Article’s Background

According to CB’s annual financial statements released on 25 April 2024, the loss of the CB for its independent monetary and financial operations was Rs. 114.4 bn. In addition, the profit remittable to the government for the year was negative Rs. 313.7 bn.

A man on the road may wonder why the CB run by an esteemed class of international economists and experts by printing of money as they wish (central bank independence) makes such colossal losses and who are accountable to and who pay for such losses.

Although CB financial statements are difficult to understand, they show many arbitrary operations hiding behind the independent monetary policy responsible for these colossal losses. In last article, (Read article here) I presented one factor as the CB’s payment of interest on daily bank excess reserves balances held at the CB. This unnecessarily incurred cost was Rs. 15.9 bn for 2023.

This short article highlights how the CB lost income by supplying reserves to banks through daily overnight reserve repo auctions at interest rates lower than the rates charged on the CB’s daily standing lending facility (SLFR) to banks. The loss is around Rs. 10.7 bn for 2023 and Rs. 17.6 from January 2023 up to the end of April 2024.

Why overnight reverse repo auctions at lower interest rates are connected with monetary irregularity?

- First, the present monetary policy model is to set a limit or corridor for the variability of overnight inter-bank interest rates. This corridor is the policy rates, i.e., SLFR and SDFR (standing deposit facility rate which is the rate pays interest on bank excess reserve balances). Therefore, overnight inter-bank interest rates will always fluctuate in the corridor depending on the bank liquidity gaps.

- Second, the CB conducts daily auctions of reverse repo lending to banks at interest rates lower than SLFR through which banks make daily profit.

- Third, both standing lending and overnight revere repos are equal in credit quality as both are secured by government securities and mature overnight. Therefore, lower interest rates on overnight revere repos have no economic basis.

Therefore, offering reserves at lower rates through overnight reverse repo auctions than SLFR is a monetary policy irregularity that may have connections to insider dealings with bank dealers.

Reverse repo monetary irregularity in graph

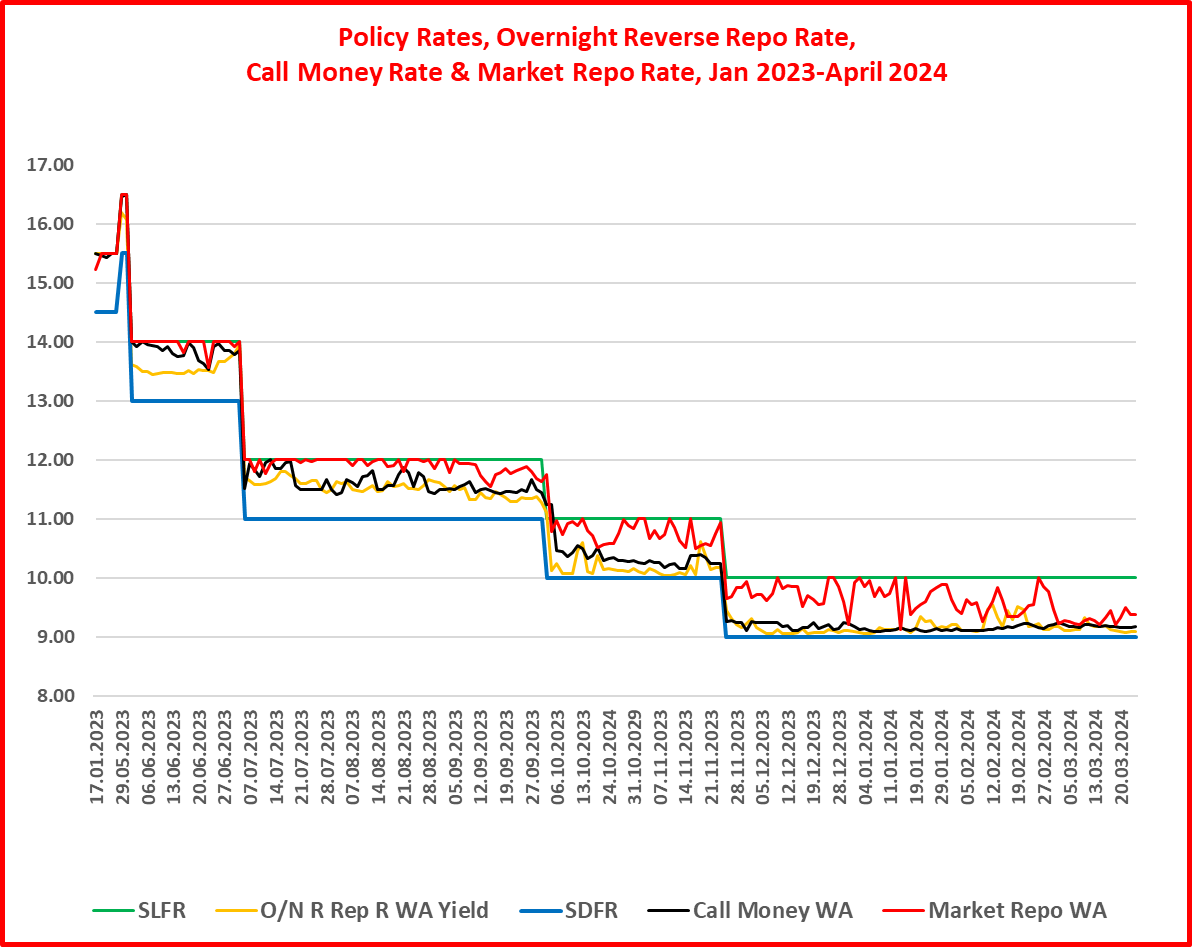

The graph below presents the extent of the irregularity.

