Article’s Background

The purpose of this article is to highlight the irrationality and inappropriateness of the Monetary Policy Board (MPB)’s last policy rates decision to keep them unchanged at 8.25%-9.25% as announced on 27 September.

The Central Bank (CB) announced the monetary policy decision at 7.30 morning of 27 September. (press here to read the statement). The prior MPB decision was 25 bps cut announced on 24 July.

I predicted on 25 September that either MPB would cut policy rates between 25-100 bps or else keep them unchanged at current level of 8.25%-9.25% as policy rate/monetary policy decision is a highly arbitrary bureaucratic decision. (press here to read my article).

Key consideration of the MPB for making the decision

Some of those considerations are reproduced below as appeared in the CB press release.

- The Board arrived at this decision after carefully considering the recent and expected macroeconomic developments and possible risks and uncertainties on the domestic and global fronts with a view to ensuring that inflation aligns with the target of 5 per cent over the medium term, while enabling the economy to reach its maximum potential.

- The Board observed that inflation is likely to remain well below the target of 5 per cent over the next few quarters, potentially recording deflation in the immediate future driven by changes to administratively determined prices and easing of supply conditions.

- Headline inflation softened significantly with the recent downward revisions to the electricity tariffs, and fuel and LP gas prices as well as the overall decline in volatile food prices. Moreover, core inflation, which reflects underlying demand conditions in the economy, also moderated, albeit at a slower pace.

- Accordingly, the latest projections confirm that headline inflation is likely to be below the target by a notable margin in the forthcoming months while core inflation is projected to remain around the current levels on average.

- Supported by appropriate policy measures, inflation is expected to gradually align with the targeted level of 5 per cent over the medium term after a likely overshooting in the second half of 2025.

- Meanwhile, yields on government securities, which came under pressure owing to perceived uncertainties amidst the Presidential election, showed preliminary signs of easing at the Treasury bill auction following the election.

- The continuation of the Extended Fund Facility arrangement with the International Monetary Fund (IMF-EFF) and early finalisation of the debt restructuring process will support the strengthening of external sector buffers further.

- The Board noted that the current accommodative monetary policy stance is yielding the expected outcomes, particularly in terms of the continued easing of market lending interest rates, expansion of credit to the private sector, and a strong rebound in domestic economic activity amidst a low inflation environment.

- The Monetary Policy Board will continue to monitor and assess incoming data on inflation developments and other macroeconomic variables and will adopt data-driven policies as required, going forward.

My comments and concerns

Almost all reasons given above are irrelevant and unjustifiable for the MPB mandate of the monetary policy for inflation target as agreed with the Minister of Finance on 3 October 2023.

- As per monetary policy framework agreement signed with the Minister of Finance (Read the Gazette here), the inflation target is 5% on quarterly average of the year-on-year CCPI monthly headline inflation for the three months of the corresponding quarter, with a margin up to 2%. Accordingly, effective target is the quarterly inflation of 3% to 7% in any quarter. This means that the mandate of the MPB is to comply with the inflation target on a quarterly basis (three months moving average) for the past. Therefore, the MPB’s only duty is to look at the trend of the quarterly average inflation figure and invoke monetary policy actions it considers fit to get the quarterly average inflation back to 2%-7% target in future.

- Therefore, all reasons or macroeconomic outlook and risks stated in the press release are inappropriate. For example, recent price revisions, core inflation, monthly headline inflation, balance of payment developments, foreign reserves and growth factors are not relevant on the monetary policy framework, i.e., policy rate change to achieve the quarterly average inflation target by changing the aggregate demand of the economy suitably. Therefore, consideration of other micro economic information such as prices of selected goods and services, deb restructuring, foreign reserves and potential production is not warranted in the monetary policy. Further, the MPB has no mechanism or mandate to influence those areas through monetary policy. However, previous Monetary Board under the Monetary Law Act had a mandate for balancing the growth, prices and balance of payment, etc., for economic and price stability.

- The price analysis in the price index is an unwarranted exercise as monetary policy has no instruments to target or influence such individual prices to comply with the inflation mandate. Such price controls are the work of the government. What the MPB should be worried is only the quarterly average inflation number. Therefore, the most part of the press release is out of its mandate and framework.

- The decision made on the basis of inflation forecast is not rational as the CB inflation forecast itself is unacceptable. The CB itself states that the forecast is nether promise nor commitment. Therefore, inflation forecast has been changed in each monetary policy statement. It is now accepted that inflation forecast of even Bank of England and US Fed are defective. Central banks may predict inflation and economic variables not more than one month or one quarter. No human being can predict present days’ economic outcomes.

- Expectation of deflationary period without early monetary policy action such as cutting policy rates and printing more money to prevent it is a violation of the MPB’s statutory mandate on inflation target. Deflation is considered as a serious blow on production and employment than inflation.

- Although past policy statements generally report the status of inflation expectations and its anchoring process by the monetary policy, the present statement does not reveal anything about it or whether the expected deflationary trend is connected with change in inflation expectations.

