• Invites the private sector to play greater role

President Ranil Wickremesinghe said that the government is looking at removing the para-tariffs and the tariffs over five years, with a trade adjustment programme to help industries and manufacturers meet competition, adding that from the government side discussions have been initiated with the World Bank and the Asian Development Bank (ADB). He said that now it is up to the private sector to decide how they are going to relate to it. He said that the private sector would have to decide whether they are going to put up the red flag of protection and take the government on or if they are going to open up.

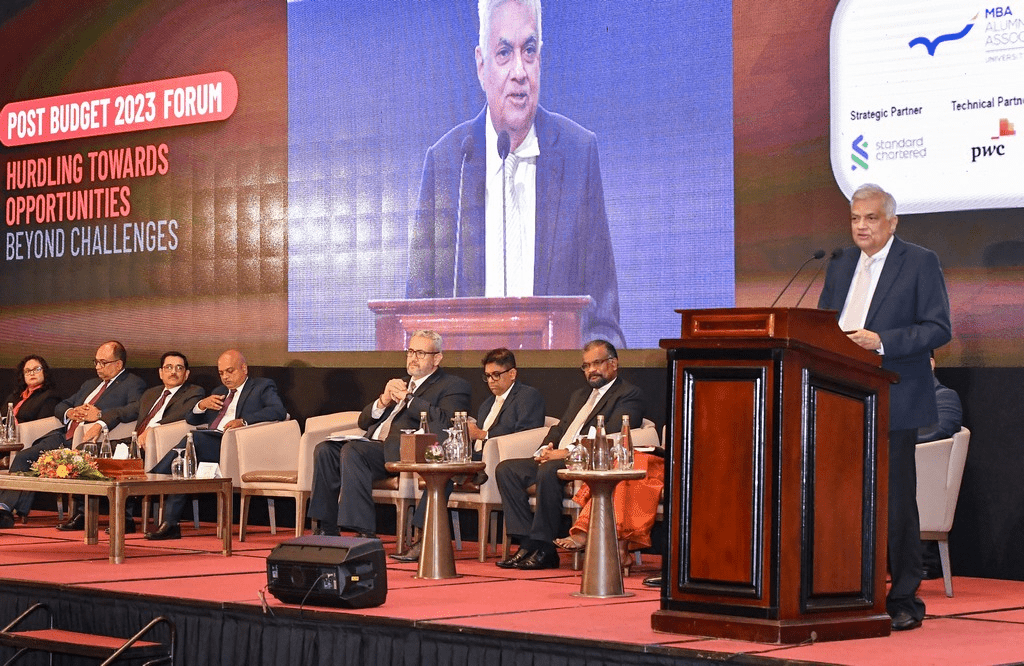

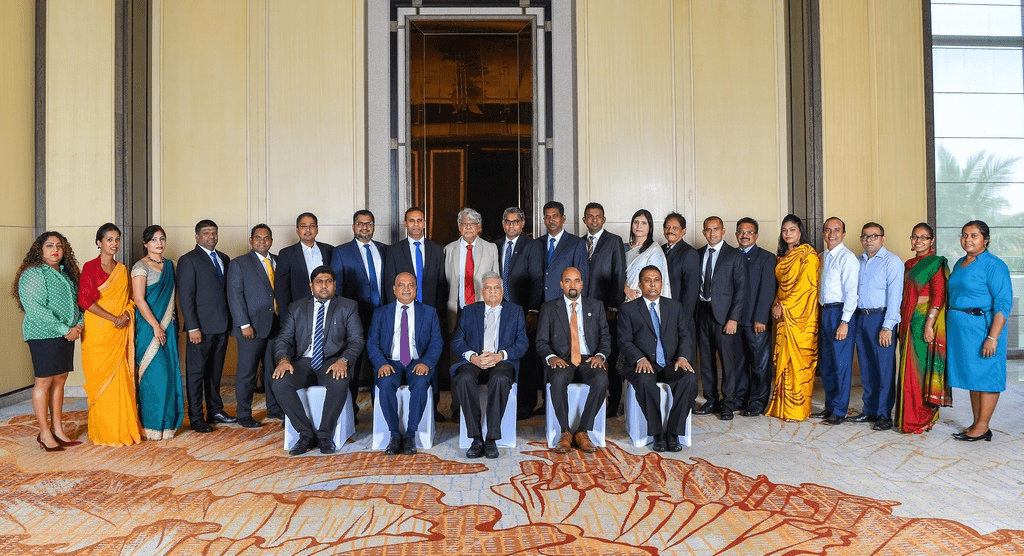

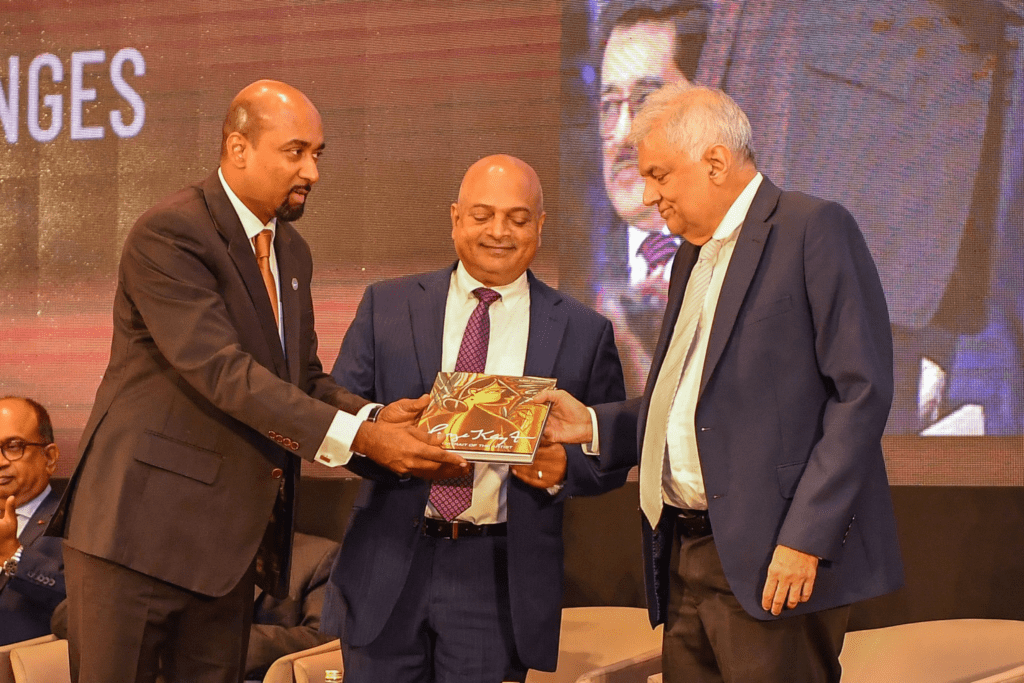

The President said this addressing the Post Budget Forum 2023, ‘Hurdling towards Opportunities- beyond Challenges’ organized by the Colombo University MBA Alumni Association which was held at the Shangri La Hotel in Colombo today (18).

The President, as a Colombo University Alumni, was the first to present a budget. He said that Sri Lanka’s strategic location should be made use of to enhance the country’s economic prospects. He called for the completion of the East terminal to promote the country as a logistics centre that can be expanded up to the North Port, which will be from Mutwal up to Ja-Ela.

