By: Staff Writer

November 09, Colombo (LNW): In a sharp and uncompromising address to Parliament, Harsha de Silva, MP for the Samagi Jana Balawegaya (SJB) and noted economic expert, delivered a blistering critique of the 2026 Budget proposals. According to Dr. de Silva, the document represents not a fresh vision for Sri Lanka’s economy, but a recycled agenda that falls far short of voter expectations and national needs.

From the outset, Dr. de Silva acknowledged that the government has managed to maintain macro-economic stability achieved by its predecessor. Yet he argued this achievement is hollow without a clear plan for growth. “This budget is not a ‘system change’; it is ‘the same old thing’ wrapped in a new flag,” he declared. According to him, the real substance of the Budget betrays the very electorate that granted the government its mandate.

One of the most trenchant criticisms centred on what Dr. de Silva referred to as the “1 Trillion Rupee Deception.” He asserted the Treasury is sitting on a windfall of around Rs 1 trillion largely from unexpected vehicle-import taxes yet instead of channeling relief to households and small businesses, the government is widening the tax burden. By lowering the VAT threshold from Rs 5 million to Rs 3.6 million per month, he claimed, the Budget hits small enterprises and raises concerns about fairness and regressivity in the tax system.

The housing programme was also described as a mockery rather than meaningful relief. Under the 2026 proposals, the allocation of Rs 10.2 billion to build 7,000 houses translates into about Rs 1 million per home. With construction costs at roughly Rs 10,000 per square foot, Dr. de Silva observed, such funding might buy only a 100-square-foot structure “this is not a home; it is an insult,” he said.

Another spotlight in his critique was the housing loan for state employees: the budget earmarks just Rs 500 million, which, when divided among 1.4 million workers, means aid for only 416 persons “not policy; it’s a lottery,” he charged. Dr. de Silva said the government’s failure to address crippling taxes on construction materials (49% on cement, 60% on fittings, 92% on PVC pipes) undermines any real progress on housing.

On the borrowing front, the minister’s claims of change rang hollow for Dr. de Silva. The Budget plans to borrow Rs 3.8 trillion in 2026 (over Rs 3,110 billion domestically and Rs 700 billion externally) clearly, he argued, a continuation of old habits rather than reform. He said that while the government claims credit for stabilisation (inflation down from 17% to 1%; USD from Rs 370 to Rs 294), the rupee is now depreciating again, currently hitting Rs 307.

Dr. de Silva reserved particular criticism for the youth and SME sectors. The “five simple dreams” of young voters jobs, tax relief, support for freelancers, a relief bank for SMEs, and dismantling the “rice mafia” were, he said, largely ignored. Freelancers previously paying no tax now face 15%; SMEs still await the promised support bank; and job creation in the public sector remains on hold.

Regarding foreign investment and exports, he dismissed government claims of US $823 million in new FDI as misleading; over half, he pointed out, comes from old agreements, including a US $229 million deal with Adani Ports & SEZ Ltd. Meanwhile, exporters face crisis after the removal of SVAT refunds and the silence on trade deals such as Regional Comprehensive Economic Partnership (RCEP) and ECommerce Trade Agreement (ECTA), showing “no political will to walk the talk.”

In closing, Dr. de Silva’s analysis leaves little doubt: the 2026 Budget is a failure of ambition and substance. It does not respond to the real needs of youth, elderly, SMEs, or exporters; instead, according to him, it perpetuates the system that voters sought to transform. With credibility eroded and promises unkept, the biggest casualty may be public trust itself.

Budget 2026 Exposed as Betrayal of Promises and Growth: Harsha

Bold Budget, Blurred Vision: Sri Lanka’s 2026 Plan Faces Tough Reality

By: Staff Writer

November 09, Colombo (LNW): Sri Lanka’s 2026 Budget, presented by President and Finance Minister Anura Kumara Dissanayake, attempts to project confidence and reformist zeal under the new National People’s Power (NPP) government. With promises of clean governance, investor transparency, and rapid economic recovery, the budget seeks to convince the public and global markets that a left-leaning administration can also be pro-business. But behind the rhetoric lies a complex web of risks, weak fiscal direction, and governance challenges that could blunt its ambitious targets.

