October 16, Colombo (LNW): Prime Minister Dr Harini Amarasuriya has set off on an official visit to India, embarking on a diplomatic engagement aimed at strengthening ties between the two neighbouring nations.

Her departure was confirmed by officials at Katunayake International Airport, with the Prime Minister boarding SriLankan Airlines flight UL-191 bound for New Delhi this (16) morning.

According to the Ministry of Foreign Affairs, Foreign Employment, and Tourism, Dr Amarasuriya is scheduled to remain in India until October 18, undertaking a series of high-level discussions with Indian counterparts.

Among the key meetings planned is an official dialogue with Indian Prime Minister Narendra Modi, during which matters of regional cooperation, economic collaboration, and cross-border development are expected to feature prominently.

In addition to diplomatic talks, Dr Amarasuriya is slated to deliver a keynote address at the NDTV World Summit tomorrow (17). Organised jointly by NDTV and the Chintan Research Foundation, the summit will bring together leaders and thinkers from across the globe to explore pressing challenges facing the world today. The Prime Minister will speak on the theme “Steering Change in Uncertain Times.”

PM Embarks on Diplomatic Mission to India for Bilateral Talks and Keynote Address

Economic Activity on the Rise as Sri Lanka’s Manufacturing and Services Sectors Gain Momentum

October 16, Colombo (LNW): Sri Lanka’s economic performance showed signs of continued recovery in September 2025, with notable gains recorded across both the manufacturing and services sectors, according to new data released by the Central Bank of Sri Lanka.

The latest figures reveal that the country’s Manufacturing Purchasing Managers’ Index (PMI) advanced to 55.4, while the Services PMI rose to a stronger 58.7. A PMI reading above 50 typically signals an expansion in activity compared to the previous month, suggesting that business confidence and economic activity remain on a positive trajectory.

The uplift in manufacturing was largely driven by broad-based gains across most key components of the index. Improvements were observed in areas such as new orders, production levels, and stock of purchases—each contributing to the overall upward momentum. However, the employment sub-index continued to lag behind, indicating that hiring in the sector remains cautious despite the uptick in production.

Meanwhile, the services sector saw robust growth, buoyed by increased demand and a steady flow of business activity, particularly in areas such as transportation, wholesale and retail trade, and financial services. The strength of the services PMI underscores a continued recovery in consumer and corporate spending, reflecting broader optimism in the domestic economy.

These figures come amid a gradually stabilising economic environment, as Sri Lanka continues its path of post-crisis recovery, supported by policy reforms and improving investor sentiment. The positive trend in both sectors provides a much-needed boost to overall economic morale, though structural challenges such as labour market rigidity and inflationary pressures still loom in the background.

Heavy falls above 100 mm likely in several districts (Oct 16)

October 16, Colombo (LNW): Showers or thundershowers will occur at most parts of the island after 1.00 p.m., the Department of Meteorology said in its daily weather forecast today (16).

Heavy falls above 100 mm are likely at some places in Western, Sabaragamuwa, Central, Southern, Uva and North-western provinces.

Showers may occur in Western, Southern and Northern provinces and in Ampara district in the morning too.

The general public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Digitalisation: The Engine of a Re-Emerging Sri Lanka – Vision 2030 Edition

Author’s Note

In an era when technology shapes destiny, Sri Lanka stands at the threshold of a digital renaissance. Having witnessed the transformation of nations through innovation and transparency, I am convinced that our own resurgence depends on embracing data, discipline, and digital governance.

This essay is both a reflection and a roadmap — an invitation to policymakers, entrepreneurs, and citizens alike to recognise that digitalisation is not merely about technology, but about trust, accountability, and renewal.

If implemented with foresight, it can cleanse governance, empower the smallest vendor, and propel Sri Lanka into the global knowledge economy where integrity and efficiency walk hand in hand.

— Roger Srivasan

13 October 2025

1. Introduction

As Sri Lanka re-emerges from years of mismanagement and stagnation, digitalisation stands as the cornerstone of its rebirth — the new architecture of a modern nation.

It promises not just convenience but transparency, equity, and efficiency — values that can rebuild public trust and accelerate economic recovery.

In this new era, bytes may achieve what bullets and budgets could not.

