The monetary policy press release issued today ( Monetary Policy Press Release ) by the Economic Research Department planted a policy rate cut of 100 bps to 10%-11% as a great thing. Meanwhile, the design of the press release shows a drastic shift of the Monetary Policy Board (PMB) from previous fashion of macroeconomic performance talks to movements of Census and Statistics’ Consumer Price Index (CPI) to drive the monetary policy/policy interest rates.

The new policy rhetoric seems to display a sort of divine ability of the MPB to fix the y-o-y CPI change around 5% in the medium-term by magical power of policy interest rates adjustment. The new rhetoric is a result of zero knowledge of the MPB on policy rates in modern monetary systems and the macroeconomic role of the CB in present plight of Sri Lankan economy.

I recall serious concerns raised by Mr. A S Jayawardena in 2002 when CB leading economists with the advice of IMF/World Bank proposed to amend Monetary Law Act objects of the CB as the price stability. Instead, he advised to term it as economic and price stability in order to prevent the CB running the monetary policy statistically after a consumer price index. Now, with domestic price stability as the main objective of the CB in the new legislation insisted by IMF, the PMB seems to start playing with the CPI exactly as predicted by Mr. A S Jayawardena. Therefore, the press release has become another text of CPI press release incorporated with a policy rates story.

Given misconceptions behind the press release and policy rates, the public may question the purpose of the existence of the CB in the current context of the bankrupted economy. Therefore, this article is to shed light on some of those misconceptions. This blog contains a large number of articles with inside facts on monetary policy actions and misconceptions.

Questionable contents in the press release and monetary policy framework

I feel that even people who drafted and approved the press release have not understood the meaning and factual position of major texts. In this regard, following 7 text contents are presented with my comments.

1. Press Text – “The Board arrived the decision following a careful analysis of the current and expected developments in the domestic and global economy, with the aim of achieving and maintaining inflation at the targeted level of 5 per cent over the medium term, while enabling the economy to reach and stabilise at the potential level.”

My comment

MPB members must be of divine beings to know everything under the sun and to decide the policy interest rates accordingly.

2. Press Text – “The Board took note of possible upside risks to inflation projections in the near term due to supply-side factors stemming from the expected developments domestically and globally. However, the Board viewed that such near term risks would not materially change the medium-term inflation outlook, as inflation expectations of the public remain anchored and economic activity is projected to remain below par in the near to medium term.”

My comment

As no data are provided on supply-side factors, medium term inflation outlook, inflation expectations and par of economic activity referred to in the text, the public is not able to assess the credibility of the text. The inflation outlook given in the press release is the past CPI-based inflation projection/forecast chart which states that the forecast is neither a promise nor a commitment. Further, inflation prediction given in the chart varies between 20% and negative 10% up to the third quarter 2024.

3. Press Text – “A one-off upward movement in inflation is expected in the near term, driven mainly by the changes to the Value Added Tax (VAT) proposed by the Government effective January 2024. The spillover effects of tax measures and other developments are likely to be muted due to subdued underlying demand pressures; hence, this rise in inflation is expected to be transitory. Accordingly, headline inflation over the medium term is expected to converge towards the targeted level of 5 per cent, supported by appropriate policy measures.”

My comment

This is just a hypothetical text without any supporting research data. In the past, so many VAT changes have been implemented. Therefore, CB economists must know the exact outcome of VAT changes on inflation. The one-off upward movement in inflation as referred to in the text is incorrect because it may refer to the direct VAT impact on the CPI numbers.

However, there will be several rounds of impact on inflation through wage rises consequent to VAT-induced price increases. It is surprised that the inflationary impact of the significant wage increase approved in the budget 2024 is forgotten by the MPB although it considered everything under the sun. Further, the MPB considers subdued underlying demand pressure as a good factor despite severe macroeconomic contraction caused by it as the MPB is not concerned over living standards.

4. Press Text – “The Board viewed that, with this reduction of policy interest rates and based on the available information, further monetary policy easing will be paused in the near term, given the space for market interest rates to adjust downwards in line with the current and past monetary policy easing measures.”

