By: Staff Writer

October 21, Colombo (LNW): The newly elected President of the Small Hydro Power Developers Association (SHPDA), Pathmanatha Poddiwala, has pledged to lead the association through a transformative era for Sri Lanka’s renewable energy sector, marked by both opportunity and uncertainty.

Speaking after his election, Poddiwala described it as a “great honour” to head one of Sri Lanka’s oldest renewable energy bodies, which currently supplies nearly 450 MW of firm power to the national grid among the most cost-effective sources of electricity in the country. He commended outgoing President Thusitha and the previous executive committee for their “exemplary leadership” through years of turbulence shaped by the pandemic and shifting energy policies.

Poddiwala acknowledged that small hydro developers are navigating what he called “turbulent weather.” He pointed to mounting industry challenges, including the enforcement of the new Electricity Act, the unbundling of the national utility, unconsented curtailments of power generation, and termination of power purchase agreements (PPAs) issues that have eroded investor confidence and project bankability.

“These are challenges we are facing for the first time in our history,” he said. “But renewable energy remains the cheapest and most sustainable power source, both locally and globally. That is our greatest strength.”

He underscored that Sri Lanka’s indigenous renewable resources particularly hydropower remain the country’s most valuable natural advantage. While investor activity has slowed due to tariff and regulatory constraints, Poddiwala views this as an opportunity to rethink the sector through innovation, efficiency, and technology integration.

Among his top priorities is the adoption of Battery Energy Storage Systems (BESS) to enhance grid stability and optimize hydro generation. “Storage technology will allow plants to store power during off-peak hours and release it during demand surges,” he explained, highlighting the growing link between renewable energy and emerging markets such as electric vehicles, tourism, and exports, all of which will drive future power demand.

Poddiwala outlined a forward-looking vision for a strategic, inclusive, and globally connected association. His agenda includes developing a long-term strategic plan, broadening stakeholder participation in decision-making, and building stronger ties with international renewable energy forums, financial institutions, and partners such as the ADB.

He also emphasized the importance of public communication, proposing regular briefings and an expanded media and social media presence to better showcase the sector’s contributions to the national economy. A membership expansion drive is also planned to bring in a wider spectrum of renewable energy players.

“We will hold a strategic brainstorming session to define measurable outcomes for each working group,” Poddiwala said, concluding his address with gratitude to members for their steadfast support. “With collective effort and commitment, we can help shape a resilient and forward-thinking renewable energy future for Sri Lanka.”

New Hydro Power Chief Charts Course for Energy Renewal

Sri Lanka’s Education Crisis Deepens amid Chronic Underfunding

By: Staff Writer

October 21, Colombo (LNW): Sri Lanka’s public education system, once considered a model in South Asia—is now facing a deepening crisis, largely due to chronic underfunding and weak fiscal management. A new report by Human Rights Watch (HRW), “Tax Giveaways, Struggling Schools,” paints a troubling picture of the country’s dwindling investment in its children’s future, linking the decline directly to inadequate tax revenue collection and misplaced spending priorities.

According to HRW, Sri Lanka spends just around 2% of its GDP on education, less than half the average for low- and middle-income countries, which stands at 4.5%. Two decades ago, the country allocated nearly 11.7% of government expenditure to education, but even then it lagged behind African peers such as Benin and Côte d’Ivoire, which dedicated close to 19%. By 2009, Sri Lanka’s ranking had slipped to among the lowest in its income group—an alarming sign for a nation that once prided itself on near-universal literacy.

The contrast in per-student spending underscores the widening gap. In 2010, Sri Lanka’s spending per primary student was just $516 (PPP)—a fraction of Morocco’s $1,278 or Bolivia’s $2,121. By comparison, the United Kingdom invested $11,192 per student, a figure that dwarfs Sri Lanka’s education allocation by more than twentyfold.

Experts say the shortfall is not merely a budgetary issue, but a reflection of structural weaknesses in Sri Lanka’s tax system. The report highlights that low tax collection—among the weakest in Asia—has forced the Government to depend heavily on borrowing, even to fund basic education infrastructure. The result has been deteriorating school facilities, teacher shortages, and widening inequalities between urban and rural areas.

