Sri Lanka’s employed persons numbering over 8.38 million are facing economic hardships and grappling to make ends meet as the cost of living has gone up sky high, former State Minister of Finance and SJB MP Eran Wickramaratne claimed.

He said that according to the Census and Statistic report of year 2022, a family of five persons needs at least Rs 62,220 per month to escape poverty and 70% of those engaged in employment are receiving the salary of less than Rs 62,000.

The gravity economic crisis exacerbates to such propotions making even the employed persons of the middle class to suffer without money to provide basic needs to lead a decent life , he pointedout. . .

Addressing a media conference in Colombo on Wednesday 07 the MP questioned whether it was right for the government to argue that the UNICEF report on Sri Lanka’s malnutrition cannot be accepted, despite the fact that the government’s official report on poverty has demonstrated that the situation has exacerbated.

Also, the World Food Program reported that about 30% of the country’s population are affected by food shortages and need relief for that, and they have launched a program to supply food to Sri Lanka with international support.

Further, Sri Lanka, which was known as a middle-income country with a per capita income exceeding $4000 in 2019, has now become a low-income country with a per capita income of $3850, which reflects the severity of the crisis.

Sri Lanka, which used to have a high percentage of literacy rate, after the SLPP government came in to power, has become the poorest country in Asia, because malnutrition causes, children with low intelligence to be born.

“Shouldn’t this government be ashamed of saying that they would give Rs 2500 to pregnant mothers through interim budget after having stopped the 20,000 rupees nutritional bag given to pregnant mothers by the good governance government” declared MrWickramaratne

Explaining the current situation with regard to good governance he said that there is no end to corruption and fraud under this government.

The stake holders of the government were fattening up with garlic, sugar and coconut oil scams.The country lost 7.6 million dollars under the guise of importing organic fertilizers.

Banks operate according to the conditions included in the letter of credit by the importer, whengoods are imported.Before proving the quality of the fertilizer, the bank had to pay the exporter as per the conditions contained in the letter of credit.

So far, the government has not investigated those responsible for entering such wrong conditions to the Letter of Credit opened to import fertilizer from China.

Because of this, the country not only lost money but also damages caused to its long-term friendship with China.

The government is silent on the compensation that should have been received from the ship Express Pearl, which was destroyed by fire in the sea, and there is no talk about it.

Mr. Eran Wickramaratne emphasized that the government should respond to these allegations and explain as to why those responsible for the country’s theft and fraud.

Economic crisis exacerbates making 70 % of the employed hard to live

Startling details reveal on Nuwara Eliya property redevelopment deal

In a bid to choose from a wider pool of potential partners to redevelop prime real estate in Nuwara Eliya Town, the Government has extended the closing date for Request for Proposals (RFPs) to 12 September.

It has been revealed that the 5 September deadline for the proposals was extended by a week to accommodate several more investors that have shown interest in the redevelopment of the property.

In July, the Urban Development and Housing Ministry’s Standing Cabinet-Appointed Negotiating Committee Chairman called for RFPs from prospective investors to redevelop prime real estate — former CeyBank Rest land extending up to two acres, one rood and 38 perches at Queen’s Road, Nuwara Eliya.

The land will be leased for 50 years; on a design, restoration, build, finance, operation, and transfer (DRBFOT) basis.

“There is a good response for the project as it is a top location. Several investors informally expressed their interest in the redevelopment of the property, and they are now in the process of compiling their proposals. All of them are financially sound and have earned a reputation for their work.

“Therefore, the officials suggested it would be good to extend the deadline by another week, to which the Committee has agreed. The extension was made primarily to accommodate those investors,” a senior official explained.

In response to the initial call, a total of 10 companies expressed their interest.The base value throughout the 50-year lease will be Rs. 385 million.

The sources said that a pre-bid meeting is also scheduled via video conferencing for prospective investors to clarify all matters concerning the project. However, the date for this has not been confirmed yet.

Initially, the property was known as the Heritage Hotel and was later leased, to the Bank of Ceylon. The CeyBank Rest in Nuwara Eliya had a colonial-type holiday resort with 20 rooms, located in the heart of the city within walking distance to most tourist hotspots — Victoria Park, Golf Club, and Gregory Lake.

