On 08 Feb 2024, the Domestic Operations Department of the CB issued a press release announcing the decision of the Monetary Policy Board (MPB) taken at its special meeting held on 07 Feb 2024 to relax restrictions on standing facilities with effect from 16 Feb 2024. The press release clarified the the purpose of imposing such restrictions as well as their favourable outcomes that helped relaxation of same now.

The purpose of this short article is to shed some light on the corruptive manner in which the CB/MPB conducts the monetary policy as revealed from those restrictions of standing facilities, their implementation, relaxation and contents of relevant press releases.

In this article, the corruption is defined as adoption of ad-hoc policy actions in non-compliance with the generally accepted policy principles, the lack of publicly accountable internal controls behind such policy actions, breach of the authority, arbitrariness of policy actions without supporting facts/data and resulting losses to public funds.

The empirical evidence is provided below as to how the CB monetary policy has been significantly corruptive since the imposition of said restrictions announced on 02 January 2023 at the dawn of the year 2023.

Principles behind policy interest rates-based monetary policy model in Sri Lanka

Similar to many central banks, the CB follows policy interest rates-based bank reserve/liquidity management model for the goal of inflation control or preservation of price stability. This model contains several principles/elements (Read global monetary policy model).

- Policy rates are the official targets for the variability permitted for overnight inter-bank interest rates (OIR). In Sri Lanka, Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) are the two policy rates treated as the official corridor for OIR. They are 9% and 10% at present.

- Standing facilities of the CB are the conduit used to keep OIR within the policy corridor. This is similar to the managed float exchange rate mechanism. Standing facilities are Standing Deposit Facility (SDF) and Standing Lending Facility (SLF) provided overnight basis without limits. Accordingly, any bank having excess funds/reserves can deposit them at the CB overnight SDF at SDFR. In opposite, any bank facing a deficit of reserves can borrow from the CB overnight SLF at SLFR. However, unlike in SDF, SLF is collateralized with government securities. Therefore, no bank has to lend at rates lower than SDFR or borrow at rates higher than SLFR in the overnight inter-bank market. Therefore, OIR will vary within the policy rates corridor.

- In addition, repo and reverse repo auctions (overnight and term) are conducted by the CB to finetune the banking sector reserves in order to keep OIR at preferred locations within the policy rates corridor, i.e., towards lower bound or upper bound.

- OIR is the operating target of the monetary policy used to transmit the policy to achieve the policy goal of the price stability.

- Accordingly, the major monetary policy decision of the MPB in this model is the policy rates, i.e., raising, cutting or keeping unchanged, at each policy meeting.

Accordingly, the model principle is the market-based OIR and policy transmission through bank reserves held at bank vaults and the CB. Accordingly, concerns over new monetary policy model with restrictions on standing facilities are presented blow.

Violation of monetary policy principle

Restrictions imposed by the CB on SDF and SLF effective from 16 January 2023 (a holiday) are a gross violation of the model principles set out above. The restrictions were as follows.

- SDF maximum 5 days a month for a bank.

- SLF maximum 90% of statutory reserve of the bank at any date.

With effect from 16 February, SDR restriction is relaxed as 10 days a month while SLF restriction has been removed.

Facts relating to policy model violations due to restrictions are as follows.

- As policy rates corridor became dormant, the policy model was irrelevant.

- Restrictions are the rations on standing facilities. Policy rates are the price controls on overnight inter-bank loans. Therefore, when price controls and rations are imposed together, natural market behaviour is the emergence of the black market. This means that OIR is likely to behave outside policy rates corridor (control price).

Further, continued restriction on SDF will involve in black market of OIR below SDFR. Therefore, SDFR will not be an effective policy rate for the official OIR corridor.

Therefore, the operating mechanism for the price stability goal of the monetary policy has been unduly changed from policy rates and OIR-based market transmission to ad-hock, bureaucratic monetary interventions in bank reserves and banking businesses (i.e., bank interest rates and credit).

Disruption of bank standard liquidity management

In any country, standard liquidity management of banking system is the reserve management through central bank standing facilities. This ensures the smooth functioning of the fractional reserve system to preserve the confidence in the fiat money system.

However, CB restrictions disrupted the system causing significant volatilities of bank reserve operations and liquidity management. As a result, daily operations of reserves of banks through OMO became highly unpredictable and bureaucratic (see two Charts below). This is a significant threat to the system stability in a fractional reserve system, given the foreign currency and debt default crisis confronted by the economy at present.

