August 27, Colombo (LNW): The Commissioner General of the Excise Department, M.J. Gunasiri, has rejected allegations of substantial tax arrears within three major revenue-collecting agencies—Inland Revenue, Sri Lanka Customs, and the Excise Department—referring to such claims as exaggerated.

Addressing a media briefing at the Presidential Media Centre (PMC) on 26th August, Gunasiri clarified that the outstanding taxes amount to only Rs. 90 billion, which is consistent with the typical 3%-5% shortfall seen in most countries.

The Commissioner General underscored that these three institutions achieved record revenue in 2023, exceeding Rs. 3 trillion, and managed to create a primary budget surplus for the first time in 25 years.

He noted that much of the arrears involve payments from government entities and are already in the process of recovery through legal channels. He explained that the delayed collection is part of standard financial procedures and is not indicative of systemic failure.

Gunasiri also highlighted the significant growth in revenue generated by the Excise Department, which recorded Rs. 179 billion in 2023, with a target of Rs. 232 billion for 2024.

By August this year, the department had already amassed Rs. 132.7 billion, reflecting a 24.6% increase compared to the previous year.

Further elaborating on the tax situation, Deputy Commissioner General B.K.S. Shantha of the Inland Revenue Department outlined their ambitious revenue target of Rs. 2,024 billion for 2024.

The department has initiated robust measures to streamline tax collection, including establishing a Risk Management Unit and accelerating efforts to resolve pending legal cases.

He dispelled rumours circulating on social media regarding officials allegedly visiting institutions undercover to collect taxes, confirming that their visits are strictly for awareness purposes.

Anura Muthukude, Finance Officer at Sri Lanka Customs, explained that their department has already collected Rs. 963.7 billion by late August, with a target of Rs. 1,533 billion for the year.

He clarified that Rs. 57.6 billion of the reported arrears are owed by government entities and are unlikely to be recovered, while the remaining sums are being pursued through the courts.

He also mentioned the department’s introduction of a “Smart Unit” for public complaints, emphasising the commitment to transparency despite staffing shortages.

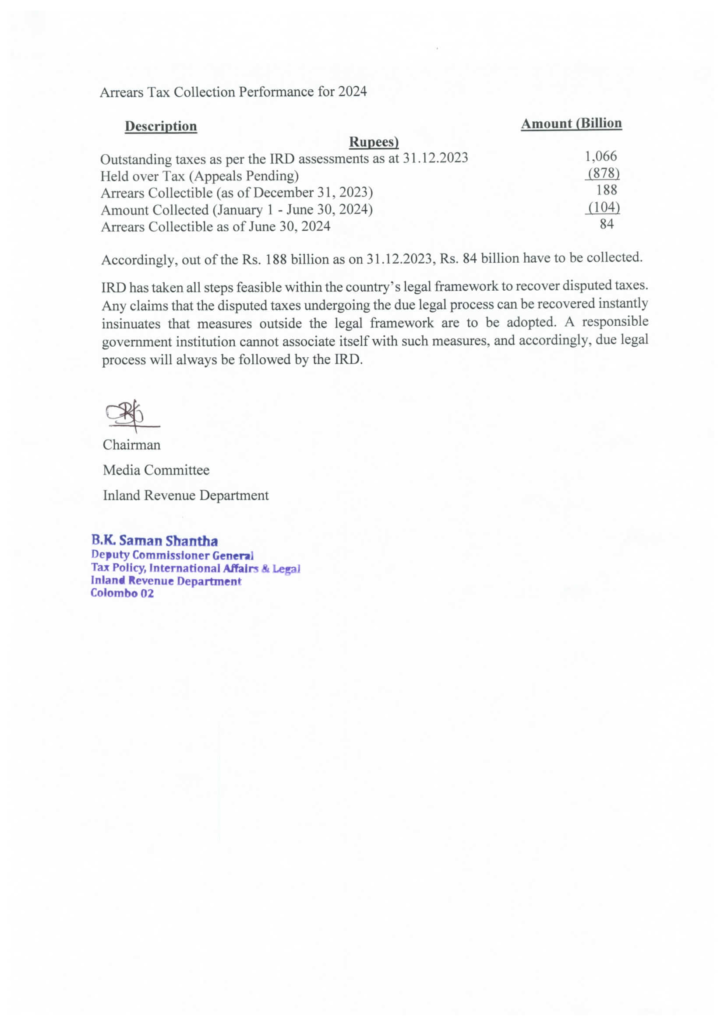

Meanwhile, in a press release issued by the Inland Revenue Department, the speculations involving tax arrears have been debunked, stating that the IRD has taken all steps feasible within the country’s legal framework to recover disputed taxes, and that any claims that the disputed taxes undergoing the due legal process can be recovered instantly insinuates that measures outside the legal framework are to be adopted.

“As of December 31, 2023, balance of 1,066 billion rupees has reported as taxes in default as per the assessments made by the Inland Revenue Department. However, due to pending tax appeals from taxpayers, a portion of this amount, totaling 878 billion rupees, is currently held over. Consequently, it is inaccurate to assume that the entire 1,066 billion rupees can be collected in full by the department. The actual amount of tax the department could reasonably expect to collect on December 31, 2023, was 188 billion rupees,” the IRD statement read.

It added: “From January 1st to June 30th, 2024, the department collected 47 billion rupees in tax arrears from the outstanding balance as of December 31, 2023. This was achieved through various methods, including seizing bank accounts of 900 taxpayers, offering instalment payment plans, and taking other legal actions. Additionally, another 57 billion rupees were recovered or reduced due to settled refunds and objections. Therefore, the total reduction in tax arrears for the year 2024 was 104 billion rupees.“

The Department emphasised that completely eliminating tax arrears through its collection processes is practically impossible. This is primarily due to the ongoing issuance of new assessments, which can contribute to increasing the arrears balance, the IRD pointed out.

Therefore, achieving a zero tax arrears balance is not a realistic goal for any tax administration, the Department went on, adding that its primary role should be to maintain efficient tax arrears collection processes within the existing legal framework.

This commitment is demonstrated by the department’s efforts to reduce tax arrears by 104 billion rupees in the year 2024.

It further clarified that a responsible government institution cannot associate itself with such measures, and accordingly, due legal process will always be followed by the IRD.