Opinion By: Adolf

The situation in the country, particularly with regard to the economy and politics, can be described as stable but stagnant. The economy is stable in that it has not experienced further economic collapse in comparison to the kind witnessed last year when international bankruptcy was admitted. But the economy still continues to contract, with a contraction of over 11 percent taking place in the beginning part of the year. The shortages of goods and power sources that brought the people on to the streets in angry protest have not recurred. The government’s ability to bring down the rate of inflation and eliminate shortages is recognized, though the shrinking demand due to price increases is continuing to debilitate living standards. The much hyped Domestic Debt Restructuring was a damp squib bordering on fraud. The Debt restructuring should have been extended for all to improve debt sustainability and equity. No educated business analyst can fathom why they left out even those outside the banking sector for they are going to make a killing. Overnight several bond kings have now been created . What was the crazy reason to raise 10 year bonds and issue them at 30 percent? People were jailed for doing it at doing 5 y bonds at 11% .The yields the buyers expected to be reprofiled but they have been left out ( unbelievable )- on what grounds is this justified? Someone must go to court . The sorry saga started with the CBSL default. That made Sri Lanka a bankrupt nation . To date no action has been taken against Nandalal Weerasinghe for this arbitrary decision . Further, the differential tax justification does not make any sense – epf being taxed at 14 percent hence they needed to be reprofiled makes no sense. Banks paying 50 percent is incorrect – corporate tax rate is 30 percent and financial vat is 18 percent. So banks are not excessively taxed as implied. As for moratoriums they did accommodate many borrowers but what other choice did they have – if they foreclosed the recovery value would be very low for liquidation yields lower recovery and if such a large number of businesses were to be foreclosed on the asset sales would have crashed the collateral market – land, cars and businesses.

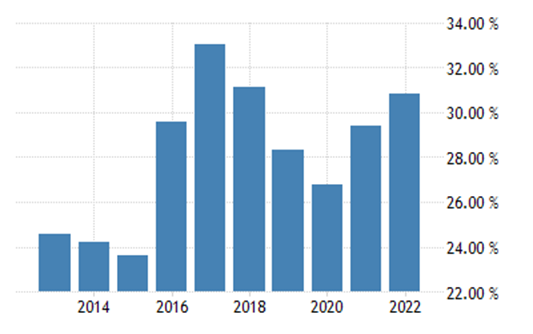

Interest Rate

The CBSL in a crazy way doubled borrowing rates overnight one year ago . SMEs we’re forced borrow at over 30% . In addition penalties we’re charged . People were willing to stomach it because they expected a haircut on the coupon or deposit rates because of the crazy interest rate policy of CBSL. It was done Nandalal publicly said to control inflation . When we were effectively importing inflation . The inflation creation was not within the country. The DDO therefore very surprisingly did not touch the TBs or the Bonds. Now imagine the money a few people will make at the expense of the tax payers, SMEs and the public. CBSL interest policy has effectively destroyed the livelihoods of over 500000 people according to estimates and destroyed over 25% of the SMEs, all for nothing. The opposition was hanged publicly for unfair bond trading . What do you call this stupidity ? Who is behind this? They must be named and shamed. The crazy interest policy of the CBSL starting from the sovereign default last year to the crazy interest rates to DDR . These actions must be investigated by a commission. The 2022 interest rate policy of the CBSL was the craziest policy intervention in the history of the CBSL. populist . The domestic debt restructuring should have been part of a broader policy package that effectively addressed the underlying economic problems and debt vulnerabilities. At least now whilst the banks, primary dealers and individuals savor their windfalls ( First Capital Holdings PLC (the Group) announces its outstanding financial performance for the first quarter ended June 30, 2023. The Group reported an impressive Profit after Tax of Rs. 2.81 billion, marking a remarkable leap from Rs. 96 million recorded in the same period last year.7 days ago ) In the absence of any common sense at least the government should bring the borrowing rates to manageable levels given that the 1 year deposit rates are now 9-10% . Unfortunately the reluctance to take action to recoup the losses from he bond traders has resulted in a surge of tax and vat for the common man. What the CBSL does not understand is that the tax payers have to service the bond issued at the crazy in the name of controlling inflation.