My comment

As policy rates are highly arbitrary numbers, the MPB can pause or do anything it prefers by presenting a rhetoric on inflation in the medium to long term. However, the further space available for market interest rates to adjust downwards in line with monetary policy easing as referred to in the text is erroneous due to several reasons.

- First, policy interest rates and SRR do not determine risks involved in bank credit where market interest rates are largely determined by credit risks. However, policy interest rates and SRR only influence short-term liquidity management connected with credit creation of banks.

- Second, policy interest rates affect only a small portion of money market operations on central bank reserves connected with liquidity management. It is the overnight inter-bank that is targeted by policy rates. However, inter-bank volume is a trivial amount (less than Rs. 10 bn a day). If there is good credit demand from the economy, banks can create credit and deposits in book entries/digitally without borrowing from the CB at policy rates. In fact, as standing facilities at policy rates have been capped so far in 2023, policy rates are quite dormant rates. Further, central bank money or reserve also is a trivial fraction of total money in circulation (around 9%) where the hard currency is only 5% in the total money circulation.

- Third, monetary policy is implemented on the old concept of the central bank ability to control money/credit in the money multiplier model where credit creation is dependent on central bank money (reserve money) and money multiplier in a fractional reserve system. This is the accounting or statistical version behind the monetary policy of policy interest rates and SRR. However, in modern banking, credit creation is a book entry to loans and deposits, like central banks print money. Therefore, banks will borrow reserve money by a tiny fraction only if they are unable to manage fractional reserves within the banking system. That also happens after granting credit to borrowers in the event of mismatch between financial outflow and inflow. Further, the level of printing or reserve money depends on demand for it from the government and private sector and, therefore, central banks cannot control this demand by changing policy interest rates. Therefore, in reality both monetary control and monetary space through monetary policy are misconceptions presented due to lack of knowledge on modern banking.

5. Press Text – “The Monetary Policy Board will continue to assess risks to inflation projections, among others, and stand ready to take appropriate measures to maintain domestic price stability in the period ahead while supporting the economy to reach its potential.”

My comment

This text is meaningless on several grounds.

- First, MPB is to assess risks to its statistical inflation projections and not risks to price stability.

- Second, domestic price stability is not interpreted. It appears that inflation target of 5% in the medium term is a deferent concept.

- Third, economic potential is not interpreted and measured in terms of real GDP to be supported by the MPB through the domestic price stability. How the earlier cited word of economic activity of par and the economy at potential are interpreted in the monetary policy is not indicated.

6. Press Text – “Headline inflation over the medium term is expected to converge towards the targeted level of 5 per cent, supported by appropriate policy measures.”

My comment

This is the key belief of central banks that they can control actual inflation at preferred target through the monetary policy, mainly by policy rates, in market mechanism. This is a baseless belief in modern macroeconomics.

- First, old monetarists believe that money has no real sector (supply side) effects as its role is valuation and exchange of value as an intermediary like a broker. Therefore, money only affects prices and inflation through demand. It is in this context that the old monetarists interpret inflation always and everywhere as a monetary phenomenon and propose monetary policy to control inflation. However, in modern monetary and supply side economics, money has real side effects where demand and supply sides operate in integration through bank credit creation as a real world factor of production. Accordingly, inflation or aggregate price level is a market phenomenon (goods, services, factors, etc.) which is not controllable by monetary policy alone in the manner it presents.

- Second, the story of the monetary policy transmission from policy rates to inflation is not established in modern economic research.

