The objective of this short article to provide my quick comments on the CBSL press note “CBSL sets record straight on money printing” published in Daily FT 4th November as a response to an anonymous press note “New CBSL regime prints more money than the former” published in Daily FT 31st October (see the notes at the end of this article).

The anonymous press note stated just one point. The CBSL has printed Rs. 691 billion at an average of Rs. 3.4 billion per day during the tenure of 203 days of the present Governor so far as compared to Rs. 446 billion at an average of Rs. 2.2 billion during the entire tenure of 203 days of the predecessor. Therefore, the money printed during the predecessor’s tenure is 54% less than the tenure of the present Governor.

Therefore, press note gives a numerical fact to which the CBSL’s counter response could have been one short paragraph of few sentences. However, the CBSL has released a technical note of about 3 A4 pages. If this note had been submitted to the Governor A S Jayawardena for approval, his remarks would have been “yanne koheda malle pol (යන්නෙ කොහේද? මල්ලෙ පොල්) reply.”

By going through the CBSL response, I feel that the CBSL economist who drafted the note would have attempted to satisfy himself although he himself did not understand its contents. The same is true for the Governor too as no CBSL press notices are issued without the approval of the Governor.

Key points observable in the CBSL press note are as follows.

- Money printing is measured by the estimate of Reserve Money. However, the money printing cited in the anonymous press note is incorrect as it refers to the change in the Treasury bill holding of the CBSL.

- During the tenure of the present Governor, Reserve Money (or money printing) has declined by Rs. 8 billion during April to September 2022. However, Reserve Money grew significantly by Rs. 297 billion during the period from September 2021 to March 2022 including the impact of statutory reserve ratio (SRR) adjustment in September 2021, that has contributed to increase reserve money only by about Rs. 170 billion.

- The CBSL under the present Governor has been able to contain the unwarranted expansion of money and credit and, therefore, inflation has commenced moderating as envisaged.

- A detailed account of vague information has been given to singularly blame the former CBSL Governor for the present economic crisis. However, the economy is now gradually recovering under the present Governor.

My Comments on selected contents in the CBSL press note

When the contents are technically perused, much unwanted information bought in by the writer to show his knowledge of economics reflects the poor quality in his economic analysis other than an attempt largely with political motives to criticize the former CBSL regime/leadership.

My technical comments are given below under selected contents of the CBSL press note. However, several contents were disregarded due to the space limitation in this article and irrelevance to the main topic contended.

Content 1

- Quantification of money printing based on the change in the CBSL’s holdings of Government securities is incorrect, as it reflects only one aspect of money printing. Rather, professional economists would know that the complete picture of money printing is reflected by changes in reserve money.

- Reserve money grew significantly by Rs. 297 billion during the period from September 2021 to March 2022 including the impact of statutory reserve ratio (SRR) adjustment in September 2021, that has contributed to increase reserve money only by about Rs. 170 billion.

- Under the current leadership, reserve money has, in fact, contracted by Rs. 8 billion during April to September 2022 despite the increase in holdings of Government securities by the CBSL.

My Comments

- The CBSL writer should have stated this in simple words at the beginning in one short paragraph and discredited the anonymous allegation. However, that also could raise several criticisms due to technical/economic aspects of money printing.

- The money printing in Sri Lanka nowadays is known by economists as well as the general people as the purchase of Treasury bills (government securities) by the CBSL. The reason is the loss of inflows to the foreign reserve of the CBSL which was the major source of money printing (reserve money) in the past. In technical analysis, the reserve money level is a sum of net foreign assets, net credit to government and net other assets of the CBSL.

- The decline in reserve money under the present Governor is due to valuation effect of the exchange rate/currency depreciation on the CBSL foreign currency liabilities where its foreign currency assets/reserve remain dormant at the rock bottom (negative net foreign asset value rising) plus decline in net other assets of the CBSL. The fact of the matter is the net foreign assets and net other assets are not policy variables at present and, therefore, present money printing is a pure result of the increase in net credit to government mainly by the purchase of Treasury bills which is also not a policy variable, given the insolvency-threatened government. For example, the share of Treasury bill holding in total assets of the CBSL has steadily risen to 70.7% in August from 67.7% in March 2022 and 6.6% in December 2019 as against the sharp decline of the foreign reserve ratio in the total assets from 78.7% to 21.9% correspondingly (see chart below). Therefore, the decline in reserve money or money printing cited in the CBSL press note is only a casual momentary event as the CBSL does not have a discretionary control over it. As such, the current reference to money printing in market analyses as the increase in Treasury bill holding of the CBSL is not technically incorrect.

