This article highlights the progress of standard monetary operations of the central bank (CB) during the first 8 months of 2023 based on a graphical presentations and their blunt failure.

Meaning of monetary operations

Monetary operations generally mean money printing operations carried out to ensure that money market interest rates are maintained within the targets of the monetary policy policy. This involves both injection and absorption of liquidity/money by the central bank to regulate the money market liquidity at levels consistent with respective interest rate targets (money market price targets). Inter-bank and government securities are the targeted markets of the monetary operations.

Key interest rate target of Sri Lankan monetary policy is the inter-bank overnight interest rate to be kept within the policy interest rates corridor, i.e., standing deposit facility rate (SDFR) and standing lending facility rate (SLFR) used by the CB for its overnight credit operations with banks. Therefore, the CB primarily focuses on overnight inter-bank liquidity. In addition, the CB habitually intervenes in primary Treasury bill yields on a weekly basis at auctions without any pre-announced targets in order to drive other term-credit markets.

Instruments of monetary operations

Standing facility window (deposits and lending), repos and reverse repos (overnight and term basis) in government securities, direct purchase of Treasury bills and statutory reserve ratio (SRR) are the monetary instruments used by the CB. All instruments except repos have been used during the reference period. Highlights of the progress of each instrument are given below.

Standing facility window

This is the prime instrument of the present policy interest rates-based monetary policy model used to target the volatility of the overnight inter-bank interest rates. The principle of the model is the standing facility window without limits.

However, this policy model has failed due to limits imposed on the standing facility window (i.e., rationing) effective from 16 January as follows.

- Deposit facility up to 5 days a month for any bank

- Lending facility up to 90% of the statutory reserve of the bank on the day

As a result, the use of the facility has been overwhelmingly volatile as shown in the chart below. Further, due to the reduction in the SRR effective from 16 August, the standing lending facility has been further contracted.

The CB communicated that the restricted standing facility window was to activate the money market and reduce interest rates through the market forces. However, that objective has not been achieved.

- First, inter-bank market volumes (call money and market repos) continued to be at low levels as shown in the chart below.

- Second, inter-bank interest rates continued to be around the upper bound of the policy rates corridor as shown in the chart below. The call money rate was seen somewhat around the middle of the corridor only in August.

- Third, the CB had to inject liquidity through reverse repos on a regular basis to make up for the restricted standing lending facility (see details below).

- Fourth, the CB had to cut policy rates twice in total by 4.5% in June (2.5%) and July (2%) to drive market interest rates down.

- Fifth, the CB had to issue a monetary order effective from 25 August to impose ceilings on interest rates of bank lending products.

As such, standing facility window-based monetary policy model has been effectively dormant during the reference period.

Reverse repos

Reverse repos has been a regular monetary instrument to inject the liquidity to the inter-bank market during the reference period. Where reverse repos have been issued for periods ranging from overnight to 89 days, the new trend is the auction of overnight and 7-days reverse repos as shown in two charts below.

The manner in which reverse repo auctions were conducted raises several concerns, some of which are listed below.

- Acceptance of overnight reverse repos is almost the bid amount. Therefore, offers have been unduly over-estimated.

- The demand for 7-days reverse repos has been high, but offers and acceptance have been highly under-estimated.

- Acceptance of overnight reverse repos mostly at interest rates lower than the SLFR and 7-days always at the SLFR (as shown in the two charts below) is highly questionable as it has caused a huge loss to public funds for undue or insider benefits to bank dealers. While the weighted average reverse repo rate has been lower by 20-55 basis points, the minimum rate accepted has been lower by 50-75 basis points than the SLFR.

- It appears that 7-days reverse repo auctions have been mostly targeted for one dealer/bidder at each auction.

Total volume of reverse repos offered during the reference period is Rs. 8,830 bn. However, the volume accepted amounted to Rs. 6,819 bn against the demand (bids) for Rs. 8,691 bn. Therefore, the macroeconomic rationale behind reverse repo auctions remains an issue, given the high demand for liquidity in the bankrupted economy.

Direct purchase of Treasury bills

This has been the traditional method of the CB to regulate the money market liquidity while facilitating the fiscal liquidity to influence short-term interest rates in line with undisclosed monetary policy. It has been the habit of the CB to first drive Treasury bill yield rates in the desirable direction of the monetary policy through insider means before revising the policy interest rates.

- During the reference period, CB’s T bill holding has been steadily high mostly in the range of Rs. 2.4 tn and Rs. 2.7 tn (as seen in the chart below) as significant bumps were reported when fiscal requirements were facilitated without allowing yield rates to rise.

- Direct purchase of T bills was the most significant source of liquidity injection to the money market through fiscal operations. If not for this source, the country’s monetary system also would severely contracted causing a historic depression.

- Yield rates were reduced faster through direct purchases as shown in the chart below for the policy interest rates to follow suit. However, while forcing banks to reduce interest rates, the CB’s attempt to keep T bill yield rates elevated during the month of August in contrast to the earlier reported declining trend is unexplainable.

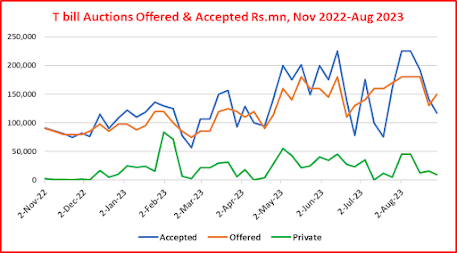

- Acceptance of bids in excess of offerings, acceptance skewed towards 91-days bills at auctions and rising volumes of bidding free post-auction private placements at weighted average yields (as shown in the two charts below) are the fundamental problems on the status of market conduct and development of the oldest government securities market in the country.