If any economist believes that reserve operations of Sri Lankan banking system as shown by above two Charts are healthy and sound despite those restrictions, he/she will need to learn the subject further.

Routine conduct of reverse repo auctions to cover up adverse impact of restrictions

Reverse repos are the means of lending reserves to banks against collaterals of government securities through auctions announced by the CB. They can be overnight basis or term basis or both.

Consequent to the SLF restriction and banks not willing to lend inter-bank out of surplus reserves, the CB introduced a routine system of reverse repo auctions to provide banks with fresh liquidity/reserves to cover up the restrictions. Accordingly, the CB conducted 297 auctions and provided a total of nearly Rs. 11,556 bn of reserves to OMO participants (see the Chart below). This comprises 72% of overnight reverse repos, 13% of 7-day reverse repos and 13% of long-term reverse repos. Therefore, the policy rationale for the SLF restriction is highly questionable.

However, even with restrictions banks also have utilized a significant volume of standing facilities during the restricted period. Accordingly, the total amounts of SDF and SLF were Rs. 16,440 bn and Rs. 22,713 bn, respectively. Accordingly, reverse repo auctions have been utilized to manage mismatches among liquidity sources.

According to publicly available information, concerns are raised on the ad-hock nature of the conduct of reverse repo auctions and resulting irregularities as follows.

- The manner in which the term for auctions is decided to provide reserves, i.e., overnight, short-term and long-term, is questionable.

- Acceptance of amounts lower than the offers for auctions despite higher demand.

- High volatility of auctions on a daily basis.

- As the main source of supply reserves, overnight reverse repo auctions were regularly conducted in a highly bureaucratic manner where reverse repo rate was used as an unofficial and arbitrary policy rate to drive inter-bank market as official policy rates were frozen with restrictions on standing facilities. This type of hidden operations is not in good governance of market based monetary policy model.

- The interest rates on overnight reverse repos have been mostly lower than the SLFR despite no difference between two types of lending of reserves. The rate difference has been in the range of 40-95 basis points with average of 64 basis points (see Chart below). Therefore, the loss to public funds for the reference period in respect of total overnight repos of Rs. 8,583 bn is around Rs. 13.5 bn. Further, reverse repo rates have been mostly lower than overnight call money rates too while inter-bank overnight repo rate has been significantly higher than the call money rate. This confirms unreasonable conduct of reverse repo auctions favouring banks.

- The basis of the offer of long-term reverse repos with terms longer than one month is highly questionable as CB’s monetary policy does not target such longer-term reserves and interest rates. For example, 11 auctions have been announced for terms between 700-1,188 days while 4 auctions failed without bids while others ended up accepting smaller amounts of bids than announced. It is strange that two outright sale auctions for bonds with remaining maturity of 741 days and 878 days were offered for Rs. 40 bn but ended up with lower amounts of bids worth Rs. 9 bn with acceptance of Rs. 4.2 bn. The yield rates applicable to acceptance are highly arbitrary as there are no market benchmarks. Data show that such longer term auctions have been arranged for targeted banks.

Use of Treasury bill auction yields as de-facto policy interest rates outside the monetary policy model