- As reserve money figures are published only for month-ends, the CBSL open market and financial operations have the ability to drive the month-end figures (or window-dressing) to some extent as wished. If the daily average for each month is considered, the picture could be different. Therefore, the IMF in the resent past imposed targets on reserve money and foreign reserve based on quarterly averages.

- In internal analyses and public communications, the CBSL generally uses Y-o-Y growth of reserve money. In the past three years up to May 2021, there has been no trend in the reserve money growth (see two Charts below). In fact, there has been negative growth in many months. However, since June 2021 the growth reported has been in the range of 21% to 45.5% due to the CBSL Treasury bill holding. The growth reported in April 2022 is 43.7% and has decelerated to 6.4% in September from 27.3% in August 2022. The decline from 27.3% to 6.4% over a month is not a discretionary outcome. Further, monthly reserve money level has got ups and downs from time to time in the past. Therefore, the statement of decline in reserve money by Rs. 8 bn since April 2022 is a sheer act of the writer to deceive the public.

- Central banks in the present era do not consider reserve money when making monetary policy decisions. It is only another monetary statistics of old text book fashion. They consider changes in financial conditions in the economy and sectors in response to changes in policy interest rates along with the size and structure of their balance sheets. As such, reserve money now is an outdated concept used in 1950s and 1960s in elementary money multiplier model-based monetary targeting frameworks.

- The comparison of the change in reserve money during the 4 months of the present Governor with the 6-month period of the former Governor is inappropriate in both arithmetic and policy analysis. The CBSL press note itself states that “macroeconomists should adopt a holistic view to assess the implications of policy across economic cycles – as this is not another accounting exercise.” Therefor, the CBSL writer who claims to be a macroeconomist also has engaged in a narrow accounting exercise.

- It is technically inappropriate to state that SRR adjustment has contributed to Rs. 170 bn of increase in reserve money during the period of the former Governor. The change in SRR is not a factor in the reserve money as it does not change total bank reserves. The adjustment in the SRR by the CBSL causes only an accounting change between bank cash reserve at hand and bank cash reserve at the CBSL without a change in total bank reserve.

- Finally, if the present CBSL regime believes that reduction in reserve money is good for the control of inflation, I wonder why the regime does not conduct open market operations with the aim of reducing reserve money at least by 50% to bring back inflation to 4%-6% target from 70% at present. Instead, it was reported that the CBSL injected nearly Rs. 90 bn through long-term reverse repos on 4th November against Rs. 100 bn announced. Therefore, the claim of decline in reserve money by Rs. 8 bn in September may not hold any ground today.

Content 2

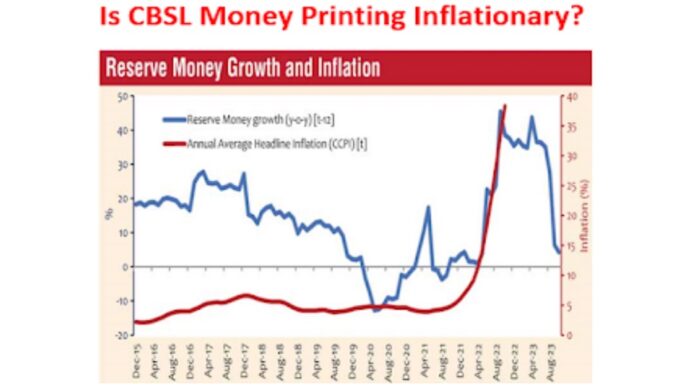

The CBSL note carries a graph (as given below) at the beginning without any economic analysis or clarification connected to it. The graph depicts Reserve Money growth (Y-o-Y)(t-12) and Annual Average Headline Inflation (CCPI)(t) for the period from December 2015 to September 2023.

My Comments

This graph shows the pathetic situation of the CBSL economists at present due to following facts.

- The graph has not been used in the CBSL press note to present any economic findings during the reference period.

- It appears that the write attempts to establish a relationship between Annual Average (Moving Average) CCPI Inflation at the current month with the 12-month lagged Y-o-Y reserve money growth possibly because the writer has been advised to find a way to depict the present hyper-inflationary pressures (in 2022 so far) as a result of growth of reserve money during the corresponding period in 2021. This is a highly unprofessional and malicious attempt.

- First, modern monetary policy does not believe in such a relationship between inflation and monetary statistics such as reserve money and money supply. Second, the period from December 2015 to April 2022 does not depict any such relationship in the graph. Third, the use of Annual Average CCPI Inflation in the graph against monetary policy consideration of CCPI Y-o-Y inflation is bizarre. Fourth, the intension to keep the reserve money growth (Y-o-Y t-12) in the chart beyond September 2022 up to September 2023 without any forecast for corresponding inflation is not clear, given extensive macroeconomic modeling exercises carried out by the CBSL economists.

