Tensions escalate: Smoke rises from the IRIB Building in Tehran, the country’s state broadcaster (source: Reuters)

- President Trump confirmed the precision strikes had “completely and fully obliterated” the facilities, since they aim to dismantle Iran’s nuclear enrichment capacity

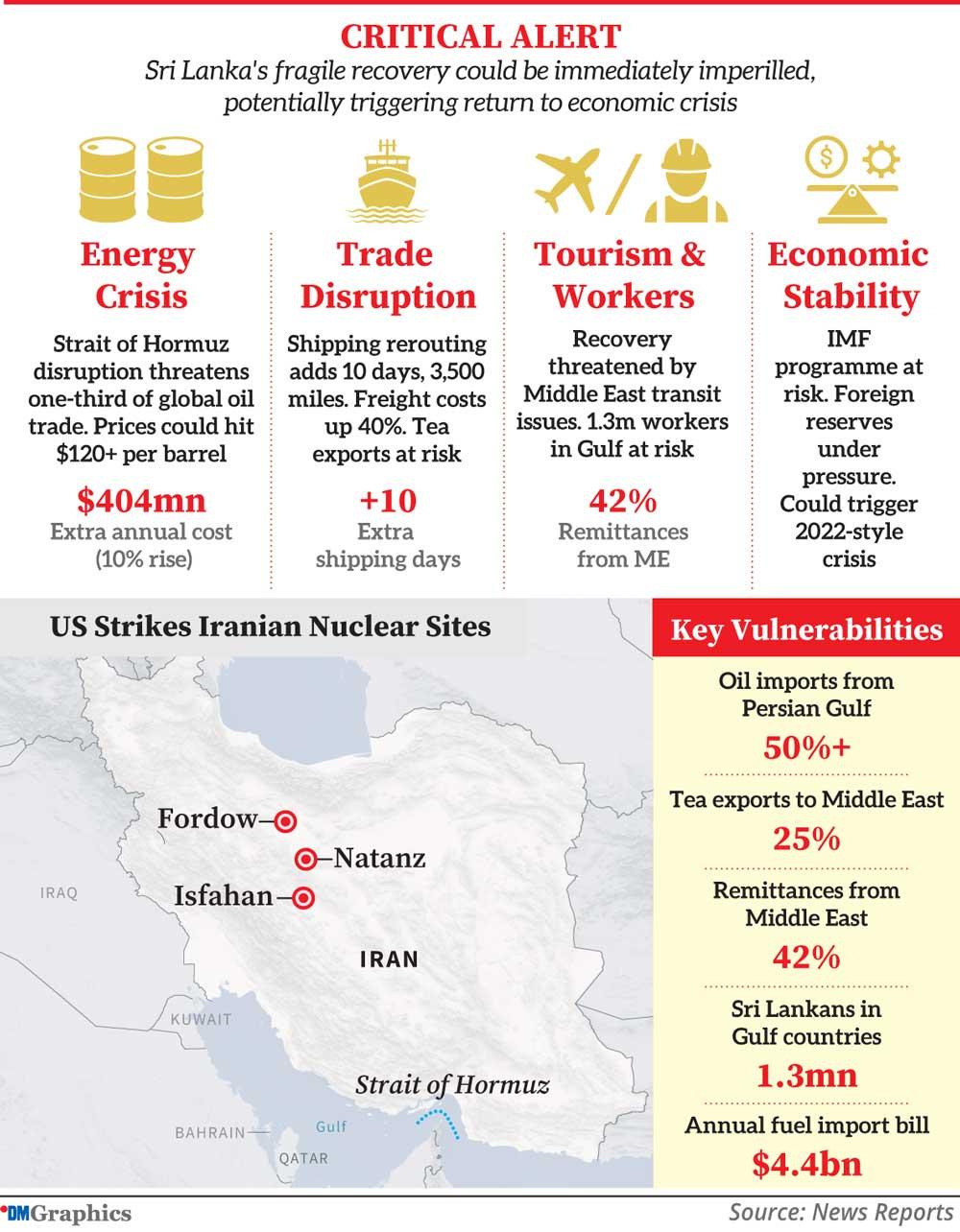

- Sri Lanka, having just emerged from its worst economic crisis in decades, would be further immediately imperilled, resulting in negative impacts on its energy sector, trade, tourism, and overall financial stability

