The objective of this article is to highlight how the Sri Lankan monetary policy has lost its purpose by being unable to provide contemporary monetary needs of the economy and sectors towards recovering from the economic crisis.

The highlights are based on the information released by the Central Bank (CB) in its monetary policy press release on 25 January and recent monetary and money market statistics available on the CB website.

Five Highlights of Monetary Mismanagement in Brief

- The policy interest rates-based monetary policy model pursued for inflation targeting has collapsed since 2 January this year, leading to a bureaucratically induced black money market. Therefore, policy decision to keep policy interest rates unchanged at 14.5% and 15.5% serves no purpose.

- Money market shows a irregular and panic volatility and near-term instability caused by new OMO manipulations.

- The story of disinflation is only a statistical illusion and a public policy fraud as the public does not gain any benefit of disinflation.

- Recent monetary statistics show early warnings of near-term systemic threats to the financial system, given the continued bankruptcy without any signs of a recovery path.

- Contents in the monetary policy press release on 25 January are baseless and reveal policy-induced market manipulations.

A brief technical discussion on each of highlights is presented below in order to provide the readers my line of views supporting the highlights.

My main massage is;

- The continuously deteriorating monetary and financial conditions and significant contraction of the economy are cause for public concerns over the fitness and propriety of high ranking officials in public seats of monetary and fiscal operations.

- The fact that they remain in public seats without providing solutions while talking about difficulties and seeking religious blessing for their seats is the responsibility of the elected leaders that should not be taken lightly.

1. The collapse of the policy interest rates-based monetary policy model

The Monetary Board does not seem to have any knowledge on or granted the post-concurrence for the new OMO rule issued by the Director/Domestic Operations on 2nd January to restrict daily standing facilities and resulting collapse of its policy interest rates-based monetary policy being implemented for the control of inflation around the target of 4%-6%. Therefore, the decision taken by the Monetary Board at its last meeting (on 24 January) to keep the policy interest rates unchanged at their current levels serves no purpose.

The policy interest rates corridor (SDFR and SLFR) is effective only if standing facilities are available without limits at those interest rates. However, the new OMO rule imposes rationing of standing facilities (i.e., standing deposit facility only for six days a month and standing lending facility only up to 90% of the statutory reserve amount). Therefore, the resulting monetary black market will drive inter-bank interest rates beyond the rates corridor and disrupt its envisaged transmission mechanism. As a result, inflation targeting monetary policy model is now lost in Sri Lanka.

Policy interest rates are considered as perfectly operating price control system in the overnight inter-bank market as central banks have no limit of money printing to keep overnight inter-bank interest rates within policy rates. However, with the implementation of restriction or rationing on money printing by the new OMO rule, policy interest rates become similar to state price controls in commodity markets. Therefore, the Monetary Board has lost the monetary policy independence.

2. Money market panic caused by new OMO manipulations

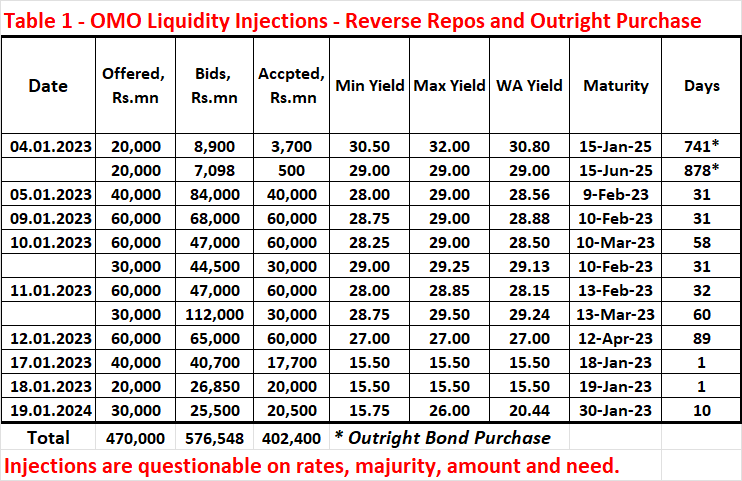

While restricting overnight standing facilities, Domestic Operations Dept. has commenced a series of reverse repo auctions to inject new liquidity to the money market. These reverse repos are unrelated to the newly rationed policy rates corridor. The review of auction results shows manipulative, insider attempts to offer favourable treatment to dealers on yield rates, the quantum and maturity (see Table 1 below).

