By: Isuru Parakrama

March 31, Colombo (LNW): In a move to alleviate financial pressure on low-income earners, the Inland Revenue Department (IRD) of Sri Lanka has introduced a new procedure allowing resident individuals to claim relief from the 10 per cent Advance Income Tax (AIT) deduction on interest income.

The announcement, detailed in Circular No. SEC/2025/E/03 dated March 28, 2025, targets those whose assessable income falls below Rs. 1.8 million annually and who earn interest from banks or financial institutions.

Under the new guidelines, eligible individuals can submit a self-declaration to their bank or financial institution to request that AIT not be deducted from their interest payments.

If the institution cannot refund the deducted AIT, individuals must claim a refund directly from the IRD. The circular, issued following instructions from the Treasury, is part of a broader effort to support low-income savers, with formal amendments to the Inland Revenue Act, No. 24 of 2017, expected to be passed in Parliament.

The self-declaration process applies to the year of assessment starting from April 01 of the previous year and ending on 31 March of the following year—a 12-month period.

For the 2025/2026 assessment year, this covers April 01, 2025 to March 31, 2026. The IRD has developed a software program to verify the accuracy of these declarations, ensuring that if a declaration is found to be invalid, the bank will deduct the AIT, and any related issues will be addressed through tax officials.

The circular specifies that all information provided in the self-declaration must be accurate and justifiable when questioned by tax officials. Non-compliance, incomplete, or fraudulent declarations will result in the declarant being denied relief from AIT, with penalties potentially imposed under Section 181 of the Inland Revenue Act.

Additionally, banks and financial institutions will collect the declarations, which will be verified by the Commissioner General of Inland Revenue to ensure accuracy.

Resident individuals can obtain copies of the self-declaration form from their bank, financial institution, or the nearest Inland Revenue Regional or Metro Office. For further assistance, the IRD has advised contacting the Inland Revenue Call Centre at 1944.