2. The Pillars of Digital Transformation

A. Governance and Accountability

Digitalisation curtails the opacity that once shielded inefficiency and corruption.

E-governance platforms can track every application, transaction, and decision — leaving an auditable trail.

Open-data systems allow citizens to monitor public expenditure and procurement, introducing a new era of accountability.

Real-time dashboards for ministries can reveal performance metrics, enabling timely corrective action.

B. Taxation and Revenue Collection

Tax evasion remains one of Sri Lanka’s greatest fiscal leakages. Vast segments of the informal economy escape the tax net due to poor record-keeping and manual reporting.

Digitalisation offers the remedy:

Electronic invoicing (e-invoicing) ensures every sale is recorded, creating a transparent chain from vendor to treasury.

Integrated tax databases enable automatic cross-checking of income declarations against banking and business transactions.

Mobile-based tax payments empower small vendors and freelancers to comply easily, reducing excuses for non-payment.

Big-data analytics detect anomalies and patterns of evasion before they spiral into losses.

By widening the tax base and reducing leakages, Sri Lanka can boost state revenue without increasing tax rates — the hallmark of a smart digital economy.

3. Empowering Citizens and Entrepreneurs

Small vendors and micro-enterprises: Digital marketplaces (e.g., QR-based street payments) integrate informal traders into the formal economy, granting them access to microloans and government schemes.

Farmers and cooperatives: Agricultural platforms can connect producers directly to buyers, eliminating exploitative middlemen.

Youth and start-ups: Digital literacy and access to online tools create new pathways for innovation and employment.

When citizens are digitally empowered, governance becomes participatory and prosperity becomes shared.

4. Education, Health and Human Capital

E-learning portals bring global classrooms into village schools.

Digital health records enable faster diagnosis and better resource allocation in hospitals.

National ID integration ensures smoother delivery of welfare benefits, eliminating ghost recipients and duplication.

Human capital, once hindered by bureaucracy, finds its liberation through connectivity.

5. Broader Economic and Strategic Benefits

Efficiency: Automated workflows reduce delays, errors, and corruption.

Investment climate: Transparency reassures investors of fair play.

Data sovereignty: A secure national cloud infrastructure ensures privacy.

Environmental gains: Paperless governance reduces waste and the carbon footprint of administration.

6. Vision 2030: The Digital Republic

By 2030, Sri Lanka can evolve into a Digital Republic — a nation where governance is intelligent, inclusive, and instantaneous.

Artificial Intelligence could predict and prevent administrative bottlenecks; blockchain could secure land titles and tenders; biometric IDs could eliminate duplication in welfare schemes.

Paperless ministries, smart cities, and AI-driven resource management would become the norm rather than the exception.

This is the dawn of a data-driven democracy, where every citizen becomes a participant in national progress through the power of connectivity.

7. Conclusion: A Nation Reborn Through Data

If wisely implemented, digitalisation can convert inefficiency into intelligence, opacity into openness, and corruption into accountability.

“In the age of algorithms, good governance begins with good data.”

Sri Lanka’s journey from paper files to digital dashboards will define its modern identity — a nation that not only rises again but leaps forward, transforming governance into service and citizens into stakeholders.