“Had Sri Lanka’s tax revenues been comparable to other countries in its income bracket, it could have generated sufficient funds to guarantee the right to quality education,” HRW noted, emphasizing the need for fiscal reform over short-term borrowing.

The report also points to “tax giveaways”—generous exemptions and concessions granted to corporations and investorsthat have drained public coffers of vital revenue. Instead of fostering growth, these incentives have left essential public services starved of funding, HRW argues.

As the Government prepares its next budget cycle, education advocates are urging policymakers to rethink national priorities. They call for an increase in education spending to at least 4% of GDP—the global minimum benchmark set by UNESCO—and the phasing out of unnecessary tax holidays.

Without decisive action, HRW warns, the current generation of Sri Lankan students could face lasting disadvantages in a rapidly changing global economy.

Sri Lanka Launches Tough Crackdown on Dirty Money Networks

By: Staff Writer

October 21, Colombo (LNW): In a decisive move to combat entrenched corruption and criminal profiteering, the Sri Lanka Police has established a powerful new investigative arm the Proceeds of Crime Investigation Division (PCID) to trace, seize, and recover wealth acquired through illegal means.

The PCID, set up under the newly enacted Proceeds of Crime Act, represents one of the most ambitious anti-corruption measures introduced by the new administration. It will operate directly under the Inspector General of Police (IGP) and collaborate with the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) and other enforcement bodies to target both public officials and criminal networks suspected of amassing illicit fortunes.

Officials say the new division will focus on the investigation, restraint, forfeiture, and disposal of assets linked to offences such as bribery, money laundering, drug trafficking, and organized crime. Importantly, the Act allows non-conviction-based forfeiture enabling the state to seize suspicious assets even before a criminal trial concludes, closing a loophole that has long shielded politically connected offenders.

The unit will be headquartered at the Old Police Headquarters in Colombo 01 and formally inaugurated by Public Security and Parliamentary Affairs Minister Ananda Wijepala, alongside IGP Priyantha Weerasuriya.

According to police data, over Rs. 4.5 billion worth of properties have already been seized in recent operations against organized crime, including luxury houses, vehicles, jewellery, and boats. A further Rs. 57 million in cash has been confiscated and placed under legal restriction in line with the Money Laundering Act.

The establishment of the PCID reflects a growing shift in the government’s anti-corruption strategy away from reactive investigations and toward financial disruption of criminal empires. Analysts note that the move signals an intent to go beyond rhetoric and tackle the economic roots of corruption.

However, experts warn that the division’s success will depend on political will and transparency. “Laws are only as strong as their enforcement,” said a former senior investigator. “If the PCID can operate independently, it could mark a real turning point in Sri Lanka’s fight against illicit wealth.”

For now, the new government’s message is clear: corruption and criminal enrichment will no longer go unchallenged. Whether this latest initiative can finally bring accountability to powerful circles remains the country’s next crucial test.

Exclusive: Wickremesinghe to shake up the UNP: More appointments after Harin

October 21, Colombo (LNW): In a significant move signaling a renewed push for political unity, the United National Party (UNP) has appointed former Minister Harin Fernando as its new Deputy Secretary General of Political Mobilization.

The appointment, made despite reservations from some close insiders, is seen as a direct and personal endorsement from party leader Ranil Wickremesinghe. He has entrusted Fernando with the crucial task of executing his strategy to unite the country’s political parties under a common banner.

Party sources reveal that Wickremesinghe’s decision stems from his disappointment with several UNP heavyweights who have allegedly avoided responsibility and failed to undertake meaningful work for the party’s revival.

As the chief architect of this ground-level campaign, Fernando will oversee 1,000 public meetings designed to build momentum for a broad alliance. This move firmly positions him as the key operative in the UNP’s ambitious plan to forge a united political front. According to sources close to the UNP leader, he is planning to hand over more responsibilities to other handpicked political leaders in due course, signaling a broader leadership shake-up.