SL to begin debt restructuring talks in a bad wicket created by debt default

Sri Lanka is going for Paris Club talks and negotiations with China, India and other creditors to convince them on their debt restructure under extremely difficult and unfavorable conditions being created as a result of preemptive debt fault declaration made on April 12,several economic experts claimed.

This was the shortest sighted decision taken by the then government in a haste and the then Finance Minister Ali Sabri who has taken the responsibility for it without parliamentary approval, they pointed out.

In response to a statement made by his own government colleague at present Vajira Abey wardena who blamed the Central Bank Governor Nandalal Weerasighe for ill advised the then Finance Minister Ali Sabri told parliament recently that Dr. Weerasinghe gave him necessary advices to make the decision.

He noted that the government was in a dilemma whether debt should be serviced or the remaining amount of reserves should be used for essentials at that time and if someone wants to strip the Central Bank governor of the position, he is ready to step down instead.

His resignation will not help in coming out from the present economic abyss where the whole country had been pushed as the country will lose IMF bailout loan if a single creditor is opposed to debt restructuring process, they claimed.

Sri Lanka has taken this decision to declare preemptive debt default on April 12 at a time where the Central Bank had to pay around 50 percent of the total 2022 debt of US$ 7 billion in the first quarter of this year. The payment due for the second quarter was $ 600 million to China, Mahinda Pathirana former Chairman of Press Council revealed in statement published in his face book

At that time the Central Bank has finalized all arrangements to obtain a loan facility of $2.5 billion to settle this debt. China has insisted Sri Lanka from the inception not to default on their loans as they cannot agree to such arrangements.

Therefore the Chinese Ambassador in Sri Lanka has offered a low interest loan to service their loan and another $1.5 billion long term finance facility to import raw materials for local industries such as garment factories.

Further another $1 billion was in the pipeline by issuing green bonds via Credit Suisse Bank

Despite these debt repayment arrangements, Central Bank Governor Nandalal Weerasinghe has declared the preemptive debt default.

Sri Lanka has to service debts taken from the IMF, World Bank, ADB. At the time of default there was only $1 billion International Sovereign Bond to be matured in July 2022 and several other interest payments.

The country has a steady inflow of foreign exchange from exports amounting to around $ 1 billion, foreign remittances and tourism.

On the other hand the government was using the Indian credit line to import fuel food and medicine. Normally Sri Lanka is importing 70 percent of such items from India.

Under these circumstances the then Finance Minister Ali Sabri and the Sri Lanka delegation had left the island on an official visit to Washington on April 17 to negotiate a bailout loan from the IMF and they were in a weak position following the declaration of preemptive default of foreign debt on April 12 .

The IMF team has suggested the Sri Lankan authorities’ to engage in a collaborative dialogue with their creditors on debt restructuring as the debt sustainability was a prerequisite for the bailout loan.

Central Bank’s sudden declaration of pre-emptive negotiated default of external debt has been made at a time where there was an expected forex inflow of over US $ 10.7 billion in the pipeline as at April 4 to boost foreign reserves, a forex inflow status report showed.

According to the Central Bank’s weekly economic indicator report issued on May 27 2022, Sri Lanka had Foreign Currency Reserves amounting US$1.618 billion as at end April 2017 before the declaration of preemptive default.

This arbitrary decision was taken without the cabinet and parliamentary approval disregarding the healthy position of the forex inflows in the pipeline, a senior official of the presidential secretariat who wished to remain anonymous disclosed. .

Of the above pipeline, a sum of $ 4.5 billion was confirmed as being in the final stages by April 3 and a further amount of around $2.6 billion was very likely to materialize over the short term, he disclosed.

This forex receipts would have enabled the Government to settle the maturing payments due in 2022, while also rolling over several other existing loans, including Sri Lanka Development Bonds and Foreign Currency Banking Unit (FCBU) loans, he said.

A petition against lifting the glyphosate ban

A petition has been filed before the Supreme Court against the decision taken to withdraw the order banning the import of glyphosate herbicide.

