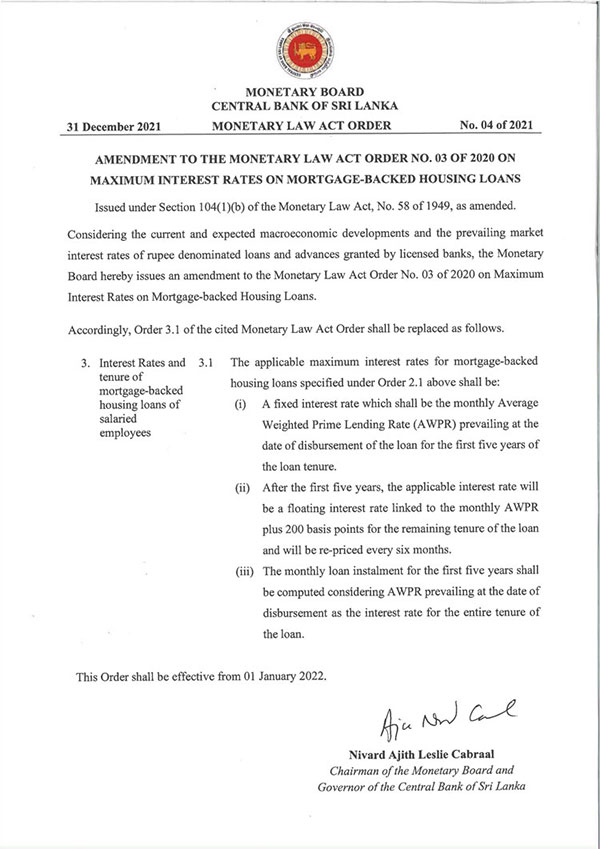

The Central Bank of Sri Lanka (CBSL) has issued a new directive regarding the maximum interest rates that can be charge on mortgage-backed housing loans, effective from January 01, 2022.

The order has been issued by CBSL Governor Ajith Nivard Cabraal on the directives of the Monetary Law Act.

The new directive stipulates that housing loans must have a fixed interest rate for the first five years and that the interest rate thereafter must be a floating rate that adds up to 200 basis points per month to the Average Weighted Prime Lending Rate (AWPR).

The figure should be reviewed every six months, the directive added.