Top 10 brain foods to sharpen memory and focus

Foods for the brain

Our brain is constantly working, even when we rest. And so, it constantly needs high-quality fuel with the right nutrients to function in the optimum capacity. Several studies have found that certain foods help improve memory, maintain focus, and protect our brain cells against damage. Over time, having a diet rich in these “brain foods” can help in slowing the cognitive decline and keeping one mentally sharp. Here we list some such brain foods to sharpen memory and focus:

2/13

Fatty Fish (like Salmon, Mackerel, Sardines)

Fatty fish are rich in omega-3 fatty acids, especially DHA and EPA, which are important structural components of brain cells. These fats support neuronal communication, help reduce inflammation, and also promote blood flow in the brain– and thus, regularly eating fatty fish can help improve one’s brain function.

A study titled ‘The Relationship of Omega-3 Fatty Acids with Dementia and Cognitive Decline‘ published in The American Journal of Clinical Nutrition reads, “Our findings suggest that 1) long-term omega-3 fatty acid supplementation may reduce risk of Alzhimer’s Disease; 2) dietary omega-3 fatty acid intake, especially DHA, may lower risk of dementia or cognitive decline; and 3) peripheral biomarkers of omega-3 fatty acids may serve as predictors of cognitive decline.”

3/13

Blueberries (and other berries)

Berries are known to be rich in flavonoids and antioxidants, which help protect the brain from oxidative stress and inflammation. A 2011 study titled ‘Blueberry Supplementation Improves Memory in Older Adults’ showed that daily intake of wild blueberry juice over 12 weeks improved memory function in older adults with early memory issues.

Green leafy vegetables

Green leafy vegetables– like spinach, kale, and broccoli– are rich in nutrients like Vitamin K, lutein, folate, and beta carotene. Having them regularly can help slow down cognitive decline, and support healthy brain cells. Highlighting this, a study published in the journal Neurology, led by researchers at Rush University, found that eating one serving per of green leafy vegetables like spinach, kale, and lettuce daily is linked to hugely slower rate of cognitive decline in older adults.

5/13

Nuts, especially walnuts

Nuts are rich in healthy unsaturated fats, vitamin E, and antioxidants– all of which improve one’s brain function and cognitive performance, when consumed regularly over a period of time. Nuts, particularly Walnuts, are packed with plant-derived omega-3 (alpha-linolenic acid), which is linked to better memory and brain function. Emphasising this, a study from the University of Reading found that eating roughly 50 grams of walnuts (which is about a handful) in breakfast every day led to faster reaction times and enhanced brain function throughout the day in young adults, compared to a nut-free meal.So, swap that junk snack with nuts for a sharper brain, today!

6/13

Whole grains

Whole grains– including rice, wheat, oats, quinoa– provide a steady supply of glucose in the body, which is also the brain’s primary fuel. And so, having whole grains offers sustained energy and support cognitive function. Apart from this, whole grains are also rich in fiber, B-vitamins, and other micronutrients beneficial to brain health.

Dark chocolate with over 70%+ cocoa

Dark chocolate is rich in flavonoids, caffeine, and antioxidants, which enhance blood flow in the brain, improve alertness, and may even boost memory. However, it is important to eat chocolate with more than 70% cocoa to minimise added sugars.

8/13

Eggs

Eggs have choline, a nutrient which is important for producing acetylcholine, which is a neurotransmitter that plays a key role in memory and learning. Apart from having protein and fats, eggs are also rich in B vitamins that help reduce inflammation and support brain cell health. A study published in the journal Nutrients found that eating eggs, along with the yolk, regularly is linked with better cognitive performance in terms of thinking and memory compared to those who don’t eat eggs.

9/13

Turmeric

Turmeric contains an anti-inflammatory and antioxidant compound called curcumin, which can help clear beta-amyloid plaques and also support memory and mood, some studies suggest. So, add this golden vegetable to curries, soups, or milk to have in it different ways. However, don’t forget to pair it with a pinch of black pepper and ghee or fat to enhance its absorption in the body.