The President promised to transform Sri Lanka into an attractive destination for investors through “transparency, predictability, and partnership.” Amendments to the Strategic Development Projects Act and the Colombo Port City Commission Act are meant to streamline approvals and reassure foreign investors. A new Investment Protection Act and Public-Private Partnership (PPP) law are scheduled for early 2026, both designed to build investor confidence and attract foreign direct investment (FDI).

However, economic analysts remain cautious. While Dissanayake projects 7% economic growth over the medium term up from the current 4–5% such optimism appears detached from ground realities. The fiscal space remains tight, with public debt still exceeding 120% of GDP and interest payments consuming over 40% of government revenue, according to Finance Ministry data for 2025. The government’s reliance on foreign borrowing and concessional aid under the IMF’s Extended Fund Facility (EFF) continues to limit its fiscal flexibility.

Although the budget includes initiatives to strengthen the export sector, promote agriculture and livestock, and develop tourism, critics argue that the real bottlenecks policy inconsistency, bureaucratic inefficiency, and political interference remain largely unaddressed. Promised reforms in state-owned enterprises (SOEs), which absorb vast subsidies and produce recurring losses, have again been deferred. Despite public assurances of “transparency and accountability,” there is no clear roadmap for restructuring entities like the Ceylon Petroleum Corporation or Ceylon Electricity Board.

Moreover, the NPP government’s credibility on governance and administration is still being tested. While Dissanayake vows to end “cronyism and nepotism,” his party rooted in Marxist traditions and including former activists once associated with subversive movements faces questions about its real capacity to manage a modern, market-driven economy. The administration’s communication and policy-coordination skills also appear weak; several top officials lack international exposure and technical literacy, which could hinder complex economic negotiations.

From a broader perspective, the 2026 Budget lacks a unified macroeconomic framework. There is heavy emphasis on new projects from AI data centres to digital ID cards and new export zones but little clarity on implementation mechanisms, monitoring frameworks, or sectoral priorities. The government’s revenue targets appear overly ambitious, relying heavily on indirect taxation while offering tax exemptions to selected investors.

For Sri Lanka to translate its promises into progress, the NPP government must move beyond slogans and address the fundamentals: credible fiscal consolidation, professional economic management, and a depoliticised bureaucracy. Without these, the 2026 Budget risks becoming another politically appealing but economically fragile document rich in promises, poor in delivery.

In essence, Budget 2026 showcases a government eager to prove reformist intent but still struggling to reconcile ideology with execution. Its success will depend not on rhetoric or new laws, but on the discipline, skill, and transparency with which those promises are turned into measurable results.

Customs Revenue Skyrockets, Yet Same Corruption Shadows Sri Lanka Ports

By: Staff Writer

November 09, Colombo (LNW): In a striking development this week, Sri Lanka Customs announced a historic one‑day collection of Rs 27.7 billion on Thursday 6, pushing its year‑to‑date haul beyond Rs 2 trillion and surpassing its 2025 target ahead of schedule. According to official figures, Rs 630 billion of this total comes from motor vehicle imports, boosted by eased import restrictions.

Yet behind the fanfare lies a deeper question: how has an institution long plagued by corruption and inefficiency suddenly delivered such dramatic results with largely the same officials and structural vulnerabilities in place?

A history of embedded corruption

The IMF’s Governance Diagnostic Assessment for Sri Lanka found that corruption in customs and tax administration is “substantial”, owing to deficient oversight, performance monitoring and sanction mechanisms for officials.

Corruption‑risk research documented that the private sector rates Sri Lanka Customs among the most problematic agencies when it comes to bribes, harassment and discretionary misconduct.

A widely cited scandal involved three senior Customs officers arrested in 2016 for soliciting Rs 125 million in bribes from an importer in exchange for favourable treatment.

More broadly, research shows that the examination yards, classification decisions, and import duty rebates have long offered fertile ground for rent‑seeking by officials and traders alike.

So what’s changed and is it genuine?

The leap past Rs 2 trillion in revenue suggests improved compliance, stronger import flows and perhaps more aggressive duty‑collection. The government, in cooperation with the World Bank, is advancing reforms within Sri Lanka Customs including structural changes to align with modern trade facilitation and integrity standards.

Yet still, several red flags remain. The very powers that enabled corruption — discretionary classification, physical inspections, duty waivers are still embedded. The IMF noted that the revenue agencies, including Customs, operate under a framework where the human‑element still dominates and digitisation remains incomplete.