He added that if the country is to be brought out of the current predicament, not only the government, but the private sector and the people also have a big role to play. He said that the government should handle the task of providing for the people and focusing on the health, education, housing and welfare sectors. Running businesses, he said, should be handled by the private sector. President Wickremesinghe noted that the government cannot get involved in running businesses.

Following is the full speech delivered by President Ranil Wickremesinghe at the Post Budget Forum 2023:

“The president of the Colombo University MBA Alumni Association, the Governor of the Central Bank, the Secretary to the Ministry of Finance, the Editor of the Financial Times, distinguished guests and friends. As a Colombo University Alumni, the first one to present a budget, it gives me great pleasure to be amongst the Colombo University Alumni in this discussion, you have organised for the 2023 budget. This is not a budget in the normal sense such as looking at proposals in which you have increased the price of cigarettes where they have reduced the price of something else and a few other statements of what they will do. If you look at it as such a budget, then you’re going on the wrong route.

Unfortunately, many members of parliament and many outside have made that mistake. We are in the middle. As your opening statement said, we are in the middle of an unprecedented financial crisis, which many countries in the world have not faced. We went into this because we followed the wrong policies. We were thinking of policies not of practical results. When I took over as Minister of Finance, my first task was to stabilise the economy. The measures necessary have been contained in the August budget.