It is highly probable that such reverse repo-based lending is carried out to prevent possible black market conditions in overnight inter-bank lending. Therefore, insider dealings and arbitrage activities possible behind reverse repo operations have potential of creation of frequent market panics. In this background, the Monetary Board, not having any involvement in decision-making and oversight over OMO operations, has lost its monetary policy as policy interest rates have virtually become purposeless.

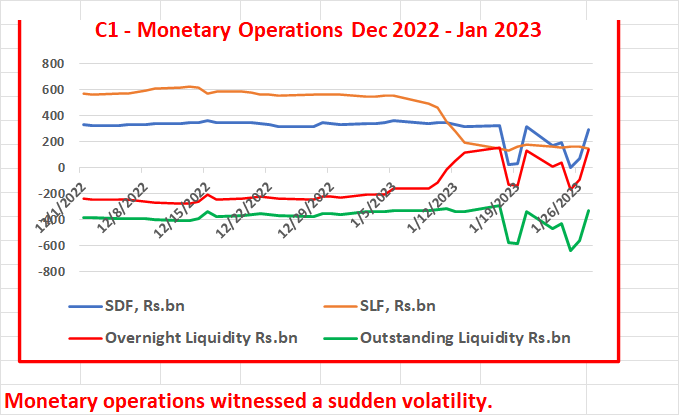

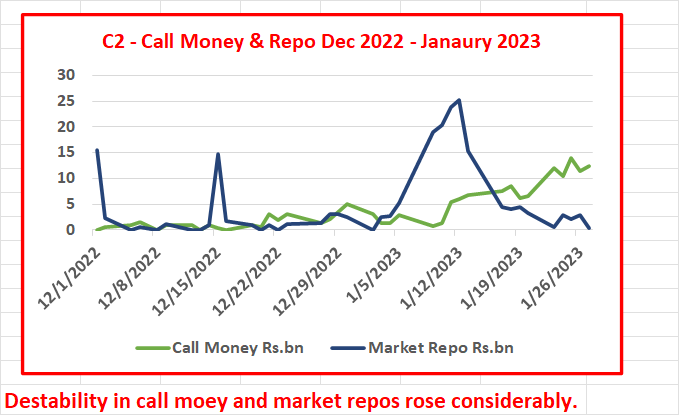

Last three weeks showed a panic volatility in the money market in both volumes and interest rates caused by new OMO operations (see images C1, C2 and C3). This volatility is an unnecessary risk created to the financial system. If the volatility continues, it is not unreasonable to expect even systemic risk triggers pulled by the money market, given current circumstances relating to the present economic crisis.

3. The fraudulent story of disinflation

The disinflation cited in the policy statement is on the statistically computed numbers and not on prices and actual cost of living in the country. The rate of inflation quoted in the monetary policy is the percentage change of the Colombo Consumer Price Index (CPI) in a particular month (for example, December 2022) from the index in same month last year (for example, December 2021).

This number rose to 69.8% in September 2022 and now has declined to 57.2% in December 2022. The underlying monetary rhetoric is that inflation has peaked and, therefore, disinflation path commenced. This only misleads the political masters who do not understand statistics as the public does not benefit from such disinflation.

Present inflation rhetoric is only a statistical exercise for the consumption of relevant intellectuals.

