By: Staff Writer

November 06, Colombo (LNW): The UK Trade Envoy for Sri Lanka, Lord John Hannett, has issued a strong endorsement of Sri Lanka’s tourism sector and its potential as a major global travel destination. Speaking at the launch of the Sri Lanka Pavilion at the World Travel Market (WTM) in London’s Excel Centre, Lord Hannett praised the island’s “story of strength and renewal” while underlining the UK’s intention to deepen trade and tourism ties with Sri Lanka.

In his address, Lord Hannett lauded the resilience, beauty and increasing appeal of Sri Lanka’s tourist offering. “You are not only promoting travel you are promoting understanding, helping communities thrive, and showing the world that Sri Lanka has an awful lot to offer,” he said. He noted the UK remains one of the top source markets for Sri Lanka, reflecting longstanding British affinity for the island.

He described his visit to Sri Lanka as inspiring: “I was moved by the optimism and passion of Sri Lankans, particularly among entrepreneurs driving the country’s post-crisis recovery.” He also stressed that tourism is far more than a revenue stream; it is “a bridge between different cultures.”

Lord Hannett highlighted ongoing UK–Sri Lanka collaborative initiatives, such as the Developing Countries Trading Scheme and the Ocean Country Partnership Programme, which support Sri Lanka’s blue economy tackling marine pollution, promoting sustainable seafood practices and conserving marine biodiversity. He said Sri Lanka has been identified among the world’s 36 global tourism hotspots for its beaches and water sports, and that the partnership is now “unlocking new opportunities for sustainable growth and shared prosperity”.

He also recognised the UK-based Sri Lankan diaspora’s vital role in nurturing bilateral ties across business, academia and health-care, noting that thousands of Sri Lankan students study in the UK each year, forging strong people-to-people connections. “The relationship between our two countries is rooted in history but defined by the future, one built on shared values and global ambitions. From eco-tourism to digital innovation, from education to enterprise, the UK and Sri Lanka are building a partnership of opportunity,” he added.

His remarks come at a time when Sri Lanka’s tourism sector is showing clear signs of resurgence. According to the Sri Lanka Tourism Development Authority (SLTDA), the country had welcomed over 1.7 million international tourists during the first nine months of 2025 a year-on-year increase of more than 16 %.

Tourism earnings likewise surpassed US$2 billion in the first seven months of the year. Key source markets include India (the largest), the UK, Russia, China and Germany.

Despite the encouraging numbers, industry watchers caution that accelerating growth must be matched with investment in infrastructure, service quality and sustainable practices to ensure long-term success. Sri Lanka is leveraging wider marketing campaigns, visa facilitation and improved air connectivity to turn its recovery into lasting momentum.

With Lord Hannett’s endorsement and the UK’s partnering support, Sri Lanka’s tourism sector appears poised for its next chapter. The challenge now lies in converting global attention and rising visitor numbers into broad-based socio-economic benefits for the island nation.

UK Envoy Hails Sri Lanka’s Tourism Revival amid Global Partnerships

Construction Sector Revival Plan Aims Big as Growth Returns

By: Staff Writer

November 06, Colombo (LNW): The Ceylon Institute of Builders (CIOB) has submitted its 2026/2027 Sri Lankan Construction Industry Budget Proposal to the Ministry of Construction, in a high-level ceremony attended by the Minister, Deputy Minister and the Secretary of the Ministry. The document lays out a sweeping roadmap to reinvigorate Sri Lanka’s construction industry positioning it as a linchpin of national economic growth once again.

According to the proposal, the industry has endured six consecutive years of stagnation and liquidity stress. CIOB argues urgent policy intervention and financial relief are necessary to reverse that trend. The roadmap sets out an ambitious target: restore the sector’s contribution to roughly 10 % of GDP, with a target industry turnover of LKR 2.97 trillion (about US$9.89 billion).

Key pillars of the plan include restarting stalled infrastructure projects (roads, hospitals, housing), rebuilding SME contractor capacity (noting a current 40 % SME failure rate), the creation of an Infrastructure Fund, concessional loan schemes (interest at or below 6 %), and encouraging exports and foreign investment via an international construction investor forum. The proposal also emphasises local material production, digitalisation of SMEs, and strong governance via formation of a National Steering Committee and an independent Programme Management Unit. CIOB President Dr. Rohan Karunaratne stated: “The construction sector is the engine that keeps Sri Lanka moving. This proposal offers a clear path to rebuild confidence, create jobs, and deliver long-term value to the economy.”