Contents 3

- It is, without doubt, true that CBSL’s intervention when the pandemic unfolded was necessary to prevent the economy from falling into a crisis. However, the monetary stimulus that was unleashed on the economy was not unwound on time as the pandemic-related concerns eased.

- Rather, the ‘former CBSL regime’ grossly overused money printing without paying heed to the need for improving the underlying macroeconomic fundamentals. This led to the rapid expansion of money and credit in 2021. In short, the macroeconomic policy mix was flawed.

My Comments

Those are views just used to allege the former CBSL regime without established facts.

- Monetary stimuli were provided in all countries led by central banks in developed market economies. However, no central bank has unwound them so far as the pandemic-related concerns were fully eased and unwinding is a gradual process. However, almost all central banks have now begun hiking interest rates to tighten financial conditions in view of 3-decade high inflation pressures whereas their balance sheet size reduction is planned over the time. For example, the US Fed’s balance sheet rose by 114% since the end of 2019 right up to April 2022 but the reduction since April 2022 so far is negligible as the increase still stood at 109%. Further, although the increase fell to 105% at the end of August 2022, the balance sheet has again risen by 2% or USD 172 bn by the end of October 2022, despite the Fed’s quantitative tightening policy.

- Underlying macroeconomic fundamentals have not been defined and described in the CBSL press note to assess whether money printing has been overused. Again, money printing and money supply are not macroeconomic policy variables used by modern central bank regimes.

- Nobody knows the correct macroeconomic policy mix. Therefore, allegation over the flaw of macroeconomic policy mix is inappropriate as the correct policy mix is not set out in the CBSL press note.

- The rapid expansion of money and credit is not a result of money printing in Sri Lanka. It is due to the increase in state sector credit creation by the banking system. Even money and credit expansion so far in 2022 is due to state credit expansion. The CBSL cannot prevent it by the control of money printing or other monetary policy tools.

Content 4

- This was the era of “denial” and “false hopes”, where basic economic relationships and fundamentals were misinterpreted.

- The relationship between money and inflation, and the cons of continued money printing were openly refuted; a gradual adjustment in the exchange rate was unallowed; aggravating underlying issues in the country, obvious even to the international community, were downright downplayed and denied…..

My Comments

- The writer has not stated what are the basic economic relationships and fundamentals that were misinterpreted because interpretations always vary as economics is not a natural science. Even in natural sciences, subject experts form new hypotheses on relationships and factors agaist the old and carry out experiments.

- The relationship between money and inflation is only an old monetary hypothesis, but inflation in modern open economies is a result of dynamic factors and not because of money per se. Everybody knows the current global inflation is a result of supply side factors and energy prices. Historically high inflation in Sri Lanka at present is mainly due to the chronic shortage of imports and excessive currency depreciation as a result of the collapse of the foreign currency reserve at the CBSL which is a miserable monetary policy failure of the CBSL. Central banks adopt monetary policy as a blind policy tool to affect the demand side of the economy, not because it has the full control over inflation. If world monetary policies had the control over inflation, the world today would not have confronted such a 3-decade high inflationary pressures. Governments also adopt several fiscal tools to ease the price pressures and cost of living.

- The present CBSL regime also does not allow exchange rate to adjust and manipulates the exchange rate by various unlawful means. If the rate adjustment had been permitted, the exchange rate would have risen above Rs. 400-500 as there is no foreign currency reserve and surplus inflows.

- The present CBSL regime has caused bankruptcies across the economy by following advice of so called international community by defaulting on debt, raising interest rates to historic highs and private sector deprived of bank credit.

Content 5

- Unlike in the previous regime, the current leadership has been transparent and truthful about the way forward, including the extent of financing Government’s budget deficit through purchase of Treasury bills by the CBSL, but continued to highlight the need for the same at the current juncture to prevent Government shutdown and hardships on the public.

- Compared to the current regime, the previous regime bought Treasury bill to provide rupees to the Treasury in order to bail out external creditors using the CBSL foreign reserves. However, the current regime, despite providing funds to the Government to meet essential requirements, has taken prudent policy measures to contain the expansionary impact of money printing – by significantly tightening monetary policy.

My Comments

- Transparency and truthfulness indicated above are just words whereas the CBSL Governor has been making various comments without research at various media interviews and appearances.