- First, disinflation does not show any easing of prices. For example, in December 2022, the index rose to 243.2 from 242.6 in November 2022. However, inflation has declined from 61% in November to 57.2% in December. In months to come too, disinflation will continue even if prices prevail at elevated levels compared to prices enjoyed by the public in 2020. Therefore, disinflation is only a statistical illusion called base effect and not any easing of actual prices.

- Second, the CB’s official inflation forecasts are always incorrect. The CB itself accepts it and still publishes same (see two inflation forecast diagrams below). Although the recovery from the crisis slips down without any brake and production collapses by 11.8% in the third quarter and by 7.1% for first nine months, diagrams show a considerable rise in disinflation path in the economy from previous monetary policy decision to new monetary policy decision. Therefore, the disinflation forecast that CB itself does not accept serves no purpose.

- Third, the CB’s claim that inflation will fall to below 10% in December this year is not only a credible claim but also a meaningless policy statement. If a 10% inflation rate is assumed for December 2023, the CPI will be 267.5. This shows a further rise in the cost of living. It will be an 85.6% increase as compared to the CPI in September 2021 (144.1), the month before inflation started to rise above the target of 4%-6%. Therefore, the economy will recover and living conditions will be eased only if the CB can reduce prices to levels that prevailed in September 2021. The CB cannot do it as it cannot control prices or supply goods and services at such market prices.

- Fourth, if central banks cross the world had any handle in controlling inflation and keeping the price stability, historic inflationary pressures spread across the world since the end of 2021 would not have been possible because all central banks are said to be inflation busters.

Overall, disinflation or inflation control rhetoric is a fraudulent act of the Monetary Board.

4. Early warnings of near-term systemic threats

The new OMO rule-based bureaucratic monetary policy model has caused a panic volatility in the money market (see images C1, C2 and C3). Systemic risks hidden in the economy are generally triggered in the money market when the public trust in finance is lost at some points on the financial supply chain. As everybody in the economy is connected to each other through modern money and banking, a default or distrust at one point on the chain will spread across everybody in the economy. This is an established fact, not a concept.

So far, nobody has been able to predict such systemic risk triggers until they hit unexpectedly due to bureaucratic delay of early preventive actions by central banks. Shadow banking is the mostly experienced trigger point. The common sense is adequate to feel systemic risks waiting to burst at any time, given the bankruptcy of everybody in the economy including banks and financial investors.

Therefore, new OMO rule-based monetary operations and market manipulations have potentials to trigger systemic risks that CB’s macroprudential experts will never detect but talk. To foresee any luck for Sri Lanka to escape a banking crisis in the current context of the economic crisis is difficult when the global literature of financial crises is reviewed. The accounting-based capital ratios, liquidity ratios and asset quality ratios generally used by central banks to show banking business soundness in normal times are artificial and meaningless in crisis times where only the public trust matters, irrespective of ownership, size and quality of individual banks.

Therefore, panic volatility and black money market dealings caused by the new OMO rule-based monetary policy could be the sources of possible triggers of near-term systemic threats waiting to burst at any moment.

5. The baseless and meaningless policy statement

Contents in the policy statement as per the press release show expectations and imaginations beyond the monetary policy. Some contents have been copied from policy statements of central banks in developed countries. There isn’t any monetary policy specific information regarding the disinflation path and the recovery of the economy.

Instead, it refers to fiscal policy and various other factors as the Monetary Board is not sure of outcomes of its policy. The policy statement suffers repetition of words used in the rhetoric and unorganized long paragraphs as nobody has paid any attention to the presenting order of contents but merely attempted to draft a rosy story not even understood by the person who drafted it. Some of the meaningless contents are commented below.

Content 1

“The Board, having noted the recent and expected developments and projections on the domestic and global macroeconomic fronts, was of the view that the maintenance of the prevailing tight monetary policy stance is imperative to ensure that monetary conditions remain sufficiently tight to rein in inflationary pressures. Such tight monetary conditions, together with the tight fiscal policy, are expected to adjust inflation expectations downward, enabling the Central Bank to bring inflation rates towards the desired levels by end 2023, thereby restoring economic and price stability over the medium term.”

