dr. Harsha De Silva and economy critics on Social Media giving popularity to the argument that money shall be used for consumption urged the government not to use them for debt repayment. The new CBSL Chief might have also endorsed this popular opinion. On the other hand, it is seemingly easier to declare that there is no money for debt repayment than to look for them somewhere.

Had Sri Lanka repaid the US$ 78 million debt along with other instalments at least assisted by other countries and stakeholders, had it not been so quick to declare a debt default, however at submission to hardship, it might have been able to obtain the Chinese debt of US$ 2200 by July 25. Had Sri Lanka passed that hardship, we might have been able to continue our international fiscal relations as a nation free from ‘bankruptcy’. But the government’s unexpected announcement yesterday declaring a debt default stemmed the Fitch Ratings to ‘monitor the downgrading of 13 public and private banks in Sri Lanka.’ Sri Lanka is now at the verge of being sucked into a blackhole in space.

Had the government been able to reach a definite understanding with the International Monetary Fund (IMF) before such a far-reached announcement that it would suspend debt services, had it been able to negotiate with the creditors and initiate a restructuring process, the situation might have been kept above water.

But that was not what has happened.

On the other hand, the new CBSL Chief’s conduct has been appreciated by Opposition MP Dr. Harsha De Silva. If truth be told, the government over the past two months has been doing what Silva was suggesting. Therefore, it would be more appropriate for Governor Weerasinghe to take over the responsibility of the Ministry of Finance at some agreement in Parliament, instead of preaching the shortcomings pleasuring the Opposition, for the responsibility of these actions must be borne by the experts who forecast the solutions themselves.

Right-to-Reply:

Our platform is open for anyone’s comment in this regard with no censorship, should you choose to provide any, as we value the golden policy of Right-to-Reply.