- The near-term and medium-term used for expectations of several key economic outcomes are not specified in calendar times. Therefore, the general public is unable to adjust their economic activities accordingly.

- Although policy statement mentions about policy consideration to enable the economy to reach its maximum potential, the monetary policy mandate does not cover any potential of the economy. Further, the MPB does not give any indicators for the maximum potential of the economy at present. In fact, lower interest rates are required to promote the economy towards its potential it is below at present. It is no secret that economy’s potential is severely blocked by tight fiscal and monetary policies and continued supply chain disruptions as shown by alarming magnitude of migration of youth and skilled professionals seeking employment overseas.

- A strong policy rate cut was expected due to several valid reasons as highlight below.

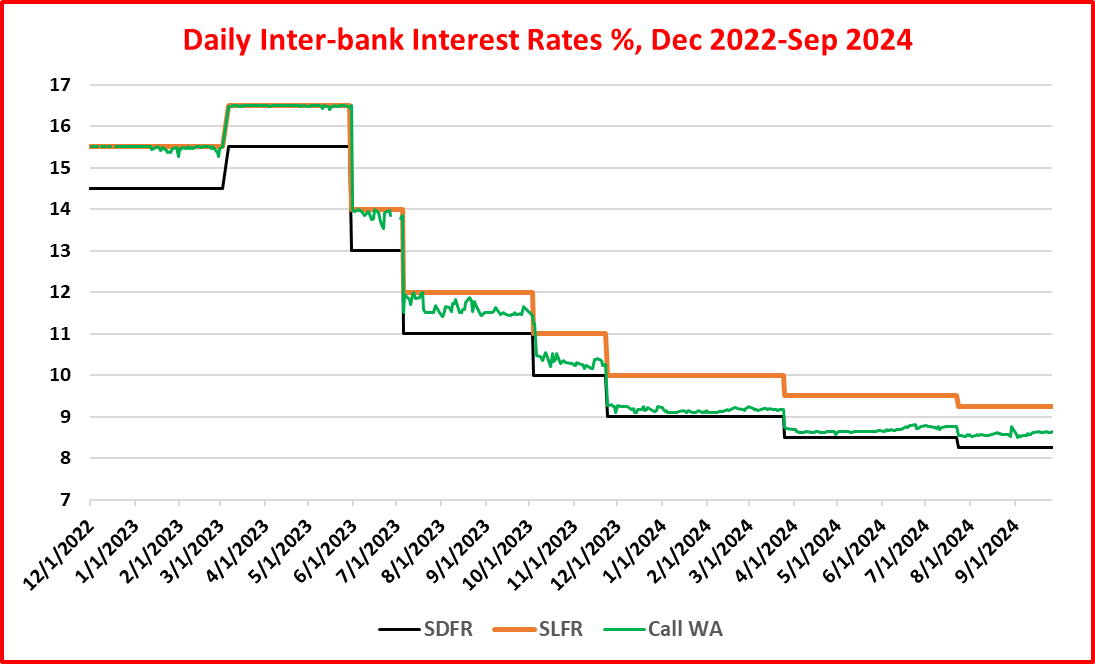

- First, inflation has been closer to zero from March this year as compared to the peak of 70% in September 2022. However, the reduction in policy rates has been only 7.25% so far from May 2023 in total of six occasions. Two jumbo rate cuts of 4.5% was announced in May and July 2023 when inflation was in the range of sugar high 35%-25%. Therefore, keeping policy rates at still high 8.25%-9.25% at inflation closer to zero is not justifiable.