My Quick Response

Wordings “monetary conditions remain sufficiently tight to rein in inflationary pressures” are copied from developed country central banks. They normally use the words “financial conditions” instead of “monetary conditions” as modern monetary policies are not targeted on old money supply concepts. They also refer to interest rates “appropriate to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” However, when compared to those market economies which nowadays do not confront any economic crisis or monetary policy bottlenecks, it is meaningless to use these words for Sri Lankan monetary policy.

Words “inflation expectations” also are repeatedly copied words from western central banks. They generally talk about anchoring inflation around them inflation target. While monetary policies do not have instruments to target expectations rather than talking, central bank do not publish statistics on inflation expectations. It is absurd to talk about the public expecting easing of prices and inflation because of the presently tight monetary and fiscal policies and enabling the CB to reduce inflation to desired levels by end of 2023. The desired level is not specified. As nobody believe in inflation stories painted by the CB, no inflation expectation can be expected to favour the monetary policy. Further, the general public is not aware of inflation statistics used by the CB and they only feel prices of goods and services in their consumer baskets.

It is also absurd to state that bringing down inflation towards desirable level by end of 2023 will enable the CB to restore economic and price stability over the unknown medium term. The current high inflationary pressure are a result of grave economic instability caused by a host of factors including the CB’s foreign exchange policy. Therefore, the CB cannot reduce macroeconomic inflation unless it can resolve causal factors behind inflation. However, statistical inflation will anyway fall due to base effect even if the CB prints money at current rates.

Therefore, the CB getting ready to claim full credit to the tight monetary policy for the reduction in statistical inflation event at presently red-hot 57% as usual is a meaningless act.

Content 2

“The downward adjustment in inflation rates is expected to continue through 2023, supported by subdued aggregate demand resulting from tight monetary and fiscal policies, expected improvements in domestic supply conditions, and the passthrough of easing global commodity prices to domestic prices, along with the favourable statistical base effect.”

My Quick Response

This presents all possible factors under the sun as monetary policy cannot detect its effects on prices. As already explained above, downward adjustment is on statistical inflation and not on actual inflation and prices confronted by the public in the economy.

The fiscal policy is tight not because of a specific policy strategy but because of the govt. bankruptcy caused by the CB debt management and Treasury management. the Treasury Secretary publicly laments the chronic shortage of funds getting aggravated, even not being able to provide Rs. 10 bn for the local election in motion.

Reference to favourable statistical base effect as a factor to reduce prices and cost of living in the economy is a joke.

Content 3

“With tighter monetary and fiscal policies in place, along with disruptions to domestic supply conditions, real activity in the final quarter of 2022 is also expected to have remained subdued. The economy is expected to make a gradual recovery during the year supported by the expected improvements in domestic supply conditions, underpinned by the timely implementation of corrective policy measures. Meanwhile, the anticipated improvements in foreign exchange flows and the resultant enhancement in business and investor sentiment are expected to reinforce the expected recovery in the period ahead.”

My Quick Response

Real activity in 2022 is not subdued but has collapsed by wrong monetary and fiscal policies. It is questionable why tight monetary and fiscal policies are pursued, knowing that real activity is subdued.

What are the corrective policies implemented for gradual recovery of the economy during the year are not stated.

Anticipation to improve foreign exchange flows and investor sentiments without stating specific policy actions required has no meaning. What most matters for the recovery is the inflow of foreign exchange, not the flows. The CB expects unknown investor sentiments to improve foreign exchange flows.

Content 4

“The envisaged finalisation of the IMF-EFF arrangement in the period ahead and the resultant developments that follow, along with the improvements in the external current account, are expected to enhance the external sector outlook.”

