Article’s purpose and background

This article is to present key points published in the Daily Mirror, 14 March 2025 (Press here to read the article), based on a public lecture made by Dr. Indrajit Coomaraswamy, Central Bank Governor 2016-2019, on 10 March 2025 in celebration of the 75th Anniversary of the Central Bank of Sri Lanka.

- This blog article reveals the importance of the contents of the Daily Mirror article to provide a key source of information critical for investigating into those who are responsible for the economic crisis that the country has been confronting since late 2020 if relevant authorities are interested in conduct of a technical investigation.

- It is the general practice seen in many countries that official reports are published after economic crises to inform the public of causes, impact and resolution measures of such crises and reform agenda proposed to prevent the recurrence of such crises.

- However, whole blame for the crisis in Sri Lanka has been singularly passed to a handful of leaders and officials who were involved in managing the economy in 2020/21 based purely on political agendas without any official crisis reports of macroeconomic nature published by relevant authorities.

Key points in the Daily Mirror article showing untold causes of the crisis

I list down important points below. However, I don’t wish to comment or add to them in order to keep their investigative value open for public debate or investigation.

- Despite a pushback against future borrowings via International Sovereign Bonds (ISBs) from certain quarters, Sri Lanka will, at some point, have to tap international capital markets to prevent further economic compression and close the external financing gap, which remains wide.

- Sri Lanka should not and cannot achieve smooth debt management and gradually reduce its external financing needs before tapping ISBs again—something the country has neither done nor been able to do since 2019.

- Without such borrowings—typically at a relatively lower cost than portfolio investments in rupee government securities and with longer maturities—Sri Lanka will struggle to bridge its external financing gap.

- Unless funds come from sovereign bonds, Sri Lanka would experience compression in both consumption and investment, which the country cannot afford due to the deep contraction and its economic consequences on businesses and the public alike.

- ISBs are probably the most effective way of doing it unless we sell ourselves to some donor who will bankroll us, which is not a good outcome.

- Total outstanding sovereign bonds rose from US$ 5.0 billion at the beginning of 2015 to US$ 15.0 billion by the end of 2019, with US$ 4.5 billion raised in 2019 alone.

- This was done for two reasons—first, to reduce reliance on highly volatile portfolio inflows into government securities, which stood at around US$ 3.5 billion in early 2015, and second, to reduce approximately US$ 2.5 billion worth of currency swaps with other central banks.

- Portfolio investments in rupee securities were causing significant trouble due to their extreme volatility, creating uncertainties for policy-making at a time when the U.S. Federal Reserve was raising interest rates. As a result, portfolio investments were brought down to about US$ 600 million and currency swaps down to US$ 500 million by the end of 2019, from where they stood at the start of 2015.

- Funds raised through ISBs were crucial in extending the maturities of Sri Lanka’s external debt and lowering borrowing costs, as ISBs were issued at rates between 6 percent and 7 percent, compared to rupee bonds, which were around 12 percent at the time.

- US$ 4.5 billion worth of bonds issued in 2019 were raised both to extend maturities and to create buffers for the next administration, which was almost certain to come into power later that year due to public dissatisfaction following the Easter bombings.

- It was fairly certain that the economic stabilisation programme would not continue under a future administration, which could lead to the discontinuation of the then-ongoing International Monetary Fund (IMF) programme.

- Even the markets were willing to lend to Sri Lanka at the time, as they believed in the country’s progress in strengthening macroeconomic fundamentals under the IMF programme and through the Active Liability Management Act, which was passed in parliament during that period.

- Pushing back against claims that large-scale bond issuances were primarily responsible for Sri Lanka’s 2022 debt default, Dr. Coomaraswamy argued that these borrowings actually helped delay an otherwise inevitable default. Without continued to borrow or issue ISBs, the default would have been much earlier because of literally borrowing to repay the debt where at least 90 percent of fresh borrowings during that period were used to settle existing debts.

Concluding remarks

- The celebration referred to in the article seems to be that of the Central Bank operated under the Monetary Law Act (MLA) since 28 August 1950 until 13 September 2023. The present Central Bank of Sri Lanka is the world’s newest central bank that was established on 14 September 2023 under the Central Bank of Sri Lanka Act, No. 16 of 2023 which repealed the MLA ,which is to celebrated its second anniversary in September this year.

- However, the said public lecture is really an insight into how those who governed the Central Bank under the MLA caused the catastrophe to the economy and living standards during its last years of operations despite their public mandates.

