By looking at the monetary policy press release issued by the Economic Research Department of the Central Bank (CB) on 3 March, I felt that the country now does not need a Monetary Board or a Central Bank if they are to implement monetary policy decisions made by the IMF staffers. Therefore, the Monetary Law Act after 72 years has now become an invalid piece of legal paper.

I further felt whether macroeconomic management policy framework of the country and its economy have now been outsourced to the IMF as our internationally trained policy economists are incompetent. In every policy action whether fiscal or monetary, we hear the policy origin as the IMF in looking for 2.9 bn. USD. Therefore, one might interpret the IMF deal as the situation of the country’s sovereignty being invaded by or rented out to the IMF by those who manage the economy.

Monetary policy decision on 3 March

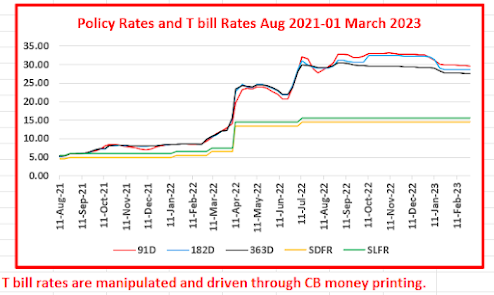

The Monetary Board/CB on 3 March 2023 raised its policy interest rates by another 1% to 15.5%-16.5% band (i.e., SDFR and SLFR). Accordingly, the total rate hike from August 2021 so far is 11% whereas 9% has been effected by the present Governor since 8 April 2022.

The CB states that such rate hikes are expected to curtail the excess demand in the economy in order to bring down inflation back to 4%-6% target in the medium-term and thereby to stabilize the economy.

Trend of inflation and recent market interest rates

However, the inflation estimated as the percentage increase in the Colombo Consumer Price Index (CPI) has accelerated from 5.7% in July 2021 to 69.8% in September 2022 and decelerated thereafter to 50.6% in February 2023. The new CPI introduced from January 2023 also has statistically helped reduce inflation from 57.2% in December 2022 (based on old CPI) to 51.7% in January 2023 (based on new CPI).

Accordingly, in view of disinflation path and projections of single digit inflation towards the end of this year, the CB commenced several strategies outside the policy rates to reduce market interest rates such as Treasury bill yields and inter-bank rates.

In fact, some media saw recent decline in Treasury bill yields as a healthy sign of gaining economic stability back and spread expectations of rate cuts by the CB in the near future. The CB also expressed hopes of market interest rates coming down gradually due to its new policy actions such as new OMO restrictions announced on 2 January 2023, series of selective reverse repo liquidity auctions and more private placements in sale of government securities.

Background of the rate hike

However, the media and markets were shocked by 1% rate hike announced on 3rd March. The Governor at the press conference disclosed that the rate hike decision was taken as part of the staff agreement with the IMF which has insisted a rate hike of 2.5% to unlock the IMF loan facility of 2.9 bn USD being awaited.

When present level of high inflationary pressures above 50% being broad-based in the economy and seen sustaining for a long period to come, further rate hike approach of the IMF is seen highly appropriate in the present policy interest rates-based monetary model believed by both IMF and CB (However, I am totally against this model for Sri Lanka).

Many central banks led by those in developed market economies are presently in same direction although inflation has been peaking during last few months because of sustained inflationary pressures of four decades high. Therefore, the CB’s temptation to reduce market interest rates through administrative actions are seen inconsistent with the monetary policy concept. In fact, the CB maintained policy rates unchanged at 14.5%-15.5% at five last meetings despite high inflationary pressures.

Policy governance concerns

The policy press release this time does not contain usual macroeconomic rhetoric of the CB unlike in other monetary policy press releases and it is a slippery, idle one page short one. Therefore, the Monetary Board or monetary policy economists of the CB do not seem to have any macroeconomic justification for the monetary policy decision this time other than the surrender to the IMF ideology.

I used to comment on contents of recent policy statements one by one on technical/economic grounds. However, I have only few contents to be commented in the present statement. They are given below in five points.

1. The CB seems to seek public sympathy for the rake hike this time.

- First, it mentions some differences between the CB and IMF staff on the inflation outlook.

- Second, it cites the consensus reached between the CB and IMF staff on the quantum of the rate hike as it states “the Monetary Board and the IMF staff reached consensus to raise the policy interest rates, in a smaller magnitude, compared to the adjustment, which was envisaged during the initial stage of negotiations.” The Governor stated at the press conference that the IMF requirement in last September was a 2.5% rate hike. Similarly, the IMF in the last week got the Central Bank of the collapsing economy of Pakistan also to hike rates further by 2% to 20% where the central bank stated that the rake hike was to anchor inflation expectations of the economy which is seemingly getting bankrupt in Sri Lankan style, while the disbursement of the IMF loan of 6 bn USD already approved is suspended.