The timing of the submission aligns with signs of renewed strength in the construction sector. According to official data, the sector expanded by 8.5 % in the quarter ended June 2025, bringing first-half growth to 9.6 % year-on-year.

The sector’s purchasing-managers index (PMI) reached 67.6 in September 2025, the strongest reading since late 2021, highlighting increased new orders, employment and purchases in the industry.

CIOB’s plan seeks to harness that momentum to drive a broader recovery.However, the proposal underscores that without targeted relief and policy changes, the sector risks faltering again. SMEs, which form a key part of the contractor base, remain vulnerable.

The proposal warns that failure to implement change will blunt job creation (targeting over 1.5 million direct jobs and safeguarding 20,000 existing ones) and hamper the revival of stalled infrastructure.

The document estimates that if adopted, the plan could complete 60 % of currently stalled projects, revive approximately 3,000 SMEs and strengthen Sri Lanka’s export capacity in construction services.

The CIOB’s agenda asks the government to formally recognise the construction industry as a “priority crisis-hit sector,” so that emergency financial support and implementation of Cabinet-approved relief can take place.

With public allocation in the 2025 budget reaching LKR 1.3 trillion for public investment, the industry sees an opportunity but also warns the gap between allocated funds and project execution remains a major challenge.

As Sri Lanka seeks to rebuild after recent economic headwinds and position infrastructure development at the heart of recovery, the CIOB’s proposal offers a structured blueprint. Yet the crucial question remains: will policy makers act swiftly and decisively enough for the construction sector’s recovery to deliver broad-based economic benefits?

Sri Lanka’s Oil-Palm Ban Drains Billions in Foreign Exchange

By: Staff Writer

November 06, Colombo (LNW): The Planters’ Association of Ceylon (PA) is sounding the alarm over Sri Lanka’s continued ban on oil-palm cultivation, warning that each day the prohibition remains, the nation bleeds yet more foreign exchange and misses out on vital economic opportunity. The association estimates that between 2021 and 2025, Sri Lanka spent over US$175 million on imported edible oils after cultivation was prohibited in April 2021.

Once a cornerstone of crop-diversification strategy, oil-palm cultivation had been firmly backed by government policy in the early 2000s. Introduced in 1968, the crop took off when Regional Plantation Companies (RPCs) began seeking alternatives to loss-making rubber. By 2009, tax breaks for hybrid seed imports were in place, and by 2016 the state formally approved expansion to some 20,000 hectares, prioritising degraded rubber lands.

Yet the policy about-face in 2021 devastated the sector. With the ban on new cultivation and crude palm oil imports, local production collapsed, forcing edible-oil demand of some 264,000 metric tonnes annually to be met almost entirely by imports. The PA estimates that Sri Lanka now spends roughly US$35 million each year to plug the shortfall.

Investment in the sector had already been substantial — the total oil-palm sector investment exceeded Rs 23 billion, and seedlings valued at over Rs 550 million had to be written off when plantings were abandoned.

The economic impact ripples through the broader plantation and food‐processing industries. The sector once provided Rs 2.5 billion annually into rural households and sustained over 5,000 direct jobs and some 21,000 dependent livelihoods.

With the ban in place, these communities face an acute income decline. Meanwhile, downstream industries including bakery and confectionery (valued at over Rs 200 billion) cite rising input costs and supply disruptions of edible fats such as margarine and cooking oil.

From a productivity standpoint, oil-palm offers a compelling case: yields of three to eight times more oil per hectare compared to crops like coconut or soybean, on less land and with lower input costs. Plantation firms argue that, had policy remained consistent, Sri Lanka might have achieved near self-sufficiency in edible oils, saved billions in imports, and created new rural employment.

Environmental concerns have been cited in support of the ban a 2018 expert panel recommended phasing out the crop over ten years, citing soil erosion and water-source threats.

But the PA counters that Sri Lankan oil-palm expansion was restricted to old rubber lands, not virgin forests, and that global exemplars such as Malaysia and Indonesia manage palm oil under strict sustainability standards such as RSPO and MSPO.

