By: Isuru Parakrama

July 08, Colombo (LNW): The Central Bank of Sri Lanka (CBSL) has announced the auction of Treasury Bonds amounting to Rs. 200 billion, scheduled to take place on Friday (11).

The move is part of the government’s broader debt management strategy aimed at raising funds through domestic financial markets.

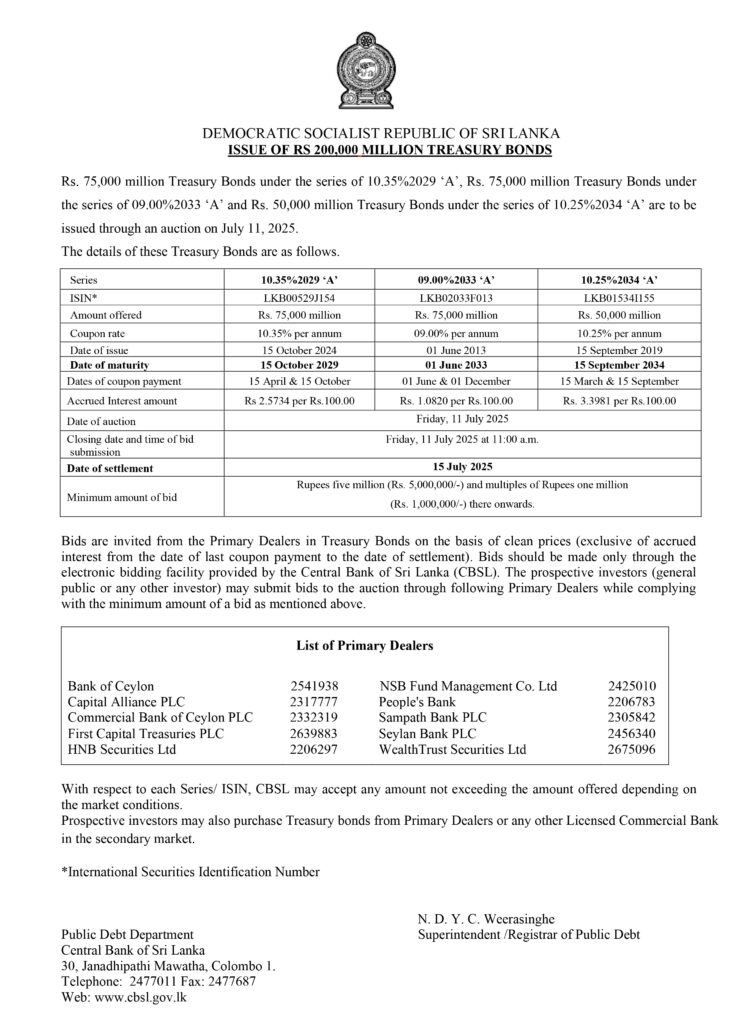

According to the official notice issued by the Public Debt Department of the CBSL, the auction will comprise three series of Treasury Bonds: Rs. 75 billion under the 10.35%2029 ‘A’ series, another Rs. 75 billion under the 09.00%2033 ‘A’ series, and Rs. 50 billion under the 10.25%2034 ‘A’ series.

Investors are invited to submit bids through registered Primary Dealers using the electronic bidding platform provided by the Central Bank.

The bonds will be issued on a clean price basis, excluding accrued interest, which ranges from Rs. 1.08 to Rs. 3.39 per Rs. 100, depending on the series. Settlement of the bonds is scheduled for July 15, 2025. The bonds carry annual coupon rates of 10.35%, 9.00%, and 10.25%, respectively, with semi-annual interest payments.

The Central Bank has reserved the discretion to accept bids for amounts below or up to the full value offered for each bond series, depending on prevailing market conditions. Interested investors, including members of the public, may participate in the auction through the following authorised Primary Dealers: Bank of Ceylon, Capital Alliance PLC, Commercial Bank of Ceylon PLC, First Capital Treasuries PLC, HNB Securities Ltd, NSB Fund Management Co. Ltd, People’s Bank, Sampath Bank PLC, Seylan Bank PLC, and WealthTrust Securities Ltd.

Each bid must be for a minimum of Rs. 5 million and thereafter in multiples of Rs. 1 million. Bids must be submitted by 11:00 a.m. on July 11.

Investors also have the option of purchasing Treasury Bonds in the secondary market through Primary Dealers or any other Licensed Commercial Bank.