The Treasury bill yields continued their weeks-long descent to usher in the new year at the first weekly bill auction held yesterday for 2023 while the Central Bank also sold the entirety of bills it offered, extending the recent trend of full acceptance.

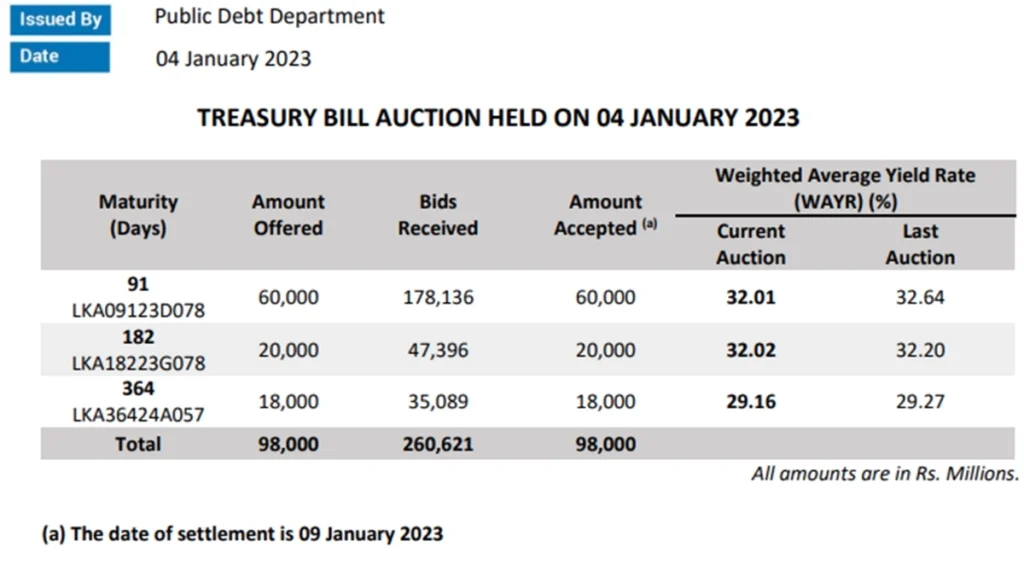

The Public Debt Department of the Central Bank sold Rs.98.0 billion in bills across the three tenures—Rs.60.0 billion under three-month bills, Rs.20.0 billion under six-month bills and Rs.18.0 billion under 12-month bills, matching the level of acceptance under the three tenures, respectively.

There has been a large tilt towards the acceptances under three-month bills in recent times, due to expectations that the elevated yields would remain only for some time.

While the yields have in fact eased from their recent peaks, such easing has been slow and has happened by extremely little amounts.

At the auction held yesterday, the three-month yield declined 63 basis points to 32.01 percent, the six-month bill shed 18 basis points to 32.02 percent while the benchmark 12-month bill came off 11 basis points to settle at 29.16 percent from their previous week’s levels.

Despite the yields of the government securities have eased somewhat, market interest rates haven’t budged, the data available through November showed.

While the Central Bank had indicated its desire to see some notable decline in the rates since November, it appears that it hasn’t materiali’ed up to now.

The Central Bank this week imposed certain restrictions on the banks of their ability to access the overnight window under the Standing Deposit and Lending facilities.

If the Central Bank still fails to see meaningful easing in the market rates, the next step could be to impose ceiling rates on deposits and select lending products offered by banks.

The elevated yields and market rates also reflect the sentiments of investors and other market participants on the current and future outlook of the economy.

The government is also offering daily by raising taxes in an ad hoc manner outside the budget, which was presented less than two months ago, raising questions if the government has a clear fiscal and an economic policy towards economic recovery.