Sri Lanka’s trade deficit shrank to US$ 450 million in November 2022 from $553 million in the corresponding month of the previous year, Central Bank’s external sector performance report revealed.

However, the merchandise trade deficit has shown a tendency to widen on a month-on-month basis since recording a surplus in June 2022.

The cumulative deficit in the trade account during January November 2022 recorded at US $ 4,839 million, a decline from $ 7,054 million recorded over the same period in 2021.

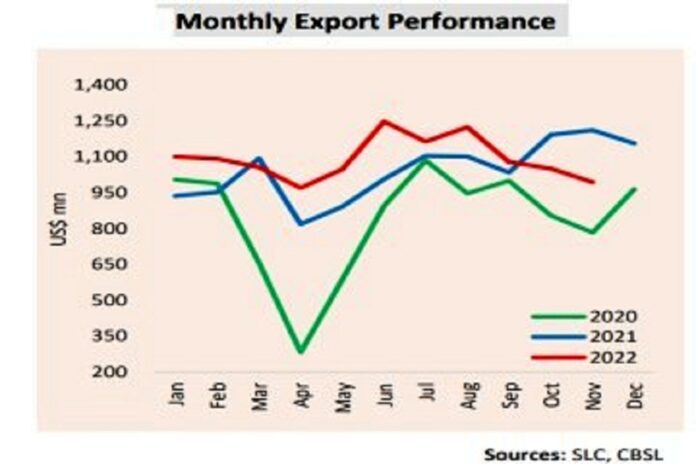

Earnings from merchandise exports declined by 17.9 per cent in November 2022, over November 2021, to $ 994 million, recording a slight decline for the third consecutive month, on a month-on-month basis.

While declines in earnings were observed across all main categories, industrial exports mainly contributed to the contraction in earnings.

However, cumulative export earnings during January-November 2022 increased by 6.0 per cent over the same period in the last year to $ 12,026 million, which was mainly driven by a 9.4 per cent improvement in industrial exports amidst a decline in agricultural and mineral exports

Expenditure on merchandise imports declined by 18.1 per cent in November 2022 to $1,445 million, compared to $ 1,765 million in November 2021.

The decline in expenditure on investment goods mainly contributed to the decline in import expenditure in November 2022.

However, merchandise imports in November 2022 increased for the second consecutive month, on a month-on-month basis, indicating the impact of recent measures to relax some import restriction measures and seasonal demand for imports.

Meanwhile, cumulative import expenditure from January to November 2022 amounted to $16,865 million, compared to $ 18,396 million recorded in the corresponding period in 2021.

Sri Lanka has high levels of imports and a trade deficit mostly due to inflows from government borrowings and in times of crisis when the central bank prints money (sterilizes interventions) after using reserves for imports.

In Sri Lanka, there is a strong belief that foreign reserves can be used for imports so that mainly the private sector can ‘live beyond its means’ on the reserves, with credit driven by sterilized interventions.

Sri Lanka has high levels of imports and a trade deficit mostly due to inflows from government borrowings and in times of crisis when the central bank prints money (sterilizes interventions) after using reserves for imports.

In Sri Lanka, there is a strong belief that foreign reserves can be used for imports so that mainly the private sector can ‘live beyond its means’ on the reserves, with credit driven by sterilized interventions.

Importing fuel on credit is another method used by policymakers and mercantilists to boost imports and widen the current account deficit (a type of so-called ‘bridging finance’, another living beyond the means tactic) after money printing creates forex shortages.

Sri Lanka defaulted on its debt in April 2022 and is now set to negotiate with creditors.

Sri Lanka’s central bank has allowed rates to go up and the economic activity has been smashed to resurrect a flexible exchange rate, which lost credibility and collapsed after two years of money printing and surrender.