Furthermore, while collection has surged, trade‑clearance delays continue to persist — an indication that efficiency gains may not be uniform. A December 2024 article found containers still waiting days at examination yards, increasing opportunities for informal payments and increased costs for businesses.

On one hand, the strong fiscal performance is welcome: higher revenue means greater resources to service debt and stabilise the economy. On the other hand, if the same set of customs officials accustomed to discretionary powers and limited accountability are driving the collections, the risk of informal tolls, mis‑classification or selective enforcement cannot be ignored.

Insiders caution that the jump in vehicle‑import duties, for instance, may simply shift the burden to importers who have fewer alternatives — thereby increasing the temptation for shortcut payments. The fact that Rs 630 billion of the total relates to motor vehicles is telling: high‑value items, fewer importers, concentrated transactions precisely the conditions where corruption thives.

Why it matters

• For importers and exporters, the question is whether the new revenue push means more transparent treatment or simply more aggressive enforcement that replaces bribes with steep taxes and penalties.

• For government policy, the danger is that the “success” in revenue may mask the underlying systemic risks: a customs agency that still has weak oversight, opaque processes and inadequate rotation or discipline of staff.

• For the economy, reliance on high‑duty imports (like vehicles) raises concerns about sustainability and casts doubt on whether increased revenue serves long‑term trade competitiveness rather than short‑term fiscal needs.

The path ahead

To move beyond the cycle of “same officials, new numbers,” the reforms will need to embed:

full‑scale digitisation of import/export workflows, limiting human discretion;

independent internal‑affairs units inside Customs empowered to investigate misconduct;

transparent public‑reporting on clearance times, classifications and duty waivers.

Without these, the dramatic Rs 2 trillion milestone may end up highlighting a one‑off revenue spike not a structural transformation. The story of Sri Lanka Customs now is one of both hope and caution: record collections are welcome, but unless the culture of discretion and corruption is cleaned out, the society may still be paying the real price.

SMEs Gain Fresh Hope as Govt implements Collateral-Free Loan Scheme

By: Staff Writer

November 09, Colombo (LNW): Sri Lanka’s small and medium enterprise (SME) entrepreneurs numbering around 77000 have been given some life line by providing access to loan facililities under a new scheme initiated under the 2025 budget, finance ministry disclosed.

It has fulfilled the financial requirements, the biggest challenge for small business owners providing loans without pledging property or other assets as loan security and this facility was based on the business’s potential rather than on collateral. .

Director General of the Department of Development Finance of the Ministry of Finance, Manjula Hettiarachchi revealed that out of the Rs. 200 billion allocated in this year’s budget to provide financial assistance to SME entrepreneurs, loans amounting to Rs. 120 billion have already been approved.

He added that that the remaining Rs. 80 billion be swiftly channeled through the banking system to make the funds available to beneficiaries without delay.

He further stated that one of the major challenges faced by SMEs and other entrepreneurs is the lack of sufficient capital to start or expand a business under affordable interest rates.

Another key issue, he noted, is the absence of adequate collateral to secure such loans. To address both challenges, the government, through the Department of Development Finance, has introduced special loan schemes in collaboration with 13 state and private banks and has also established a National Credit Guarantee Institution (NCGI).

Under this scheme, individuals already operating successful businesses can obtain working capital loans of up to Rs. 25 million at an interest rate of 7 percent, with a 12-month grace period for interest payments. The loan repayment period has been structured over 10 years.

Loans under this scheme range from Rs. 500,000 to Rs. 25 million and are available across all sectors. To qualify, SME owners must show their business is viable when applying through banks.

Additionally, those currently classified as Non-Performing Loans (NPLs) and unable to meet existing loan repayments can access up to Rs. 15 million at an 8 percent annual interest rate. Borrowers are exempt from paying interest for the first six months, and repayment can be made over five years.

The government has officially launched the National Credit Guarantee Institution on June 2, 2025, SME entrepreneurs to access loans without providing collateral, making it easier for small businesses to grow.

It is offering a 67 percent guarantee to banks, allowing them to provide loans based on the business’s potential rather than on collateral.

The institution is a joint effort by the Asian Development Bank (ADB) and Sri Lanka’s Ministry of Finance. It operates as a public-private partnership with the government owning 90 percent and the remaining 10 percent held by 13 private banks and financial institutions.

The ADB has contributed US$ 50 million in capital and technical support to establish the institution.

