December 13, Colombo (LNW): Sri Lanka and Italy have reaffirmed their long-standing cooperation on road transport by renewing the bilateral arrangement that allows for the mutual recognition of driving licences, following a formal signing ceremony held in Rome.

The agreement was endorsed on behalf of Sri Lanka by its Ambassador to Italy, Satya Rodrigo, while Italy was represented by the Deputy Minister and Undersecretary of State for Foreign Affairs and International Cooperation, Maria Tripodi.

The renewed pact marks the successful conclusion of extensive discussions between the respective transport and motor traffic authorities of both countries.

Originally introduced in 2011, the agreement has played a key role in easing mobility for Sri Lankan and Italian nationals living abroad. After a previous renewal in 2016, the arrangement lapsed in 2021, prompting renewed negotiations to restore the facility in line with current administrative and regulatory requirements.

The updated agreement enables eligible residents who have settled permanently in either country to exchange their valid domestic driving licences for a local one, without the need to sit written or practical driving tests.

This provision applies to individuals who have been resident in the host country for up to six years, offering a significant convenience for expatriate communities.

Officials from both sides described the renewal as a practical step that strengthens bilateral ties and supports the everyday needs of citizens living and working overseas, while also reinforcing cooperation in transport and consular affairs.

Sri Lanka and Italy Renew Agreement Allowing Reciprocal Driving Licence Conversion

UN Agency Seeks Emergency Funds to Protect Women and Girls After Sri Lanka Cyclone

December 13, Colombo (LNW): The United Nations Population Fund (UNFPA) has issued an urgent appeal for US$8.3 million to safeguard the health, safety and dignity of women and girls in Sri Lanka following the devastation caused by last month’s cyclone.

The storm, which struck on 28 November, has affected more than two million people across multiple districts, sweeping away homes, damaging hospitals and clinics, and forcing large numbers of families into temporary shelters.

As recovery efforts struggle to keep pace with the scale of destruction, women and girls are facing growing risks, including disrupted access to sexual and reproductive healthcare, heightened exposure to gender-based violence and increasing psychological distress.

UNFPA estimates that those impacted include around 520,000 women of reproductive age, among them more than 22,000 pregnant women, as well as nearly 194,000 elderly women. Flooded roads, debris and damage to medical facilities have sharply limited access to essential services, including emergency obstetric care, placing expectant mothers and newborns in particular danger.

Conditions in evacuation centres have further compounded vulnerabilities. Overcrowding and a lack of privacy have raised safety concerns, especially for adolescent girls, older women and women living with disabilities.

UNFPA’s Officer-in-Charge in Sri Lanka, Phuntsho Wangyel, said the agency moved quickly in coordination with national authorities, dispatching more than 1,200 maternity and dignity kits within a day of the emergency being declared.

However, he warned that the situation is deteriorating and that far more resources are needed to prevent women and girls from being overlooked as the crisis deepens.

The agency plans to expand its operations to reach over 200,000 women and girls with life-saving services. These include mobile health clinics for displaced and remote communities, the distribution of maternity supplies and essential care kits, and efforts to restore damaged health centres.

UNFPA also aims to strengthen protection measures by supporting safe spaces, providing targeted cash assistance, improving referral systems for survivors of abuse and scaling up mental health and psychosocial support.

Despite the urgency, only a small fraction of the appeal has been funded so far. UNFPA has cautioned that without swift international backing, critical gaps in care will widen, leaving women, girls, newborns and the elderly to shoulder the heaviest burden of the disaster. The agency has called on governments and donors to respond quickly to ensure vital services reach those most at risk.

Appeal Court Upholds Lengthy Sentence, Warning of the Deep Social Scars of Rape

December 13, Colombo (LNW): Sri Lanka’s Court of Appeal has underscored the profound and lasting damage caused by sexual violence, describing rape as a grave offence that harms not only individual victims but society as a whole.

The remarks were made while rejecting an appeal by a man convicted of sexually assaulting a teenage girl.

Delivering the judgement, Justice Amal Ranaraja, with Justice Sasi Mahendran concurring, noted that sexual offences remain disturbingly common in Sri Lanka and continue to erode social trust and security.

The Court stressed that rape inflicts enduring psychological trauma on victims and creates a climate of fear, particularly among women and girls, making firm judicial responses essential.

The case centred on offences committed in Adippala, Chilaw, between November and December 2006. At the time, the offender was a 27-year-old married man, while the victim was just 15.

