Japan’s Foreign Minister Yoshimasa Hayashi expressed his country’s willingness to take a leading role in Sri Lanka’s creditor talks on debt restructuring

.Mr Hayashi gave this assurance when he held talks President Ranil Wickremesinghe held Tuesday morning in Tokyo.

President Ranil Wickremesinghe says that discussion on restructuring Sri Lanka’s bilateral debt has already commenced with India and China at a lower level and that he has held talks with Japan on their leading role in the process.

He stated that talks with China would go to a higher level probably after the National Congress of the Chinese Communist Party.

The President stated this during an exclusive interview with StratNews Global Editor-in-Chief Nitin A.Gokhale Responding to a question regarding the progress made thus far with regard to resolving the economic crisis, he said:“We’ve had discussion with the IMF. We have come to a staff level agreement.

But now we have to deal with our creditors. We didn’t have to do that earlier, we didn’t have this serious crisis. But now we have to deal with our creditors. We are unable to service our debts. Once we have a final… come to a conclusion with the creditors then we will go back to the IMF board.

“So, if you are looking at what is the phase we are in, okay we are implementing the prior actions that are required under the staff-level agreement and we have started the discussions with the bilateral creditors.

Once that’s over I think we have to do with the private creditors. “We are just starting the talks with China.

We’ll have to go to a higher level, but we have to now see whether we do it before the Chinese Communist Party conference or after.

He said “Since we are just starting the talks it may have to be just after the conference. But we will first talk with Japan then we will have the discussion with India.”

President Wickremesinghe expressed regret over the breakdown of relations between Japan and Sri Lanka following the cancellation of several investment projects by the former Government.

The President stressed that he was keen to restart those projects.The President also indicated that the Government was interested in Japan investing in Sri Lanka’s renewable energy projects.

Japan Foreign Minister Hayashi explained that Japan had increased its commitment to renewable energy and would be willing to explore future investment opportunities in Sri Lanka.

The Foreign Minister also explained that Japan would begin the skilled worker examinations in January 2023 for Sri Lankan migrant workers.

The President appreciated the support extended by Japan on the international stage and expressed the Government’s willingness to support both Japan’s and India’s campaign to become permanent members of the United Nations Security Council.

The Foreign Minister welcomed the news, stressing that Asia required greater representation on the world stage.

Japan expresses willingness to lead creditors in SL’s debt restructure– Japanese FM

Janaka challenges Kanchana!

Chairman of the Public Utilities Commission Janaka Ratnayake says that he is waiting for the Minister of Power and Energy Kanchana Wijesekera or the CEYPETCO to go before the court against him. He says that if a case is filed against him, a lot of information will be revealed before the court.

Janaka Ratnayake stated in a televised discussion that the crude oil imported by the Petroleum Statutory Corporation is substandard and the crude oil obtained from the refinery cannot be used for electricity production. Janaka Ratnayake also mentioned that the crude oil cannot be used for any other purpose except to give it to the people who brought it to ‘drink’.

Responding to that, Kanchana Wijesekera had released a message on Twitter. He says he completely denies the allegations leveled by the chairman of the Public Utilities Commission. The minister has also said that legal action will be taken against him.

Janaka Rathnayake further states that what the minister should do is to look into the allegations and if there is a mistake, correct it, not to chase the people who point out the mistakes.

Ranil leaves for the Philippines today after meeting the PM of Japan

President Ranil Wickremesinghe, who is on an official visit to Japan, is scheduled to meet the Japanese Prime Minister today. In addition, the President’s Media Division says that he is also scheduled to meet the Emperor of Japan.

Wickramasinghe is scheduled to leave for the Philippines today after concluding his visit to Japan. It is to participate in the Asian Development Bank Governors’ Conference that will begin in that country. Sri Lanka has the chairmanship of this year’s conference.

During his stay in the Philippines, Ranil Wickramasinghe is scheduled to meet with the Chairman of the Asian Development Bank and after that he is scheduled to meet with the President of the Philippines.

These days, Sri Lanka is holding talks with creditor countries and organizations regarding debt restructuring, and for this reason, the President’s visit to the Philippines will be extremely crucial.

SRI LANKA ORIGINAL NARRATIVE SUMMARY: 28/09

- President Ranil Wickremesinghe assures Sri Lanka’s support to Japan’s and India’s campaigns to become permanent members of the UN Security Council: Japan’s Foreign Minister welcomes the news: stresses Asia requires greater representation on world stage.

