The Monetary Board at its meeting held on 23rd has decided to maintain its policy interest rates at current levels of 14.5% and 15.5%, despite the continuance of hyper-inflationary pressures. The contents of the press release issued on 24th are clear evidence that the Monetary Board has no clue whatsoever as to what the monetary policy should be for the bankrupt Sri Lankan economy in terms of the public mandate given by the Monetary Law Act.

Therefore, the purpose of this article is to establish the meaninglessness of the monetary policy as revealed from the contents of its press release. My comments are given below under 6 categories of contents in the press release.

Overall, the press release is formal evidence for Monetary Board’s inability to carry out a sort of monetary policy to assist the government and general public to recover the economy from the current bankruptcy caused by the monetary policy itself. Therefore, the mandate given to the Monetary Board by the Parliament through the Monetary Law Act is meaningless and non-operative in the current context.

1. Maintenance of tight monetary policy to contain any demand driven inflationary pressures in the economy

- The Board noted that the maintenance of tight monetary policy stance is necessary to contain any demand driven inflationary pressures in the economy, while helping to further strengthen disinflation expectations, thus enabling to steer headline inflation towards the targeted level of 4-6 per cent over the medium term.

- The Board was of the view that the prevailing tight monetary policy stance is necessary to rein in any underlying demand pressures in the economy.

My comment

- The Monetary Board is not sure about whether there is demand driven inflationary pressures in the economy. Therefore, it refers to any demand driven inflationary pressures.

- In fact, demand driven inflationary pressure should prevail only if the money stock/monetary liquidity rises in real terms faster than the growth of production/supply. The inflation believed by central banks for the monetary policy is a situation when the demand for goods and services carried by monetary expansion rises faster than the supply.

- However, the present contraction of the supply/economy is around 9%-10%. The YoY contraction of the real money stock in September is 32.3%. While the contraction was 2% in January, it has accelerated since May (i.e., 14.8%).

- Therefore, there is no demand driven inflationary pressures in the economy. Wording in the press release is a routine one without any facts.

- Disinflation expectations are not supported by any research. Therefore, statement that tight monetary policy will strengthen disinflation expectation is baseless as nobody except the Central Bank economists believes in the monetary policy to control inflation in modern monetary/financial economies.

2. Envisaged Disinflation

- Supported by favourable supply side developments and tight monetary policy measures, headline inflation pivoted towards the envisaged disinflation path in October 2022, after passing the peak in September 2022.

- The deceleration in inflation is expected to continue in the ensuing period, supported by subdued aggregate demand pressures, expected improvements in domestic supply conditions, normalisation in global commodity prices, and the timely passthrough of such reductions to domestic prices, along with the favourable statistical base effect.

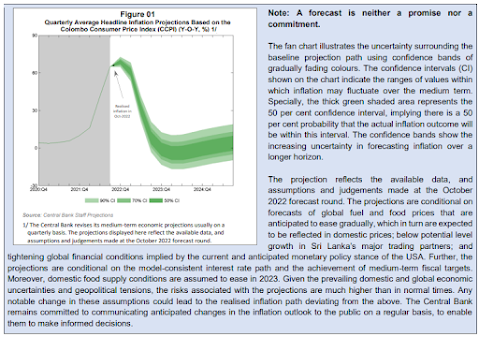

- Global as well as domestic risks to the inflation outlook in the near term are tilted to the downside, thereby supporting the disinflation path (Figure 01) and stabilising inflation at the desired levels towards the end of 2023.

My Comments

- Reported marginal decline in inflation (or cost of living index) in October is due to momentary easing of few food items with a high weight in the cost-of-living basket and, therefore, it is not a reversing trend from a such a high level of inflation above 70%.

- There is no information on global inflation to ease soon. Therefore, all central banks are still raising interest rates. The Fed raised interest rates by 75 bps on 2nd November although inflation started falling since June (i.e., from 9.0% to 7.7% in October). The Central Bank of Sweden also raised interest rates by 75 bps on 24th November.

- Worlds in the press release such as subdued aggregate demand pressures, expected improvements in domestic supply conditions, normalisation in global commodity prices and the timely passthrough of such reductions to domestic prices which are used as reasons for disinflation are meaningless worlds because no evidence has been produced.

- The favourable statistical base effect given as a reason for the decline in inflation is not a macroeconomic case to analyse inflation. It shows that inflation is a statistically flawed number, not having any macroeconomic rationale.

- Wording of stabilization of inflation at desired levels towards the end of 2023 is highly meaningless. The supporting figure/chart given in the press release is highly unacceptable as it mentions that the inflation forecast given is neither a promise nor a commitment (see Figure 01 below). If the forecast is neither a promise nor a commitment, monetary policy taken on such forecasts has no basis. The public credibility and accountability of monetary policy have no grounds if policies are taken based on such meaningless information.