Evidence before the trial court established that the abuse resulted in the birth of a child, with DNA analysis conclusively identifying the accused as the father.

The Attorney General had brought three charges of rape under the Penal Code, to which the accused pleaded guilty. The High Court in Chilaw subsequently imposed 18 years of rigorous imprisonment on each count, with the sentences ordered to run concurrently.

In appealing against the ruling, the convict argued that the punishment was excessive. However, the prosecution pointed out that he had occupied a position of trust and effectively acted as a guardian to the girl, a responsibility he had grossly betrayed.

Dismissing the appeal, the Court of Appeal ruled that the sentence was lawful and proportionate to the seriousness of the crimes. The judges emphasised that strong penalties in such cases are necessary both to deliver justice to victims and to send a clear deterrent message.

The Court also highlighted the severe physical and emotional suffering endured by the victim, who was forced to face pregnancy and childbirth while still a child herself, a burden the judges described as particularly cruel given her age and vulnerability.

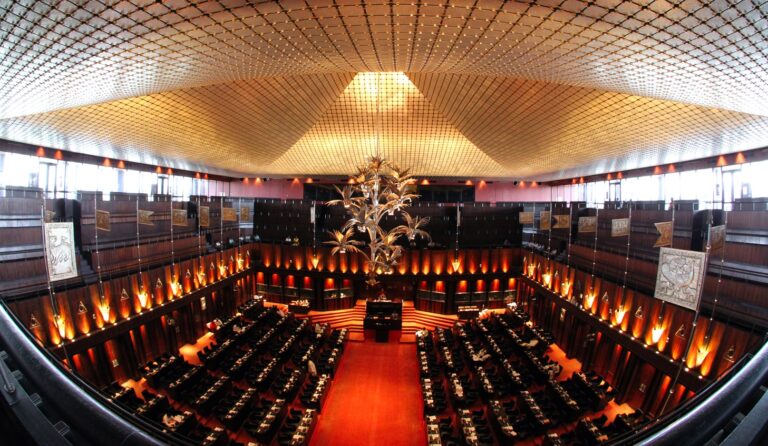

Parliament to Meet on Dec 18: Speaker

December 13, Colombo (LNW): Sri Lanka’s Parliament has been called to sit on December 18, 2025, with proceedings scheduled to begin at 9.30 a.m., Speaker Dr Jagath Wickramaratne confirmed on Thursday (12).

The decision was formalised through an Extraordinary Gazette notification issued under Standing Order 16.

The notice followed a formal request by the Prime Minister, paving the way for legislators to reconvene later this month to take up pending parliamentary business and address key national matters.

Remittance Inflows Continue Upward Momentum in November

December 13, Colombo (LNW): Sri Lanka received just over US$673 million in foreign currency inflows from overseas workers in November 2025, reflecting the continued resilience of remittances as a key source of external financing, figures released by the Central Bank reveal.

With one month still remaining in the year, total remittances for the January–November period have climbed to approximately US$7.19 billion.

This represents a robust increase of more than 20 per cent compared with the same eleven-month span in 2024, underscoring a steady recovery in overseas employment earnings and transfer channels.

Ditwah Catastrophe: More than 5,700 houses destroyed nationwide

December 13, Colombo (LNW): Widespread extreme weather has caused extensive damage across Sri Lanka, with more than 5,700 homes reduced to rubble nationwide, according to the Disaster Management Centre (DMC).

Thousands more buildings have suffered varying degrees of damage as communities grapple with the aftermath of flooding, landslides and high winds.

Kandy District has emerged as the hardest hit in terms of housing losses, recording over 1,500 homes completely destroyed alongside more than 14,000 partially damaged. Nuwara Eliya follows closely, where hundreds of houses have been flattened and several thousand more rendered unsafe. Puttalam ranks third overall, with more than 600 homes destroyed and over 20,000 sustaining partial damage, underlining the scale of destruction along the western belt.

Significant losses have also been reported elsewhere, including Kurunegala, Badulla, Kegalle, Anuradhapura and Polonnaruwa, each seeing hundreds of homes wiped out as the severe weather swept across the island.

Human impact figures remain deeply concerning. Colombo District has recorded the highest number of affected residents, with more than 330,000 people from over 86,000 families impacted. Large numbers have also been affected in Puttalam, Kandy, Trincomalee, Kurunegala, Mannar, Kegalle, Anuradhapura, Badulla and Ratnapura, reflecting the nationwide reach of the disaster.