— Roger Srivasan

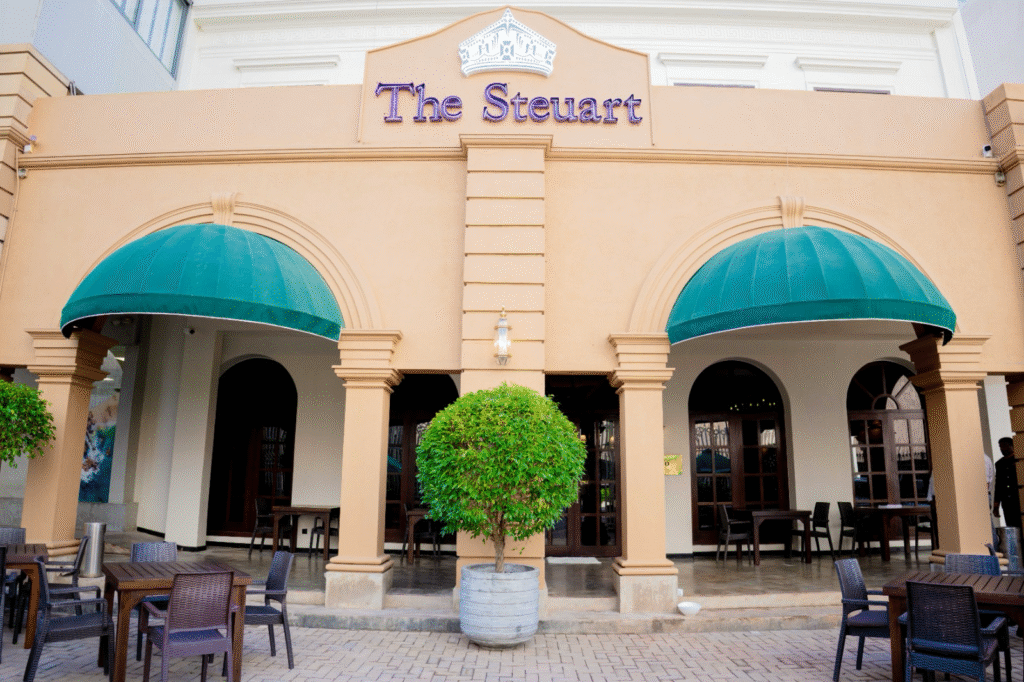

The Steuart by Citrus Reopens – A Historic Gem in the Heart of Colombo

Colombo, Sri Lanka – 10 October 2025 Citrus Leisure PLC proudly announces the reopening of The Steuart by Citrus, following an extensive refurbishment that breathes new life into one of Colombo’s most iconic heritage properties. Reimagined for the modern traveller, the hotel reopens its doors with a refreshed spirit, upgraded spaces, and exciting experiences, all while preserving the charm and history that have long defined it.

Housed in the landmark Steuart House, the building served as the city headquarters of George Steuart & Co., Sri Lanka’s oldest business house and one of the oldest in the world. Founded in 1835 by British sea captain James Steuart and his brothers George and Joseph, the company stands as a pillar of Sri Lanka’s mercantile history, and the legacy continues today.

The Steuart by Citrus is more than a hotel; it is a living tribute to Colombo’s colonial and commercial heritage. Located in the heart of the capital’s bustling business district, it offers 44 fully refurbished rooms that combine traditional Scottish charm with warm Sri Lankan hospitality, creating a boutique experience ideal for business and leisure guests alike.

A standout feature of the hotel is the charming old boardroom of George Steuart &Co carefully preserved within the property. This historic space has been modernised for contemporary use while honouring its storied past, offering a rare and meaningful venue for meetings and intimate corporate events.

As part of the reopening, the much-loved &Co Pub and Kitchen also returns with a refreshed look and menu. The &Co Pub and Kitchen is an integral part of the hotel experience, offering great food, drinks, and a welcoming atmosphere for all.

Chandana Thalwatte, Vintage pub Director and CEO of Citrus Leisure PLC, shared:

“The Steuart by Citrus has always been a special part of our portfolio and of Colombo’s hospitality landscape. We’re honoured to reopen its doors and invite guests to experience a space that reflects both the rich history of George Steuart & Co. and the vibrant, contemporary spirit of Citrus.”

