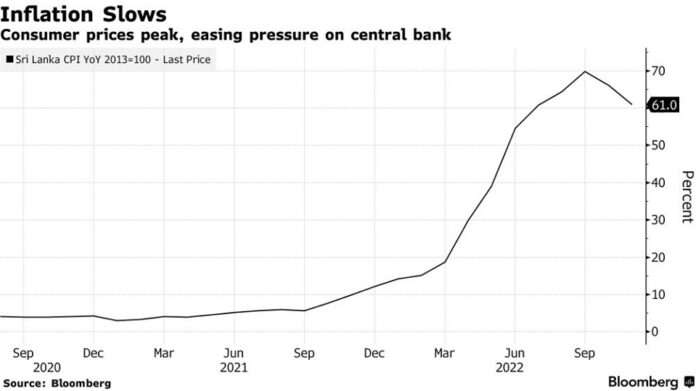

Sri Lanka’s headline inflation based on the Colombo Consumer Price Index (CCPI) for November fell for the second consecutive month to 61.0 percent from 66.0 percent in October as food prices eased off, though the prices of services remained in rather uncertainty, according to the Department of Census and Statistics.

Food prices rose by 73.7 percent in November from a year ago, slowing from 85.6 percent through October while monthly prices declined for the second month in a row by 1.5 percent after falling 2.0 percent a month earlier.

The non-food prices also decelerated marginally to 54.5 percent from a year ago from 56.3 percent in October while monthly prices remained unchanged after rising 0.7 percent a month ago.

People are still paying over 60 percent more for the same basket of goods than a year ago.

A developed economy tolerates no more than 2.0 percent annual inflation and in Sri Lanka this level is set at between 4 to 6 percent, reflecting that the country is still far off from its desired level of inflation.

However, the monthly prices have continued to ease at a faster pace as November prices have fallen by 0.5 percent over the previous month, compared to 0.4 percent decline a month ago.

The monthly prices mostly provide direction of the future inflation path and thus the prices appear to be in a disinflation path, as claimed by Central Bank officials last week.

Meanwhile, the core inflation, which is measured barring the most volatile food, energy and transport costs, rose by 49.4 percent in November from a year ago, easing from 49.7 percent a month ago.

Sri Lankans have been facing runaway inflation since April this year after the Central Bank floated the rupee causing it to lose 80 percent of its value in a matter of months, effectively doubling the prices of everything.

The condition was compounded by commodity shortages, administrative price revisions introduced to power, energy and other utilities, and the sharp increase in taxes.

The Central Bank raised rates at the fastest levels seen in its history this year to curb demand and thereby to bring the prices down.

The Central Bank last week expressed desire to see the short-term rates easing in line with the slowing inflation before it cuts key rates perhaps in a signal to banks to re-open their lending taps, though slowly, to segments which require support to restart and ramp up production.

It also said it would provide liquidity to banks in the inter-bank money market. The Central Bank expressed confidence that it could bring down the inflation to the desired band of 4 to 6 percent by the end of next year.