The death toll has climbed to 640, the DMC confirmed, with Kandy District accounting for the largest share of fatalities at 234. Badulla has reported 90 deaths, followed by Nuwara Eliya, Kurunegala, Puttalam, Kegalle and Matale, each recording significant losses of life.

Displacement remains a major challenge. More than 82,000 people from over 26,000 families are currently sheltering in 847 temporary camps across the country. Kandy hosts the largest number of relief centres, accommodating more than 27,000 people, while substantial numbers are also housed in camps in Nuwara Eliya, Badulla and Kegalle. Authorities say relief operations are ongoing as assessments continue and further assistance is mobilised for affected communities.

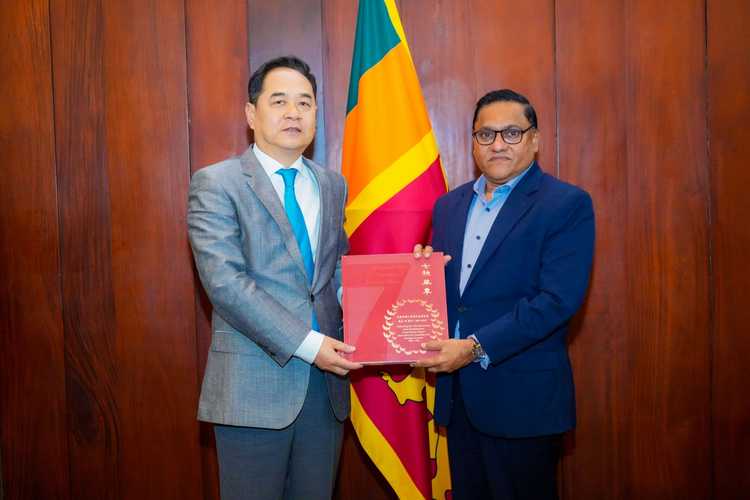

Sri Lanka and China Reaffirm Ties Following Cyclone Support

December 13, Colombo (LNW): Sri Lanka’s Foreign Minister Vijitha Herath met Yang Wanming, President of the Chinese People’s Association for Friendship with Foreign Countries, during a courtesy call at the Ministry of Foreign Affairs, Foreign Employment and Tourism on Wednesday.

Following the meeting, Minister Herath said China’s assistance in the wake of Cyclone Ditwah had been deeply appreciated, noting the continued solidarity shown by the Chinese government and its people during a difficult period for Sri Lanka.

He described Beijing’s support as timely and meaningful as the country works through the humanitarian and economic challenges left by the disaster.

The discussions also focused on strengthening the long-standing relationship between Colombo and Beijing, with both sides reaffirming their commitment to closer cooperation and people-to-people exchanges. Minister Herath indicated that there was mutual interest in building on existing partnerships and exploring new avenues for collaboration in the years ahead.

Singapore pledges US$ 100,000 to back relief efforts post-Ditwah

December 13, Colombo (LNW): Singapore has pledged fresh backing for relief efforts in Sri Lanka, setting aside US$100,000 (about S$129,000) as seed funding to boost a public fundraising drive led by the Singapore Red Cross (SRC).

The move is intended to galvanise wider donations as communities across the island struggle to recover from a powerful cyclone that struck earlier this month.

The government’s contribution adds to the SRC’s own commitment of S$50,000, which is being directed towards urgent humanitarian needs such as shelter, clean water and medical assistance. The Ministry of Foreign Affairs said the combined support reflects Singapore’s desire to stand with Sri Lanka during a period of acute hardship.

In a separate gesture of solidarity, President Tharman Shanmugaratnam and Foreign Minister Vivian Balakrishnan have written to their Sri Lankan counterparts, President Anura Kumara Dissanayake and Foreign Affairs Minister Vijitha Herath, to express condolences over the heavy loss of life and extensive damage caused by the storm.

Cyclone Ditwah tore through Sri Lanka roughly two weeks ago, unleashing severe flooding and landslides across much of the country. Authorities estimate that more than two million people — nearly a tenth of the population — have been affected, making it the most destructive cyclone to hit the island in a century. At least 639 deaths have been confirmed, while around 200 people remain unaccounted for.

The scale of the disaster has prompted an international appeal. The United Nations has urged donors to step forward, noting that Sri Lanka cannot shoulder the cost of reconstruction alone. UN resident coordinator Marc-André Franche has outlined a US$35.3 million emergency funding plan, with US$9.5 million already secured from partners including the European Union, Switzerland, the United States and the United Kingdom.

