YOLANDA FOSTER

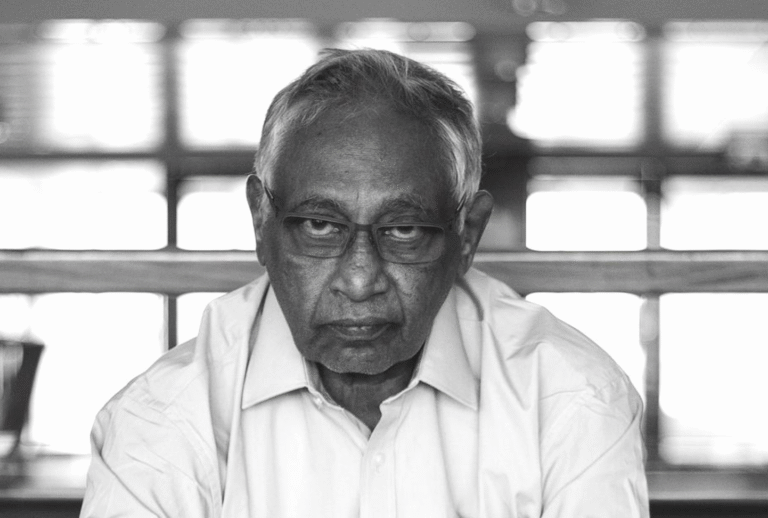

Dr. Kasipillai Manoharan has left us, but the imprint of his courage and moral clarity will remain. He was first and foremost a father, and through his devotion to his son Ragihar he became one of the most steadfast voices for justice in Sri Lanka.

When Ragihar and four other students — the Trinco 5 — were brutally killed in 2006, Dr. Manoharan’s life was shattered. Yet from that grief he carved a path of dignity and truth-telling. He spoke when silence was safer and stood up when others were forced down. He carried not only his son’s story, but also the unspoken stories of many families who had lost loved ones to violence and impunity.

I first met him in 2008 while working with the South Asia team at Amnesty International, at a time when human rights abuses in Sri Lanka were on the rise. What struck me most was his integrity. He told me clearly that he was not political, but that as a father he felt bound to seek justice for his son. It was through his devotion to Ragihar that he became one of the clearest voices for truth and justice in Sri Lanka.

In the years that followed, we often exchanged information about the deteriorating situation in Sri Lanka and his deep concerns for civilians still caught in the aftermath of war. In May 2010, to mark the first anniversary of the war’s end, he joined a global action aimed at focusing worldwide attention on impunity. At its heart was a petition to Secretary-General Ban Ki-moon calling for an independent international investigation — a demand that reflected both his personal struggle and the broader call for accountability.

Two years later, Dr. Manoharan carried that demand in person to New York, delivering a petition directly to Ban Ki-moon’s office. It was more than advocacy; it was a father’s plea, carrying the weight of love, memory, and hope for justice. Soon after, we travelled together to Geneva, where he addressed the Human Rights Council and delivered Amnesty International’s statement during Sri Lanka’s Universal Periodic Review. Despite his grief, he sent a clear and unflinching message: the Council must act. I was with Dr Manoharan in Geneva when the Council adopted Resolution 30/1 which endorsed the findings of the OHCHR investigation on Sri Lanka (OISL) and passed a resolution to begin investigations. This milestone was reached thanks to the relentless advocacy of Sri Lankan campaigners like Dr Manoharan and others.

For me personally, Dr. Manoharan’s integrity became an anchor in my own campaigning. At a time when the Sri Lankan government tried to silence dissent — even branding Amnesty International “liars” and “apologists for terror” — working with defenders like him preserved our commitment to non-partisanship and reminded me why we had to speak out. His courage steadied mine.

What made him powerful was his honesty as a father. He never sought to politicise his son’s case or turn it into a weapon for factional gain. Instead, he spoke in the direct, unembellished language of truth. At a time when human rights abuses flourished in Sri Lanka under a veil of secrecy, his voice cut through with a clarity that reached further than reports or statistics. His story, told with quiet but unwavering conviction, spoke truth to power in a way few others could.

That solidarity stretched across borders. Amnesty International USA’s Sri Lanka Country Specialist Jim McDonald, together with ordinary volunteers in the Get on the Bus campaign, carried the Trinco 5 case into the streets of New York and beyond. Their persistence kept the demand for justice alive in places far from Trincomalee. Dr. Manoharan valued such solidarity, for it showed him that ordinary people – not only diplomats and institutions – were carrying Ragihar’s story and insisting on the truth.

Dr. Manoharan was also proud of his work as a doctor, recalling how he tended to members of the Armed Forces as well as ordinary citizens when he lived in Trincomalee. I remember him showing me photos of his son’s funeral, which revealed how all communities supported Ragihar and his family. Despite the state’s pretence and denial, he wanted me to know that most Sri Lankans care for community and friendship.

To me, he will always remain a symbol of integrity – and a reminder that truth has its own quiet power, one that endures beyond fear and beyond death.

This week, as the Human Rights Council discusses a new resolution on Sri Lanka, the best homage to Dr. Manoharan would be to honour that plea. The Council’s mandate is to defend the rights of victims’ families like his, which makes it incumbent never to forget cases such as the Trinco 5. Member states must ensure that monitoring and investigations continue, and that the campaign for truth he sustained does not end with his passing.