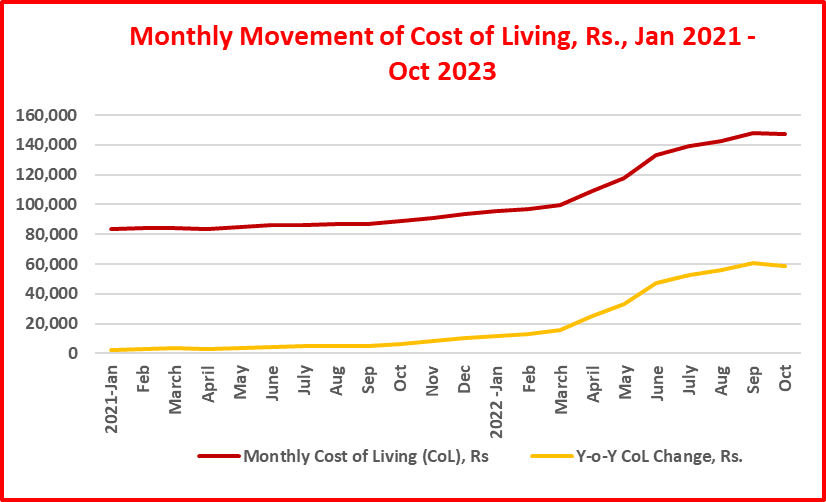

- Third, the inflation used in monetary policy is the year to year (YoY) percentage of consumer price index which is only a statistical outcome. The inflation target such as 2% or 5% is set on this statistics. Accordingly, the conduct of monetary policy is only a math. The base effect is the well-known error in this inflation measure. If same consumer price index is used for annual average change or change over a period of time, the rate of inflation is vastly different. Therefore, monetary policy in present version is not connected with the control of prices or cost of living in the economy. For instance, the inflation in Sri Lanka has now fallen unexpectedly from 69.8% in September 2022 to 1.5% in October 2023. However, CPI continues without any fall where inflation level from CPI December 2019 has risen close to 90%. In this context, CB’s rosy story of inflation control and macroeconomic stabilization by the monetary policy is meaningless in any macroeconomics concerning living standards. The technical questionability of monetary policy on inflation control is shown by following charts (CPI, 2021=100, is statistically combined to CPI, 2013=100, for consistent analysis).

Inflation figures are diverse.

Policy rates do not accord with inflation where

YoY inflation over-shooted and under-shooted.

YoY inflation is just base effect, not an economic factor.

Cost of living remains high and continues to rise.

- Fourth, as highlighted above, credit control ability in modern banking and monetary systems rests with banks and not on central banks. Therefore, the monetary policy that the CB is actually engaged in is only printing of few billions of money on daily basis to facilitate wholesale money trades of some dealers/banks. This does not represent any macroeconomic stabilization or inflation control story as presented by the MPB ( see monetary operations).

7. Press Text – “The Monetary Policy Board underscored the need for a swift and full passthrough of monetary easing measures to market interest rates, particularly lending rates, by the financial institutions, thereby accelerating the normalisation of market interest rates in the period ahead.”

My comment

Nobody knows what are the normal level of market interest rates as market interest rates from time to time depend on various macroeconomic and financial market factors including central bank monetary policy actions.

Concluding Remarks

The constitutional legality of the present monetary policy framework adopted by the MPB is questionable in view of the following.

- Violation of key provisions of the new CB Act

- The conduct of the policy without the monetary policy framework agreement (agreement not published yet).

- Non-registration of other relevant financial institutions such as specialized banks, registered finance companies and registered leasing companies for account operations, credit operations, open market operations and statutory reserves.

- Continuation of trade of government securities and non-listing of private securities in open market operations.

- Continuation of branches (Supreme Court declined to branching powers).

- Significant variability in inflation projection that indicates the breach of domestic price stability as required in the legislation and inappropriate announcement of pause of policy interest rates.

- The rationale of charging 11% interest on overnight lending through money printing to open market participants against collateral of government securities and of paying 10% interest through further money printing for acceptance of earlier printed moneys deposited by them with the CB on overnight basis in the present bankrupted and considerably contracted economy.

It is mostly observed that MPB members/experts have no option but to stay looking at magical staff presentation of charts and statistics at the board meeting, given their complications and conceptualities. The press release is simple evidence for it.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

https://economyforward.blogspot.com