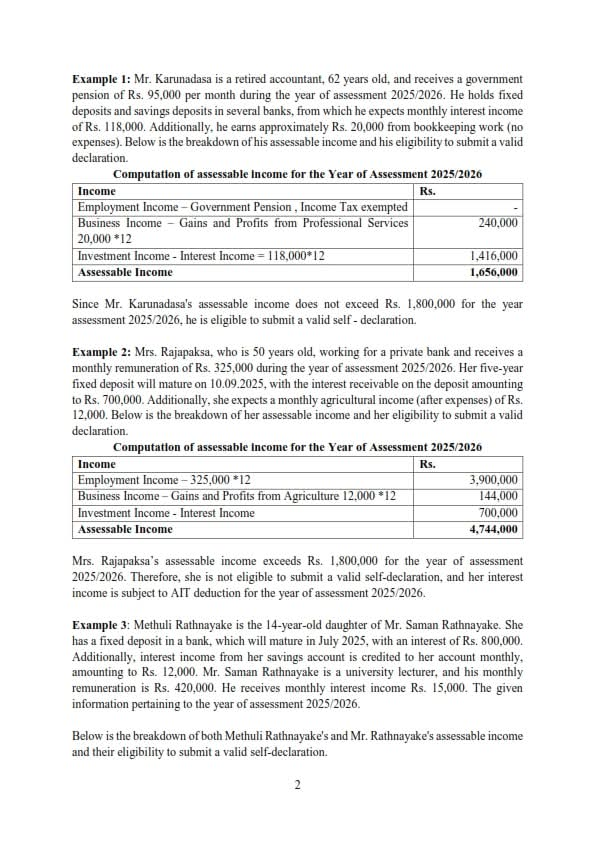

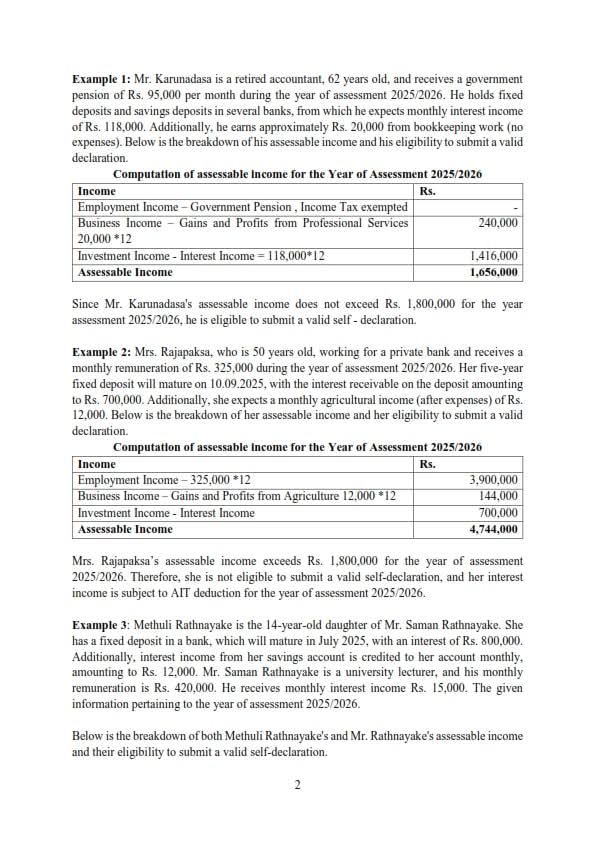

The circular also provides examples to illustrate eligibility. For instance, a retired accountant with an assessable income of Rs. 1,656,000, including a government pension and interest income, qualifies for the relief.

However, a 50-year-old private bank employee with an assessable income of Rs. 4,744,000, including employment and agricultural income, exceeds the threshold and must have AIT deducted.

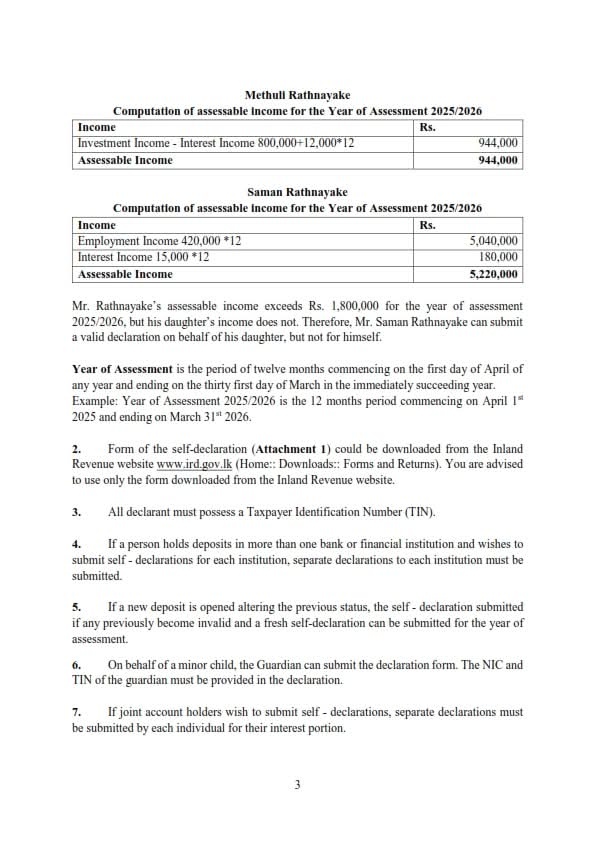

The IRD has also outlined specific conditions for eligibility: individuals must be Sri Lankan residents, receive interest from banks or financial institutions, and have an assessable income not exceeding Rs. 1.8 million for the relevant year. Joint account holders must submit separate declarations, and guardians can submit on behalf of minors. The IRD advises downloading the form exclusively from its official website (www.ird.gov.lk) to ensure authenticity.

Commissioner General of Inland Revenue, Rukdevi P.H. Fernando, emphasised the importance of accurate declarations, warning that any discrepancies could lead to penalties.

“This measure is designed to support those with limited income, but it relies on the integrity of the self-declaration process,” Fernando stated.

With the new system in place, the IRD aims to provide much-needed financial relief to low-income savers while ensuring compliance with tax regulations.