With Sri Lanka’s foreign-exchange reserves under severe pressure and the plantation sector faltering, the association is calling for a pragmatic policy reset: lifting the ban, adopting certified sustainable palm-oil practices, integrating smallholders, reforming import-tax regimes and investing in R&D and traceability. “Every day the ban remains in place, the country loses money, opportunities and credibility,” says PA Secretary-General Lalith Obeyesekere.

Ultimately, the case for oil‐palm is not just economic but strategic: reviving a forward-looking plantation sector that bolsters food security, generates employment and conserves foreign exchange. The question now is whether policy will pivot quickly enough to salvage the lost ground and avoid further fiscal leakage in an already fragile economy.

Europe Dominates Global Rankings of Wealth per Person in 2025

By: Isuru Parakrama

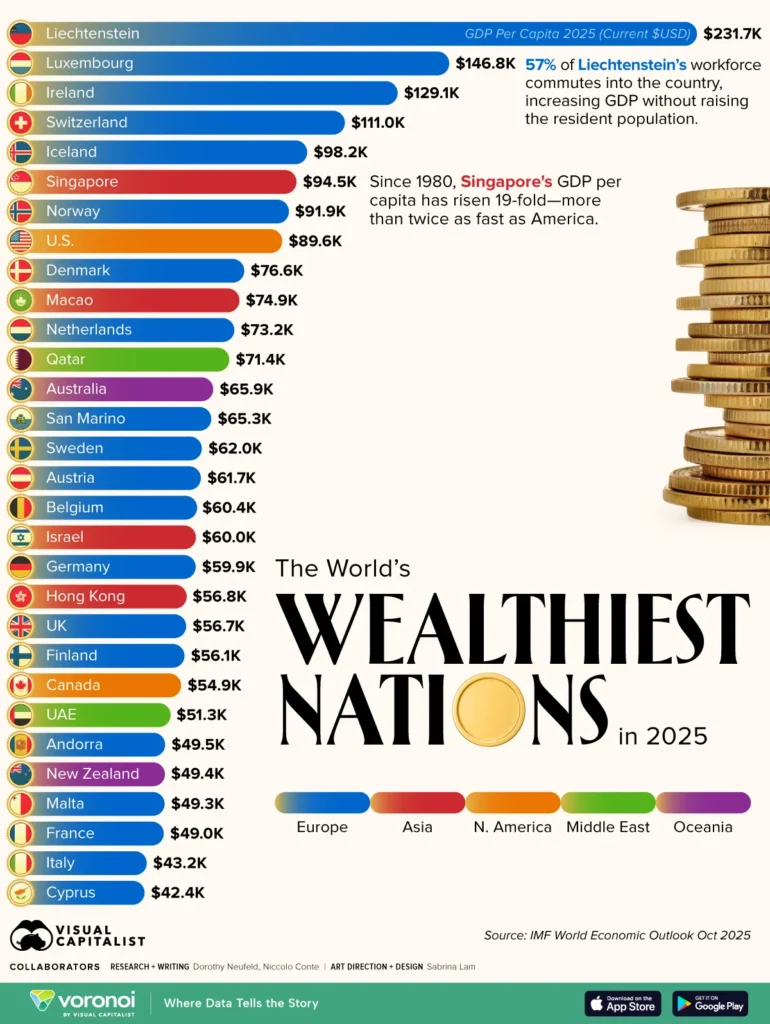

November 06, World (LNW): Seven of the ten nations with the highest income per person are located in Europe, many of which are small states known for robust social systems and highly developed economies, according to the International Monetary Fund’s World Economic Outlook (October 2025 update).

When measuring national prosperity, economists often refer to GDP per capita — the total economic output divided by the population. Using this metric, the United States places eighth worldwide, with an estimated average of around US$89,600 per person.

At the top of the list is Liechtenstein, boasting an extraordinary GDP per capita of about US$231,700. A notable factor behind this figure is that a majority of its workforce commutes daily from abroad, increasing productivity figures without expanding the resident population.

Luxembourg follows in second place with roughly US$146,800, benefiting from a similar dynamic of cross-border employment.

Ireland ranks third, recording about US$129,100 per person. The presence of major multinational technology firms headquartered there, drawn by favourable tax conditions, has significantly contributed to this figure.

Rounding out the upper tier are Switzerland, Iceland, and Singapore — each with notably high average incomes not primarily dependent on tax incentives or commuter inflows. Singapore’s rise is particularly striking: since 1980, its per-person income has increased almost twentyfold, reflecting the city-state’s rapid evolution into a global financial and trading powerhouse.