- Recommendations for GOSL to be resilient and anti-fragile against external disruptions include: Stockpiling on Oil as a cushioning mechanism against price spikes plus supply disruptions, Expediting adoption of Renewable energy, stopping relying on primary import channels for fuel needs and exploring alternatives and ensuring the safety of Sri Lankans who are abroad

As of June 22, 2025, Sunday morning hours, the United States has launched strikes against three Iranian nuclear sites: Fordow, Natanz, and Isfahan. President Trump confirmed the “massive precision strikes,” stating they “completely and fully obliterated” the facilities, aiming to dismantle Iran’s nuclear enrichment capacity. This decisive action inserts the U.S. directly into the ongoing conflict between Israel and Iran. While Iranian authorities have acknowledged the attacks, they insist their nuclear programme will continue and reported no immediate radioactive contamination. The strikes, utilising advanced “bunker-buster” bombs, mark a significant escalation in regional tensions, with global reactions closely monitoring potential retaliatory measures from Tehran.

As of June 22, 2025, Sunday morning hours, the United States has launched strikes against three Iranian nuclear sites: Fordow, Natanz, and Isfahan. President Trump confirmed the “massive precision strikes,” stating they “completely and fully obliterated” the facilities, aiming to dismantle Iran’s nuclear enrichment capacity. This decisive action inserts the U.S. directly into the ongoing conflict between Israel and Iran. While Iranian authorities have acknowledged the attacks, they insist their nuclear programme will continue and reported no immediate radioactive contamination. The strikes, utilising advanced “bunker-buster” bombs, mark a significant escalation in regional tensions, with global reactions closely monitoring potential retaliatory measures from Tehran.

However, Iran declared US attacks on its nuclear sites “empty,” stating enriched uranium and personnel were removed beforehand. Tehran asserted no contamination, warning of “everlasting consequences” for the “savage aggression.”

The spectre of direct US involvement in the escalating conflict between Israel and Iran looms large, threatening to transform a regional dispute into a global conflagration. While the immediate focus remains on the Middle East, the ripple effects of such an intervention would be felt across continents, with particularly dire consequences for small, import-dependent economies such as Sri Lanka. Having just emerged from its worst economic crisis in decades, Sri Lanka’s fragile recovery would be immediately imperilled, leading to a cascade of negative impacts on its energy sector, trade, tourism, and overall financial stability. The island nation, highly susceptible to external shocks, would face an existential threat to its hard-won stability, potentially plunging it back into the depths of economic despair.

Vulnerability Amplified in the Energy Sector

Sri Lanka’s Achilles’ heel lies in its overwhelming dependence on imported energy, particularly oil. As an island nation without indigenous oil or natural gas reserves, it relies entirely on foreign sources to fuel its economy. The Middle East, especially the Persian Gulf, is a primary supplier, providing over half of Sri Lanka’s oil needs. A direct US intervention in the Israel-Iran conflict would inevitably target Iran’s energy infrastructure and, more critically, threaten the Strait of Hormuz – a choke point through which nearly a third of the world’s seaborne oil trade passes.

The immediate consequence would be a dramatic surge in global oil prices. Experts predict that prices could easily hit $120 per barrel, and potentially much higher, even surpassing the 2008 record of nearly $150 per barrel, if disruptions persist. For Sri Lanka, which spent approximately $4.4 billion on fuel imports annually even before the current escalation, a 10% increase in global fuel prices could add an additional $404 million burden to its annual import bill. This would drain its already precarious foreign exchange reserves, which are still being painstakingly rebuilt under an IMF programme.

Beyond crude oil, the impact would extend to refined petroleum products, liquefied petroleum gas (LPG), and diesel, all of which Sri Lanka imports. Higher fuel costs would permeate every aspect of the economy, increasing transportation expenses for goods and people, raising manufacturing costs, and burdening households with exorbitant energy bills. This surge in input costs would fuel inflation, eroding the purchasing power of ordinary citizens and making essential goods unaffordable. The Ceylon Electricity Board (CEB), heavily reliant on thermal power generation using imported fossil fuels, would face immense pressure, potentially leading to increased electricity tariffs and even power outages, further crippling economic activity. The country’s efforts to transition towards renewable energy, while crucial in the long run, are not yet mature enough to provide immediate relief from such a severe fossil fuel shock.

