With the country facing the most challenging times marred with steep unprecedented inflation, severe foreign exchange crisis, highly volatile international oil prices, threat of new COVID variants and fears of global recession, the operational environment has been full of uncountable bottlenecks.

Notwithstanding the economic crisis , highly volatile international oil prices and fears of global recession, Lanka Indian Oil Corporation’s(LIOC’s) performance during the Q1 22-23 has been remarkable , company officials said.

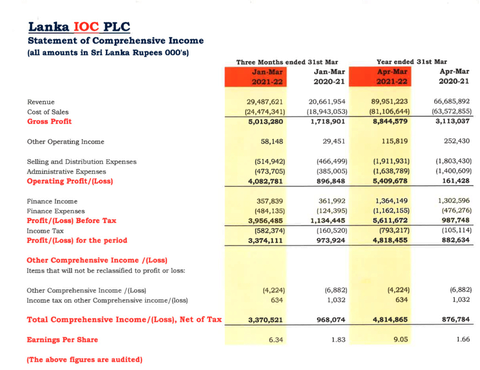

with an increase in revenue by nearly 196% Y-o-Y from Rs. 16.86 billion to Rs. 49.93 billion mainly on account of high cost of product, in view of steep rise in international oil prices.

The Sales volume of the company also increased to 139,762 MT from 135,354 MT on a Y-o-Y basis. With Net Profit after Tax at Rs. 9.93 billion, the Earnings per share of the company increased to Rs. 18.64 in Q1 22-23 as against Rs. 0.51 in Q1 previous year reflecting Q1’s robust performance.

However, the incessant devaluation of currency from Rs. 299 to Rs. 367 per $ coupled with extremely high borrowing costs, raising the finance expenses during the quarter to Rs. 1792 million as against Rs. 123 million Y-o-Y, significantly affected Q1’s performance and remains an area of concern, being uncontrollable.

Describing the robust performance, LIOC Managing Director Manoj Gupta said: “The company ventured into a new line of business of selling diesel directly to Sri Lanka industries in dollars .

These included export houses, tourism services providers registered under Sri Lanka Tourism Development Authority, licensed telecommunication service providers and Power Generation Companies.

The collection in $ eliminated the exchange rate risk and allowed sale of fuel to industries at a predetermined price.

“On the other hand, it met the essential fuel requirement of innumerable industries which are responsible for the livelihoods of millions of employees and their dependent family members.

It is beyond imagination to believe the repercussions in case fuel requirements were not met on time he added.

LIOC workforce at Trincomalee Terminal had round the clock operation of the terminal for more than three weeks with limited resources to supply fuel not only to industries but also to ensure supply of 7500 MT of diesel to CPC for onward dispatches for essential services, he disclosed.

Company’s Bunkering business has registered strong exceptional performance, the main contributor has been the exchange gain in view of depreciation of currency, as the sales take place in $.”