- Talking about desired levels of inflation without specifying those levels is meaningless.

- Further, no country has experienced stability in inflation. Even if statistical inflation falls to monetary policy targets of 4%-6%, it is still an increase continued on levels of skyrocketed prices. Therefore, stability in inflation will not reach unless prices fall in general to pre-crisis levels.

3. Contraction of the Economy

- The real economy is expected to contract in 2022 impacted by the stability-oriented policy measures that led to tightened monetary and fiscal conditions, along with supply side constraints and prevailing uncertainties, among others.

- Nevertheless, economic activity is expected to make a gradual, yet sustainable recovery, supported by envisaged improvements in supply conditions, improved market confidence, and the impact of corrective policy measures being implemented to stabilise the economic conditions.

- Outstanding credit extended to the private sector by commercial banks is expected to have contracted for the fifth consecutive month in October 2022, reflecting the impact of increased market lending interest rates and the moderation in economic activity

My Comments

- The contraction already experienced is due to the monetary policy failure of the Central Bank (i.e., loss of control over foreign reserve, exchange rate and debt management) that disrupted the supply side.

- If stability-oriented policy measures have contracted the economy, such policies are public crimes and, therefore, those who are responsible should be prosecuted. Stability policies in fact are to help the public avoid bad outcomes for living standards.

- So called “corrective policy measures implemented to stabilize the economic conditions” cannot help sustainable recovery as they are hurdles to the economy. They have already contracted the economy. Tightened fiscal condition is not because of stabilization policy but because of liquidity problems caused by debt default and bankruptcy.

- If the credit to the private sector has contracted by high interest rates, the recovery cannot be expected. Credit has declined not because of interest rates and moderation in economic activities, but because of private business bankruptcies and risk aversion by banks due to high default risk. In fact, the economy has not moderated but contracted significantly.

- Improved market confidence is just a rosy word not supported by data. An economy with default of debt, interest rates around 30% and no foreign reserve cannot have market confidence or a recovery.

4. Persistent anomalies in the interest rate structure

- Market deposit interest rates have also risen notably disproportionate to the adjustment in the policy interest rates.

- The continued excessive upward adjustment in market interest rates, despite the improvements in domestic money market liquidity and the deceleration of inflation, has resulted in persistent anomalies in the interest rate structure.

- Going forward, the anomaly in market interest rates is expected to be rectified, benefiting mainly from the notable reduction in the overall money market liquidity deficit and the anchoring of inflation expectations in line with the envisaged disinflation path.

- Meanwhile, yields on government securities are showing some signs of easing recently, and are expected to moderate further.

- Further, the high-risk premia attached to the yields on government securities are expected to shrink in the period ahead as the debt restructuring process progresses and fiscal sector performance improves with the consolidation measures in place.

- The Central Bank would expect a moderation of excessive market interest rates, in line with the prevailing policy interest rates. If an appropriate downward adjustment in the market interest rates would not take place in line with the envisaged disinflation path, the Central Bank will be compelled to impose administrative measures to prevent any undue movements in market interest rates.

- However, the Board noted with concern the anomalous rise in market interest rates, particularly deposit interest rates and short-term lending interest rates, despite the recent improvements in overall money market conditions and the adverse implications on business and economic activity.

My Comments

- Central banks do not have a system to describe differences in market interest rates based on policy rates because central banks are not aware of the risk premium underlying each layer of interest rates. Interest rate structure is only a conceptual tool to analyse trends of interest rates and risk premia across classes of credit and investments. Therefore, anomaly or rectification of anomaly referred to in the press release has no basis.

- Yields on government securities are determined by the Central Bank largely through direct purchase of Treasury bills and not by market factors. Therefore, easing in yields referred to the press release is also an act of the Central Bank. Further, easing is only a difficult few basis points.

- High risk premia on yields on government securities cannot shrink as debt default cannot be rectified and so-called fiscal consolidation is not achievable. However, if the Central Bank cuts policy interest rates, the yields also would follow as it is the reality.

- The significant increase in deposit rates is due to the Central Bank’s force unnecessarily applied on banks. In fact, the Monetary Board has issued an order requiring banks to raise deposit rates under the false premise that deposit mobilization would curtail aggregate demand and ease inflationary pressures. However, inflation sharply accelerated from 18.7% in March to 69.8% in September. The reality behind high deposit rates is the bank investment out of deposits in government securities at yields of 30%-32% at auctions plus guaranteed private placements at the weighted average auction yield.

- In present overnight-interbank based monetary policy models, central banks can control only policy interest rates through money printing. They cannot control any other interest rates unless they print money for those credit sectors. This happens in Sri Lanka only for Treasury bills. Therefore, the reference to imposition of administrative measures to control market interest rates is only a bluff. The Central Bank attempted to do this twice in the recent past, but it miserably failed.