My Quick Response

The present Governor assumed the post with a promise to save the country with a loan from the IMF under Rapid Financial Instrument in three months. Relevant authorities had an exhibitive visit to Washington immediately after new appointments. Subsequently, the politically elected President fled the post, the economy crashed into the bankruptcy, living standards collapsed to pre-1977 levels and IMF loan dragged on to unknown months.

Even if the IMF loan is received, the amount of 2.9 bn USD in several tranches in years serves no purpose, given the extent of the country’s crisis. If that can improve the external current account and outlook of such a bankrupted, politically destabilized and socially agitated economy, the IMF and its agents deserve divine treatment.

However, the IMF now seems to be acting like a secured money lender by asking financial assurances from external parties to lend member countries struggling in crisis. It is reported that the IMF prepares to lend 15 bn USD to war-torn Ukraine on financial assurances provided by the set of wealthy nations supporting Ukraine to fight the war.

Content 5

“The Board was of the view that the current monetary policy stance is appropriate to ensure that underlying monetary conditions in the economy remain sufficiently contained to drive inflation along the envisaged disinflation path.”

My Quick Response

The CB has not given information to prove the sufficient containment of underlying monetary conditions connected to envisaged disinflation path which is meaningless as already presented above. The envisaged disinflation path also has not been officially released as the inflation forecast shown in the diagram in the press release is not accepted by the CB itself.

Content 6

“Excessive market interest rates have begun to adjust downward and are expected to ease further in the period ahead Early signs of a gradual easing of excessive market interest rates have been observed recently in response to the administrative measures adopted by the Central Bank, along with the improvements in domestic money market liquidity and overall sentiments in the domestic markets. Recent measures adopted by the Central Bank to reduce the overreliance of licensed commercial banks on the standing facilities of the Central Bank and the concurrent conduct of open market operations helped improve liquidity in the domestic money market. This prompted activity in the interbank money market. Improved liquidity conditions, along with improved investor sentiment on the anticipation of “financing assurances” from official creditors, led to a notable moderation in the yields on government securities recently, reflecting the easing of the high risk premia attached to government securities. Meanwhile, the market deposit rates have also shown a notable moderation, benefiting from improved liquidity conditions. These developments are expected to pave the way for an easing of excessive market interest rates in the period ahead. Nevertheless, outstanding credit extended to the private sector by commercial banks continued to contract in response to the tight monetary conditions and the moderation in economic activity. Monetary expansion also moderated from peak levels, albeit at a slower pace.”

“While some downward adjustment in market interest rates has been observed lately, the Monetary Board is of the view that there is sufficient space for excessive market interest rates, including lending interest rates to Small and Medium Sized Enterprises (SMEs), to adjust downwards considering the recent improvements in domestic money market conditions and sentiments along with the moderation in the yields on government securities.”

My Quick Response

The CB now attempts to blame the banks and money market for excessive interest rates. It brings the subject of lending rates to SMEs to create political issues for banks. The problem of SMEs is not just excessive interest rates but unavailability of credit and credit restructuring to deal with present bankruptcy situation.

“Sufficient space for excessive market interest rates to adjust downwards” is meaningless as the CB does not give any indication or the estimate of the space. There is no fundamental improvement in domestic money market conditions for downward adjustments in market interest rates. The administrative OMO only manipulated the market through reverse repo injection of around Rs. 400 bn on 10 days from 4 January in the new year so far (see Table 1, images C1, C2 and C3). Inter-bank and repo market did not recover but underwent a panic volatility.