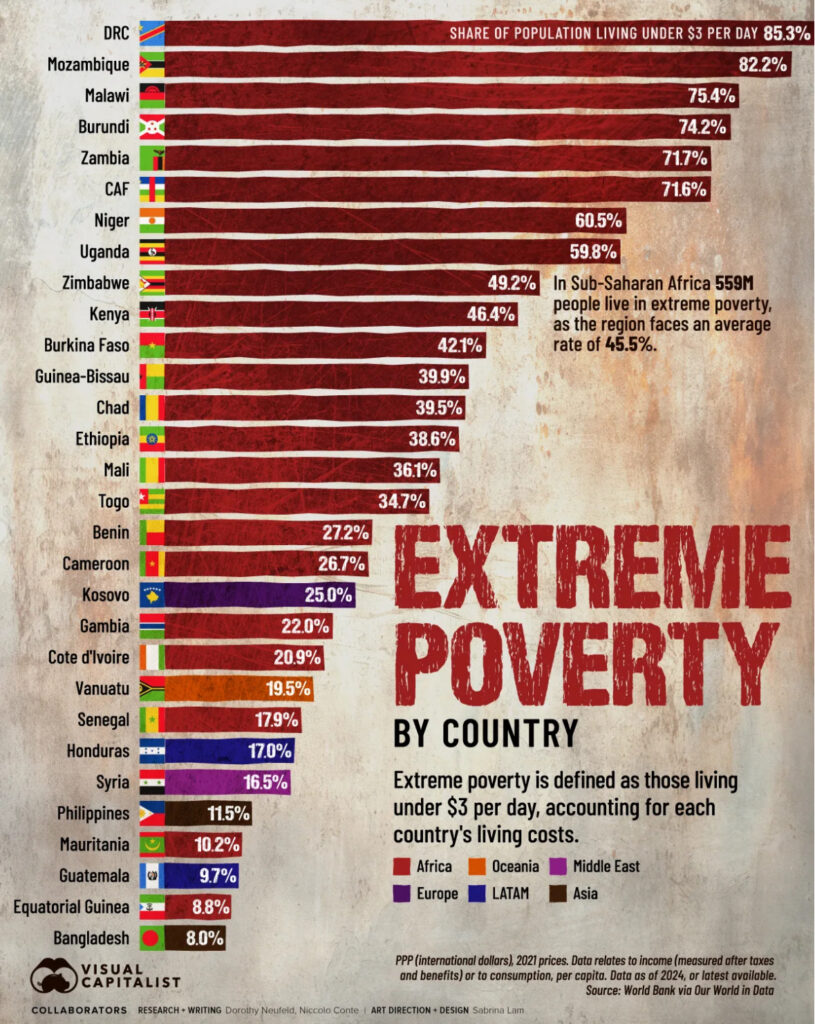

Where Extreme Poverty Rates Are Highest in the World

The Highest Rates of Extreme Poverty by Country

Key Takeaways

- Africa is home to 23 of the top 30 countries with the highest rates of extreme poverty.

- Kosovo ranks in 19th globally in 2024, seeing the highest rates outside of Africa—a country that faces high unemployment rates and ongoing conflict.

The Democratic Republic of Congo (DRC) produces roughly three-quarters of the world’s cobalt, it is also among Africa’s most populous nations.

Yet despite this vast mineral wealth, it has the highest extreme poverty rate in the world. Weak governance, armed conflict, and multinational human rights abuses have all contributed to entrenched poverty in the country for decades.

This graphic shows extreme poverty rates by country in 2024, based on data from the World Bank via Our World in Data.

Extreme Poverty by Country in 2024

Here are the 30 countries with the highest share of people living on less than $3 per day, adjusted for purchasing power.

Today, Africa is home to eight countries where more than half of the population lives in extreme poverty led by the DRC, Mozambique, and Malawi.

The post-conflict territory of Kosovo, meanwhile, has the highest level of extreme poverty outside of Africa. Across its population of 1.6 million, one in four live under $3 per day.

In Latin America, Honduras faces the highest levels of extreme poverty, ranking 24th globally. While poverty has declined in recent years, it remains the most unequal country in the region.

When it comes to Asia, the Philippines ranks among the poorest, with about 11% of its 110 million population facing extreme poverty. Although the poverty rate has dropped by nearly two-thirds since 1985, many citizens continue to lack reliable access to electricity, clean water, and education.

VISUAL CAPITALIST

LAUGFS Gas PLC halts operations of Slogal Energy DMCC after U.S. sanctions listing

LAUGFS Gas PLC yesterday announced the suspension of operations of its Dubai-based subsidiary, Slogal Energy DMCC, following its designation by the U.S. Department of the Treasury for allegedly trading in Iranian-origin petrochemical products.

The company, one of Sri Lanka’s largest liquefied petroleum gas (LPG) suppliers, said it had launched a comprehensive compliance and legal review in collaboration with U.S. sanctions counsel to ensure full adherence to international regulations.

“LAUGFS Gas reaffirms its unwavering commitment to integrity, transparency, and adherence to international regulatory frameworks,” the company said in an official statement.