Seeds (especially pumpkin seeds)

Some seeds like pumpkin, sunflower, flax, and chia are excellent sources of magnesium, zinc, iron, and copper — all of which are important trace minerals for the proper functioning of the brain. So, add these power-packed seeds to your daily diet. Sprinkle them on salads, oats, or enjoy them as seeds mix. These seeds also provide healthy fats and antioxidants, which further support cognitive function, memory, and overall brain health.

11/13

Green tea

Green tea contains caffeine and L-theanine, which together may improve one’s focus, attention, and even make them feel relaxed. The antioxidant EGCG in green tea further protects neurons from damage. So, swap one of your daily cups of coffee or tea with green tea to boost your brain function and memory. Additionally, drinking green tea regularly may support cardiovascular health, aid metabolism, and help reduce stress, making it a simple yet powerful addition to your daily routine for both mind and body benefits.

12/13

How having the right food can impact the brain

The food you eat directly affects your brain’s performance, mood, and memory. Nutrient-rich foods like fruits, vegetables, nuts, and omega-3 fatty acids support healthy brain cells and improve focus and alertness. On the other hand, processed and sugary foods can cause brain fog, mood swings, and fatigue. Eating a balanced diet helps regulate neurotransmitters, reduces inflammation, and boosts cognitive function. Simply put, feeding your body right fuels your mind for clarity, creativity, and better decision-making every day.

Consume a healthy diet

Consume a healthy diet to keep your brain sharp

Experts hail ‘remarkable’ success of electronic implant in restoring sight

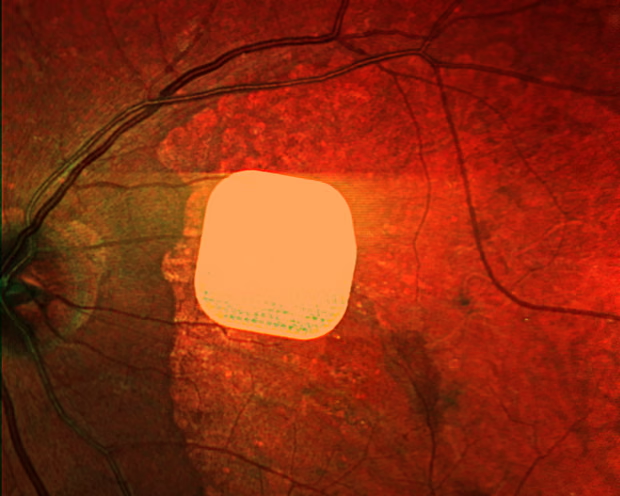

The Guardian : Sight of 84% of people with form of age-related macular degeneration restored after being fitted with device

An electronic eye implant half the thickness of a human hair has helped people with incurable sight loss to see again, opening up a potential “new era” in tackling blindness.

Doctors who implanted the sim card-shaped prosthetic devices say they have helped many of the 38 elderly patients in the trial regain their ability to read letters, numbers and words.

“In the history of artificial vision, this represents a new era,” said Mahi Muqit, a senior consultant at Moorfields eye hospital in London, one of the 17 sites involved.

“Blind patients are actually able to have meaningful central vision restoration, which has never been done before. Getting back the ability to read is a major improvement in their quality of life, lifts their mood and helps to restore their confidence and independence.”

The trial found 84% of participants were once again able to read letters, numbers and words after being fitted with the implant, called the Prima device.

Eye specialists hailed the results as “remarkable” and said the device could help people with the “dry” form of age-related macular degeneration (AMD), the leading cause of sight loss in the over-50s.

Moorfields said: “The revolutionary new implant is the first ever device to enable people to read letters, numbers and words through an eye that had lost its sight.”

The 38 patients all had geographic atrophy with dry AMD, which over time progressively deprives someone of their sight and for which there is no treatment. Most people with the condition lose some of their central vision and in some cases it progresses to full sight loss as the cells in the macula die and the central macula melts away.

