January 05, Colombo (LNW): Sri Lanka’s automotive industry is experiencing a remarkable upswing, with more than 108 varieties of locally assembled vehicles dominating the nation’s roads. This diverse lineup includes luxury cars, trucks, military vehicles, three-wheelers, and motorcycles, reflecting a burgeoning local manufacturing landscape.

Thilaka Jayasundara, Secretary of the Ministry of Industries, highlighted the sector’s progress, emphasizing the increasing prominence of the automobile component manufacturing industry. “It’s not just a revenue generator; it’s becoming a significant contributor to our FOREX reserves,” Jayasundara stated.

Key players like VEGA INNOVATIONS, Mahendra, and Micro Car have significantly contributed to this momentum. VEGA INNOVATIONS has ventured into crafting luxury vehicles, while Mahendra and Micro Car have introduced various vehicles to the Sri Lankan market. The government is actively encouraging these manufacturers to pivot towards assembling electric vehicles, a shift that is gaining traction.

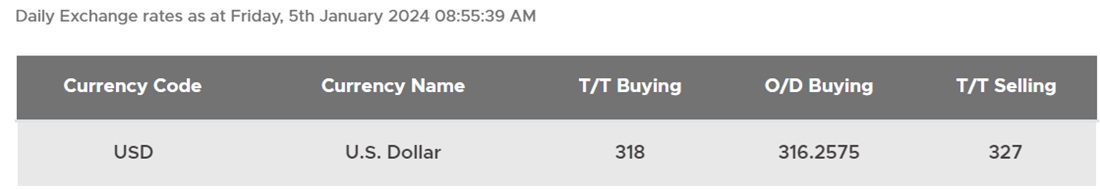

Jayasundara underlined the industry’s global impact, noting that local component manufacturers are now exporting to major companies like Toyota and Tesla, diversifying Sri Lanka’s export portfolio. The implementation of the Standard Operating Procedure (SOP) for local vehicle assembly and component manufacturing, initiated by the Ministry of Industries four years ago, has been pivotal in fostering a thriving ecosystem. With over 100 local manufacturers now operating, this SOP has not only generated export revenues but has also led to substantial savings, estimated to exceed Rs. 200 billion annually from reduced vehicle and spare parts imports.

Furthermore, the SOP has empowered existing local manufacturers, such as tire, battery, exhaust component, rubber part, and cushion makers, by securing larger orders and improved prices. The government’s strategic plan includes establishing a specialized automobile component manufacturing zone in Katana, earmarking 100 plots of land to attract foreign companies for joint ventures, streamlining logistics for industrial operations.

Addressing the need for industrial land allocation, Jayasundara emphasized plans to increase it from less than 0.4% to 1% by 2025, facilitating industry growth.

Highlighting additional government initiatives, Jayasundara discussed President Ranil Wickremesinghe’s Green initiatives. The goal is to introduce environmentally friendly practices to 1,000 SMEs in the industry. She also shed light on the industry’s heavy reliance on foreign raw materials, citing special measures taken during economic crises to ensure the continuity of imports through the Indian credit line. Efforts were made to address temporary restrictions on over 1,000 items, easing the burden on local industries amidst dollar scarcity.