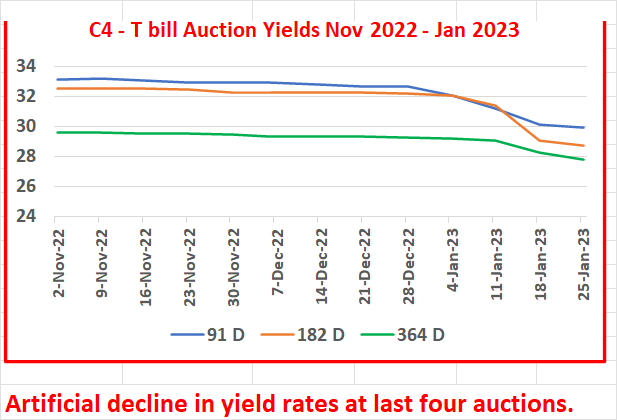

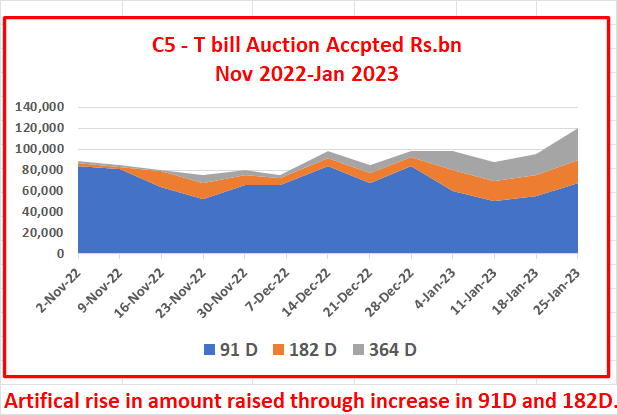

The moderation in the yields of government securities is not a factor to affect interest rates on risky loans, given the moderation also appears to be a manipulated and marginal event from their high levels around 33% since July 2022, despite the CB’s excessive intervention through money printing and private placements. At last four Treasury bill auctions, subscriptions have dramatically risen for all three maturities due to restricted standing deposit facility. Therefore, the four auctions alone could raise Rs. 401 bn, nearly 12.6% of total funds raised from April this year, at falling yield rates (i.e., by 1.5%-3.5%), despite the tight monetary policy, where a historic Rs. 125 bn was raised at the last auction (see images C4 and C5). The demand for post-auction placements also has risen noticeably. That is the reason for moderation of yield rates .

It appears that the hidden purpose of new OMO rule is to drive funds to government securities market to push yields downwards in order to prepare for a policy rate cut. This is an unfair market manipulation and an insider dealing not supported by market fundamentals.

However, this could well be a temporary development, given rising shortages of public finance. Therefore, there is no basis for sentiments to be expected from anticipated financial assurances and improved liquidity in the domestic money market to moderate yields as market participants know actual story under financial assurances, public finance and OMO manipulations.

Everybody knows that the government is going into a deeper bankruptcy not being able to pay even monthly salaries and pensions on the due dates and to fund the democracy by providing Rs. 10 bn for the scheduled local election. In such conditions, reference to easing of high-risk premia attached to government securities in view of downward yields has no basis as marginally downward yield rates are highly driven by inside monetary operations which is an irresponsible and unlawful act. Therefore, talking about sentiments along with moderations in the government securities yield rates is unfounded and deceitful.

The reliance or the use of standing facilities under OMO is the decision of respective banks, given their liquidity management and market conditions. The very purpose of standing facilities is the fair market regulation.

Therefore, it is unprofessional for the CB to use the standing facility window as the conduit for hidden, cross purposes. Bureaucratic or moral suasion to force banks to stay away from the window and resort to risks of markets in the present context is both unfair and systemically risky.

Credit delivery in the national interest is a subject of the monetary policy and not a business priority of individual banks. Further, while keeping monetary conditions excessively tight, the CB’s attempt to force banks to lower interest rates and lend in national economic interest is a miserable policy conflict.

If the CB wishes to drive a reduction in market interest rates and activate money market and lending, the easiest way is to cut the policy rates and withdraw the new OMO rule without trying to catch the nose through backside of the head. Further, the CB must withdraw the Monetary Board Order issued on 21 April 2022 which forced the banks to raise deposit interest rates in line with present policy interest rates. Lending rates can come down only if deposit rates come down supported by monetary policy relaxation. This is a, b and c in the monetary policy.