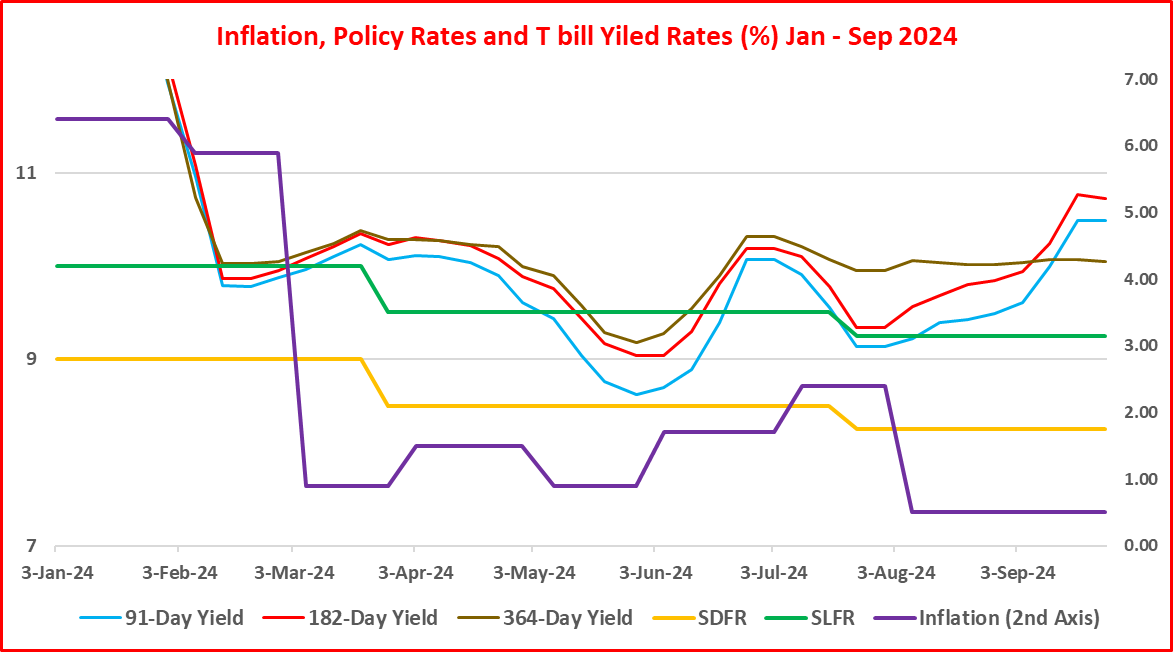

- Second, although press release states that market interest rates have fallen, it is observed that market rates have tended to move up for past three months even for the CB controlled interest rates such as Treasury bill yields and call money rate. Despite the injection of reserves through reverse repo auctions daily around Rs. 40 bn – 60 bn at lower interest rates than SLFR, call money rates recently have been moving towards the upper policy rates corridor from its lower bound (see the charts below). Therefore, market interest rates and policy rates are inconsistent with zero bound inflation. Accordingly, a strong policy rates cut is now necessary to bring market interest rates sustainably down to be in line with zero bound inflation.

- Third, global central bank community has now commenced a rate cutting cycle after more than two years of rate hiking cycle as inflation has been strongly and sustainably fallen to around the target of 2%. While the cycle started with 25 bps cut by the European Central Bank in last June (second 25 bps cut in September) and Bank of England in last August, it was strengthened by the Fed’s unexpected jumbo rate cut of 50 bps on 18 September even facing the Presidential Election coming up on 5 November. As a result, many central banks are now in the cutting bandwagon. The MBP in the past cited the global rate hike as one reason for steeper policy rates hike in Sri Lanka. Therefore, the MPB has no global reason now to keep policy rates high further because Sri Lankan monetary system is also a dollarized one through capital flows.

- The MPB’s view that “that the current accommodative monetary policy stance is yielding the expected outcomes, particularly in terms of the continued easing of market lending interest rates, expansion of credit to the private sector, and a strong rebound in domestic economic activity amidst a low inflation environment” to keep policy rates unchanged is factually incorrect and unacceptable due to following reasons.

- First, what expected outcomes are yielding are not indicated.

- Second, easing of market lending rates is not correct as market interest rates are now rising as shown above, despite high volume of reserves of banks parked at the CB for risk free return now at 9.25% (see the chart below) with hardly overnight borrowing from at SLFR, partly due to low level of economic activity requiring reserves.

- Third, private credit expansion is not a matter for the monetary policy framework as its present mechanism is the policy rates, financial conditions/money supply and quarterly average inflation. Private credit is only a sectoral finance matter for the banking sector and government. The new CB does not have instruments for bank credit controls under the monetary policy.

- Fourth, strong rebound in domestic economic activity is justified with relevant information while domestic economic activity is not a matter for the present monetary policy framework. Further, if the activity had been so strong, the former President would have been re-elected. However, he lost to a brand new political movement.

- Fifth, the link between the economic activity rebound and low inflation environment is not provided in the policy statement.

Remarks

- In view of comments and observations made by me as above, the MPB’s decision to maintain policy interest rates unchanged at 8.25%-9.25% is irrational and arbitrary while reasons given for the decision are incorrect and irrelevant. Almost all contents are meaningless jargon that nobody understands.

- The current level of policy interest rates of 8.25% and 9.25% on risk free and cost free money printing operations has no economics for a bankrupt economy with sky-rocketed cost of living as such high interest rates worsen the economy.

- In common business sense, a jumbo policy rate cut of at least 2%-3% is now required to spearhead a new dynamism of the economy in order to recover from the present bankruptcy status.

- Keeping interest rates unchanged while global interest rates are falling in low inflation environment is an indication of the MPB using it monetary policy unlawfully for other motives such as raising foreign reserve buffer through hot capital inflow on rising interest differential.

- It is reported that the even the IMF who is the architect of Sri Lankan monetary policy is also now not happy with present two policy rates (rates corridor) system with ample lending to primary dealers for on lending to the government although the system was set up under the assistance of the IMF/World Bank.

- The CB cannot do all economic wonders under the sun through its policy interest rates as it is not a magician or scientist but a geo-political bureaucrat managed by people of politics, not of divine.

- Therefore, the system of the present monetary policy requires a major revamp to make it advantageous to the general public of the presently bankrupt economy which is to be managed by a fresh political leadership elected first time by voters after 75 years.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(35 years of staff grade service in the Central Bank, a former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Source: Economy Forward