- From October 2023, overnight inter-bank rate (Call Money Rate) has been moved closer to SDFR from being close to SLFR before.

- For this motive, overnight reverse repos auctions have been conducted unnecessarily by the CB at rates closer to SDFR but mostly below overnight inter-bank rate. The loss to the CB based on inter-bank rate is Rs. 2.3 bn. The specific reason why the CB wanted such lower overnight inter-bank rates is not known, given the policy rates corridor and market-based monetary policy model for inter-bank interest rates.

- The inter-bank loan product comparable with CB’s overnight reverse repos is the market repos. However, overnight repo rates have been significantly lower than market repo rates which have been within the policy rates corridor. The loss to the CB based on market repo rates is Rs. 11.7 bn.

- The CB has granted a total of Rs. 10.4 trillion against the offer of Rs. 13.6 trillion through 226 auctions during the period from January 2023 to the end of April 2024 (see the graph below).

Irregularity of term reverse repo auctions

In addition, the CB has been frequently conducting reverse repo auctions on term basis mainly ranging from 6 days to 90 days (longer auctions exceeding 800 days also are reported.) to provide additional reserves on long-term basis. However, it is difficult to find benchmark interest rates to compare these auctions rates and estimate losses incurred by the CB in such auctions.

Further, the specific reason why the CB want such long-term term-reverse repos when it implements a policy rates corridor based monetary policy is not known.

The CB has granted a total of Rs. 3.9 trillion against the offer of Rs. 5.1 trillion through 147 auctions during the period from January 2023 to the end of April 2024 (see two graphs below).

Special liquidity facility

The CB also has operated an additional facility to supply reserves to commercial banks and National Savings Bank on a case by case basis (private placements). Applicable terms and conditions and turnover are not known. The only information available is the interest income earned on the facility is Rs. 16.7 bn for 2023 as compared with interest income of Rs. 51.5 bn on supply of reserves through reverse repo auctions.

Why the CB provides such liquidity facilities privately despite the policy rates corridor-based monetary policy is a serious concern over the CB’s policy governance and independence.

Misleading graph presented by the CB

Policy rates and inter-bank interest rate are presented by the CB as below in its brand new Annual Economic Review 2023 (page 25) along with selected liquidity information. This graphical tries to misleads the public by providing only inappropriate information.

Two basic problems arise here.

- First, how interest rates fell in 2023 while overnight liquidity falling to zero where the opposite happened in 2022. It is a simple monetary fact that lower interest rates are maintained by the supply of more reserves to banks and vise versa.

- Second, the outstanding/term liquidity supplied through term revere repo auctions and special liquidity facility by the CB is not shown here. Outstanding liquidity supplied by the CB has been mostly between Rs. 100 bn to Rs. 300 bn on daily basis in 2023. Therefore, the reason for the fall of inter-bank interest rates is the supply of longer term reserves and the manipulated overnight reverse repo auctions and other term auctions by the CB as highlighted above.

Concerned remarks

It appears that the CB lavishly prints money to supply reserves as stated above to fill the cash flow mismatch on credit creation-based business of banks without any regard to the bankruptcy of the economy. In fact, it appears that the CB supplies such reserves as the lender of first resort to bank in a manner of spoon-feeding that encourages banks be negligent on liquidity management behind the credit creation business. It is in this context the CB states that the banking system is sound and resilient.

National leaders approaching for national elections propose various economic development models to upgrade living standards of the general public from the present bankruptcy and poverty. However, nobody seems to propose underlying models of financing such development models. They need funds because they do not bring inherited wealth to fund these models.

In modern sovereign currency-based monetary economies, it is the monetary policy that is the nuclear in distribution of finance across economic and business activities, irrespective of the development model. It happens through the types of reserves supplied by central banks to the financial system. Therefore, national leader must consider whether the present model of bank dealer supporting monetary policy model will provide required financing for their country development models.

I saw one political party stating that it would use the exiting bank branch network to finance the proposed development without any specific development banking services. This raises two issues.

- First, who will issue regulations to banks to engage in such development lending as part of their profit-based money creation business. Will the Parliament issue specific regulations directly overriding the present sect of regulations issued by the CB?

- Second, will the CB provide reserves to fill cash mismatches arising from such development credit creation of banks similar to the present spoon-feeding practice.

Therefore, national leaders have to propose how they fund their economic governance system as against the present bankrupt system.

However, if they plan to sell government bonds to foreign investors and use proceeds to finance the economy to keep the public happy with cash and abundant imports, the country and general public will slip from the poverty to the poverty in generations to come while most of us would have dead and gone with those election promises leaving a new round of foreign debt to new generations to default.

This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Source: Economy Forward