- Regional Plantation Companies call for the lifting of the ban on oil palm cultivation: claim the RPCs have invested over Rs.26 bn on expansion of oil palm cultivation up to 12,000 hectares.

- CID arrests barber 37, from Kolonnawa for allegedly attempting to extort money from former first lady Ayoma Rajapaksa: Police say the suspect had telephoned and demanded Rs.1 mn.

- Tough resolution submitted by UNHRC Core Group of countries on Sri Lanka, to be taken for vote on 6th October: the highly offensive resolution against Sri Lanka is co-sponsored by US, UK, Canada & Germany, who regularly claim they are Sri Lanka’s “friendly countries”.

- President Ranil Wickremesinghe pledges to implement FTA with Singapore: Singapore PM Lee Hsien Loong says his country is looking forward to investing in Sri Lanka again.

- ADB lowers Sri Lanka’s growth outlook to negative 8.8% this year from positive 2.4% as estimated before the debt default: also forecasts negative 3.3% growth next year, down from positive 2.5% forecast previously.

- Cardinal Ranjith calls on Elections Commission to hold Local Government polls in March next year: says people must be given opportunity to respond to “arrogant rulers”.

- SJB MP S M Marikkar says President Ranil Wickremesinghe will not be allowed to remain in power till 2024: warns the President will be surrounded from all sides wherever he resides, if he fails to resolve starvation and other issues.

- President Ranil Wickremesinghe attends state funeral of former Japanese PM Shinzo Abe in Tokyo.

- Secretary, Ministry of Public Administration issues circular preventing public officials from expressing their opinions on social media without following the Establishment Code: deviations to be an offence leading to disciplinary action.

4 more arrested in relation to the events of July 09!

According to the police, four more people were arrested in connection with the violent incidents that occurred on July 9.

Accordingly, the police have arrested three suspects for trespassing and damaging the President’s House in Colombo on that day.

Three persons aged 22, 40 and 55, residing in Angunakolapalassa area, have been arrested.

It is said that they have been arrested by the Colombo Central Division Criminal Investigation Division and have been presented to the Kompanjaveediya police.

Also, on July 9, the police have arrested a person who behaved violently in front of President Ranil Wickramasinghe’s house and at J.O.C. junction.

A 37-year-old resident of Malambe area has been arrested.

It is said that he has been arrested by the Kurunduwatta police on the charges of being a member of an unruly crowd and assaulting police officers, using criminal force and causing damage to vehicles.

Sri Lanka: Revoke Sweeping New Order to Restrict Protest

Misuse of Official Secrets Act Latest Measure to Suppress Dissent

(New York, September 28, 2022) – The Sri Lankan government should reverse a new regulation that unlawfully restricts protests in large areas of the capital, Colombo, Human Rights Watch said today. On September 24, 2022, a day after the measure was issued, police arrested 84 people and used tear gas and water cannonto disperse protesters calling for the release of student activists being held under the notorious Prevention of Terrorism Act.

On September 23, the Sri Lankan government invoked the Official Secrets Act to designate public streets and government buildings in central Colombo “high security zones,” where written permission from the police is required to hold any public gathering. Under the regulation, police have wide-ranging authority to arrest anyone inside these zones and only the High Court can grant bail to those detained. These broad, severe restrictions threaten the excessive use of force and prolonged detention for people exercising their rights to peaceful assembly and expression, Human Rights Watch said.

“The sweeping new regulation severely restricting public protest in Colombo is President Ranil Wickremesinghe’s latest desperate attempt to stop people from protesting,” said Meenakshi Ganguly, South Asia director at Human Rights Watch. “While the country is struggling to deal with a deep economic crisis, the government should be making it easier for people’s voices to be heard, not throwing them in jail when they speak out.”

Although the September 24 protest was not within one of the new “high security zones,” police said they used tear gas and water cannon because the demonstration was “organized illegally without any permission.”

Sri Lankans have protested frequently during 2022 amid an economic crisis and collapsing living standards, which led to the resignation of President Gotabaya Rajapaksa in July. The authorities have frequently responded to protests with excessive or unnecessary use of force, including “less-lethal” weapons such as water cannons.

The new president, Ranil Wickremesinghe, has sought to negotiate external economic support from the International Monetary Fund while suppressing peaceful dissent.

The Human Rights Commission of Sri Lanka, an independent government body, said that the regulation “grossly violates the fundamental rights of the people of this country.” The Bar Association of Sri Lanka said the order “seeks to significantly curtail the liberty of the citizen, without any reasonable or legal basis.”