The legislative process will also start. In addition to this, while we commit to a staff-level agreement, now we have to negotiate with our main bilateral creditors. We are again unique in that two of our creditors are not members of the Paris Club. We are negotiating at the moment both with India and with China. Once those negotiations are completed, and I believe it will be done successfully, then we have to talk to the private creditors and go back to the board. So that process is known and we are carrying it out.

The results of the measures we took in August will be known in the first half of next year. We had to look beyond that. We had to then look at recovery. What is our economic recovery? What is the plan? What is the structure? What is the framework? We must have that in mind. 2023 is not only a year of stabilisation but also a start of the recovery programme. The stabilisation measures will be a four-year one, ending in 2026. By that time hopefully, our GDP will be back to what we were in 2019. I still don’t know what will happen. However, how do we go beyond that? Are we satisfied with the system? Can we start borrowing again and getting into the same crisis in another ten years’ time? The only difference is that we may go to the IMF before the crisis hits us.

Are you going to be Asia’s version of Argentina? Are we going to make it, and this time succeed? My view was that we had to make it and we must succeed. What is the way to go? Many other systems that we have talked of have failed. Many articles are today being written in the newspapers about the old system. In the end of it, we failed. I looked at another example, which we did not follow from the institution that was there before the University of Colombo, the University College.

The professor of economics was Professor M.J. Shenon, an Indian. In 1965, when we had a similar crisis, Mr Dudley Senanayake wanted him to give a report. It was a report on opening out, which, if we had implemented it, would have put us ahead of Singapore. But we didn’t. To look at the success stories, Prof. Erhard who opened up the German economy at its worst stage, and Lee Kuan Yew opened up the Singapore economy. Then Deng Xiaoping opened up the Chinese economy. So, let’s go ahead. We can’t be frightened. If you are frightened of competition, you’re not going to win. In this world, you must compete to win. If you don’t compete, you can’t win. And that’s what you have to remember. And what is there in my budget, all is contained in seven paragraphs. It runs through three pages.

Paragraph 3.21- I would like to define the new economy we will build as a social market economy or an open economic system with social protection. 3.22- In this new economy, we will focus on the three main aspects of an export-oriented competitive economy and an environmentally friendly green and blue economy. A digital economy. Creating such a new economic foundation is a challenging task. Such a new economy cannot be created merely by making changes in the tax system. New sources of revenue need to be found. New areas of economic activity must be identified. Extending o economic reform and restructuring need to be carried out. 3.24 – The creation of which will be twofold. 3.25 – The first will be economic reform, and reorganisation, while the second will focus on modernisation.

Then Paragraph 3.29, we expect to achieve the following goals through the social market economy or the social security open economy we are creating.

Economic growth of 7 to 8%. Increasing international trade as a percentage of GDP by more than 100%.

Annual growth of USD 3 billion from new export from 2023 to 2032. Foreign Direct Investment of more than 3 billion USD in the next ten years. Creating an internationally competitive workforce with high skills in the next ten years.

And the last comes in paragraph 3.37. The macro-fiscal framework. Our fiscal stabilisation programme envisages government revenue increasing to around 15% of GDP by 2025 from 8.3% of GDP by the end of 2021. The Government is targeting a primary surplus of more than 2% of GDP in 2025 and expects to improve from this level thereafter.

We aim to reduce public sector debt from 110% of GDP at the end of 2021 to not more than 100% of GDP in the medium term. It is expected that inflation will be brought back under control in line with this. Interest rates are also expected to gradually reach a moderate level. Once macroeconomic confidence is re-established and foreign exchange reserves are replenished through foreign finances, the adverse pressure on the exchange rate is also expected to abate.

With the implementation of a series of growth-enhancing structural reforms, the medium-term economic growth is expected to return towards 5% in the medium term and accelerate to a high level thereafter. This is all this economy is about, this is the framework. How are we going to implement it? We have made some proposals. We can all comment on it, good, and bad amendments. But the proposals by themselves are not sufficient. So this is not a normal economy.

Look at the first proposal. A combined investment export agency. We’ll create that. But if you don’t remove any of the other laws, if you don’t do a fundamental restructuring of the economy, it will be as empty as I think today. And it’ll be another real estate agency, nothing more. So all these proposals are linked to it. Just that in light of what we are going to do. But first, study the framework. We have to make it in this world. There’s no other option. The Indian Ocean is becoming the geopolitical centre in the next two, three, or four decades. Only the countries that have strong economies will survive.

