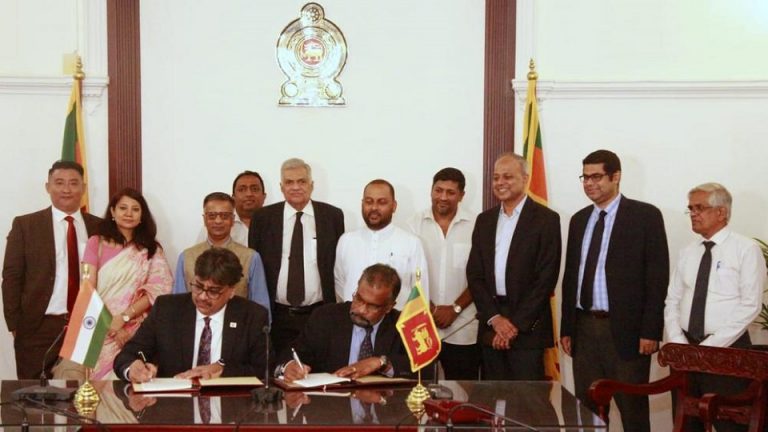

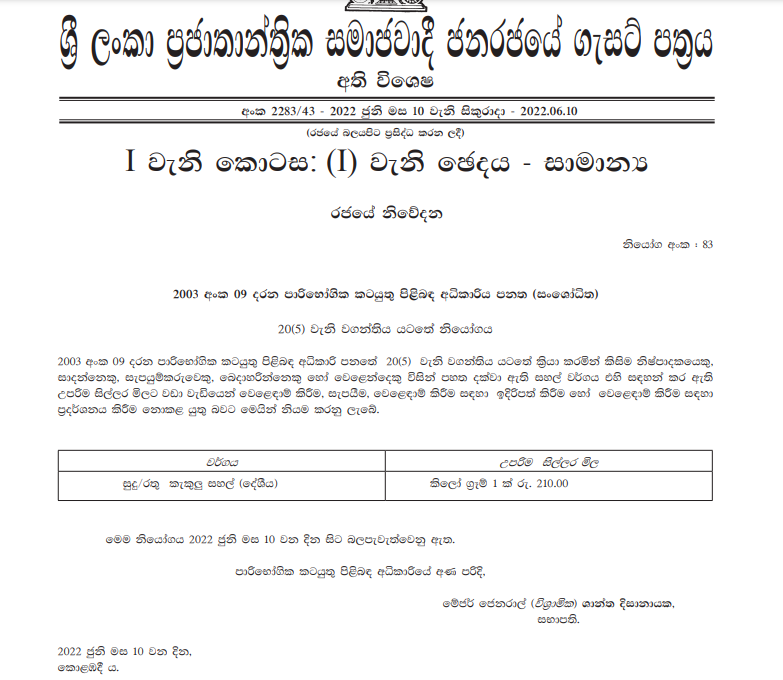

In response to an urgent request from the Government of Sri Lanka (GOSL), the Government of India (GOI) has decided to extend a Line of Credit (LOC) of US$ 55 million to Sri Lanka for procurement of Urea Fertiliser. In this context, a LOC agreement was signed between GOSL and the Export-Import Bank of India today (June 10, 2022) at Colombo, in the presence of the Prime Minister of Sri Lanka HE Mr. Ranil Wickremesinghe, the Minister of Agriculture HE Mr. Mahinda Amaraweera, and the High Commissioner of India to Sri Lanka HE Mr. Gopal Baglay. Senior officials from the Sri Lankan and Indian side were also present during the signing ceremony.

2. This LOC will help GOSL secure urea fertilizer for the ongoing paddy sowing ‘Yala’ season. In view of the critical requirement, GOSL and EXIM Bank have agreed to complete all procurement procedures expeditiously so that urea supplies can reach Sri Lanka in a short span of time. During the signing ceremony, Prime Minister expressed his gratitude to GOI for the timely assistance. High Commissioner highlighted that the speedy finalization of the LOC testifies to the importance GOI attaches to the welfare of the people of Sri Lanka.

3. It may be recalled that in line with its ‘Neighbourhood First’ policy and as an earnest friend and partner of Sri Lanka, India has extended multi-pronged assistance to the people of Sri Lanka in the last few months. The support from India ranges from economic assistance of close to USD 3.5 billion to helping secure Sri Lanka’s food, health and energy security by supplying essential items like food, medicines, fuel, kerosene etc.

***

Colombo

10 June 2022