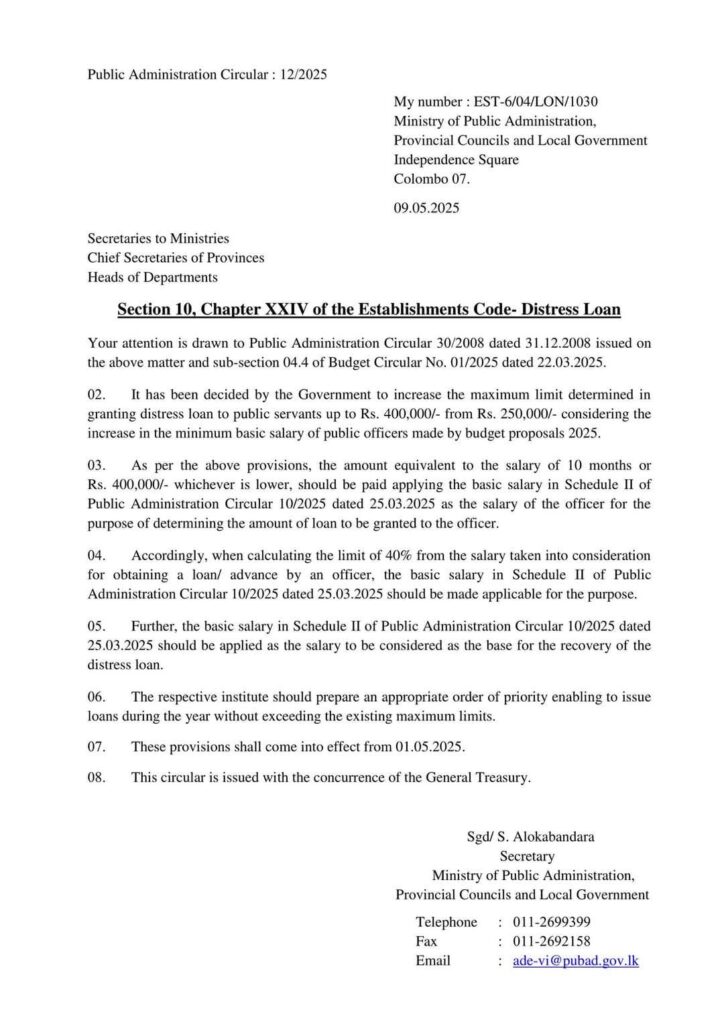

May 11, Colombo (LNW): Public sector employees in Sri Lanka will now be eligible for a higher distress loan, with the ceiling increased from Rs. 250,000 to Rs. 400,000.

The Ministry of Public Administration confirmed that the new limit will come into effect from 1 May 2025, marking a significant policy adjustment aligned with the 2025 Budget’s commitment to improve the financial well-being of state workers.

The change stems from recent adjustments to the minimum basic salaries of public servants, which were announced in the national budget earlier this year.

The updated loan cap has been formalised through Public Administration Circular 10/2025, issued on 25 March, and was prepared in consultation with the General Treasury.

Under the revised terms, the distress loan granted to a public officer will now be calculated based on their updated basic salary, providing access to greater financial relief during times of personal or family emergencies.

This move is expected to benefit a wide cross-section of state employees, including teachers, administrative officers, and health workers, many of whom have been facing increased cost-of-living pressures.

Government departments and public institutions have been directed to facilitate the processing of applications under the new ceiling and to ensure that requests are prioritised based on genuine need.

The Ministry has also advised accounting officers and administrative heads to adopt transparent and efficient procedures to manage loan disbursements fairly.