The Finance Minister, the Pesticides Registrar, the Agriculture Minister, the Health Minister, the Director General of Health Services, the Central Environment Authority, the Consumer Service Authority and the Attorney General have been named as respondents in this petition, which has been filed by several parties including the Environmental Justice Centre.

Pointing out that due to the use of glyphosate, water sources, soil and plants are severely damaged in this country, the petitioners further say that through this, human health as well as fish and birds are also damaged.

The petitioners are asking the Supreme Court to rule that the basic human rights of the people are being violated by lifting the ban on the import of glyphosate, and to invalidate the order to lift the ban.

President invites all parties to unite for building the country

President Ranil Wickramasinghe says that he invites all parties to unite for building the country without any differences.

The President emphasizes that the people’s struggle to send the rulers home is over, and now there is the economic struggle to build the country. Ranil Wickramasinghe mentioned this yesterday (06) while addressing the 76th anniversary of the United National Party held at Sugathadasa Stadium.

Wickramasinghe states that today Sri Lanka is facing a crisis that has never been faced before in history, and everyone has no other option but to come together and find solutions. He says that a significant percentage of the country’s people are unable to eat three meals a day and unemployment has increased.

He can be called the fourth president representing the United National Party, but pointing out that he does not have a parliamentary group representing the United National Party, the President says that he has the support of several parties including Podujana Peramuna. However, Wickramasinghe states that his aim is to build the country with the support of all the parties represented in the Parliament, and he will not hesitate to make every effort for that.

Importers announce the dates that the shortage of wheat flour would end

It is believed that the current wheat flour shortage in the country will end after September 15, says the Importers of Essential Materials Association.

Nihal Senaviratne, the president of the association, said that the shortage will be over by that time as wheat flour is being imported from Turkey.

In the last few days, the Minister of Trade has mentioned to the media that there is no reason for the shortage of wheat flour, but currently wheat flour is being sold at various high prices in the market due to the shortage.

Motor Traffic Department goes digital in collecting Payments for services

The Department of Motor Traffic (DMT) launched the facility for all consumers to make their payments for all the services obtained from the department via electronic cards from today.

The announcement was made by the Commissioner of Motor Traffic (Development), Mrs. D. Kusalani De Silva at the media briefing at the Information Department.

The facility was introduced to increase the productivity of the services. Payments via electronic cards were introduced to the DMT Narahenpita head office and Werahera department.

Later, the facility will be introduced to other branches considering the progress of the system, DMT Commissioner Controller Susantha Jayathilaka said.

The motor vehicle regulator has suffered a setback in its revenue collections following the adverse impacts of the COVID pandemic and the ongoing economic crisis.

As a top agency that generates revenue for the Government, the Department of Motor Traffic’s monthly contribution to the Treasury has dropped from around Rs. 1 billion to Rs. 700 million at present given the multiple challenges.

“Following the adverse impacts of the pandemic and the ongoing economic crisis, the Department’s average daily income has dropped to around Rs. 35 million to Rs. 40 million,” Department of Motor Traffic Accountant Aravinda Samarakoon told journalists yesterday.

Closure of the department at the early stages of the COVID outbreak, import restrictions on motor vehicles, and high interest rates imposed on the transfer of vehicle ownership were outlined as key reasons for the revenue drop.

As per the Department, the total number of new vehicles registered up to May was 10,159, and of that 3,358 were motorcycles, whilst 2,694 were LV tractors and 1,653 LV trailers.

However, he said that the income generation of the Department has slowly picked up, as it had adopted digital payment systems and technology to boost efficiency.

Department of Motor Traffic Commissioner (Control) Susantha Jayathilaka also said they are short of driving license cards.

“The import restrictions impacted the issuance of new license cards and renewals as these cards are imported. However, to avoid any inconvenience to the motorists, at present we issue a document till the cards are sorted,” he explained.

Jayathilake also said the Department continues to operate a self-financing institution that manages the salaries and wages and maintenances of systems

Construction sector warns of workers upheaval if govt defaults their payments

The government’s move to halt the construction projects without settling the bills of the contractors would severely impact those dependent on the sector, a senior representative of the construction industry said.

