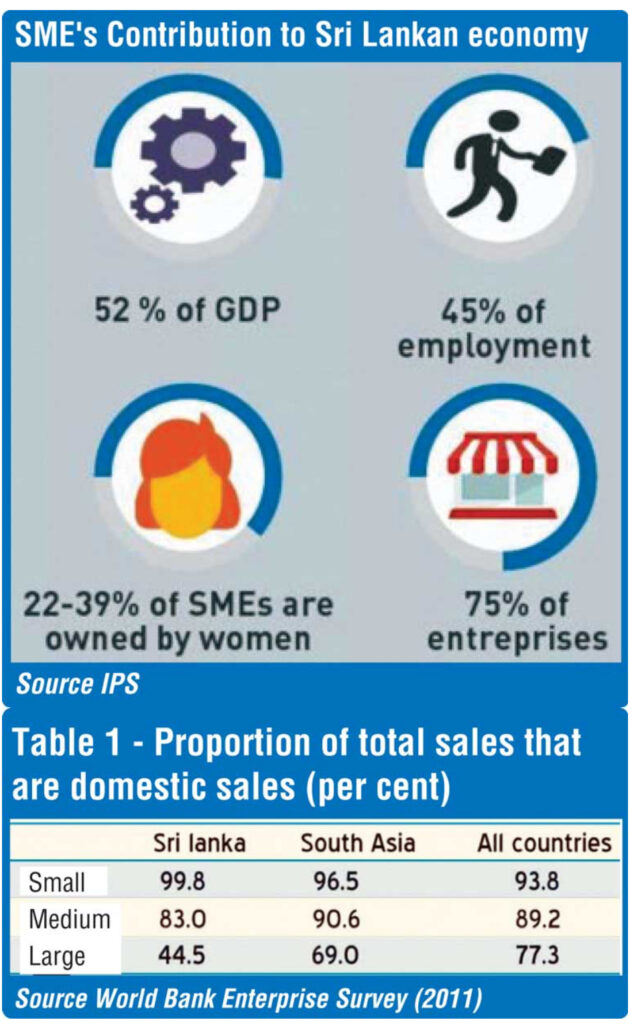

Sri Lanka’s small and medium enterprises (SMEs) endured one of their most challenging periods in recent history, as the economic crisis of 2022–2023, exacerbated by the impacts of the Easter Sunday attacks, dealt a severe blow to the sector. Soaring exchange rates, rampant inflation, exorbitant interest rates, and a significant talent drain pushed many SMEs to ruin and the brink of collapse in 2022-2023. With SMEs contributing over 50% of GDP and serving as a vital source of employment, a sustainable recovery plan is imperative to reintegrate them into the mainstream economy and ensure their long-term resilience.

Sri Lanka’s small and medium enterprises (SMEs) are the lifeblood of the economy, contributing over 50% of GDP and employing thousands of people. They are an integral part of the export value chain that generates valuable USD from large scale exporters. For Sri Lanka to achieve a robust economic recovery, reviving and growing the SMEs is imperative. However, this revival must be sustainable, focusing on long-term resilience rather than temporary fixes. Possibly five areas that needs attention in addressing this problem in a sustainable way could be;

Access to affordable finance

For many SMEs non-competitive interest rates and stringent credit conditions have made borrowing prohibitively expensive for many SMEs. To address this, the Government and financial institutions should introduce targeted financing schemes with concessional interest rates. Expanding credit guarantee programs can incentivise banks to lend to SMEs by reducing perceived risks. The setting up of a Development Bank at the national level, needs to be expedited. Additionally, alternative financing models such as venture capital, peer-to-peer lending, and development finance should be explored to provide SMEs with diverse funding options without overburdening them with debt. Also the existing non performing debt will need to be managed through a National Asset Management Company.

Supply chains and market access

Many SMEs rely heavily on imported raw materials, making them vulnerable to exchange rate fluctuations. Encouraging local sourcing and developing domestic supply chains can enhance resilience. Simultaneously, integrating mature SMEs into global export markets through our embassies can provide stability and growth opportunities. Government-led initiatives to secure preferential trade agreements and reduce regulatory barriers for exports will help SMEs expand beyond domestic markets and tap into international demand.

Digitalisation

Digital transformation is a cornerstone of SME sustainability. Businesses must be encouraged to adopt e-commerce platforms, digital payment systems, and automation tools to improve productivity and reduce operational costs. Government incentives for technology adoption, coupled with public-private partnerships, can accelerate digitalisation. Establishing SME innovation hubs will foster entrepreneurship and drive the development of competitive, high-value industries, positioning Sri Lanka as a hub for innovation in the region.

Addressing the talent drain

The exodus of skilled professionals in 2022-23 has left many SMEs struggling to find qualified talent. While reversing brain drain is a long-term challenge, short-term measures such as flexible work arrangements, vocational training programs, and targeted reskilling initiatives can help bridge the gap. SMEs should be incentivised to invest in employee development, while policies to attract diaspora professionals back to Sri Lanka should be explored to bring back much-needed expertise.

Policy and institutional support

A streamlined regulatory environment is essential for SME growth. The Government must reduce bureaucratic challenges, simplify business registration processes, and implement fair tax policies that do not disproportionately burden small businesses. Strengthening SME development agencies and improving coordination between public and private stakeholders will create a more supportive ecosystem for SMEs to thrive. Additionally, policies that promote gender equality and support women-led SMEs can unlock further economic potential.

Conclusion

Reviving Sri Lanka’s SMEs with sustainability requires a comprehensive, multi-faceted approach. By ensuring macroeconomic stability, improving access to affordable finance, strengthening supply chains, embracing technology, addressing talent shortages, and providing robust policy support, Sri Lanka can rebuild its SME sector into a resilient and dynamic engine of economic growth, similar to India’s success in fostering entrepreneurship and innovation.

This revival will not only generate employment but also lay the foundation for a more inclusive and sustainable economy, ensuring long-term prosperity for the nation. A stable macroeconomic environment is crucial to this process. While inflation has been controlled, maintaining price stability remains essential for restoring business confidence. Additionally, minimising exchange rate volatility through prudent monetary policies and a disciplined fiscal framework will provide SMEs with a more predictable operating environment.

Furthermore, managing interest rates in a controlled manner, as is currently being done, will ease financing costs, enabling SMEs to reinvest, expand, and innovate. By aligning policy measures with long-term economic goals, Sri Lanka can revitalise its SME sector, positioning it as a key driver of economic resilience and sustainable growth.

DAILY FT

Reference:

https://www.themorning.lk/articles/redPXdOouF3CLU