By: Isuru Parakrama

May 06, Colombo (LNW): A recent announcement by the Government of the Maldives, in partnership with MBS Global Investments, to create an $8.8 billion international financial free zone has sent ripples across South Asia’s economic and geopolitical landscape.

Dubbed the Maldives International Financial Centre (MIFC), the ambitious project is being touted as a major disruptor in the region’s quest to attract foreign investment, particularly as it mirrors—and in some areas surpasses—the objectives of Sri Lanka’s much-hyped Colombo Port City.

With the Maldives now firmly entering the race to become the Indian Ocean’s premier financial and business hub, Colombo may find its aspirations under serious threat.

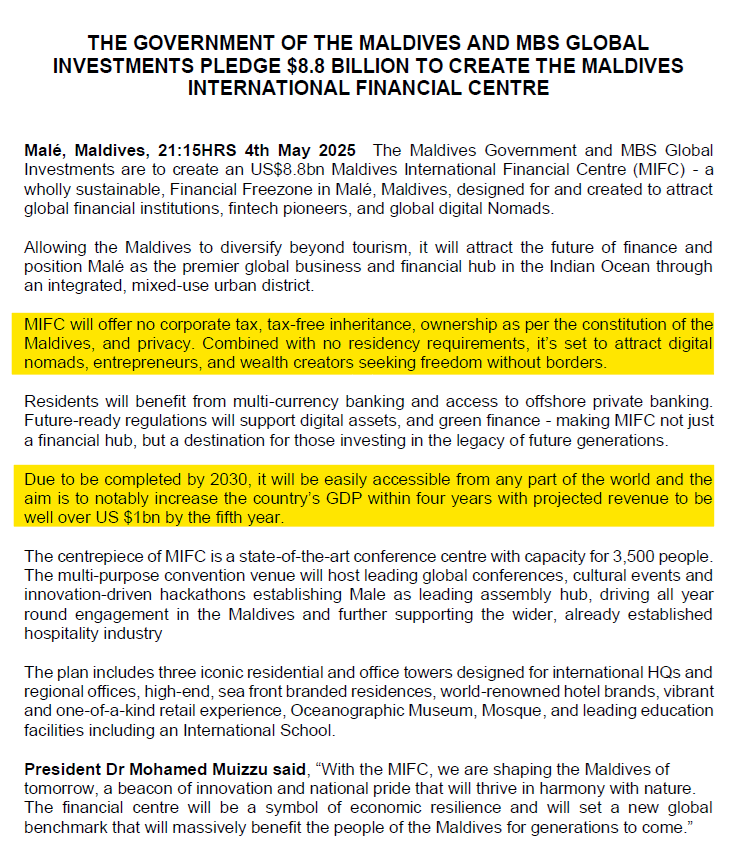

Set to be completed by 2030, the MIFC promises a slate of lucrative incentives: zero corporate tax, tax-free inheritance, full foreign ownership, and stringent privacy protections. Furthermore, there are no residency requirements for those looking to invest or operate within the free zone.

These policies are specifically tailored to attract high-net-worth individuals, digital nomads, global investors, and fintech pioneers. Significantly, this vision is underpinned by support from MBS Global Investments, chaired by a Qatari royal family member, signalling strong Middle Eastern backing and geopolitical weight.

Colombo Port City, developed with Chinese investment and first proposed as Sri Lanka’s answer to Dubai or Singapore, was similarly envisaged as a magnet for international capital. Yet the project has faced delays, legal battles, environmental opposition, and most recently, policy uncertainty.

Despite years of groundwork, regulatory hiccups and Sri Lanka’s ongoing economic fragility have hampered its momentum. In contrast, the Maldivian proposal appears more cohesive, politically stable, and financially secured—precisely what many investors look for.

There is a stark contrast in timing and market perception. The Maldives’ plan projects a revenue of over $1 billion by the fifth year, with completion expected by the end of this decade. Meanwhile, Colombo Port City is still grappling with local integration issues and an uneasy public narrative about sovereignty and foreign influence.

The Chinese footprint in Port City has often been criticised as lacking transparency, raising fears of debt-trap diplomacy and neocolonial control. In comparison, MIFC’s Qatari backing is seen as less politically fraught and more aligned with sustainable development values—a narrative that sits well with Western investors wary of authoritarian entanglements.

Geographically, the Maldives has the advantage of being a well-established luxury and tourism brand, which it now aims to leverage into finance. With plans for a futuristic conference centre, residential and commercial towers, regional HQs, and education institutions, MIFC offers an all-encompassing, mixed-use urban experience.

Malé’s reputation as a safe and politically neutral location further boosts its appeal, especially as Sri Lanka continues to wrestle with domestic unrest and institutional reform following its recent economic collapse.

Sri Lanka’s economic strategy, especially post-IMF bailout, relies heavily on foreign investment flows to stabilise its balance of payments and stimulate growth. Colombo Port City was positioned as a linchpin in this recovery. However, the arrival of MIFC threatens to dilute investor interest and regional capital flows.

If global businesses perceive the Maldives as a more viable and less risky option, Colombo may find itself sidelined in an already competitive Asian investment landscape.

Moreover, the environmental and governance model proposed by the Maldives may draw additional attention. By branding MIFC as “wholly sustainable” and aligned with green finance, the Maldives is speaking directly to a new generation of investors who prioritise ESG (Environmental, Social, and Governance) standards.

Sri Lanka has struggled to market its own development agenda along similar lines, often weighed down by opaque policies and bureaucratic inertia.

It is worth noting that both nations are strategically situated along vital maritime routes in the Indian Ocean, and their financial centres are as much geopolitical statements as they are economic ventures. The Maldivian move thus not only introduces competition but also shifts the balance of influence in a region already fraught with China-India rivalries, Western interests, and Gulf ambition.

In the wake of this announcement, Colombo will need to make swift and bold adjustments. That means tightening regulatory clarity, accelerating infrastructure delivery, improving investor protection, and most importantly, building trust both locally and internationally. Otherwise, the promise of the Port City may well remain just that—a promise.