Introduction

The history and performance of Litro Gas Lanka Ltd demonstrate that privatizing this national pro ider of LPG in Sri Lanka is not a prudent course of action. This report aims to present a comprehensive analysis of the key reasons why the privatization of Litro Gas Lanka Ltd is unwarranted. The company’s historical background. current status. and proposed solutions for its growth will be examined.

Historical Background

The history of Litro Gas Lanka Ltd can be summarized as follows:

• Prior to 1995, the company was 100% owned by the Government of Sri Lanka (GOSL).

• Tn 1995/96, 51% of the shares were sold to Royal Dutch Shell. leading to the establishment of Shell Gas Lanka Ltd.

• ln 2010, Royal Dutch Shell sold back its 51% shares to the Government of Sri Lanka, which subsequently led to the creation of Litro Gas Lanka Ltd.

• Since 2011, Litro Gas Lanka Ltd has been 99.9% owned by the Sri Lanka Insurance Corporation.

Current Status of Litro Gas Lanka Ltd

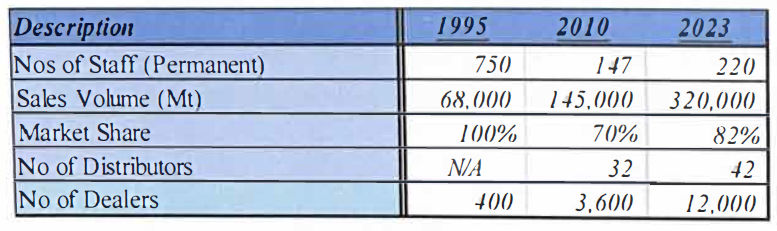

Litro Gas Lanka Ltd is a significant player in the Sri Lankan energy industry, operating one of Asia’s largest filling plants with the capacity to process I 00.000 domestic cylinders· refills per day. The Litro Gas Lanka network comprises 42 distributors. approximately 12,000 point-of-sale locations, and 1,500 home deli very hubs, serving over 4 million households and various commercial and industrial sectors.

Litro Gas Terminal Lanka (Pvt) Ltd

Litro Gas Terminal Lanka (Pvt) Ltd, the leading LPG storage facility in the country, is responsible for storage and filling facilities for LPG distribution. It was established in 201 O when the Sri Lanka Insurance Corporation acquired the Shell-owned LPG Storage Terminal in Kerawalapitiya. The terminal has a current capacity of 8,000 Mt and is fully automated. It is also the only company in Sri Lanka with a Central Mooring Facility.

Key Points

Several key points highlight the reasons for not privatizing Litro Gas Lanka Ltd.

- Economic Contribution: In July 2022, the company received a long-term loan of USO 70 million from the World Bank to aid the government during a foreign exchange crisis. This loan, equivalent to Rs. 25.8 billion, was expeditiously repaid by December 30, 2022, in order to address the government’s pressing financial needs.

- Resilience: Litro Gas Lanka Ltd swiftly recovered its business in a short period following an economic crisis, demonstrating its ability to adapt and thrive.

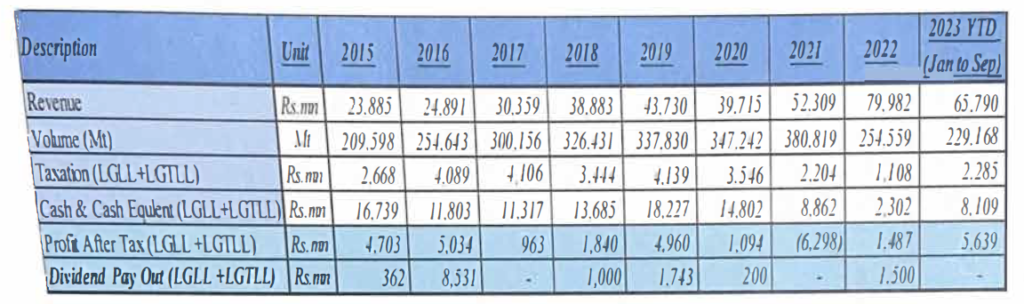

- Revenue and Profitability: The company’s current average annual revenue stands at Rs. 75 billion, with an average annual profitability of Rs. 4-5 billion.

- Dividends and Taxes: Since 2015, the company has paid a total of Rs. 13.4 billion in dividends and Rs. 27.6 billion in taxes.

- Debt Management: Litro Gas Lanka Ltd obtained short term loan facility around Rs. 10 billion from commercial banks in 2022 and efficiently cleared all outstanding amounts. Presently, the company holds no outstanding loans and has no financial obligations to the national treasury or any commercial bank.

- Financial Health: Litro maintains a current cash equivalent of Rs. 8.1 billion. ensuring its financial stability.

- Labor Relations: The absence of trade unions within the company is a positive factor in maintaining operational efficiency.

Volume and Sales Data

Summary of Financials for 2015 – 2023

Proposed Solution

instead of privatization, a Joint Venture (JV) approach is recommended to enhance Litro Gas Lanka Ltd’s capacity and competitiveness.

- Establishing a joint venture (JV) with a qualified credible management team that can safeguard employees’ rights and ensure the smooth and effective operation of the company

- Infusion of advanced technology and systems by the JV can optimize operational efficiency

- The JV can explore opportunities to introduce the Litro brand to new markets outside Sri Lanka and develop new products like LNG and CNG

Conclusion

The data presented supports the notion that privatizing Litro Gas Lanka Ltd may not be in the best interest of Sri Lanka. The company has a proven track record of contributing significantly to the government’s finances while maintaining financial stability. A JV approach offers a more favorable path to capitalize on the company’s potential for growth and innovation.