- Third, the CB passes the blame to the government for the surrender to the IMF by stating that “this decision demonstrates Sri Lanka’s commitment to the IMF-EFF arrangement, which has been pursued by the Government in order to ensure stability in the economy on multiple fronts.” It is public secret that the present Governor and Secretary to the Treasury are the people who overwhelmingly ran after the IMF with a motive to newly build their public positions. However, now the CB sees IMF deal as the work of the government and excuse for the rate hike.

2. The purpose of the Monetary Board is now lost because the policy statement recognizes the IMF to resolve the economic crisis. This is established by the statement “the finalisation of the IMF-EFF arrangement is expected to benefit all stakeholders and bolster confidence, which would help restore stability in the economy on a sustained basis. This will incentivise more foreign exchange flows in the period ahead that would aid the economy to overcome the prevailing economic crisis.” How the economy is stabilized by the 17th IMF loan program with 2.9 bn USD disbursed over a period of four years after failing of 15th and 16th IMF programs in the last decade is questionable, especially at the time of present economic crisis confronted by the country.

3. Like in the Central Bank of Pakistan, the Monetary Board also has given a slippery justification for the policy decision by stating that “the Board was of the view that the economy has already traversed through the most difficult and unprecedented times with tremendous resilience and strongly believes that today’s decision would pave way for a faster-than-expected deceleration of inflation.” However, the Monetary Board does not give any time frame for the public to assess its inflation control performance.

4. The Monetary Board also provides uneconomic anticipation from the rate hike by stating that “the Monetary Board anticipates that this monetary policy action would help lower the spread between policy interest rates and high market interest rates. This spread is expected to be further reduced with the reduction in market interest rates in the period ahead, especially the yields on government securities, reflecting the easing of risk premia as the debt restructuring process progresses.” This is a monetary joke made without any idea on economic principles behind interest rates.

- First, the Monetary Board raises policy rates to narrower the gap between policy rates and high market interest rates. In fact, policy interest rates is the base that drives other interest rates. Therefore, if the monetary theory works, market interest rates also should rise in response to higher policy rates in the next week and the spread will continue. Therefore, it is joke expect a narrower spreads while policy rates are raised.

- Second, Monetary Board members are unware of economic/financial fundamentals behind risk premia reflected in interest rates among different credit sectors. Risk premia are determined by credit markets and, therefore, the present mode of policy rates cannot intervene in market risk premia.

- Third, debt restructuring in fact will raise the risk premia on government debt due to concerns over domestic debt restructuring and uncertainty. In fact, the CB purposely drove government securities yield rates to rise at the beginning in order to tighten the monetary conditions without raising policy rates adequately as Treasury bill rates are directly controlled by the CB through various undisclosed devices. In contrast, the recent reduction in Treasury bill rates is also a hidden manipulation to mislead the public that the economy is now stabilizing gradually.

5. The Monetary Board states that “the Board urges all stakeholders to remain hopeful and reiterates its commitment to ensuring price and economic stability, and financial system stability, thereby assuring the normalisation of the interest rate structure no sooner the price pressures are sufficiently contained in the period ahead.” This is a meaningless statement.

- First, stakeholders of the Monetary Board are not listed. In fact, the Monetary Board is a stakeholder of the public.

- Second, as the Monetary Board implements the monetary policy of the IMF for Sri Lanka as revealed from the present decision, the Board cannot offer any commitment to the public.

- Third, the nature of the commitment whether Board steps down in the event the stated stability is not restored in a specified period is not stipulated.

- Fourth, normalization of interest rate is only a slang policy word and nobody knows what the normalized level is for any activities.

Concluding Remarks

If Mr. John Exter was alive, he would cry over the pathetic plight of the Sri Lankan Central Bank after 72 years. He recommended the authorities to assess the performance of the CB on its public duties after a period of 10-15 years. However, the authorities have failed to do it even after 72 years and, therefore, the present CB is a technically bankrupt both policy-wise and finance-wise and led the government and economy also to bankrupt after 72 years of its existence.

The present monetary policy press release itself is the evidence for policy bankruptcy. The evidence for the financial bankruptcy is the collapsed foreign currency reserve and resulting heavy exposure to government securities in quasi-default.

Therefore, relevant state authorities have to decide urgently whether they go with a new Central Bank to take risks of banks and financial institutions at a cost to the public under the new law proposed by the IMF or restructure the CB under the present monetary law to help the public recover from the present economic crisis in association with fiscal policies of the governments elected by the public.

Otherwise, the economy of Sri Lanka will be managed by the IMF to facilitate capital flows of international investors belonging to its controlling member countries. This is self-evident from policy statements that the IMF loan program is to rebuild confidence of international investors in Sri Lanka in old style of financial investments that the IMF has failed 16 times so far in the past.

However, the IMF and its agents in Sri Lanka act on past statistics management of the economy without any assessment of natural resource base of the country and potential development. Therefore, the IMF and its agents will definitely fail to stabilize Sri Lankan economy again for 17th time in the Sri Lankan recent economic history.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2023/03/monetary-policy-by-imf-staff-should-we.html