Chief Executive Officer of the National Credit Guarantee Institution, Jude Fernando, revealed that so far, Rs. 3.5 billion worth of guarantees have been issued, enabling 633 loan facilities. He added that the institution plans to further expand its services

Dear Comrade Aravinda..

Dear Comrade Aravinda,

Sometimes – thankfully not all the time – your team simply asks for negativity instead of enjoying the democratic luxury of a significant vote base. This majority came your way principally since the people of Sri Lanka had grown rather weary of the triumphalism espoused by the Rajapaksa clan and their cohorts. The people were quite weary for another reason: corruption was the new endemic, and the people feel abused by their elected representatives. It had become beyond a joke.

Take for example the Yahapalanistas. Faizer Mustapha was the Minister in charge – he proposed the Provincial Council changes and by the time it was time to vote on that in parliament, the same man voted against what he was responsible for! Truly, Comrade it was beyond a joke. Somehow the people don’t like it when that happens.

Comrade Aravinda: your Minister in Charge of Cultural and Religious Affairs is on the face of it trying to hitch a free ride on the ‘equality’ bandwagon. The negativity though is to you and your party.

His comparison of the newly elected Mayor of New York with the appointment of the Nilame role in Kandy is totally out of context. Your Minister suggests that it should be possible for a non-Buddhist to be the holder of that position.

Come on Comrade! What kind of absolute non-starter positions is that? Are we to have a Hindu woman to be the head of the Mosques in Sri Lanka? Or a Muslim – maybe Azaath Salley or Rauf Hakim or MSM Thowfeek or Rishad – to take over the role of Archbishop of Colombo?

Espousing the cause of equality and togetherness and even communal harmony is truly marvellous – especially as we all know that communal harmony has been fractured for a while thanks to a bunch of terrorists who found it convenient to latch on to the aspirations of the Northern people who ever only wanted equality of opportunity.

To make absurd statements – whilst holding high office – suggests that the Minister knows zero about the subject or in the full knowledge of the system, chose to be mischievous like that other Doctor now newly in parliament. (This fellow is either letting off steam or asleep in the chamber)

Comrade Aravinda – the Mahanayakes must have been delighted on the appointment of the Maligawa Chief – the Diyawadana Nilame, Pradeep Nilanga Dela. The reason or one such reason would be the unhappiness shown by the Senior clergy in terms of the effort by Tourism assets, to highlight the LGBT community.

Many without really understanding the system, feel that it would be a breakdown of the cultural values in Sri Lanka. Nothing of course can be further from that but one must consider that for traditional believers in the entire concept of Buddhism any such move to apparently promote LGBT travellers is nothing new, but it is a new scheme to raise awareness of the tolerance levels for LGBT travellers in Sri Lanka.

In that context the fears and concerns of all the religions in Sri Lanka will be assuaged by the election of Nilanga Dela. It is best Comrade Aravinda if you told your Ministers to be a bit more thoughtful before opening their traps.

At the end of the day the perception is this, “A Secular State: A core principle in many leftist ideologies is that the government should not use religion as a constitutive device for holding society together and should avoid enforcing purely religious norms (such as specific dietary laws). For a majority Buddhist nation the palpable fear is that even though Buddhism is give its rightful place in the Constitution, there is a fear that such values may well be eroded.

My warmest wishes to you,

Faraz Shauketaly

Team NewsLine

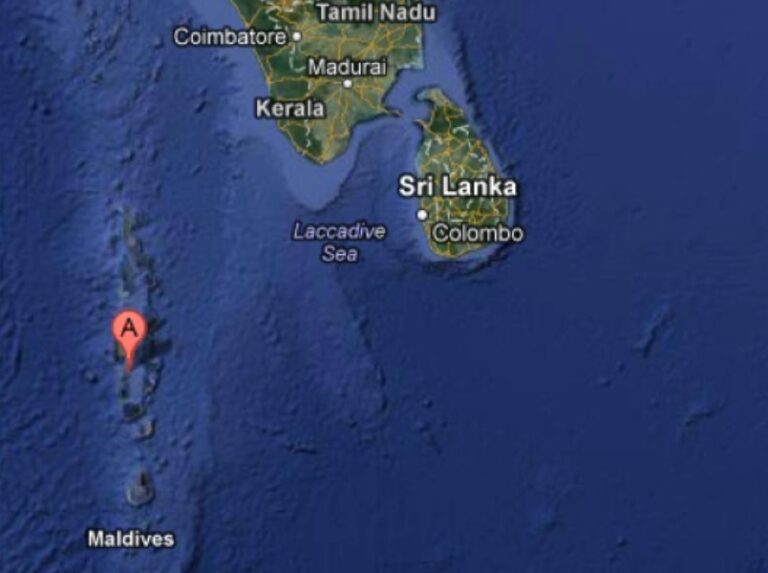

Diplomatic Efforts Underway to Secure Return of Sri Lankan Fishermen Detained in Maldives

