By: Staff Writer

September 12, Colombo (LNW): The government is set to establish a Financial Stability Fund aimed at boosting under the financial crisis management program led by the Central Bank of Sri Lanka (CBSL).

To kick start the Financial Stability Fund, an initial nominal amount of Rs. 1 billion will be allocated by the Finance, Economic Stabilisation, and National Policies Ministry, finance ministry sources revealed.

“The fund will be gradually built up through annual budgetary allocations, adhering to financial limitations,” Cabinet Spokesman and Minister Bandula Gunawardena said at the weekly post-Cabinet meeting media briefing yesterday.

Cabinet of Ministers on Monday approved the establishment of this Financial Stability Fund tostrenthen the country’s bank resolution framework.

The Financial Stability Fund, is a key measure under Section 15 of the Banking (Special Provisions) Act No. 17 of 2023, is designed to ensure the smooth resolution of financial institutions in crisis, safeguarding financial stability in the country.

Under Section 15(2) of the Act, the Financial Stability Fund will be managed independently, separate from the other assets held and regulated by the CBSL.

The urgency of establishing the Financial Stability Fund stems from its inclusion as a priority policy procedure in the second subprogram of the financial sector stability and reform program.

This initiative is also supported by a US$ 200 million loan from the Asian Development Bank (ADB) to implement effective resolution procedures, backed by comprehensive guidelines.

Gunawardena said the Financial Stability Fund is expected to play a crucial role in enhancing Sri Lanka’s financial crisis management framework, ensuring the stability of the banking sector.

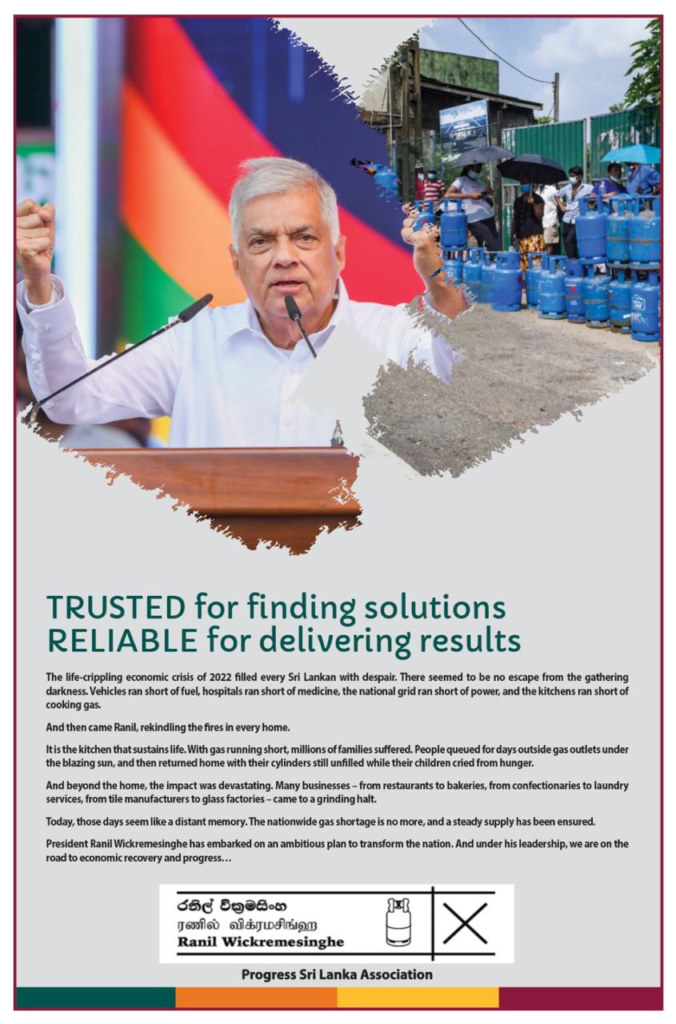

The proposal was presented by President Ranil Wickremesinghe in his capacity as Minister of Finance, Economic Stabilisation, and National Policies.

By July 31, 2024, indicators tied to the second subprogramme of the financial sector’s stability and reform programme will guide the implementation of the fund.

The Ministry of Finance will provide comprehensive guidelines for the fund’s operation, using the initial allocation to ensure an effective resolution framework.

The program adopts a programmatic policy-based loan (PBL) modality with two subprograms of $200 million each to properly sequence reforms and ensure the needed flexibility while implementing multi-year policy reforms in a crisis period.

Subprogram 1 prioritizes immediate reforms to enhance the crisis management regulatory framework and stabilizing the financial sector while subprogram 2 prioritizes follow-on reforms to build a resilient and inclusive financial system.

It will be supported by an attached transaction technical assistance (TA) for subprogram 2 and post-program partnership framework (PPPF) activities.

A programmatic approach that combines policy-based loans, TA, and knowledge support was selected as it allows complex and challenging reforms to be addressed comprehensively.