All had lost their central vision and had only limited peripheral vision before they had the device implanted in an operation lasting less then two hours. Five were treated at Moorfields and the others at hospitals in Germany, France, Italy and the Netherlands.

Sheila Irvine from Wiltshire, one of those who had the chip implanted at Moorfields, said: “Before receiving the implant it was like having two black discs in my eyes, with the outside distorted. I was an avid bookworm and I wanted that back. There was no pain during the operation but you’re still aware of what’s happening.

“It’s made a big difference. It’s a new way of looking through your eyes and it was dead exciting when I began seeing a letter. It’s not simple, learning to read again, but the more hours I put in, the more I pick up.”

The Prima device, a super-thin microchip that is just 2mm by 2mm in size, is inserted under the centre of the eye’s retina in a procedure known as a vitrectomy.

To help them to see and write, patients were given augmented reality glasses containing a video camera connected to a small computer, which they attached to their waistband. It included a zoom feature to make text bigger and easier to read.

Patients can use the glasses to focus and scan the object in the projected image that they want to read. The glasses project the scenes as an infra-red beam across the chip, which activates the device. Artificial intelligence in the waistband computer processes the information and converts it into an electrical signal, which passes through the cells in the retina and optical nerve into the brain.

Muqit stressed that patients had to undergo training and intensive rehabilitation of their eye in order to realise the benefits of the technology.

“It’s not like you’re popping a chip in the eye and then you can see again. You need to learn to use this type of vision,” he said.

The results of the trial are reported in the New England Journal of Medicine.

9 countries other than India that celebrate Diwali

Times of India : 9 countries other than India that celebrate Diwali

Every year, when fireworks light up the sky and homes glow with diyas, Diwali brings people together across the world. Known as the festival of lights, it celebrates hope, happiness, and the victory of good over evil. Though it began in India, Diwali is now celebrated in many parts of the world, uniting cultures through light, family, and festivity.

Nepal

In Nepal, Diwali is called Tihar and is celebrated for five days. It happens around the New Moon in the month of Kartik and honours gods, animals, and family bonds. Each day has a special meaning– from worshipping cows to celebrating the love between brothers and sisters. Homes shine with oil lamps, and people enjoy music, dance, and festive food.

Sri Lanka

In Sri Lanka, Deepavali is mostly celebrated by the Tamil community and is a public holiday. Families light lamps, make sweets, and visit temples over a few days. It’s seen as a time to forgive, start fresh, and bring light into one’s life. The festival is filled with joy, togetherness, and pride in tradition.

Myanmar

In Myanmar, Diwali is celebrated based on the Hindu solar calendar. Families come together for prayers, light diyas, and exchange sweets. Schools and offices usually close, so everyone can enjoy the festival. Though the celebrations are smaller, they are just as warm and meaningful.

5/10

Mauritius

Mauritius, home to one of the largest Hindu populations outside India, celebrates Diwali as a national festival. People clean and decorate their homes, light diyas, and cook traditional dishes. Families visit each other and share sweets, while the island glows beautifully at night, showing its deep Indian roots.

6/10

Guyana

In Guyana, Diwali is a national holiday and one of the most loved festivals. Families pray, light diyas, and enjoy special meals together. For many, it also marks the start of the Hindu New Year. The bright lights across the country reflect how Indian traditions have become part of everyday life in Guyana.

Trinidad and Tobago

Diwali came to Trinidad and Tobago with Indian workers in the 1800s and is now one of the biggest cultural festivals there. Families decorate their homes, light lamps, and celebrate with food, music, and gatherings. It’s a time to reconnect with family and celebrate shared roots. The festival also brings together people of all backgrounds, showing the country’s diverse culture.

8/10

Suriname

In Suriname, Diwali is celebrated with devotion and love. Families light diyas, pray, and share meals with neighbours and friends. Many offices and community groups hold events and charity drives, spreading happiness and kindness beyond homes.

9/10

Malaysia

In Malaysia, Diwali– called Deepavali– is a public holiday in most states. The day begins with an oil bath and prayers, followed by temple visits and family gatherings. Homes and streets are filled with diyas and colourful lights, and sweets are shared with everyone. The festival brings people together and shows unity in diversity.