Afternoon showers, thundershowers to continue: Fairly heavy falls above 50 mm expected (Dec 13)

December 13, Colombo (LNW): Several spells of showers will occur in Northern, North-Central, Eastern, Uva, Central and North-Western provinces, the Department of Meteorology said in its daily weather forecast today (13).

Showers or thundershowers may occur at several places in the other areas of the island after 1.00 p.m. Fairly heavy falls above 50 mm are likely at some places in these areas.

Fairly strong winds of about (30-40) kmph can be expected at times over Eastern slopes of the central hills, Northern, North-central and North-western provinces and in Trincomalee, Hambantota and Monaragala districts.

Misty conditions can be expected at some places in Sabaragamuwa, Central and Southern provinces during the early hours of the morning.

The general public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

Condition of Rain:

Showers will occur at several places in the sea areas off the coast extending from Puttalam to Pottuvil via Mannar, Kankasanthurai and Trincomalee. Showers or thundershowers may occur at a few places in the other sea areas around the island during the evening or night.

Winds:

Winds will be north-easterly. Wind speed will be (30-40) kmph. Wind speed can increase up to (50-55) kmph at times in the sea areas off the coast extending from Colombo to Trincomalee via Puttalam and Kankasanthurai and from Hambantota to Pottuvil.

State of Sea:

The sea areas off the coast extending from Colombo to Trincomalee via Puttalam and Kankasanthurai and from Hambantota to Pottuvil will be rough at times. The other sea areas around the island will be moderate.

Temporarily strong gusty winds and very rough seas can be expected during thundershowers.

Vehicle Plan Reflects Deep Structural Gaps in Public Health

By: Staff Writer

December 12, Colombo (LNW): Sri Lanka’s decision to use US$150 million in World Bank IDA financing to purchase a large fleet of vehicles for health-sector workers has stirred debate not only about financial priorities but also about the deeper systemic weaknesses in the country’s public health infrastructure.

While the funds fall under the Primary Health Care System Improvement Project (2024–2028 a programme aimed at strengthening non-communicable disease prevention, elderly and palliative care, and climate-resilient health services the government’s use of this money for an extensive transport procurement plan reveals how the health system has been operating under severe logistical strain for years.

Across Sri Lanka’s districts, midwives, public health inspectors, community nurses and field-monitoring officers often work with minimal or outdated transport.

Many rely on personal motorbikes, hired three-wheelers or irregular public transport to reach remote households, conduct maternal and child health visits, carry out screenings, investigate disease outbreaks or transport medical samples.

The lack of mobility not only slows service delivery but can also compromise patient care, particularly in rural and estate communities where distance and terrain are major obstacles.

The government’s request to purchase more than 4,000 vehicles, including scooters, motorbikes, clinical-waste lorries, freezer trucks, double cabs, vans, buses, forklifts and an ambulance boat, therefore reflects far more than a procurement choice.

It exposes the hidden operational backbone required for primary health care to function at all.

Officials argue that without adequate transportation, the World Bank-mandated goals of early detection of non-communicable diseases, home-based care, community outreach, screening programmes and emergency preparedness would remain on paper rather than translate into actual impact.

Supporters of the plan say that the transport deficit is a structural problem decades in the making.

Sri Lanka’s public health system, often praised internationally for its maternal and child health achievements, has silently accumulated logistical debt meaning that for many years, core frontline services have been expected to perform without corresponding investment in vehicles, equipment, IT systems or cold-chain capacity.

The new vehicle procurement, they argue, is not a deviation but a necessary precondition for delivering the outcomes the World Bank expects.

However, this interpretation has not silenced concerns. Critics point out that the scale of the procurement including thousands of two-wheelers and dozens of heavy vehiclesrisks overshadowing other essential components of primary health care reform.

They warn that relying heavily on capital purchases may dilute attention from systemic needs such as training, chronic-disease management protocols, diagnostic capacity, digital health records and community-level health education.

Others question whether the use of IDA financing for large-scale imports complies strictly with the World Bank’s results framework, noting that any major reallocation of funds typically requires explicit justification and approval.

Still, the controversy highlights an uncomfortable reality: Sri Lanka’s primary health care network cannot deliver modern, community-based services without fixing the most basic element of all mobility.

Whether the vehicle procurement proves transformative or merely a temporary patch will depend on how effectively it is integrated into broader reforms, accountability mechanisms and measurable improvements in public health outcomes.