The U.S. Office of Foreign Assets Control (OFAC) last week accused Slogal Energy of purchasing and selling Iranian LPG shipments to Sri Lanka and Bangladesh through a network of intermediaries, including UAE-based and Hong Kong-based trading entities.

However, LAUGFS strongly denied any intentional violation of international trade sanctions, asserting that all Slogal transactions were supported by certificates of origin and Know Your Customer (KYC) documentation confirming legitimate sources of supply. “Slogal Energy has never knowingly engaged in, or facilitated, any trade involving sanctioned entities or products of sanctioned origin,” the company stated.

According to OFAC, Slogal Energy and UAE-based Markan White Trading Crude Oil Abroad Co. L.L.C. were key intermediaries in facilitating sales of Iranian LPG, allegedly on behalf of Iranian petrochemical broker Persian Gulf Petrochemical Industry Commercial Co. (PGPICC). The network reportedly used multiple entities including Amita Petrochemical Trading L.L.C., Ravenala Trading Co., and AIX Company Limited—to channel payments exceeding $100 million between 2024 and early 2025.

OFAC further linked the transactions to shipments made aboard vessels such as the MAX STAR and GAS DIOR, which delivered Iranian LPG to Sri Lanka and Bangladesh. Several of these vessels and their management companies were simultaneously designated under Executive Order 13902 for operating in Iran’s petroleum sector.

Despite these developments, LAUGFS emphasized that its domestic gas distribution business in Sri Lanka remains unaffected and continues to operate independently of Slogal’s international trade activities. The company said it intends to petition for the removal of Slogal Energy DMCC from the U.S. Treasury’s Specially Designated Nationals (SDN) list.

Industry analysts said the development comes at a time when Sri Lanka’s LPG market is already under pressure due to rising import costs and volatile global energy prices. LAUGFS, alongside its main competitor Litro Gas, plays a vital role in maintaining the nation’s energy supply chain.

If sanctions-related complications persist, industry observers warn that Sri Lanka’s LPG import logistics and price stability could face short-term disruptions. LAUGFS has reassured consumers that it remains committed to regulatory compliance and business continuity in Sri Lanka.

Bairaha Marks 50 Years as Poultry Industry Faces New Challenges

Sri Lanka’s pioneering poultry producer, Bairaha Farms PLC, marks its 50th anniversary this year, celebrating a half-century of shaping the nation’s nutritional landscape and transforming chicken from a luxury item into an affordable household staple.

When Bairaha began operations in 1975, chicken was a rare delicacy on Sri Lankan tables. Today, it stands as the country’s most accessible source of protein a transformation largely credited to the company’s vision and consistent quality standards. Over the decades, Bairaha has built one of Sri Lanka’s largest fully integrated poultry operations, spanning grandparent and parent broiler breeder farms, hatcheries, feed mills, processing facilities, and islandwide distribution.

“Our 50-year journey has been one of continuous learning, innovation, and adaptation,” said Managing Director Yakooth Naleem, reflecting on the milestone. “Despite economic turbulence and shifting consumer demands, our focus has remained on quality, affordability, and trusensuring that every Sri Lankan household can access safe poultry products.”

Bairaha’s founding chairman, M.I.M. Naleem Hajiar, laid the foundation for a modern poultry industry when he established the country’s first large-scale parent breeder farm and hatchery in 1977, followed by a state-of-the-art processing plant in 1980.

A turning point came in 1985 with the Contract Growing Scheme, which empowered hundreds of rural farmers in Gampaha, Puttalam, and Kurunegala to join commercial poultry production. This model not only uplifted village economies but also boosted demand for local maize and feed ingredients strengthening Sri Lanka’s agricultural base.

Today, the company operates across 13 locations, employing over 1,300 staff and partnering with hundreds of contract farmers. Its operations from breeder farms to distribution adhere to rigorous safety and quality standards, ensuring fresh, hygienic chicken products reach consumers daily.

However, Bairaha’s golden jubilee comes amid a challenging backdrop for Sri Lanka’s poultry sector. The industry has been grappling with soaring feed costs, foreign exchange constraints, and shortages of raw materials such as maize and soybean meal. Many small and medium-scale poultry producers have reported difficulties maintaining production levels, while farm-gate prices fluctuate with global commodity trends.