- The Governor immediately after assuming the post on 7 April stated that he would reduce money printing professionally and independently by reducing the size of Treasury bill holding of the CBSL. However, while he was increasing its, he introduced a new unlawful method to print money through the purchase of Treasury bills outside weekly auctions whenever the Treasury confronts cash deficits. Total printing or purchase of Treasury bills under the new method is about Rs. 558 bn for 26 days so far.

- The CBSL current leadership has never highlighted the need for the purchase of Treasury bills at the current juncture to prevent government shutdown and hardships on the public. The Monetary Law Act (MLA) does not provide for money printing to provide funds to meet government essential requirement and prevent government shutdown and hardships on the public. The government shutdown is a political governance and fiscal subject and not a subject for the monetary policy or the CBSL. The MLA provides for the grant of provisional advances in such instances subject to several limits, i.e., each such advance be repaid within sic months and total of all such advances outstanding should not exceed 10% of the estimated government revenue for the current fiscal year. Therefore, until the government is able to raise new taxes and foreign loans, the current CBSL regime will have to print further money through the purchase Treasury bills for prevention of government shutdowns, despite the so called tight monetary policy.

- Although the CBSL press note stated that prudent policy measures have been taken to contain the expansionary impact of money printing by significantly tightening monetary policy, no such prudent measures are known. Only the measure known is the historic rise in interest rates causing the government interest rates to rise to 30%-33%. This has caused private business bankruptcies and threatened the solvency of banking sector. Recently, the President stated the need to restructure all state and private banks in order to rescue bankrupt private sector businesses.

- Therefore, it is clear that the current CBSL regime does not show any difference in printing of money carried out by the former CBSL regime except the printing by the current CBSL regime has phenomenally increased.

Content 6

- But today, as a result of those carefully-executed and timely corrective policy measures, the CBSL has been able to contain the unwarranted expansion of money and credit, and inflation has commenced moderating as envisaged.

- Economic conditions have gradually improved compared to six months ago – fuel queues have normalized, shortages have come down, stability has set in, and slow but gradual progress is observed.

My Comments

- Money and credit figures are highly distorted due to the excessive currency depreciation since March 2022 and, therefore, unwarranted expansion must be described. As already presented, money and credit is not a tool to affect inflation in modern monetary economies. Although the CBSL new regimes talk about moderating inflation from the peak, the Fed Chairman at the last monetary policy press conference (held on 2nd November) stated that the Fed does not have a scientific way to determine whether inflation is entrenched.

- The present economic conditions are not because of the monetary policy of the new CBSL regime. It is purely due to disappearance of fuel ques, thanks to private developers who introduced the fuel rationing QR code. As a result, economic activities have commenced. However, the fact of the matter is the economy is bankrupt with nearly 10% of contraction projected in 2022 whereas the monetary policy does not show any signs of rebuilding the foreign reserve and appreciating the currency so that the economy can come back with disinflation.

- Everybody knows that the present economic crisis is a direct result of the failure of the CBSL to manage its foreign currency reserve, government debt and exchange rate. The present Governor led it for nearly 15 years although he now passes the blame to the former Governor. In fact, he led the former Governor for 8 years (2006-2014) and other three Governors to follow same macroeconomic model trap of government foreign debt-based foreign currency and exchange rate control.

Concluding Remarks

Overall, the CBSL press note has been unnecessarily and politically victimized by getting into unwanted details on money printing rather than responding direct to the issue of excessive money printing raised in the anonymous press note.

It is highly pathetic that the CBSL is separated between the former regime/leadership and the current regime/leadership based on the change of the Governors. I feel very sorry for the internationally trained professional economists to have different policy views and opinions as soon as the Governor changes. In fact, the present Governor and all leading economists of the present CBSL have grown up with the generous helping hand of the former Governor during a long span of 8 years. The present Governor is the leading international economist who got the most privileges in CBSL history by working with and contributing to the former Governor. Therefore, this CBSL press note is largely reflective of possible post-personal conflicts that the present Governor may have got with the former Governor. It is highly unpublic that high ranking public officials use their public powers to victimize those who follow conflicting views and policy tools in democratic governance systems.

Macroeconomic management is not a divine subject that has clear-cut policy tools and actions to suit unknown risks and shocks such as the Corona pandemic and geopolitical developments. Present global inflation as well as Sri Lankan economic crisis are largely results of such shocks.

Therefore, I am lost in understanding how the writer of the CBSL press note and the present CBSL Governor have reached such an inferior level both personally and professionally in responding to a technically valid fact cited in the anonymous press note relating to money printing by the CBSL.

Finally, this press note is clear evidence against the standards and practices expected from internationally qualified professional macroeconomists of the CBSL.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles published)