As a party to the International Covenant on Civil and Political Rights (ICCPR), Sri Lanka has obligations to respect and protect the rights to freedom of peaceful assembly and expression, and to actively facilitate and promote their exercise. Under the ICCPR, any restrictions on these rights must be set out in law and be necessary and proportionate to achieve a legitimate government aim. The new regulation does not meet human rights law standards, Human Rights Watch said.

The Sri Lankan government has as recently as June told diplomats at the United Nations Human Rights Council in Geneva that it was imposing a moratorium on the use of the Prevention of Terrorism Act, which has long been used to facilitate torture and arbitrary detention. The Human Rights Council is currently considering adopting a resolution on Sri Lanka to advance accountability for past violations of human rights and to provide monitoring of the human rights situation.

The government’s repeated broken promises on rights concerns and the accelerating repression under President Wickremesinghe show that a robust Human Rights Council resolution is crucial to help prevent further violations, Human Rights Watch said.

“Sri Lankans peacefully calling for reforms and government accountability for the economic crisis now face even greater risks of violence, arrest and prolonged detention,” Ganguly said. “Countries at the UN Human Rights Council should do all they can to help people carry out their basic rights and liberties.”

For more Human Rights Watch reporting on Sri Lanka, please visit:

https://www.hrw.org/asia/sri-lanka

For more information, please contact:

In London, Meenakshi Ganguly (English, Bengali, Hindi): +91-9820-036-032 (mobile); or [email protected]. Twitter: @mg2411

In Geneva, Lucy McKernan (English): +41-079-103-77-19 (mobile); or [email protected]. Twitter: @LucMcK

President instructs to provide relief to those affected by the fire in Thotalaga apartment complex immediately

President Ranil Wickramasinghe, who is on an official visit to Japan, has instructed the President’s Secretary Saman Ekanayake to take steps to provide immediate relief to all the residents affected by the fire that broke out yesterday (27) afternoon in a Kajimawatta apartment complex in Thotalaga, Colombo.

It is said that President Ranil Wickramasinghe has given these instructions last night.

In this regard, the President has given instructions to

immediately intervene and coordinate with the Colombo District Secretary, the Armed Forces, the Fire Brigade, the Health Department, the Urban Development Authority and all other relevant government agencies, and look into the needs of the people who have been residing in the apartment complex since last night and provide prompt facilities for them.

Accordingly, all those departments have already taken steps to provide the maximum intervention required to extinguish the fire and provide all other necessary facilities promptly.

The President has further stated that the facilities needed by mothers, women and children who are in great difficulty due to this situation should also be looked into.

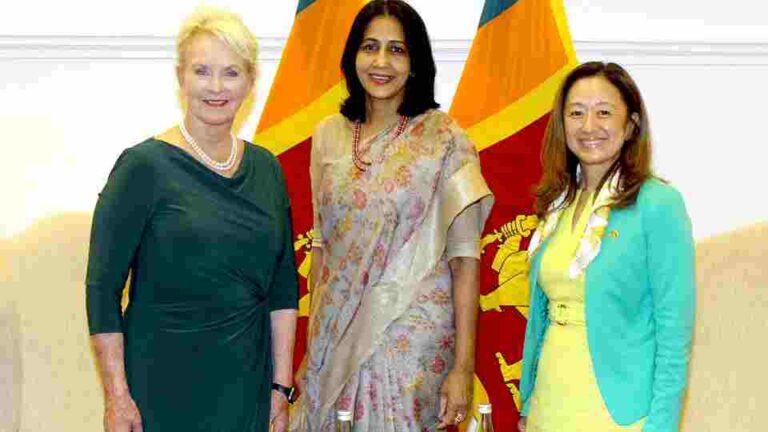

Foreign Secretary welcomes U.S. assistance to Sri Lanka in meeting with U.S. PRUN to Rome

Secretary, Foreign Affairs Aruni Wijewardane met the Permanent Representative of the United States to the United Nations Agencies in Rome Ambassador Cindy McCain at the Ministry of Foreign Affairs in Colombo on Monday 26 September, 2022. Ambassador McCain is the U.S. Representative to the Food and Agriculture Organization (FAO), the World Food Programme (WFP), and the International Fund for Agricultural Development (IFAD). The U.S. is the largest financial contributor to the budgets of FAO, WFP, and IFAD.

