By: Staff Writer

Colombo (LNW): Sri Lanka’s business confidence is tumbling on its slippery course, sliding perilously into the unknown – and taking a nation’s hopes along on an unbidden ride,” business magazine LMD reported in its latest edition.

News about how the domestic debt optimization framework (a.k.a. DDO) will unfold, an easing of monetary policy and the downward spiral in inflation have brought some respite to a beleaguered business community in the recent past.

But we have yet to see the effects of these events – and the burdens loom large LMD observed in its analysis of current and expected developments, including the disinflation process and benign inflation expectations in the domestic economy..

The Monetary Board of the Central Bank of Sri Lanka reduced its Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 200 basis points to 11 percent and 12 percent respectively in July – for the second consecutive month.

Meanwhile, the Governor of the Central Bank Dr. Nandalal Weerasinghe alluded to three key aspects that will be addressed in the debt restructuring process: firstly, discussions are underway regarding the restructuring of official bilateral debt; secondly, deliberations regarding the monies borrowed through sovereign bonds in commercial markets are ongoing; and thirdly, the focus is on optimising domestic debt.

By the end of June however, Sri Lanka had fulfilled only 33 out of the 41 trackable programme commitments under the IMF’s Extended Fund Facility (EFF), according to the ‘IMF Tracker’ maintained by Verité Research.

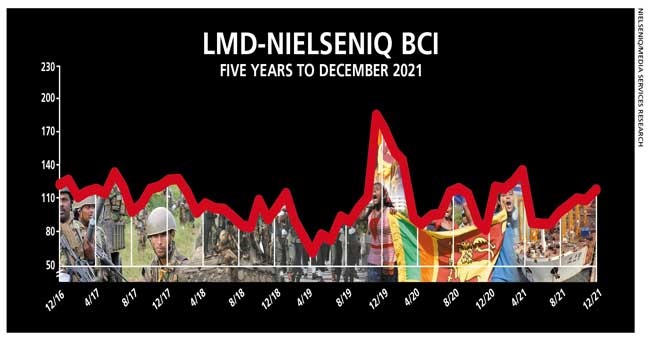

THE INDEX It is against this backdrop that the LMD-NielsenIQ Business Confidence Index (BCI) shed 10 basis points in July to register 93 – although this mark is five notches higher than the 12 month median (88) and almost twice as high as where it stood in July last year – i.e. 49.

After gaining ground in the preceding three months, the barometer headed south once again to below the 100 mark. The BCI has seen fluctuations since the beginning of this year with the index at its peak (108) in April.

SENSITIVITIES Financial sector volatility, the ongoing fluctuation of the value of the Sri Lankan Rupee and high taxes continue to fluster the business community.

In addition, the price of black gold rose to its highest level in nearly three months recently when US inflation data suggested that interest rates in the world’s largest economy were close to their peak. This could have implications for our forex outflows in the short term at least.

PROJECTIONS NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya cautions that “as the country struggles to maintain equilibrium, businesses and the people are still in a state of flux.”

In the last two months, we have maintained that “the burning question for the weeks ahead is whether the perceived pros will outweigh the cons – and if they do, we expect the BCI to stand firm and not fall below the psychologically important 100 mark.”

The verdict therefore, seems to be that we’re currently in negative territory – although we may see a reversal of sorts next month if the real benefits of lower inflation begin to filter through and there’s more good news on the debt restructuring front.