Statutory reserve ratio

The CB cut the SRR by 2% to 2% effective from 16 August to release about Rs. 200 bn to free reserves of the banking system with a view to easing the liquidity management. The SRR is the portion of funds that banks keep at the CB out of their rupee deposit liabilities to the non-bank private sector. The CB expects this to reduce bank cost of funds and interest rates and to expand credit flows, accordingly.

The SRR cut is indicative of the failure of the CB’s market-based liquidity instruments such as standing facilities and reverse repos.

The side effect of the SRR cut is the reduction in depositor protection in the event of bank stress liquidity situations as bank reserves available at the CB have now fallen to bare 2% of private sector deposits.

Impact on monetary conditions

The impact of the CB’s monetary operations can be identified at three monetary layers, i.e., liquidity operations/injection to the banking sector, reserves provided or money printing to the monetary system and eventual creation or supply of money to the public.

- Liquidity Injection

The CB’s monetary operations, primarily of standing facility window and reverse repo auctions, are immediately reflective of the overall liquidity overnight and outstanding basis. The significant volatility of both overnight and outstanding liquidity figures as shown in the chart below is evidence for unhealthy instability of the banking sector liquidity management in the bankrupt economy environment.

Data show that the injection of the liquidity (negative figures) has been mostly up to Rs. 100 bn on overnight basis and up to Rs. 300 bn on outstanding basis. The difference arises from term-reverse repo operations.

- Reserve Money

Standing facility window, reverse repo auctions and direct purchase of Treasury bills together with the CB’s operations on the foreign reserve are reflective of the level of reserve money which is a technical estimate of money printing by the CB. As shown in the two charts (monthly reserve money and weekly reserve money) below, money printing has been significantly raised in 2022 and 2023. However, the CB has been attempting to cut the money printing during certain periods for undisclosed reasons. In this regard, May-Nov 2022 and July-July 2023 are specifically observed.

The high volatility of reserve money is indicative of it being out of the control of the CB without macroeconomically supportive or consistent targets/trends.

- Money Supply M2b

In old monetary theory followed by many central banks including the CB, all monetary operations are considered to have an eventual impact on monetary conditions of the economy as reflected in movements of the broader money supply estimates.

In 2023, the M2b stock, a broader estimate of the money supply, has risen at elevated levels as shown in the chart below, indicating of continuously higher purchasing power at the hand of the public in general. This trend is contrasting with the irregular trend of money printing shown above.

- Monetary growth

Annual monetary growth used by central banks to gage the changes in monetary conditions shows a general trend of a significant reduction in the growth of both reserve money and money supply as shown in the chart below.

However, the reduction in annual growth of both estimates of money has been the trend observed since the middle of 2021.

The high volatility of the reserve money growth together with its negative growth in several months in 2023 is a major concern as it hampers the liquidity management of the banking sector. This will hinder the supply of credit to meet the rising demand for money by the private sector in its efforts for the recovery from the present debt and foreign currency crisis caused by the CB since the beginning of 2022.

This is revealed by the significant reduction in annual growth of credit to the state sector from 36.6% in April 2022 to 12.4% in July 2023 with corresponding reduction in the private sector credit growth from 20.3% to negative 7.6% as shown in the following chart caused by the contracted economy and underlying rise of credit risks. A person with common business sense will understand how the economy and living standards will struggle in economies with such a catastrophic level of the contraction of the credit growth of the state and private sectors.

Concluding Remarks

- Above highlights show that CB’s monetary operations have miserably failed as they have not been carried out on a macroeconomic basis to recover the economy from its bankruptcy caused by the CB’s failure in debt and foreign currency management in terms of the provisions of the Monetary Law Act.

- The failure of the CB’s liquidity management instruments including policy interest rates in its latest strategy to reduce market interest rates and to expand credit flows is evident from the issuance of an administrative monetary order which imposed ceilings on interest rates on bank lending products effective from 25 August. The reason behind the issuance of the order is the poor transmission and inappropriateness of monetary instruments in Sri Lanka, given the current status of the bankrupt economy. Therefore, it is useless to talk about efficacy of the monetary policy for maintaining the economic and price stability of the country.

- Overall, the CB’s monetary policy is another bureaucratic act of Sri Lankan policy-makers as the government has failed to present any time-bound innovative policy action plan to recover the economy from the bankruptcy caused by the failure of the CB in its debt and foreign currency management responsibilities. Therefore, the use of monetary instruments has been a stray activity of the country’s national economic management.

- Therefore, it is proposed that the government/Parliament urgently implement public criteria for performance ranking of each policy-making institution based on the effectiveness of policy instruments used for practically measured/identified tasks within national priorities before they approach unknown foreign parties to do the ranking on external criteria to mislead the national leaders and general public. It is warned that such external rankings of insider sources could serve as sources to even destabilize the country governance system. What ever the criteria adopted, any external ranking of high figure awarded to policy-makers despite the country’s economy struggling with default sovereign credit rating, negative GDP growth, non-liquid foreign reserves, credit growth at rocked bottom and exodus of the young and adult desperately looking for employment abroad will only be a rating joke.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Source: Economy Forward