10/10

Singapore

In Singapore, Diwali has been a public holiday since 1929. Families light diyas, visit temples, and celebrate with prayers and festive meals. Little India becomes the centre of celebrations, covered in colourful lights and decorations. The festival shows how Indian traditions continue to shine in Singapore’s multicultural society.

Sri Lanka Insurance Life Delivers Robust Growth in 2025, Reinforces Sector Leadership

October 21, Colombo (LNW): Sri Lanka Insurance Life (SLIC Life) has reported a strong financial and operational performance for the nine months ending September 30, 2025, reinforcing its position as one of the country’s most resilient and trusted life insurers.

The company’s results reflect not only its solid market footing but also its long-term focus on delivering sustainable value to policyholders and contributing to the national economy.

During the review period, SLIC Life recorded a pre-tax profit of Rs. 23.9 billion, representing an 11 per cent growth year-on-year. Gross Written Premiums (GWP) also rose sharply, reaching Rs. 23.6 billion—a notable 32 per cent increase compared to the same period in 2024. New business premiums surged to Rs. 5.4 billion, an impressive 61 per cent growth, signalling rising consumer confidence in the brand and its life insurance offerings.

Profit after tax stood at Rs. 22 billion, underscoring SLIC Life’s robust financial governance and efficient operations. In line with its commitment to policyholder protection, the company settled Rs. 13.2 billion in claims and maturity benefits, averaging Rs. 1.5 billion per month. This marks a 49 per cent increase in disbursements compared to the previous year, further demonstrating SLIC Life’s ability to meet its obligations even amid challenging economic conditions.

The company’s asset base now stands at Rs. 264 billion, anchored by the largest Life Fund in Sri Lanka, valued at Rs. 239 billion. This reflects a strong capital position and prudent fund management—critical indicators of long-term stability in the insurance sector.

As a state-owned enterprise, SLIC Life continues to make meaningful contributions to national development. In the first nine months of the year, it paid Rs. 0.9 billion in taxes and maintained investments of Rs. 115 billion in government securities, supporting public finances. Additionally, a dividend of Rs. 1.5 billion was paid to the Treasury, marking a 17 per cent increase from the previous year.

Demonstrating its ongoing commitment to policyholders, the company announced a record Rs. 12.5 billion in annual bonuses for 2024—the highest declared in Sri Lanka’s life insurance industry. Since 2006, cumulative bonus payouts have reached Rs. 116.6 billion, reflecting consistent returns on long-term savings products.

SLIC Life’s financial strength continues to be recognised, with Fitch Ratings affirming its National Insurer Financial Strength Rating at ‘A+(lka)’ with a Stable Outlook. The company also maintains ISO certifications in information security, quality management, and greenhouse gas verification, signalling adherence to global standards in governance, sustainability, and customer service.

On the branding front, SLIC Life was once again recognised as Sri Lanka’s “Most Loved Life Insurance Brand” by LMD, an honour it has held for eight consecutive years. It was also ranked among the Top 3 Most Valuable Life Insurance Brands in the country.

Beyond its business success, the company has made significant contributions to social development. Its long-standing CSR programmes—such as Suba Pathum, which has awarded over 2,200 scholarships, and Pasal Piriyatha Surakimu, which has supported over 3,300 under-resourced schools—continue to uplift communities across the island. Marking World Children’s Day in 2025, the company again offered a complimentary Rs. 1 million life cover to parents of all children born on 1 October in hospitals across Sri Lanka.

Authorities Warn of Potential Flood Risk as River Levels Continue to Rise

October 21, Colombo (LNW): The Department of Irrigation has urged residents in vulnerable areas to remain alert, as flood warnings remain in place for several river basins following days of persistent heavy rainfall across parts of the country.

The public, especially those living near rivers and reservoirs, have been advised to take precautionary measures as water levels continue to rise.