November 09, Colombo (LNW): Formal discussions have commenced to facilitate the repatriation of Sri Lankan fishermen who were recently detained in Maldivian waters on allegations of drug trafficking.

Minister of Public Security Ananda Wijepala confirmed that the Ministry of Foreign Affairs is actively supporting the process, noting that an official request has already been submitted to the Maldivian authorities seeking the fishermen’s return.

In parallel, a specialised unit from the Police Narcotics Bureau has been dispatched to the Maldives to assist with the ongoing investigations.

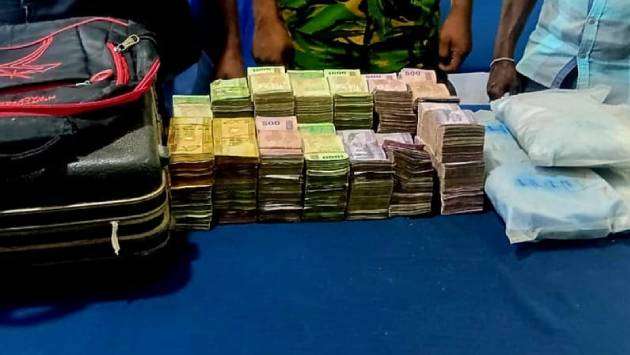

The fishermen were taken into custody after the authorities intercepted a Sri Lankan multi-day fishing vessel in Maldivian waters, where suspected narcotics were allegedly found on board.

Officials emphasised that both countries are cooperating closely to ensure the matter is resolved promptly while adhering to legal protocols.

Related Stories: https://lankanewsweb.net/archives/142213/maldivian-coast-guard-seizes-sri-lankan-vessel-carrying-massive-drug-haul/

Foreign Minister Explores Healthcare Partnerships During Visit to Saudi Arabia

November 09, Colombo (LNW): Foreign Minister Vijitha Herath held discussions with senior executives of the Dr Sulaiman Al Habib Medical Group, one of the Middle East’s most prominent healthcare networks, during his official visit to Saudi Arabia this week.

The talks centred on strengthening bilateral cooperation in the field of healthcare, with particular focus on investment opportunities in Sri Lanka’s growing medical sector.

Both parties explored prospects for collaboration in medical tourism, healthcare infrastructure development, and technology transfer.

Minister Herath also toured one of the group’s flagship hospitals, which features cutting-edge medical technology and artificial intelligence-based healthcare systems.

He commended the institution’s commitment to innovation and efficiency, noting that several Sri Lankan professionals have played a vital role in developing the technology used by the group through its Colombo-based development centre.

New “Plastic Loop” Project Launched to Tackle Waste in Colombo’s Canals

November 09, Colombo (LNW): A pilot initiative designed to curb plastic pollution in Colombo’s waterways was launched on November 07 near the Nawala canal in Sri Jayawardenepura Kotte, marking a significant step in the city’s efforts to keep its drainage systems and rivers free of plastic waste.

The project, part of the national Clean Sri Lanka programme, is being implemented with financial assistance from the PLEASE project. The newly introduced “Plastic Loops” are floating barriers engineered to capture plastic debris carried through major canals before it enters rivers or eventually reaches the ocean.

Officials explained that the Colombo region’s network of 14 main canals and connecting waterways has long suffered from blockages caused by discarded plastic and other non-biodegradable waste—problems that often worsen during heavy rainfall and contribute to urban flooding.

The new system, they said, aims to provide an environmentally sustainable and cost-effective solution to this challenge.

The launch ceremony was attended by several senior government figures, including Deputy Minister of Urban Development Eranga Gunasekara, Deputy Minister of Public Security and Parliamentary Affairs Sunil Watagala, Deputy Minister of Environment Anton Jayakody, and the Mayor of Sri Jayawardenepura Kotte, Arosha Athapaththu.