Sri Lanka Raises Import Duty on Big Onions to Support Local Farmers

November 06, Colombo (LNW): Lanka Sathosa has so far purchased more than 70,000 kilogrammes of big onions from local cultivators, while private traders have also made substantial purchases, Trade, Commerce, Food Security and Cooperative Development Minister Wasantha Samarasinghe announced.

According to the Minister, this year’s domestic big onion yield is estimated to be nearly four times higher than last year’s output. To assist farmers and stabilise market prices, the government has increased the import duty on big onions from Rs.10 to Rs.50 per kilogramme.

Sri Lanka’s annual demand for big onions stands at around 300,000 metric tonnes, with 7,000 metric tonnes imported in September and a further 12,000 metric tonnes in October. Although the higher import tax will remain in effect, the Minister admitted that it is only a partial remedy.

He said the authorities are also working to improve seed and fertiliser supplies to help locally grown onions achieve a shelf life comparable to imports from India.

Looking ahead, the Trade and Agriculture Ministries are formulating a joint programme to ensure that potato and onion cultivators are better protected from recurring market challenges by 2026.

Minister Samarasinghe further revealed that Keeri Samba rice cultivation will be expanded from 35,000 to 50,000 hectares in the coming seasons to avoid shortages and curb market manipulation by large millers. He noted that the current shortfall of approximately 100,000 metric tonnes has required a temporary 12-day import window for alternative rice varieties.

The government aims to boost Keeri Samba output starting this Maha season under the Yaya Pansiya (500 paddy fields) initiative.

He added that prices of around 40 essential goods have fallen by nearly 19 per cent this year and assured that further price reductions are being pursued. The Minister concluded that the forthcoming national budget will prioritise economic resilience and long-term development.

Rising Toll of Drowning Deaths Prompts Safety Warnings Across Sri Lanka

November 06, Colombo (LNW): Sri Lanka’s Police Life Saving Division has revealed that 230 people have died in drowning incidents across the island so far this year, with most of the victims being young individuals.

Despite the grim figures, rescuers have successfully saved 195 people from similar fates during the same period — a group comprising 135 Sri Lankans and 60 foreign nationals — through swift and coordinated response efforts.

Tragedy struck again yesterday when five young men from the Kiribathgoda–Makola area lost their lives while bathing in the Deduru Oya at Halawatha. The victims had reportedly travelled there for a day trip, and among them were two boys under 16 years old.

Authorities have once more appealed to the public to remain vigilant around rivers, lakes, and coastal areas, particularly during holidays and festive periods when recreational water activities are most frequent.

Sri Lanka to Establish Temporary Detention Facilities Amid Severe Prison Overcrowding

November 06, Colombo (LNW): Sri Lanka’s Department of Prisons has unveiled plans to set up provisional detention sites nationwide in response to an escalating overcrowding emergency within the country’s correctional system.

Official statistics reveal that prisons built to hold just over 10,000 individuals are currently accommodating close to 37,000, representing an excess of more than two and a half times their intended capacity.

Authorities attribute the sharp rise in inmate numbers largely to the ongoing wave of drug-related arrests across the island.

Most detainees are reported to be between 30 and 40 years of age, reflecting growing concerns over the imprisonment of working-age citizens.

Prison officials stated that the new temporary centres are an interim solution intended to alleviate the strain on existing facilities, while more sustainable policy and infrastructure reforms are under consideration.

Sri Lanka Unveils National Showcase at World Travel Market London 2025

November 06, Colombo (LNW): Sri Lanka Tourism inaugurated its exhibition space at the World Travel Market (WTM) London 2025 today, presenting the nation’s distinctive heritage, renowned hospitality, and commitment to eco-conscious travel.

Situated at Stand N11-220 within the Asia section of ExCeL London, the Sri Lankan stand made a striking impression at the globally recognised tourism fair.

The opening drew a wide audience of international industry professionals, partners, and visitors.

During the event, representatives underscored the country’s ambition to establish itself as a premier travel destination in South Asia by fostering sustainable tourism, expanding international partnerships, and enriching the overall visitor journey.

WTM London 2025 continues until November 06, welcoming exhibitors and participants from every corner of the worldwide travel sector.