Despite these headwinds, Naleem remains optimistic: “The growth potential for Sri Lanka’s poultry industry remains strong both domestically and for export. We will continue to build on our legacy through innovation, sustainability, and farmer empowerment.”

As Bairaha celebrates five decades of resilience and leadership, its journey mirrors the evolution of Sri Lanka’s poultry industry from modest beginnings to a modern, integrated value chain that continues to feed the nation.

Moody’s Warns Sri Lanka’s Recovery Still Fragile despite Progress

Sri Lanka’s latest sovereign rating review by Moody’s Ratings paints a picture of cautious optimism, one of gradual recovery tempered by deep-seated fiscal weaknesses and persistent debt pressures.

While acknowledging the nation’s improving macroeconomic fundamentals, the agency reaffirmed the country’s Caa1 rating with a stable outlook, underscoring that structural fragility and high external dependency still weigh heavily on its credit profile.

Moody’s said Sri Lanka’s economic recovery “remains broadly on track,” supported by fiscal reforms, a rebound in tourism, and robust remittance inflows.

However, it cautioned that the nation’s heavy debt burden, limited fiscal flexibility, and dependence on foreign financing pose continued risks to stability. “Debt affordability remains weak, even as liquidity pressures have eased since the 2022 default,” the report noted.

According to Moody’s, real GDP expanded by 4.8% year-on-year in the first half of 2025, following a 5% rise in 2024. The agency expects growth to moderate to around 4.5% by year-end as base effects fade. Recovery in tourism to near pre-pandemic levels and stronger investment activity are expected to drive medium-term growth, supported by higher social spending that could lift consumer confidence.

On the fiscal side, Moody’s projects a deficit of 6–6.5% of GDP in 2025, narrowing from 6.8% last year. Revenues grew 26.5% year-on-year during the first seven months of 2025, aided by the lifting of vehicle import restrictions and stronger tax receipts. The primary balance is expected to remain in surplus, marking slow but steady debt reduction.

However, the agency warned that Sri Lanka’s narrow tax base and continued reliance on external funding remain key vulnerabilities. “Sustained reform momentum under the IMF programme could strengthen Sri Lanka’s credit profile, but any policy reversal or weakening in external buffers would increase downside risks,” it cautioned.

Moody’s also highlighted that while liquidity risks have eased following the 2022 debt restructuring and a buildup in foreign reserves, external vulnerabilities persist. The government’s ability to manage debt service obligations depends heavily on continued multilateral and bilateral support.

The agency’s stable outlook reflects a balance of risks optimism over reform progress offset by the fragility of Sri Lanka’s fiscal position. Moody’s said that upward pressure on ratings could emerge if reforms broaden the revenue base, improve debt affordability, and enhance institutional credibility. Conversely, any slowdown in fiscal reform, external shocks, or erosion of foreign exchange reserves could trigger renewed instability.

The reaffirmation of Sri Lanka’s low credit rating serves as a reminder that, despite signs of economic normalization, the country remains vulnerable to policy slippage and external shocks. Sustained commitment to reforms and prudent debt management will be key to securing a durable recovery and regaining investor confidence.

Cabinet Approves ‘Ratama Ekata – National Operation’ to Combat Drug Menace

The Cabinet of Ministers has approved the establishment of a National Operational Council to implement an emergency rapid program titled “Ratama Ekata – National Operation,” aimed at eradicating the drug menace and rehabilitating drug addicts through broad public participation.

The proposal, submitted by President Anura Kumara Dissanayake, received Cabinet approval earlier this week.

According to the government, the spread of narcotic drugs has become a serious national concern, with an increasing number of crimes linked to drug trafficking and abuse. Addressing this issue, the Cabinet Spokesman stated that a comprehensive, national-level response—backed by strong political leadership, effective decision-making, and active community engagement—is urgently required.

The “Ratama Ekata – National Operation” seeks to fulfill this objective by combining enforcement, rehabilitation, and public awareness initiatives. The program will include a nationwide information campaign to raise awareness about the dangers of drug use, crackdowns on trafficking networks, the strengthening of rehabilitation facilities, and expanded support for individuals recovering from addiction.

The newly established National Operational Council will be responsible for coordinating and monitoring all related activities to ensure the effective implementation of the initiative.