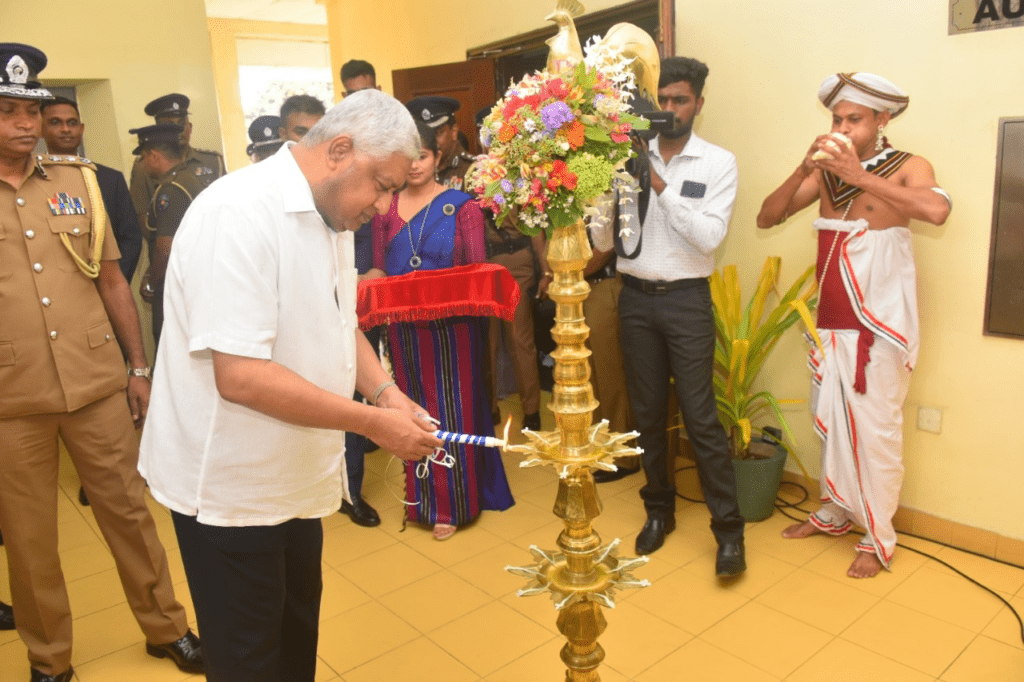

Colombo (LNW): In an effort to enhance the inclusion of differently-abled persons in the Parliament of Sri Lanka, a few selected groups of the staff and Members of Parliament went through basic sensitisation sessions from Aug 18 to 23, 2023.

Parliamentary Task Force for Disability Inclusion, the Media Division and Public Outreach Division of the Communications Department of Parliament, and the Select Committee of Parliament to look into and report to Parliament its recommendations to ensure gender equity and equality with special emphasis on looking into gender-based discrimination and violations of women’s rights in Sri Lanka participated in this.

This series of sensitisation sessions is the very first step in the long-term process of strengthening the capacity of parliament on the inclusion of differently-abled.

The Parliament of Sri Lanka is taking steps to make the whole of parliament – including physical, digital and social spaces – friendly for the differently-abled. In the beginning of this year, a comprehensive assessment of parliament’s accessibility to persons who are differently-abled was conducted. The report recommended a number of areas for improvement including physical constructions, making the parliament website and digital spaces friendly for the differently-abled and capacity development of the staff and Members of Parliament.

As a result, the Secretary General of Parliament appointed a special Task Force on the inclusion of the differently-abled to work on this in a consistent and sustainable manner. The Task Force comprises Heads of Departments and is chaired by the Assistant Secretary General of Parliament. Further, in response to the recommendations of the assessment report, a training manual is developed with modules focused on different aspects of the inclusion the differently-abled in the context of parliament and the parliament secretariat. This manual will be vernacularised and will be used for capacity strengthening in future.

It was emphasised that a person with impairment coupled with environmental, attitudinal and institutional barriers will experience being differently-abled, thereby allowing them to in society as equal citizens.

Therefore, if we remove the barriers, we will not have to draw a line between those who are differently-abled and those who are not. As society and institutions, what we need to strive for is to remove these barriers so that persons who are differently-abled can participate in society like any other person without impairments.

During the sessions, the participants engaged in practical activities to help them experience and hence better understand the realities of persons who are differently-abled. An international consultant with years of experience on the subject conducted the sensitisation sessions while a pool of local trainers joined the training session as observers. These efforts of parliament are supported by the National Democratic Institute and funded by USAID.