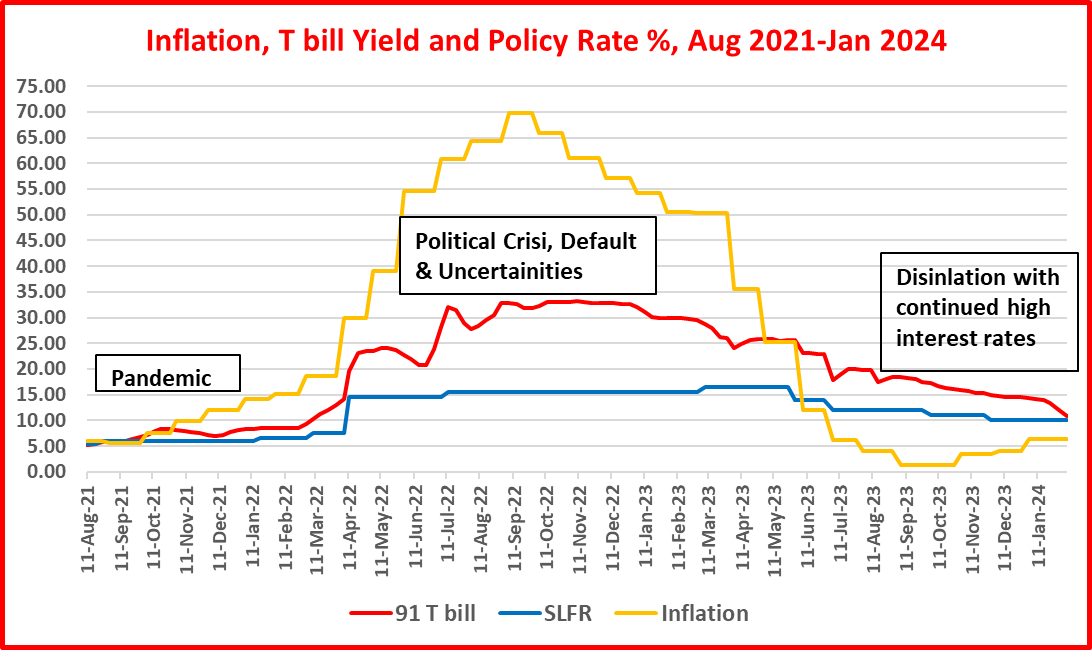

As policy interest rates-based OIR did not exist due to restrictions and other structural issues, the CB has been using Treasury bill auction yield rates as de-facto policy rates to communicate and transmit the monetary policy direction. The high activity in the Treasury bill market as compared to the small size of the inter-bank market and bank reserves during the reference period has led to this unofficial policy stance. In this regard, 91-day yield has been highly targeted due to dominant demand.

CB’s direct subscriptions to auctions and special issuances of Treasury bills and post-auction private placement window have performed as contingent funding to drive yield rates at levels and directions preferred by the CB (see Chart blow). In addition, restructuring of provisional advances to the government and Treasury bill holding of the CB (around Rs. 2,713 bn) on 21 September 2023 has helped ease market pressure on new issuances. With that ease, the CB now uses post-auction private placement window to drive yield rates.

At the Presidential Commission 2017, all frontline monetary policy economists of the CB testified that private placement system was a powerful policy instrument to control interest rates in the monetary policy where the Commission determined the system was filled with significant irregularities subject to forensic audit. Therefore, the present post-auction private placement window in driving yield rates in the direction of the monetary policy is not immune to such irregularities as the system is implemented by same officials who favoured the old system.

The above Chart shows that policy rates and OIR have behaved without a clear policy trend while 91-day Treasury bill yield has got an underlying story. In this story, it is surprised to observe following two facts.

- Why the yield rate was driven down continuously while policy rates continued to be raised in March 2023.

- Why the yield rate was held flat in the last quarter of 2023 despite significant cut in policy rates since June 2023.

- Why the yield rate has been left for faster reduction during the last four weeks. This seems to facilitate the latest CB communication for the need to reduce market interest rates without cutting policy rates further.

In fact, Treasury bill yields were used as the conduit to implement the super monetary tightening cycle too (see the Chart below). This unauthorized practice has punished the public debt and tax payers unreasonably for the conduct of the arbitrary monetary policy. For example, raising yield rates to 30%-33% during the post-pandemic political crisis driven by the monetary policy led domestic debt service unsustainable causing a de facto default by way of restructuring of domestic debt. The government has failed throughout the history to set up an independent debt office due to the resistance of the CB’ s market network.

Overall, this type of hidden, unauthorized monetary manipulations is not in good governance of the market-based monetary policy model and principle.

Serious lapse in policy governance

The restrictions on standing facilities were imposed by the Director, Domestic Operations of the CB from his circular (see below) dated 02 January 2023 issued in terms of Consolidated Operating Instructions on Market Operations dated 21 May 2021. However, the Director does not indicate specific reasons for such restrictions/new market regulation.

However, the relaxation now communicated by Communications Department on 08 February 2024 is a decision of the MPB. Therefore, several governance issues are raised.

- First, whether the Director, Domestic Operations, had the statuary powers to invalidate and supersede the policy rates corridor-based monetary policy decided by the Monetary Board at that time.

- Second, why does the MPB enter into shoes of the the Director, Domestic Operations, to relax a market regulation imposed by him if Consolidated Operating Instructions on Market Operations still prevail.

- Third, specific reason why the MPB has decided to continue with the restriction on standing deposit facility as 10 times a month is not communicated in the CB press release. Therefore, it is clear that the MPB has not made any empirical study on market implications and risks caused by restrictions including the continued restriction.