Dr. Rohan Karunaratne, an industry veteran and President of the South Asian Lean Construction Association, commenting on the recent statement made by Central Bank Governor Dr. Nandalal Weerasinghe, where he stated that hyperinflation may bring people back to the streets, said a similar scenario is possible if the government continues to halt the construction projects and avoid settling the bills, as the livelihoods of thousands are affected.

The government’s decsion oF stopping the construction projects will also lead to a situation where the people without the means to feed their families flooding the streets, pleading for their livelihood,” said Dr. Karunaratne.

As the economic crisis worsened, the government halted the construction projects without settling the contractors’ bills. According to the industry stakeholders, the total amount due is over Rs.130 billion, while the contractors owe the banks around Rs.200 billion.

“Interest rates have skyrocketed to 25-28 percent and the temporary overdraft limits are 30 percent, both of which contractors cannot bear,” Dr. Karunaratne highlighted.

“The construction companies have been crushed under the boot of high bank rates and unpaid government bills, leaving them unable to take care of their vast workforce and supply chains.

Thus, as the governor advised Parliament, the contractors, in turn, advise the governor that the unpaid dues to the contractors may lead to hundreds of thousands of unemployed labourers and workers flooding the streets pleading for their survival. The contractors shall not be held responsible for this crisis,” he added

The local construction sector is a major contributor to the national economy, accounting for about 10 percent of the GDP.

In 2020, the sector contributed over Rs.300 billion to the GDP. There are over one million people involved in the construction industry.

The construction supply chain is easily one of the largest in Sri Lanka and includes around 4,000 small and medium enterprises, including sand suppliers, rubble suppliers and brick makers.

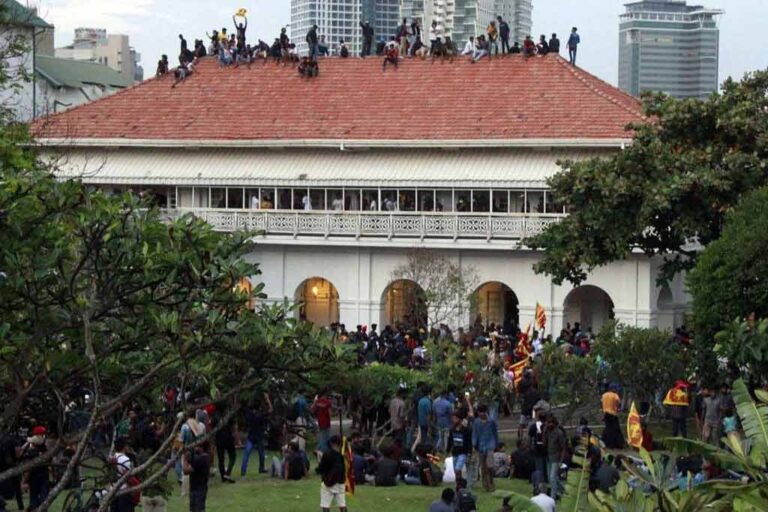

03 more arrested for damaging the property at Temple Trees

Three more people were arrested by the Colombo South Division Criminal Investigation Department for trespassing and damaging property at the Temple Trees on 09th July.

Three residents of Padukka and Watareka areas have been arrested.

Police say they are aged 35, 38 and 44 years.

CBSL Governor says that he cannot comment on debt restructuring due to sensitive issues (VIDEO)

Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka, says that he cannot comment on debt restructuring due to sensitive matters regarding market affairs.

“In the next 4-5 years, on average, we have about 6 billion dollars of external debt to pay off. After that, four to five billion dollars and 27 billion dollars have to be paid within 4-5 years. When we announced our debt default, we only wanted to restructure external debt and resolve the foreign exchange crisis. That was the situation in April. As we moved forward, we reached an official level agreement with the International Monetary Fund and officially began the process of restructuring our debt. As officials, we are not in a position to talk about debt restructuring, because they are market sensitive. So I cannot comment on this. From the day we went into an officer-level agreement, we started negotiating with our creditors with financial agreement consultants. It is good to have transparency in the government’s dealings with the International Monetary Fund. But we can’t disclose certain market-sensitive information until it’s implemented.”

Weerasinghe said this while joining a television program.