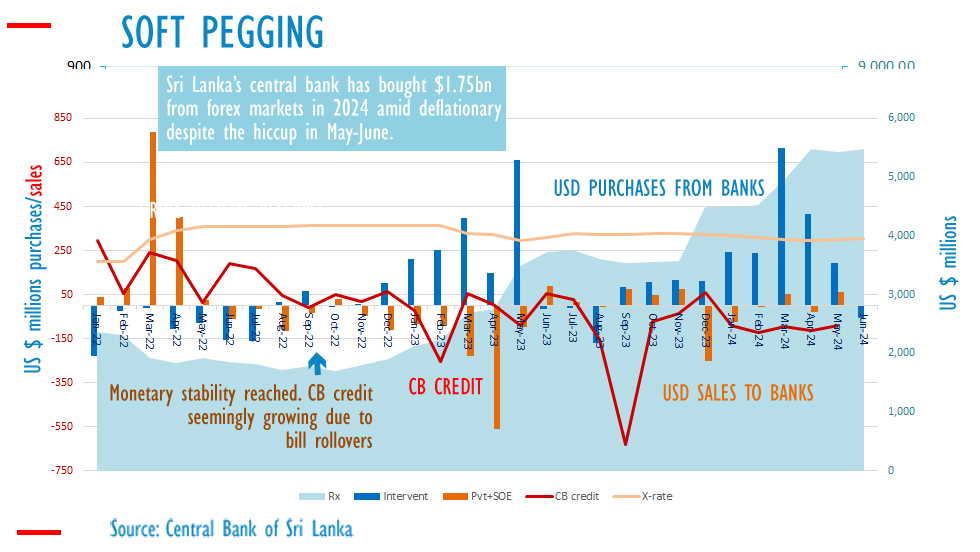

ECONOMYNEXT – Sri Lanka’s central bank was a net seller in forex markets in June 2024, official data shows, data shows after a build-up of excess liquidity from dollar purchases up to May.

The central bank sold 57 million US dollars to banks in June and did not buy any dollars, data shows, after buying 224.5 million US dollars and selling 32 million dollars in May.

There was a build-up of excess liquidity up to 200 billion rupees after dollar purchases in April and May.

Sri Lanka operates a so-called flexible exchange rate, which analysts says is not backed by consistent policy.

When there is higher import demand, usually due a pick up in private or state enterprise credit or both, the flexible exchange rate slides triggering a confidence shock in both importers and exporters.

Importers try to cover early and exporters try to delay, when the exchange rate weakens.

In July the rupee has stabilized.

The flexible exchange rate is one of several ‘age-of-inflation’ developed by Western Mercantilists and are peddled to unfortunate countries without a doctrinal foundation is sound money, critics say, but are not used in stable Western nations.

Excess liquidity reduced in June and July but liquidity was injected overnight to some banks as the system tightened.

The central bank has also injected 7 day money, below the overnight window rate, data show.