This article raises public concerns as to why T bill yields rose by more than 1% at the auction held on 12 July immediately after the policy rates cut of 2% on 5 July.

T bill Auction on 12 July

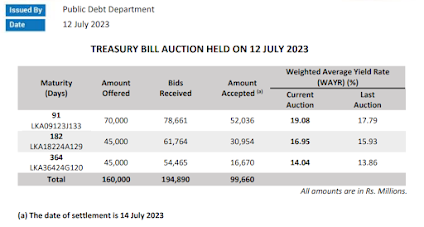

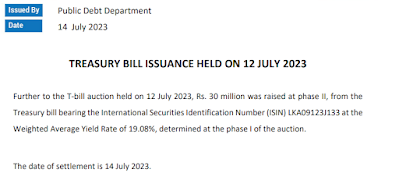

- At this first T bill issuance after the policy rate cut of 2% on 5 July, T bill yields were raised by 1.26% for 91D, 1.02% for 182D and 0.18% for 364D. Even though yields were raised, only Rs. 99.66 bn was accepted against the offered Rs. 160 bn. A mere Rs. 30 mn was accepted from the post-auction private placement window as compared to funding shortfall of Rs. 60.34 bn (37.7%).

- This is the first auction conducted after the second policy rates cut of 2% on 5 July (first rate cut of 2.5% on 31 May).

- It is usual to see the transmission of a policy rates cut to T bill rates at least at 2-3 subsequent auctions.

- However, it is bizarre that T bill yield rates rose by more than 1% at this auction. This has happened just after policymaking authorities expressed sentiments over continuous reduction in interest rates as a result of the economic stabilization gaining at present.

Public Concern

The increase in yields at this auction is bizarre due to several reasons.

- First, immediately after a policy rates cut, its immediate transmission is felt on T bill rates determined by the CB weekly. However, it has not happened at this time.

- Second, the CB uses T bill rates as a forward guidance on future path of policy rates whereas T bill rates are used as de facto policy rates to guide term credit markets as the bond market is not active at present. For this purpose, the CB uses the private placement window opened at auction weighted averages and the CB’s direct subscriptions to T bill issuances. Further, the CB has been heavily injecting new liquidity to the money market through reverse repo auctions. Therefore, the market liquidity is not a factor disturbing the trends of T bill rates as preferred by the CB.

- Third, from April 2022, the CB has heavily used T bill rates to effect the red-hot interest rate policy up to early January 2023 and then to effect a continuous reduction in T bill rates even when policy rates were raised (see the Chart below). In June 2023, the CB has fixed a drastic decline in T bill rates to express sentiments over economic stabilization.

- Therefore, why did the CB abruptly permit a 1% hike in T bill rates on 12 July, despite its ability to fix yield rates at any levels they wish to drive the monetary policy, is a serious concern. As such, above chart does not show any market fundamentals other than unlawful market manipulations by the CB.

- Therefore, the CB could have printed a few billions of Rupees to cut off bids at lower yield in line with the transmission of the policy rate cut, given the fact that the current level of such money printing has reached Rs. 2,539 bn in addition to lavish money printing through reverse repo auctions to fund money dealers at lower rates while capping the CB’s overnight lending facility.

- As such, a loss to public funds of at least 1% on funds raised from this auction needs an external investigation.

- This happened not long after another issuance irregularity causing at least of 2.5% loss to public funds consequent to keeping yield rates unchanged at the auction held on 31 May, despite the policy rate cut of 2.5% on same day afternoon.

- These are losses to public funds on the top of losses caused by the CB arbitrarily by concealing the money printing profit of Rs. 235 bn in 2022 and Rs. 27.5 bn in 2021 in violation of section 39(c) of the Monetary Law Act without the transfer of such profits to the government (as revealed in the Part II of the CB Annual Report).

Concluding Remarks

- An external investigation is necessary to reveal specific dealers benefitted from this arbitrary and unjustified T bill rate hike.

- Authorities supervising the CB must ensure that CB’s monetary operations comply with transparent public policies to prevent arbitrary use of money printing and that the CB stays away from the use of public debt management to drive its scientific monetary policy that has caused the country’s bankruptcy.

- Treasury bill market, if manipulated in this manner, may get disrupted and cause another debt crisis soon if the government continues in deep sleep dreaming of stabilization of the economy.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)