- The market liquidity cannot improve under present level of tight monetary policy unless Central Bank prints money. The acute shortage of liquidity in the banking sector and government is revealed from rising overnight lending to banks and Central Bank direct subscriptions to Treasury bill issuances. it is reveled that, despite the ultra tight monetary policy, the Central Bank lends to banks through term reverse repos to help resolve systemic liquidity problems.

- The monetary policy does not have psychological tools to anchor inflation expectations of the pubic. This is a term just borrowed from western monetary policy rhetoric.

- Financial loss caused by a 8% hike in policy rates so far from April to the public on government debt alone will be multi-trillions if same argument raised against bond auctions carried out in 2015 is followed.

5. Exchange Rate Stability

- The merchandise trade deficit for the ten months ending October 2022 contracted significantly, owing to the robust export earnings and a substantial decline in import expenditure due to policy measures taken to curtail demand for imports, amidst the shortage in foreign exchange

- Amidst the improvements observed in liquidity in the domestic foreign exchange market, the Central Bank continued to facilitate the import of essential goods to ensure the availability of energy, power and other supplies necessary for uninterrupted economic activity.

- Workers’ remittances are expected to improve in the period ahead with rising departures for foreign employment, while the tourism sector is set to mark an improvement in view of the upcoming season for tourist arrivals.

- Risks to external demand could emerge amidst moderating global growth prospects in the near term, however, rising prospects of the tourism sector and workers’ remittances would help offset any negative spillovers to a large extent.

- Meanwhile, the exchange rate remained broadly stable.

My Comments

- Everybody knows that tourism and workers’ remittances cannot address the acute foreign currency problem in the economy and risk to external demand/acute shortage of imports.

- Whether rising departure is for foreign employment is not supported by figures. Further, whether those will send remittances through official channels is not certain.

- Everybody knows that the exchange rate from May onwards does not have any market element. Therefore, exchange rate stability is only a result of administrative fixing of the rate unlawfully by the Central Bank and does not have any macroeconomic background.

- It is well known that the foreign currency reserve is at rock bottom without any improvement. Therefore, notation of improved domestic foreign exchange market stability is not true and economic activity continues to be heavily interrupted by acute shortages of foreign currency and imports.

- Reference to contraction of merchandise deficit is meaningless as its a forced action on import controls and does not have any importance to the monetary policy. What matters for the economy and monetary policy is the overall BOP balance. For 9 months so far in 2022, the overall deficit has continuously risen to 2,927 million US dollars as compared to 2,573 million US dollars for corresponding period in 2021. This means higher foreign borrowing from various official sources.

- Therefore, there is no rationale for the Monetary Board to talk about improvement in domestic foreign exchange market and exchange rate stability under the monetary policy.

6. False Promise of Price Stability and Financial System Stability

- At the same time, the Board reiterates its continued commitment to restoring price stability and ensuring financial system stability, and remains confident that inflation would follow the projected disinflation path underpinned by the prevailing monetary policy stance, while supporting the economy to reach its potential over the medium term.

My Comments

- It is an illusion that the present monetary policy that has bankrupted businesses and supply side would help disinflation path from present hyper-inflation prevailing around 70% seen among few countries in the world. Monetary policy will help reduce inflation only in economies with high growth, not in depressed economies. Therefore, the Monetary Board cannot have policy measures for restoring the price stability as it has lost almost all monetary policy instruments other than printing of money to bailout the government on daily basis.

- Smokes of financial system instability are flowing out everywhere although the Monetary Board is not aware, despite its white collar macroprudential surveillance mechanism. Foreign currency crisis is not expected to ease any soon. The worsening plight of high non-performing loans due to bankrupt economy is a sure way to cause a banking crisis as the Central Bank does not have any policy strategy to resolve the non-performing loan problem. The high dependence of bank assets on government securities is a sure way to banking crisis on concerns over domestic debt restructuring and rollover risks. In the event of a financial crisis, the Central Bank does not have any crisis resolution package as fiscal measures are not available at present.

- It is common practice for all central banks to boast about financial system stability until a financial crisis hits. then, they will start blaming other. The current plight of the economy reflects enough signs of a banking crisis caused by various roots including non-performing loans, illiquidity and shadow banking.

Overall Observations

- Above analysis shows that the public cannot expect a policy stimulus from the Central Bank to recover from the bankruptcy.

- The economic immune system of the economy is lost as the respiratory system, i.e., financial blood circulation, has been blocked by monetary policy and default on debt. Therefore, public economic welfare will be lost for decades as the political leaders do not have any interest in other than taking care of their personal welfare. Therefore, such bureaucracy can continue as white collar criminals who destroy living standards by unfounded monetary concepts developed in tribal economies.

- Undefined words and expectations given in the press release clearly shows the Monetary Board operating without a purpose for the general public.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2022/11/sri-lankan-monetary-policy-white-collar.html