- Fifth, the press release has not been issued as a statement of the MPB with names of the members voting and non-voting and, therefore, who accepts the responsibility of the press release is not clear, given its flawed contents as indicated below.

- Sixth, these restrictions have not been applied to primary dealers. As they are not subject to statutory reserve requirement, they may have used standing facilities without limits.

Deceptive and flawed contents of the relevant press releases

Selected contents of the press release dated 07 January 2023 on the imposition of restrictions

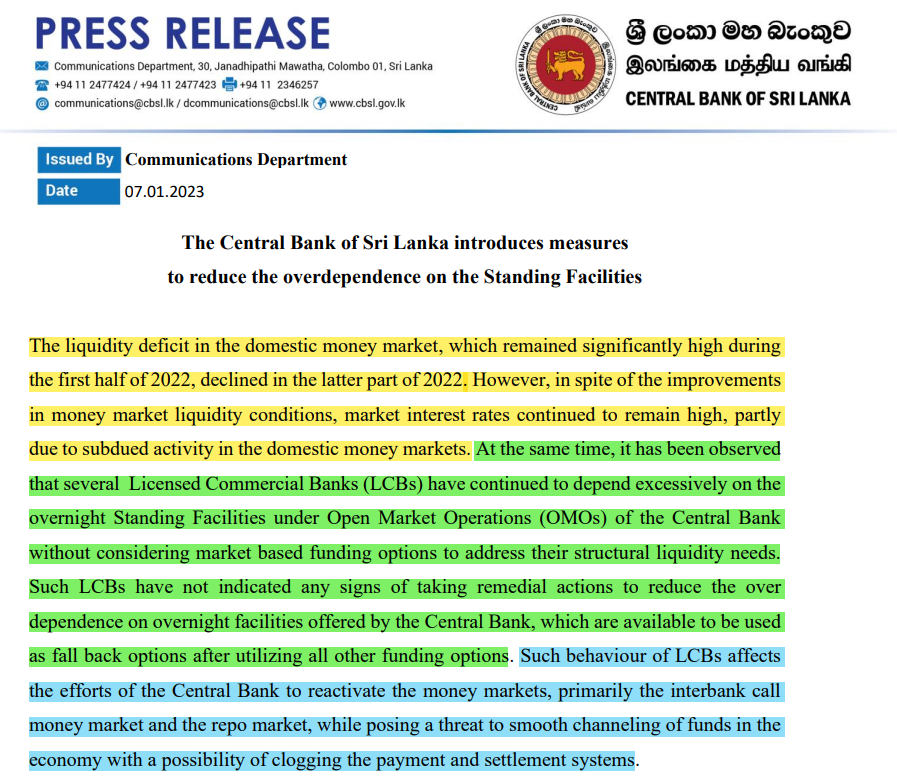

The Director, Domestic Operations, did not indicate reasons behind his circular dated 02 January 2023. However, Communication Department of the CB issued a press release later on 07 January 2023 to explain the rationale behind the circular. Accordingly, the press release is reproduced with highlights below (Press Release).

Five selected highlights of the press release and my comments are as follows.

Highlight 1. The liquidity deficit in the domestic money market, which remained significantly high during the first half of 2022, declined in the latter part of 2022. However, in spite of the improvements in money market liquidity conditions, market interest rates continued to remain high, partly due to subdued activity in the domestic money markets.

My comments

There is no data to show the decline in deficit and improvement in the market liquidity conditions as stated. Subdued inter-bank market activity was not a result of liquidity deficit but a result of the loss of inter-bank trust and channeling funds to Treasury bill market in view of super high yield rates and low risks.

Highlight 2. At the same time, it has been observed that several Licensed Commercial Banks (LCBs) have continued to depend excessively on the overnight Standing Facilities under Open Market Operations (OMOs) of the Central Bank without considering market based funding options to address their structural liquidity needs. Such LCBs have not indicated any signs of taking remedial actions to reduce the over dependence on overnight facilities offered by the Central Bank, which are available to be used as fall back options after utilizing all other funding options.

My comments

- Standing facilities are the core of the monetary policy for daily OIR target or policy rates corridor. Therefore, these facilities are not fall back options to be utilized after other funding options for bank liquidity management.

- In the monetary policy model, standing facilities are free from limits or rations and, therefore, banks are not expected to limit themselves on the dependence over them.

