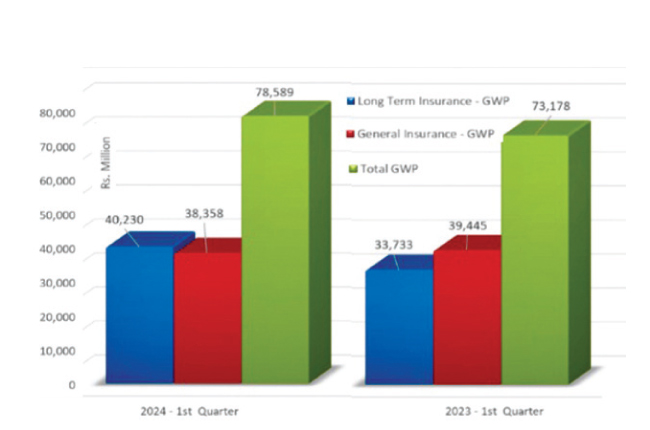

August 01, Colombo (LNW): The insurance sector in Sri Lanka reported a total Gross Written Premium (GWP) of Rs. 78,589 million for the first quarter of 2024, marking a 7.39 per cent increase from Rs. 73,178 million in the corresponding period of 2023.

The Long-Term Insurance Business saw a substantial growth of 19.26 per cent, with a GWP of Rs. 40,230 million, whilst General Insurance Business experienced a 2.75 per cent decline, amounting to Rs. 38,358 million.

The industry’s total assets grew by 10.88 per cent to Rs. 1,098,988 million. Long-Term Insurance assets rose by 18.54 per cent to Rs. 824,890 million, whereas General Insurance assets decreased by 7.17 per cent to Rs. 274,098 million.

Investments in Government Debt Securities increased by 30.07 per cent to Rs. 552,158 million.

Claims incurred by both insurance sectors dropped by 6.97 per cent to Rs. 32,384 million, with Long-Term Insurance claims at Rs. 18,320 million and General Insurance claims at Rs. 14,064 million.

The Profit Before Tax (PBT) for the period rose by 35.06 per cent to Rs. 12,332 million, driven by significant growth in General Insurance Business PBT, which surged by 106.11 per cent to Rs. 5,677 million.