Disruptions to Trade and Supply Chains

The Strait of Hormuz is not just vital for oil; it’s a critical artery for global trade. Any significant disruption or closure of this waterway would lead to massive rerouting of shipping, primarily via the longer and more expensive Cape of Good Hope route around Africa. This rerouting, already being experienced due to Red Sea attacks, adds approximately 10 days and 3,500 nautical miles to journeys, increasing fuel costs by about 40% and pushing up insurance premiums.

For Sri Lanka, an import-dependent nation, this means a significant increase in the cost of all imported goods, from raw materials for its apparel industry to food staples and medicines. Increased freight charges and longer transit times would translate to higher consumer prices and further inflationary pressures. On the export front, Sri Lankan goods, particularly its vital tea exports and apparel, would become less competitive in international markets due to higher shipping costs. The Middle East accounts for a substantial 25% of Sri Lanka’s total tea exports, and any disruption to trade routes or economic instability in the region would directly impact demand for Sri Lankan tea, leading to a potential loss of millions of dollars in export revenue. This double whammy of more expensive imports and less competitive exports would severely worsen Sri Lanka’s balance of payments and external financial position, undermining its economic recovery efforts.

Pillars of Tourism and Remittances under Threat

Two other critical foreign exchange earners for Sri Lanka are tourism and worker remittances, both of which are highly vulnerable to instability in the Middle East. Sri Lanka’s tourism sector, which had been showing promising signs of recovery, would face an immediate downturn. Heightened geopolitical tensions and the perception of a volatile Middle East would deter tourists, particularly from key European markets, who often transit through Middle Eastern hubs like Dubai and Doha. Rerouted flights due to airspace closures, longer travel times, and increased airfares would make Sri Lanka a less attractive destination. A general climate of global uncertainty and security concerns would also dampen travel confidence, hitting arrivals and revenues hard.

Even more critically, worker remittances are a lifeline for the Sri Lankan economy, with approximately 42% of the country’s remittances originating from the Middle East. Over 1.3 million Sri Lankans are employed in Gulf countries, sending home billions of dollars annually. A prolonged conflict, economic instability in the Middle East, or even a perceived threat to the safety of migrant workers could lead to a significant decline in remittances. Middle Eastern economies might reduce their demand for foreign labour during periods of instability, or workers themselves might return home, further depleting a crucial source of foreign exchange. A 10% drop in private remittances, for instance, could reduce foreign exchange reserves by hundreds of millions of dollars, placing immense pressure on the rupee and the country’s ability to finance its imports and service its external debt.

Macroeconomic Instability and Debt Vulnerability

Sri Lanka is currently under an Extended Fund Facility (EFF) programme with the International Monetary Fund (IMF), a critical lifeline for its debt restructuring and economic reform agenda. The programme aims to rebuild external buffers, strengthen public finances, and restore macroeconomic stability. However, a major external shock like a full-blown US-Iran war would severely derail these efforts. The surge in import costs, decline in export revenues, and reduction in remittances would rapidly deplete foreign exchange reserves, making it challenging to meet import needs and service external debt commitments.

The government’s hard-won fiscal reforms and revenue mobilisation efforts would be undermined by the need to potentially subsidise essential goods, manage inflationary pressures, and support a struggling populace. The Central Bank of Sri Lanka would face immense pressure to raise interest rates to combat inflation and defend the currency, which could stifle economic activity and investment in an already fragile economy. The increased borrowing costs for businesses and the government would further exacerbate debt vulnerabilities. While the IMF programme aims to build resilience against shocks, the magnitude of a US-Iran war’s impact would likely overwhelm existing buffers and necessitate renegotiations or additional financial assistance, pushing Sri Lanka further into debt.