- How banks resort to standing facilities for liquidity risk management is their choice and addressing structural liquidity needs is a subject to be resolved by bank supervision. Accordingly, bank supervision has imposed liquid asset and liquidity coverage requirements and management of liquidity risk on prudential grounds among other banking risks. Further, how such ad-hock restrictions imposed by the monetary policy would support the structural liquidity is unknown even in bank supervision.

- The subject of structural liquidity needs is not clear in both bank risk management and bank supervision. In opposite, liquidity is a very short-term accounting concept derived from the mismatch of tenures between assets and liabilities of banks, mainly deposit liabilities and loans. As deposits are byproducts of loans created by banks and all deposits are sight liabilities, banks have no options other than liquidity risk management on a daily basis while resorting the inter-bank market and central bank standing facilities. It is natural for banks to confront mismatch between cash inflows and outflows arising from the structure of assets and liabilities which affect bank reserves. Accordingly, central bank can target market interest rates in their monetary policies only if they they carry out monetary operations to fill the bank liquidity/reserve gaps on a daily basis. Therefore, structural liquidity needs is bizarre concept of the CB’s Communication Department.

Highlight 3. Such behaviour of LCBs affects the efforts of the Central Bank to reactivate the money markets, primarily the interbank call money market and the repo market, while posing a threat to smooth channeling of funds in the economy with a possibility of clogging the payment and settlement systems.

My comments

- Stability of the payment and settlement systems is not a part of the the policy rates- based monetary policy model. It is a technical aspect to ensure that payments go through without interruption. However, as payments arise from bank reserves, the CB has to ensure orderly supply of reserves to avoid liquidity crunches. In this regard, the CB has various other instruments such as interest free intra-day liquidity facility and emergency lending outside the monetary policy to deal with such payment system risks. Therefore, restrictions on standing facilities in fact will worsen payment system risks. This may have led banks to borrow more from intra-day liquidity facility. As reported, borrowing through intra-day liquidity facility in 2022 has been as high as nearly Rs. 650 bn a day on average.

- Activity level of inter-bank and money markets is part and parcel of the monetary policy OMO operations. It is common sense that the CB’s super tight monetary policy driven through government securities yield rates at around 30% disrupted money and inter-bank markets, given extremely high risks involved in private credit markets above 30% interest rates.

- The loss of inter-bank trust amid the liquidity and interest rate risks consequent to the super tight monetary policy was the reason for the low activity in the money and inter-bank markets where markets were closed some days. Liquidity stresses and bank turmoil were reported from many countries including the US and UK in the recent past due to such tight monetary policies.

Highlight 4. The imposition of the limitations on the Standing Facilities is expected to reduce over dependence of LCBs on the overnight facilities offered by the Central Bank and support the reactivation of the domestic money market, which remained nearly inactive for the last few months, while encouraging LCBs to transact among themselves.

My comments

- As stated above, inactivity of money markets, i.e., inter-bank market, is an outcome of the super tight monetary policy and underlying inter-bank trust issues in the environment of the debt default and economic crisis in Sri Lanka. Therefore, there is no macroeconomic or monetary policy rationale to impose such restrictions on CB standing facilities as they would worsen the bank liquidity situation.

- Further, data do not show any significant reactivation of inter-bank market so far (see Chart below). The increase in repo market with significant volatility from November 2023 is due to significant increase in market values of government securities consequent to the steady reduction in yield rates and high liquidity risks caused by interest rates. Meanwhile, inter-bank call money has remained at a low activity mostly below Rs. 10 bn throughout the period as banks had frequent access to the CB’s reverse repo window at lower interest rates.

Highlight 5. These measures would also eliminate unhealthy competition for deposits among financial institutions and would be instrumental in inducing a moderation in the market interest rate structure (of both deposit and lending interest rates) in the period ahead along with improving market liquidity conditions, which will help to restore stability of the Sri Lankan economy, while preserving stability of the financial system.

My comments

This is a completely meaningless view.

- First, it is impossible to think that these restrictions will improve the healthy competition for deposits among financial institutions. The flow of deposits is an outcome of credit creation and market share of banks.

- Second, the CB issued a monetary order to require banks to reduce interest rates on credit products as interest rates did not moderated as the CB envisaged. It is common sense that such restrictions will not moderate market interest rates as those are market distortions. Recent interest rate reductions came from other monetary policy actions inclusive of manipulations in Treasury bill yield rates as already stated.