- The Central Bank under the MLA was the monetary policymaker, public debt manager, fiscal agent, fiscal adviser, banker to the government, country’s foreign reserve manager, exchange rate manager and bank regulator supported by a wide range of public policy powers granted by the MLA for the overall statutory objective of maintaining the economic and price stability and financial system stability of the country financed by discretionary money printing as determined by a handful of central bank managers. This is the only institution in the county that does not encounter financing constraints for its operations. Therefore, the Central Bank has been so generous even to borrow through ISBs in 2019 to create a buffer for the next government predicted by the Central Bank on prevailing political circumstances.

- Therefore, in reading through relevant provisions of the MLA and events that led to the crisis, there is no doubt that the crisis was the singular outcome of the gross failure and negligence of the managers of the Central Bank on their public policy duties especially after 2015.

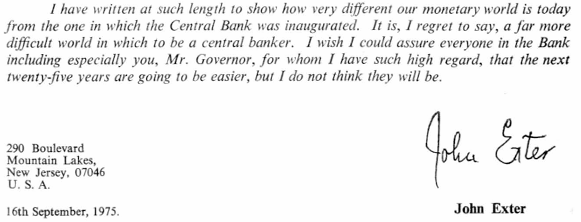

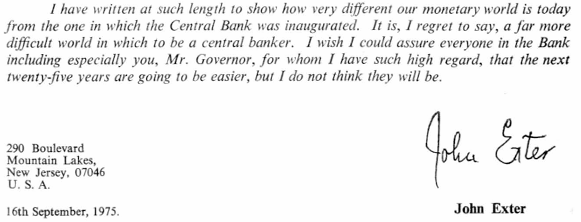

- For any investigation on the crisis if it were to commence, the Exter Report along with subsequent amendments made to the MLA from time to time would be a necessary source of information. In addition, two paragraphs are noted below from Mr. John Exter’s message sent to the 25th Anniversary Commemorative Volume of the Central Bank, who alerted a difficult period of next 25 years and beyond for the Central Bank.

- Until we do the investigation and resolve the monetary and economic structure of the country to be capable of mobilizing resources and opportunities for higher living standards targeted in next 50 years, the present crisis may never end as the monetary system will be governed by those of the network macroeconomic thoughts connected to the contents of the Daily Mirror article as revealed at present. Therefore, what we should be interested in are only the capable systems and not artificially created images of specific persons and institutions.

- Otherwise, the crisis will continue as the single source of the country’s political instability created by leaders struggling for the power through false promises made for recovering the economy and people from the crisis without knowing real causes and effective recovery measures.

- Finally, contents of the Daily Mirror article show how the economy and people of Sri Lanka were trapped in the global network of IMF and financial investors and firm signals of its persistence despite the change in the hands of national leaders.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Article’s purpose and background

This article is to present key points published in the Daily Mirror, 14 March 2025 (Press here to read the article), based on a public lecture made by Dr. Indrajit Coomaraswamy, Central Bank Governor 2016-2019, on 10 March 2025 in celebration of the 75th Anniversary of the Central Bank of Sri Lanka.

- This blog article reveals the importance of the contents of the Daily Mirror article to provide a key source of information critical for investigating into those who are responsible for the economic crisis that the country has been confronting since late 2020 if relevant authorities are interested in conduct of a technical investigation.

- It is the general practice seen in many countries that official reports are published after economic crises to inform the public of causes, impact and resolution measures of such crises and reform agenda proposed to prevent the recurrence of such crises.

- However, whole blame for the crisis in Sri Lanka has been singularly passed to a handful of leaders and officials who were involved in managing the economy in 2020/21 based purely on political agendas without any official crisis reports of macroeconomic nature published by relevant authorities.

Key points in the Daily Mirror article showing untold causes of the crisis

I list down important points below. However, I don’t wish to comment or add to them in order to keep their investigative value open for public debate or investigation.

- Despite a pushback against future borrowings via International Sovereign Bonds (ISBs) from certain quarters, Sri Lanka will, at some point, have to tap international capital markets to prevent further economic compression and close the external financing gap, which remains wide.

- Sri Lanka should not and cannot achieve smooth debt management and gradually reduce its external financing needs before tapping ISBs again—something the country has neither done nor been able to do since 2019.

- Without such borrowings—typically at a relatively lower cost than portfolio investments in rupee government securities and with longer maturities—Sri Lanka will struggle to bridge its external financing gap.

- Unless funds come from sovereign bonds, Sri Lanka would experience compression in both consumption and investment, which the country cannot afford due to the deep contraction and its economic consequences on businesses and the public alike.

- ISBs are probably the most effective way of doing it unless we sell ourselves to some donor who will bankroll us, which is not a good outcome.

