By:Staff Writer

January 27, Colombo (LNW): Sri Lanka’s land market continued its upward trajectory in 2025, signalling renewed confidence in real assets despite broader economic uncertainties. The latest updated Land Price Index (LPI) published by LankaPropertyWeb (LPW) shows that suburban and peri-urban areas—rather than central Colombo are now driving both transaction volumes and price appreciation, with clear spillover effects on construction, household wealth, and regional development.

According to the index, average land prices in Colombo’s prime city limits (Colombo 1–15) rose by a modest 4% year-on-year to Rs. 12 million per perch. In contrast, Colombo’s suburban belt recorded a stronger 8% increase, averaging Rs. 2.3 million per perch, underlining a decisive shift in buyer preference toward affordability and expansion potential.

The trend is even more pronounced across the wider Western Province. Gampaha District posted a 15% increase in average land prices to Rs. 769,097 per perch, while Kalutara recorded a 10% rise to Rs. 486,396. These gains reflect sustained demand for residential land sales, driven by new housing projects, infrastructure upgrades, and improved connectivity.

Specific localities stand out. Yakkala and Homagama emerged as top performers, each recording 35% price growth in 2025. Negombo and Bandaragama followed closely, while areas such as Piliyandala, Kaduwela, Pannipitiya, Moratuwa, and Nugegoda posted gains exceeding 25%. These locations are increasingly seen as viable alternatives to central Colombo for both end-users and investors.

From an economic perspective, rising land prices support balance sheets across households and small developers, stimulating construction activity and related employment. However, the slower growth in core Colombo where some areas recorded minimal gains suggests that demand is becoming more selective, favouring value and livability over prestige.

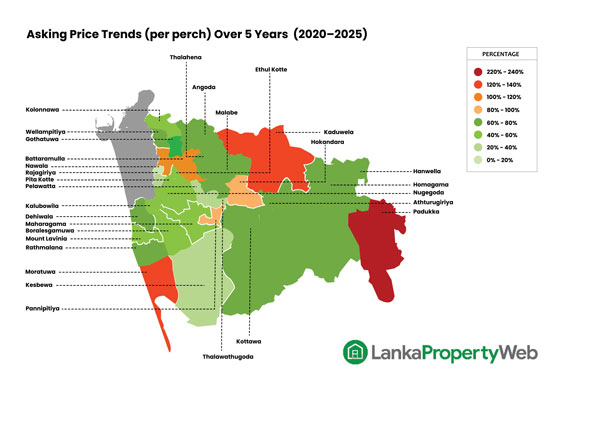

Longer-term data reinforces this structural shift. Between 2020 and 2025, land prices in towns such as Ingiriya, Padukka, Ragama, and Dompe surged between 143% and 322%, far outpacing inflation and wage growth. These gains highlight the role of land as a hedge during economic stress while also raising affordability concerns for first-time buyers.

LPW notes that the momentum is rooted in accessibility and infrastructure-led development rather than speculative excess. Still, policymakers face a balancing act. Sustained land appreciation supports growth and local investment, but without parallel increases in income and housing supply, it risks widening inequality and urban sprawl pressures.

As Sri Lanka’s economic recovery stabilises, the land market is emerging as both a barometer of confidence and a driver of domestic investment particularly beyond Colombo’s traditional boundaries.