L.S. Sooriyabandara, Director of Hydrology and Disaster Management at the Department, stated that river systems such as the Maha Oya and Deduru Oya are currently experiencing high water volumes, raising concerns of possible flooding in adjacent low-lying regions. These alerts are expected to remain in effect until conditions begin to stabilise.

Among the areas most affected by the current weather conditions is Baddegama, which recorded the highest rainfall with 172 millimetres in a 24-hour period. The situation is particularly concerning in zones surrounding several key river basins, including the Kelani, Kalu, Gin, Attanagalu Oya, and Nilwala rivers. Ongoing rainfall in these catchment areas could lead to further complications if it persists.

Director Sooriyabandara also highlighted increased water inflows into the Kirindi Oya and Lunugamvehera reservoirs, noting that rising reservoir levels could further intensify the risk downstream, especially if additional rainfall necessitates water release.

Officials have advised local authorities to be on high alert and have urged the public to follow guidance issued by disaster management units and remain informed through official weather updates.

New Crime Division Launched to Enforce Asset Recovery Law in Sri Lanka

October 21, Colombo (LNW): Sri Lanka has formally launched a new investigative body to tackle illicit wealth and criminal enterprises, marking a major step in the government’s fight against organised crime, corruption, and drug trafficking.

The Proceeds of Crime Investigation Division (PCID) was inaugurated yesterday at the old Police Headquarters in Colombo, with top government and law enforcement officials in attendance.

Speaking at the opening ceremony, Public Security and Parliamentary Affairs Minister Ananda Wijepala emphasised that while legislation is important, real progress depends on swift and effective enforcement. “Laws alone do not bring change. The public must see justice being done—and being done without delay. That is when laws become deterrents,” he said.

The PCID has been established under the newly enacted Proceeds of Crime Act 2025, a sweeping piece of legislation designed to identify, freeze, and reclaim assets obtained through unlawful means. The Minister hailed the Act as a landmark in Sri Lankan legal history, describing it as a comprehensive tool that empowers authorities to act decisively against economic crimes.

Under the new law, authorities can initiate both criminal and civil proceedings against individuals and entities suspected of acquiring assets illegally. The PCID is authorised to cooperate with 34 government agencies in order to trace and recover such wealth. Moreover, it is empowered to accept complaints from the public, freeze suspicious assets for up to 30 days, and bring civil claims to recover unlawfully obtained property.

Senior DIG Asanga Karawita has been appointed as the Director General of the Division for a three-year term, with approval from the National Police Commission. A Deputy Director General has also been appointed to support the Division’s operations.

The Minister noted that although additional laws are being drafted—particularly those targeting organised crime, terrorism, and online safety—the existing framework already provides sufficient authority to act decisively. He stressed that illegal enrichment and the accumulation of wealth through criminal means can be intercepted even without new legislation, as long as the current laws are applied with determination.

Amendments to the Online Safety Act are also underway, being drafted by a multi-ministerial committee involving representatives from the Justice, Public Security, Mass Media, and Foreign Affairs ministries. The proposed changes are expected to be tabled in Parliament within the next two months.

Additionally, Minister Wijepala revealed that steps are being taken to review and ultimately replace the Prevention of Terrorism Act (PTA). A legal committee, led by the Attorney General’s Department, has been tasked with drafting new legislation that aligns with contemporary security challenges and international human rights standards.

Inspector General of Police Priyantha Weerasooriya, also speaking at the event, acknowledged that the current legal system has suffered due to a failure to enforce existing laws properly. He welcomed the creation of the PCID and the Proceeds of Crime Act, noting that police officers have now been granted greater legal authority than ever before—but urged them to wield that power responsibly and in the public interest.

He also noted that a Bill specifically targeting organised crime is being finalised for presentation in Parliament and stressed the need to close longstanding legal loopholes that have hindered enforcement efforts.

One key feature of the new Act is its retroactive application. The law enables action to be taken based on past audit reports, with the Auditor General granted expanded authority to forward findings directly to the Commission to Investigate Allegations of Bribery or Corruption (CIABOC).