- Total outstanding sovereign bonds rose from US$ 5.0 billion at the beginning of 2015 to US$ 15.0 billion by the end of 2019, with US$ 4.5 billion raised in 2019 alone.

- This was done for two reasons—first, to reduce reliance on highly volatile portfolio inflows into government securities, which stood at around US$ 3.5 billion in early 2015, and second, to reduce approximately US$ 2.5 billion worth of currency swaps with other central banks.

- Portfolio investments in rupee securities were causing significant trouble due to their extreme volatility, creating uncertainties for policy-making at a time when the U.S. Federal Reserve was raising interest rates. As a result, portfolio investments were brought down to about US$ 600 million and currency swaps down to US$ 500 million by the end of 2019, from where they stood at the start of 2015.

- Funds raised through ISBs were crucial in extending the maturities of Sri Lanka’s external debt and lowering borrowing costs, as ISBs were issued at rates between 6 percent and 7 percent, compared to rupee bonds, which were around 12 percent at the time.

- US$ 4.5 billion worth of bonds issued in 2019 were raised both to extend maturities and to create buffers for the next administration, which was almost certain to come into power later that year due to public dissatisfaction following the Easter bombings.

- It was fairly certain that the economic stabilisation programme would not continue under a future administration, which could lead to the discontinuation of the then-ongoing International Monetary Fund (IMF) programme.

- Even the markets were willing to lend to Sri Lanka at the time, as they believed in the country’s progress in strengthening macroeconomic fundamentals under the IMF programme and through the Active Liability Management Act, which was passed in parliament during that period.

- Pushing back against claims that large-scale bond issuances were primarily responsible for Sri Lanka’s 2022 debt default, Dr. Coomaraswamy argued that these borrowings actually helped delay an otherwise inevitable default. Without continued to borrow or issue ISBs, the default would have been much earlier because of literally borrowing to repay the debt where at least 90 percent of fresh borrowings during that period were used to settle existing debts.

Concluding remarks

- The celebration referred to in the article seems to be that of the Central Bank operated under the Monetary Law Act (MLA) since 28 August 1950 until 13 September 2023. The present Central Bank of Sri Lanka is the world’s newest central bank that was established on 14 September 2023 under the Central Bank of Sri Lanka Act, No. 16 of 2023 which repealed the MLA ,which is to celebrated its second anniversary in September this year.

- However, the said public lecture is really an insight into how those who governed the Central Bank under the MLA caused the catastrophe to the economy and living standards during its last years of operations despite their public mandates.

- The Central Bank under the MLA was the monetary policymaker, public debt manager, fiscal agent, fiscal adviser, banker to the government, country’s foreign reserve manager, exchange rate manager and bank regulator supported by a wide range of public policy powers granted by the MLA for the overall statutory objective of maintaining the economic and price stability and financial system stability of the country financed by discretionary money printing as determined by a handful of central bank managers. This is the only institution in the county that does not encounter financing constraints for its operations. Therefore, the Central Bank has been so generous even to borrow through ISBs in 2019 to create a buffer for the next government predicted by the Central Bank on prevailing political circumstances.

- Therefore, in reading through relevant provisions of the MLA and events that led to the crisis, there is no doubt that the crisis was the singular outcome of the gross failure and negligence of the managers of the Central Bank on their public policy duties especially after 2015.

- For any investigation on the crisis if it were to commence, the Exter Report along with subsequent amendments made to the MLA from time to time would be a necessary source of information. In addition, two paragraphs are noted below from Mr. John Exter’s message sent to the 25th Anniversary Commemorative Volume of the Central Bank, who alerted a difficult period of next 25 years and beyond for the Central Bank.

- Until we do the investigation and resolve the monetary and economic structure of the country to be capable of mobilizing resources and opportunities for higher living standards targeted in next 50 years, the present crisis may never end as the monetary system will be governed by those of the network macroeconomic thoughts connected to the contents of the Daily Mirror article as revealed at present. Therefore, what we should be interested in are only the capable systems and not artificially created images of specific persons and institutions.

- Otherwise, the crisis will continue as the single source of the country’s political instability created by leaders struggling for the power through false promises made for recovering the economy and people from the crisis without knowing real causes and effective recovery measures.

- Finally, contents of the Daily Mirror article show how the economy and people of Sri Lanka were trapped in the global network of IMF and financial investors and firm signals of its persistence despite the change in the hands of national leaders.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Source: Economy Forward

*The content in this article is of personal views of the author and does not reflect the opinion of LNW in any way.