Social and Political Ramifications

The economic fallout would inevitably spill over into social and political instability. Rising cost of living, job losses in export-oriented industries and the tourism sector, and a potential reduction in remittances would lead to widespread hardship. Public discontent could escalate, reminiscent of the protests that characterised the 2022 economic crisis. The government, already navigating a delicate political landscape, would face immense pressure to mitigate the impact on its citizens, potentially resorting to measures that could undermine long-term economic stability. The safety and well-being of the large Sri Lankan diaspora in the Middle East would also be a significant concern, adding a humanitarian dimension to the crisis.

Recommended Action Steps

The escalating conflict between Iran and Israel presents significant challenges for Sri Lanka, a small island nation heavily reliant on imports, remittances, and tourism. While completely avoiding the consequences is impossible, the Sri Lankan government can take proactive measures to mitigate the impact.

- Strengthen Energy Security and Diversify Sources: The most immediate and devastating impact of a Middle East conflict is on global energy markets. Sri Lanka, which imports nearly all its fuel, will face soaring crude oil prices, straining its already fragile foreign exchange reserves and crippling various sectors.

- Strategic Stockpiling: The government should prioritise increasing its strategic oil reserves to cushion against price spikes and supply disruptions. Accelerate Renewable Energy Adoption: Double down on efforts to transition to renewable energy sources like solar, wind, and hydro power. This aligns with existing national energy policies and reduces dependence on volatile fossil fuel imports in the long run.

- Explore Alternative Import Channels: Investigate and establish alternative, reliable sources and shipping routes for fuel imports to reduce vulnerability to disruptions in the Strait of Hormuz.

- Protect Foreign Remittances and Explore New Employment Markets: The Middle East is a significant source of foreign remittances for Sri Lanka, with a large number of Sri Lankans employed in countries like Israel. An escalating conflict could lead to job losses and a significant drop in these vital inflows.

- Ensure Safety of Expatriates: Prioritise the safety and well-being of Sri Lankan nationals in affected areas, providing emergency hotlines, consular assistance, and evacuation plans if necessary.

- Diversify Foreign Employment Destinations: Actively explore and negotiate new avenues for foreign employment in stable regions and sectors, reducing over-reliance on the Middle East.

- Incentivise Remittances through Official Channels: Implement policies that encourage Sri Lankan migrant workers to send remittances through official banking channels to bolster foreign exchange reserves.

- Bolster Economic Resilience and Diversify Trade: The conflict threatens to disrupt crucial shipping routes, leading to increased freight costs and impacting key exports like tea, especially to Middle Eastern markets.

- Explore New Export Markets: Actively seek and cultivate new markets for Sri Lankan exports, particularly tea and apparel, beyond the Middle East to reduce market concentration risks.

- Support Local Production: Implement policies that boost domestic food production and other essential goods to reduce import dependence and mitigate the impact of supply chain disruptions and import price inflation.

- Engage in Diplomatic Efforts: While a small nation, Sri Lanka should continue to advocate for de-escalation and peaceful resolution through multilateral forums, emphasising the humanitarian and economic consequences of prolonged conflict on non-aligned nations.

By taking these comprehensive and proactive measures, Sri Lanka can better prepare for and mitigate the adverse impacts of the Iran-Israel conflict, safeguarding its economic stability and the well-being of its citizens.

Conclusion

Direct US involvement in the Israel-Iran conflict would unleash a torrent of economic devastation on Sri Lanka. The island nation, still reeling from its recent economic collapse, is acutely vulnerable to external shocks, particularly those impacting global energy markets, trade routes, and worker migration patterns. The inevitable surge in oil prices, disruptions to shipping, decline in tourism, and reduction in remittances would rapidly erode Sri Lanka’s hard-won economic stability, deplete its foreign exchange reserves, exacerbate inflation, and jeopardise its IMF-backed recovery. The consequences would be a severe setback to its development trajectory, plunging millions back into poverty and potentially reigniting social and political unrest. For Sri Lanka, the escalating tensions in the Middle East are not just distant geopolitical events; they are an imminent threat to its very survival and the well-being of its people. The world must recognise that the ripples of conflict in one region can create tidal waves of crisis in others, demanding a concerted effort to de-escalate tensions and protect the most vulnerable economies.

The writer is an Infantry officer who served the Sri Lanka Army for over 36 years, a former Security Forces Commander of the Wanni Region and Eastern Province, and he holds a PhD in economics. He can be reached at: [email protected]