Others can’t. This is not only a military conflict or a military competition, it’s also an economic competition. The whole world that was created in the 18 and 19th and 20th centuries, the European domination and Western domination is again shifting back to Asia. And you’re finding the rise of Asian countries China, India, and Japan. It is no secret. It’s how the US economy and the US will correlate to China, the Chinese economy and thirdly, the rest of us.

So that is the political background, geopolitical background. We are not going to have nuclear bombs, but strong economies will survive.

However, our strategic location is also a means of enhancing our economic prospects. Firstly our location says we should be a logistics centre with three good harbours and a small one in Kankasanthurai. We are not talking about it. We are just thinking about it. Last time when I was Prime Minister, I wanted to push it forward. We had an agreement on the East Terminal with Japan and India. We cancelled it. It is still lying there. The port is unable to run. We haven’t the money. As you know, our shipping trade is under threat. However, let us open up there and let’s go all out. Finish the East Terminal and promote ourselves as a logistics centre that we can expand next from there to the North Port, which will be from Mutwal up to Ja-Ela.

We can then be the feeder port for Pakistan, India, and Bangladesh. We had the Hambantota port. When the Belt and Road are complete, the Hambantota Port will link to several Chinese ports, which have been built by Chinese companies in Africa and some of the other ports. Look at the opportunities we have. And now we are looking at the Trincomalee Port to work with India, which will service the Bay of Bengal. Those are new opportunities. We have to realise that the population of these regions will increase just from Pakistan onwards to Indonesia by about 400 or 500 million by 2050. Asia, the Middle East and Africa will have an even larger growth.

So we should use our ports. That’s the best asset we had from the time of the Anuradhapura Kingdom. From Manthai to Trincomalee, these are the ports we had. Then the Galle Port, the Colombo Port. We have forgotten all about it. We looked inward and we forgot our ports. When a port comes up to Ja-Ela just four miles across and you link up to Katunayake and you have an air-sea hub there is immense potential in what we do.

But that’s one area. Secondly, modernise your agriculture. We have neglected our agriculture. Its subsistence agriculture. Our tea which was the best in the world is now being overtaken by others. A completely modernised agriculture is easier said than done. We have to ensure the security of the land. So, therefore, we bring legislation where people who are given land will have the security of tenure. It cannot be taken away just by the government. There will have to be a process to be followed and a remedy in court, which is a guarantee you have for any land in Sri Lanka. It will be equal to any freehold land that you have. The government’s land acquisition law has to be changed. Those we will do. Then we had to build up a new system, not merely for large-scale agriculture, but also the smallholders.

Everyone must own freehold land, and we will go ahead and do it. That is essential. If you don’t modernise your agriculture, where do you feed such a large number of people in the region and a large middle class? Modernise it and let’s see how we go ahead. But as the world develops, population changes are going to have an impact. The population in Europe will reduce. There would be more money. But the markets will be smaller. The population will drop in China, Japan, and South Korea, and the next one will be in Africa. So let’s think of the future. So these are two of them, but there are so many other areas that we can develop. We are looking at tourism. Why are we spending? Why are we reaching out to those who only spend $100 or $150? Why can’t we average $500 a night or $750? By looking at a new programme to attract 2 million high-end tourists, it will be a completely new tourist industry. Go for them. We have to learn the lesson from the Maldives. We have to rescue the tourist industry, but that alone won’t do. Of the main areas that I discussed is maritime tourism, you have all the opportunities of yachting around the Jaffna islands.

But more than that, we want to start from here and we have already discussed this with Singapore. We want to start cruises in the Bay of Bengal, which goes from Trincomalee or Colombo to the Andaman islands which can go across to Myanmar and Thailand, Andaman Sea, across to Malaysia and ends up in Singapore. Just imagine the immense potential. A large middle class from China, India, Pakistan, Bangladesh and Southeast Asia. Well, that has to be tapped. We have to move out. So we are now looking at new types of industries, nano-technology, and even manufacturing. As far as manufacturing is concerned, we have to remember manufacturing is relocated to India, which is still a low-wage economy. We will not be a low-wage economy if these principles are followed, we will be a high-middle-income or a high-income economy.