Therefore, the CB has no right to blame the banks for high interest rates at present, given the fact that the very purpose of high interest rates is the brave inflation controlling monetary policy in its textbooks, despite the supply side of the economy has crashed.

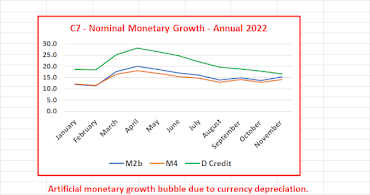

The contraction in private credit and moderation in monetary expansion referred to above are misleading as monetary statistics from March 2022 are artificially inflated by the currency depreciation policy implemented on 7 March 2022. Therefore, outstanding credit and money supply M2b (nominal terms) remain at elevated levels (see images C7 and C8). Some deceleration in private credit in recent months is largely due to crowding out of private credit to government securities in view of extraordinarily high credit risk of the private sector attributable to the economic bankruptcy.

However, it is observed that credit and monetary growth is below zero when currency valuation effect is removed. This is revealed from negative growth of real credit and money between 20%-32% since June 2022 (see image C6). Therefore, maintenance of such a tight monetary policy until disinflation on the statistical inflation reaches 4%-6% target when the real growth of money and economy remains at high negative levels is a public policy crime.

The ratio of money supply to reserve money (known as money multiplier) is seen an unreasonably upward trend despite high interest rates and tight monetary policy (see image C9). This seems to be a result of the manipulation of the CB balance sheet unreasonably to show a deceleration in reserve money at month-ends with the political motive of fabricating a story of a decline in money printing by the present Governor.

Overall Observations

As presented above, contents in the monetary policy statements and information on recent monetary operations and trends provide good evidence for incompetence of the Monetary Board and monetary policy economists of the CB to conduct a model of monetary policy required to stop the crashing economy and help the recovery thereafter without daydreaming of the IMF and talking about difficulties and difficult decisions.

In fact, if the CB follows standard inflation targeting monetary policy similar to many central banks led by developed countries, it should have further raised policy interest rates as inflation is red hot close to 60%, i.e., nearly 12 times the CB’s inflation target (4%-6%) although it has peaked. Inflation in many countries including developed countries has now peaked and started to decelerate, but their central banks have announced that they would continue to hike interest rates at a slower phase as inflation rates are still significantly high levels, i.e., 4-5 times the official target of 2%. Therefore, the Monetary Board has violated the policy standard and principle.

Experts have been appointed to high-ranking public seats to provide solutions to public difficulties and not to enjoy those public seats like freshers while talking about difficulties and blaming everybody for such difficulties. It is evident that these officials have no innovative policy strategies other than old policy files to resolve burning problems confronted by the public to survive. Political leaders who keep them in public seats are equally answerable to the public.

Monetary policy is not a topic in theology that only those who have seen old files can perform it and what they state are the words of God as they believe. The policy is also not a private property belonging to those who hold or have seen policy files and attended international seminars.

A person who has common sense in business and money can perform the policy better if he/she is guided and disciplined by the relevant statutory provisions on public mandates. The practice of the policy in violation of statutory provisions, as in the case of the present CB, is legally punishable as it helps undue benefits to insiders.

The excessive contraction of the economy continuing with high interest rates and restrictive monetary conditions blocking monetary needs of the contemporary economy is a subject for public litigation under fundamental rights against the willful breach of public trust by relevant policy-making officials.

The socio-economic catastrophe presently suffered by the public is wider in coverage than isolated incidences of terrorism and wars. Children becoming malnourished, dying the sick without medicine, parents and young loosing jobs on business bankruptcies and borrowers trapped in excessive interest rates determined by bureaucrats and cutting livings standards to pay taxes for funding the political leaders and their bureaucracy in crisis are not second to instances of massacre.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2023/01/vandalized-and-lost-plight-of-sri.html