Treasury Records Rs. 227 Billion Income from State Enterprises

November 06, Colombo (LNW): Deputy Minister of Industries and Entrepreneurship Development Chathuranga Abeysinghe announced that Sri Lanka’s Treasury has received a substantial income of Rs. 227 billion from State-Owned Enterprises (SOEs) this year, underscoring the continued financial contribution of public-sector institutions to the national economy.

Addressing recent reports that pointed to uneven performance among SOEs in the first half of 2025, the Deputy Minister emphasised that the revenue generated represents value created through public capital and market-driven operations.

“This is wealth created for the people, reflecting the productivity and efficiency of our state enterprises,” he said. “Although overall profits have declined slightly from last year, that reduction stems mainly from the non-adjustment of electricity tariffs and the foreign exchange gains recorded by SriLankan Airlines in the previous year.”

Abeysinghe acknowledged that some state entities continue to face difficulties, largely due to past mismanagement and corruption. However, he stressed that an extensive restructuring effort is underway to restore these institutions to profitability.

“The process to revitalise underperforming enterprises has already begun, and we expect Treasury revenue from these entities to strengthen further in the coming years,” he stated.

Rejecting suggestions that state assets should be transferred to private hands, the Deputy Minister reiterated that the government’s policy framework promotes a balanced economic model that integrates state, private, and cooperative sectors.

“Those who argue that the government should not engage in business are misleading the public,” he said. “Around the world, even in advanced economies such as China, Vietnam, South Korea, Singapore, and India, state-owned enterprises continue to play a central and strategic role in national development.”

He further explained that the purpose of state ownership is not merely to maximise profit but to enhance economic and social outcomes, especially in sectors where markets function inefficiently.

“Sri Lanka has 52 carefully managed state-owned enterprises identified as strategic. Their goal is to strengthen the economy and serve the people, not to drain public resources,” Abeysinghe added.

The Deputy Minister also revealed that the government is in the process of drafting new legislation aimed at improving the governance of state enterprises, reducing political interference, and ensuring that board appointments are based on merit and professional competence.

“Our government is committed to ending waste and corruption. The claim that these institutions waste taxpayers’ money is completely unfounded,” he remarked.

Highlighting the performance of the public sector, Abeysinghe noted that SOEs collectively earned profits of Rs. 427 billion in 2023 and Rs. 538 billion in 2024.

“Imagine if these enterprises were privatised — all that income would flow to a handful of private investors, and essential services would lose price competition, ultimately hurting the public,” he argued.

He went on to clarify that in 2025, institutions such as the Ceylon Electricity Board and the Ceylon Petroleum Corporation maintained stability without imposing additional burdens on citizens.

“Contrary to the false claim that the country is collapsing due to SriLankan Airlines, the Rs. 20 billion allocated to the airline came from these profits — not from taxpayers’ money,” he concluded.

CB Chief Reaffirms Readiness to Face Parliament on Economic Matters

November 06, Colombo (LNW): Central Bank Governor Dr Nandalal Weerasinghe has reaffirmed his willingness to appear before Parliament at any time to respond directly to questions from Members of Parliament on issues concerning the national economy.

Speaking in reference to recent discussions involving the Committee on Public Finance (COPF), Dr Weerasinghe clarified that any perceived delay in receiving responses from the Central Bank is the result of procedural requirements rather than reluctance or inefficiency.

“When a Member of Parliament raises a question, it is first directed to the Minister of Finance. The Ministry then reaches out to us for clarification or data. Once the request is made, we promptly provide all relevant information,” he explained.

He added that the Central Bank itself cannot formally address Parliament, as responses must be presented through the Finance Minister or the Deputy Minister of Finance, in accordance with established parliamentary protocol. “We are always ready to cooperate and respond swiftly, but the timing of delivery depends on the administrative process,” Dr Weerasinghe said.

The Governor further observed that many of the questions raised by legislators involve not just the Central Bank but also the Ministry of Finance and several related institutions. “In such cases, it falls to the Finance Minister to gather inputs from all agencies and compile a unified report for Parliament,” he noted.

Dr Weerasinghe emphasised that if the Central Bank were formally invited, he and his team would have “no hesitation whatsoever” in appearing before Parliament to provide clarifications directly. He also reminded that under the recently enacted Central Bank Act, the CBSL holds a unique responsibility among state entities — to report to Parliament every four months, ensuring transparency and accountability in its operations.