Foreign Secretary Wijewardane welcomed the support extended by the visit of Ambassador McCain to ensure food security and sustainable agriculture in Sri Lanka, including through the Rome-based Agencies FAO, WFP, and IFAD. Ambassador McCain apprised the Foreign Secretary on the recent action taken by the U.S. to address food security concerns globally, and assured of their consistent and continued assistance to Sri Lanka to supplement the Governments’ efforts in ensuring food and nutritional needs of the population.

Foreign Secretary Wijewardane and Ambassador McCain discussed the impact of climate change, in particular on countries on the tropical belt which are most vulnerable to climate change. Referring to the disproportionate impact of the current economic situation on children, they discussed the means of addressing child malnutrition, as well as concerted action towards meeting the Sustainable Development Goals amidst challenges.

Ambassador McCain is thespouse of the late U.S. Senator John McCain.

Ambassador McCain was accompanied by the Ambassador of the U.S. to Sri Lanka Julie Chung, and senior officials from the U.S. Mission to the UN Agencies in Rome and the U.S. Embassy in Colombo. Senior officials of the Foreign Ministry were associated with the Foreign Secretary at the meeting.

Ministry of Foreign Affairs

Colombo

27 September, 2022

Sri Lanka participates at the IFTM TOP RESA, International and French Travel Market 2022

The Sri Lanka Association of Inbound Tour Operators (SLAITO) successfully participated at the IFTM TOP RESA, International and French Travel Market 2022, held from 20 to 22 September 2022 with the coordination of the Embassy of Sri Lanka in France.

France is the fifth largest source market to Sri Lanka, with tourist arrivals from the first eight months totaling to 28,235. IFTM is one of the most prestigious tourism exhibitions and attracts thousands of participants from around the world. Nearly 200 destinations, 1,700 brands and 34,000 tourism professionals participated at IFTM TOP RESA – 2022.

Under the flag of SLAITO, leading tour operators from Sri Lanka, Aitken Spence Travels, Andrew the Travel Company, Authenticities Sri Lanka, Connaisance de Ceylan, Jetwing Travels, Lion Royal Tourism, Lanka Sportreizen, Walkers Tours and national carrier Sri Lankan Airlines were represented at the Sri Lanka Pavilion.

Sri Lanka’s participation at this exhibition is significant and timely in light of many countries in the EU Region especially France and Spain that have relaxed their travel advisories against Sri Lanka. Therefore, representation at this exhibition encourages tourists visits to Sri Lanka for during the forthcoming winter season.

The Sri Lanka pavilion was officially opened by the Ambassador of Sri Lanka to France Prof.Kshanika Hirimburegama with the participation of Diplomatic officers, members of leading tour operators and representatives of the travel industry in France. The pavilion was widely publicized among tour operators, journalists, social media bloggers and other relevant stake holders in France and Spain sending the message that Sri Lanka is ready to welcome all tourists.

Embassy of Sri Lanka

France

27 September, 2022

BTF Statement to the 3rd informal session on Sri Lanka, 51st session UNHRC, Geneva

Dear Delegates

Objective Political Climate and Human Rights

We submit that political climate and human rights are inseparable twins and human rights abuses are the product of oppressive governance, a fact well recognised by the member states of the UN.

Economic Crimes and Human Rights

Article 04 of the resolution 60/251, adopted by the General Assembly mandates the council “to enhance the promotion and protection of all human rights, civil, political, economic, social and cultural rights, including the right to development”. Therefore, it is obvious that economic rights and economic crimes can be raised in this council.

Victims’ centric justice is delayed forever

Many thousands of victim families have been waiting in vain, for over 13 years, to get justice from this council, having reposed their faith in it. Even though mountains of credible evidence have been collected by the UN system, it is regretted that to date there is not a single criminal justice prosecution anywhere in the world.

Non Recurrence

Addressing underlying governance factors and root causes that have contributed to the current economic collapse, including largely unresolved historical injustices, cycles of violence, deepening militarization, genocide, lack of accountability in governance and impunity for serious human rights violations and abuses is essential for reconciliation and nonrecurrence.

Lack of measurable progress by the Government of Sri Lanka on their commitments to the International community of a political solution to the ethnic conflict has been already flagged in this council.

Ask

We request the states to address the underlying causes of the crisis, including impunity for human rights violations and economic crimes by pursuing a number of options to advance accountability at the international level, and request UNHRC to pursue the prosecution of the available emblematic cases through appropriate mechanisms; and to refer through the General Assembly to establish an International criminal justice mechanism for Sri Lanka.

We request the International Community to work towards a negotiated political solution for the Tamil people through international arbitration and to undertake to implement it in Sri Lanka.

BRITISH TAMILS FORUM

22.09.2022