They were joined by key officials from the Clean Sri Lanka Secretariat and the Presidential Office, including Additional Secretary S. P. C. Sugishwara, Director of Environment Anjula Premarathna, and Director of Coordination Dasun Wijesekara, who expressed confidence that the initiative could be expanded citywide once its effectiveness is evaluated.

Environmental advocates at the event noted that if successful, the “Plastic Loop” concept could become a model for other urban areas grappling with similar pollution and drainage issues, signalling a progressive shift towards cleaner, more resilient cities.

Army Intelligence Tips Lead to Major Drug and Wallapatta Busts in Southern Sri Lanka

November 09, Colombo (LNW): Swift coordination between military intelligence and law enforcement agencies has resulted in two major operations uncovering large-scale narcotics and illegal forest product trafficking in the south of the island, officials confirmed yesterday.

Acting on intelligence provided by the Sri Lanka Army, officers from the Colombo Organised Crimes Division carried out a decisive raid in the Mitiyagoda–Godagama area on November 08.

The operation led to the arrest of six suspects and the seizure of 5.42 kilogrammes of heroin, with an estimated street value of around Rs. 75 million. Investigators also recovered more than Rs. 10.8 million in cash believed to be linked to the drug trade.

The suspects are currently in police custody, while the Galle District Anti-Narcotics Unit has taken over the investigation.

In a separate operation conducted in the Kotapola area of Matara, Army Intelligence officers teamed up with Deniyaya Wildlife officials to intercept a group suspected of smuggling wallapatta (Gyrinops walla), a rare and highly valuable fragrant wood used in the production of agarwood. Three residents of Deniyaya were arrested with 110.45 kilogrammes of wallapatta, worth an estimated Rs. 662 million.

Authorities believe both incidents are linked to broader organised networks engaged in illegal resource extraction and drug trafficking. Security sources said the operations underscore the growing importance of intelligence-led policing and inter-agency cooperation in dismantling such criminal enterprises.

Further inquiries are underway to trace the origins of the confiscated goods and identify additional suspects connected to both rackets.

Records Tumble as Young Swimmers Shine at Inter-International Schools Championship

November 09, Colombo (LNW): The opening day of the 30th Inter-International Schools Swimming Championship 2025 got off to an electrifying start at the Sugathadasa Swimming Pool Complex on Saturday (08), with several long-standing records rewritten in a remarkable display of young talent.

Leading the charge was 15-year-old Jayden de Silva of Stafford International School, who stunned spectators by breaking a decade-old record in the Boys’ Under-16 100m backstroke.

The national squad swimmer clocked an impressive 1:04.25 to secure gold, surpassing the previous mark of 1:05.84 set by Vihanga Perera of Gateway College in 2015.

De Silva’s teammate, Shaqib Riyaj, kept Stafford’s winning momentum alive by storming to victory in the Boys’ Under-20 50m breaststroke. Riyaj set a new meet record of 30.87 seconds, improving on the 31.36-second benchmark held by Wycherley International’s Vinul Senanayake from last year.

Gateway College’s rising star Hashel Senarath made waves in the Boys’ Under-14 division, rewriting two meet records within hours. He clinched the 200m individual medley title with a time of 2:30.88—breaking a record unchallenged for seven years—before powering through the 50m butterfly in 28.38 seconds to erase a nine-year-old mark.

Not to be outdone, Okitha Gunasekara of Elizabeth Moir School smashed the Boys’ Under-20 200m individual medley record with a commanding swim of 2:14.78, while Lyceum Ratnapura’s Ometh Pathirana claimed the Boys’ Under-10 100m freestyle crown in 1:15.38, shaving precious milliseconds off the previous record.

Lyceum Ratnapura’s Visakya Dias also made her presence felt, breaking two Under-12 records—one in the 100m freestyle with a time of 1:08.90 and another in the 50m breaststroke with 39.04. Lyceum Panadura’s Sandini Nihinsa added to the excitement by setting a new Girls’ Under-10 100m freestyle record of 1:20.75, while Sasha Rajapakse of The British School powered to gold in the Girls’ Under-16 100m freestyle, rewriting the record books with a brilliant 1:02.01.

The day closed with cheers echoing across the pool complex, setting the stage for what promises to be an unforgettable weekend of fierce competition and record-breaking performances.