- Third, there is no evidence to establish that these restrictions helped restore the stability of the Sri Lankan economy and preserve financial stability as the country is still struggling in the foreign currency and debt crisis. Those are the subjects of a wider macroeconomic policy package. If restrictions have been so favourable as stated, the MPB should continue these restrictions for several years to come until the economic crisis is over.

Overall, if these contents of the press release are correct, the Director of Domestic Operations of the CB should be the most single public official who can act to recover the economy from the current crisis because market restrictions imposed by him on 02 January 2023 has had magical powers on the stability of the financial system and economy.

Selected contents of the press release dates 08 February 2024 on the relaxation of restrictions

The press release is reproduced with highlights below ((Press Release).

This press release has been issued by Domestic Operations Department by referring to the purposes of restrictions on standing facilities communicated in the press release dated 07 January 2023 issued by the Communication Department on such restrictions imposed by the Director, Domestic Operations, who failed to indicate such purposes in his Circular dated 02 January 2023. Accordingly, three key highlights of the press release and my comments are as follows.

Highlight 1. These measures were imposed with the intention of reducing the overdependence of LCBs on the overnight facilities offered by the Central Bank, supporting the reactivation of the domestic money market, particularly the call money market, and inducing LCBs to introduce internal corrective measures.

Highlight 2. The Central Bank observes that these measures have yielded positive outcomes by way of reactivating the domestic money market and curtailing excessive competition for deposit mobilisation among financial institutions. These measures were also instrumental in inducing a moderation in the market interest rate structure in line with the monetary policy stance, while preserving stability of financial institutions and the financial system.

Highlight 3. The relaxation of the restrictions on the Standing Facilities is expected to accelerate the downward adjustments in market interest rates as envisaged under the overall monetary policy direction of the Central Bank.

My comments

- As already commented above on the first press release, all contents in this press release are unjustified. There is no evidence to establish that inter-bank market got activated and market interest rates structure got moderated or financial system stability was preserved by those restrictions. If the position is correct, the relaxation is unfounded as it would worsen favourable market outcomes already achieved and will not help accelerate downward adjustments in market interest rates in line with the monetary policy, especially as inflation has started rising again.

- Further, the first highlight mentions about inducing LCBs to introduce internal control measures. However, what those measures are not stated in the press release.

- This press release has forgotten to mention about progress on restoration of the stability of Sri Lankan economy through market restrictions as envisaged in the first press release.

- Accordingly, the rosy story painted as usual in the press release regarding reasons for relaxation of standing facilities is unjustified. It is only a text of fancy technical terms which are not understood by even those who drafted and approved the press release. Therefore, press releases are meaningless communications to the public.

Concluding Remarks

- Empirical facts presented above justify that monetary policy with stated restrictions on standing facilities has been an arbitrary, bureaucratic operation in violation of principles behind the present market-based monetary policy model.

- These restrictions have led to a massive scale of providing reserves to banks through ad-hoc reverse repo auctions-based money printing. As internal controls and processes on such auctions are not transparent, the possibility of significant irregularities exists, given its involvement in trillions of money printing to identified bank dealers. There is no information whether auditing authorities are even aware of such bureaucratic monetary operations and resulting exposure to significant financial and system irregularities including losses to public funds.

- It is not possible to assume that this type of bureaucratic monetary policy is able to achieve the price stability of the economy because it is only carried out to provide billions of new reserves to money dealers on a daily wholesale basis.

- As the IMF financial programme is built on good governance and anti-corruption principles, relevant authorities must examine how the said restrictions and their outcomes inclusive of concerns raised as above could pose risks to the good governance and anti-corruption-based macroeconomic management model.

- As a final piece of advice, the government must consult subject specialists whether the present form of bureaucratic monetary policy model (with or without restrictions) can help recover the credit flow which is directly instrumental in the recovery of the economy, especially through small and medium enterprises and other priority production sectors (such as exports and import substitution) before it is too late. This is necessary as the CB Governor stated at a recent Parliamentary Committee meeting that elected members of the government do not have the technical knowledge on such macroeconomic management subjects.

- The recovery from the present bankrupt economy status requires a blend of expansionary monetary and fiscal policies that target priority sectors and distribution of credit to revive production and investment activities on priority basis. Therefore, the present monetary policy model will not help that type of policy package and macroeconomic recovery.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)