Our population profile suggests there will be more older people and fewer young people. Why don’t we start now with being semi-automated? Then go on to automation, to robotics. We might as well encourage it, for which we need a completely new system of education. I am criticised for not giving enough money for education this year. The fact is with COVID, the Education Ministry is still trying to recover from its impact. Even if you give more money, they will not be in a position to spend that money effectively. It’s much better to plan and give them more money from next year onwards. So we have got to think forward. The whole green economy. We are thinking of renewable energy, but beyond that, green hydrogen. That is possible. But if you look at it, you’ll find opportunities. This is something that the government is looking at.

There is much more for you all. If it’s foreign employment, high-end, highly skilled persons should go out. Can we make the country a health centre? Regional Centre for Health Services. How do we develop the Port City as an offshore centre? So these are the issues you must look at and then see whether these proposals help. We’ve already started discussions with the World Bank. I’ve also discussed this with the ADB in Manilla. There would be other countries such as the US, China, and India, all are interested. From the government side, we are engaged in discussions. Now, how is the private sector going to relate to it? Are you putting up the flag of protection and taking the government on, or are you opening up?

We are looking at removing the para-tariffs and the tariffs over five years, with a trade adjustment programme, to help industries and manufacturers meet that competition. But beyond that, the Singapore FTA will be in operation by early 2023. Then the FTA with India, Thailand, and China. But the long-term goal is by next year or the year after, to agree with the Regional Comprehensive Economic Partnership. That brings you to Southeast Asia and East Asia. And that’s not the end. Finally, we should look at being able to join the high standards that are set out in the comprehensive and progressive Trans-Pacific Partnership that raises the level of our economy in the next 10-12 years. That’s the only way that we can go. There’s no other way. And I know as the economy grows, the private sector will grow. We are handing over most other functions to the private sector. The government can’t get involved in running businesses. We got involved in running businesses and billions and trillions of rupees have been wasted which would have been better spent on education, health or housing. So we have to spend on education, we have to spend on health, we have to spend on housing. We have to spend on social welfare which has been neglected. We need money for those. As far as businesses are concerned, we should be able to give that to the private sector, both local and foreign. So that is the thinking behind it. They still ask, why are you selling profit-making enterprises, look at the SLT It’s making profits. If you ask the secretary of the Treasury, he will tell you what profits are made and how much more money we are to pump into the future. The money we haven’t got.

We have to decide whether we want to strengthen the people or whether we want to take public money and strengthen the Insurance Corporation, Sri Lankan and Telecom. My priority is to look at the people and not these companies and buildings. All of you who want to know why we are selling it, we are selling it so that we can put this money into the foreign exchange reserve and strengthen the rupee. I will tell you one thing. If I can sell more and put 7 billion back, I will do it. And tomorrow we will be back to normal. I don’t know if we have 7 billion, but if I can get 7 billion, I will do it. I have no hesitation about that. I want the people of this country to have a good life. And then it’s for the private sector now to deliver. Now we are putting the whole challenge on to the private sector and we have a big task which we are discussing.

What do we do with the debt that the banks are carrying? The tourism sector, the construction sector, and more than that, the small and medium enterprise sector. We are giving our attention to it and we have to go ahead. We have over-relied on the construction sector of our economy. That doesn’t mean that we should abandon it. We should get it back. Some people want to know why we spend even this much on roads. But the simple reason we have to keep the people employed, minimise job losses. Secondly, we are not spending on all the roads. We are spending on things like the Central Expressway. When you finish the Central Expressway, look at the economic benefit. We’ve taken too long on it and should finish it. So this is part of the programme we have. I am not discussing the proposals, you can discuss them about the framework, whether it’s sufficient or insufficient. There would be more proposals coming next year. But first, look at the seven paragraphs which lay out the framework of the economy. How do we go there? You want to ask the question, can we make it? But how do we go there? So, I am open to the house and would like to listen to your proposals. And again, my thanks for inviting me.”

Secretary to the Ministry of Finance Mr. Mahinda Siriwardhena, Central Bank Governor, Nandalal Weerasinghe, World Bank Country Director for Maldives, Nepal and Sri Lanka Mr Faris Hadad-Zervos, Country Director ADB Dr Chen Chen, Executive Director of the Institute of Policy Studies of Sri Lanka Dr Dushni Weerakoon, Chief Executive Officer of Standard Chartered Bank Mr Bingumal Thewarathanthri, Chairman of the Ceylon Chamber of Commerce Vish Govindasamy and the Colombo University MBA Alumni Association President Chandima Samarasinghe were among the other panellists.

PMD