Economy Forward: The Central Bank (CB) introduced a new monetary policy model with standard policy interest rates (SDFR and SLFR) added with restricted standing facilities (taking overnight deposits and overnight lending) (OMO) from mid January 2023.

This article is to highlight outcomes of the new policy model during the first quarter 2023 covering monetary operations and market developments through a short graphical presentation. However, an analysis of micro perspective behind such developments is not the purpose of this article.

The article reveals the prevalence of monetary manipulations that could cause systemic triggers in the event the authorities delay the policy response.

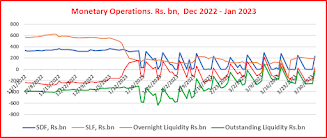

Monetary Operations

- Standing operations and liquidity level fluctuated in an unusual volatility.

- Money printing through the direct purchase of Treasury bills by the CB rose significantly to provide monetary liquidity to the economy through fiscal operations.

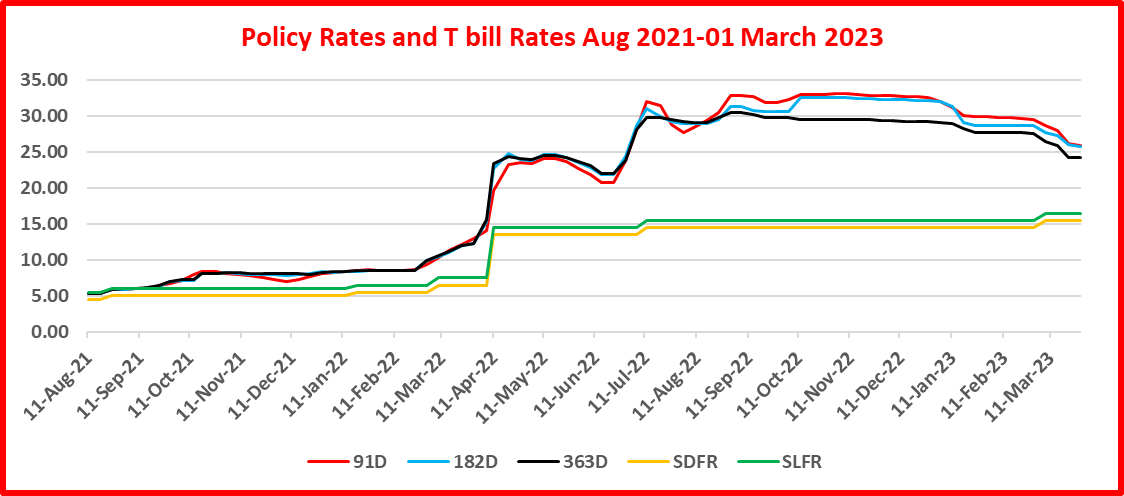

- Policy rates were raised by 1% to 15.5%-16.5% on March 3 by following the IMF advice blindly without any macroeconomic justification.

- Although policy rates continue to increase due to grave concerns over hyper-inflation broad-based across the economy above 50%, Treasury bill weekly auction yield rates were brought down artificially against prevailing market conditions arising from continuously rising funding requirement and heightened risks of domestic debt restructuring anticipated. The CB’s direct purchases, post-auction private placements and insider captive funding have been used to suppress and reduce yield rates outside general market conditions.

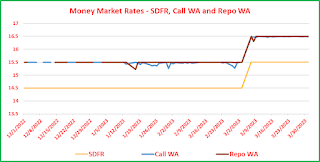

Overnight Money Market

- Although new OMO restrictions were introduced with the motive to bring down market interest rates through increased market activity, a different market outcome is observed.

- Although market volume rose in the second of of February, it has come down back to low levels towards the end of March.

- Further, money market rates stood around upper bound of policy rates without showing any sign of decline predicted by the CB.

- Overall, monetary operations and money market developments are not aligned on the motive of the new monetary policy model.

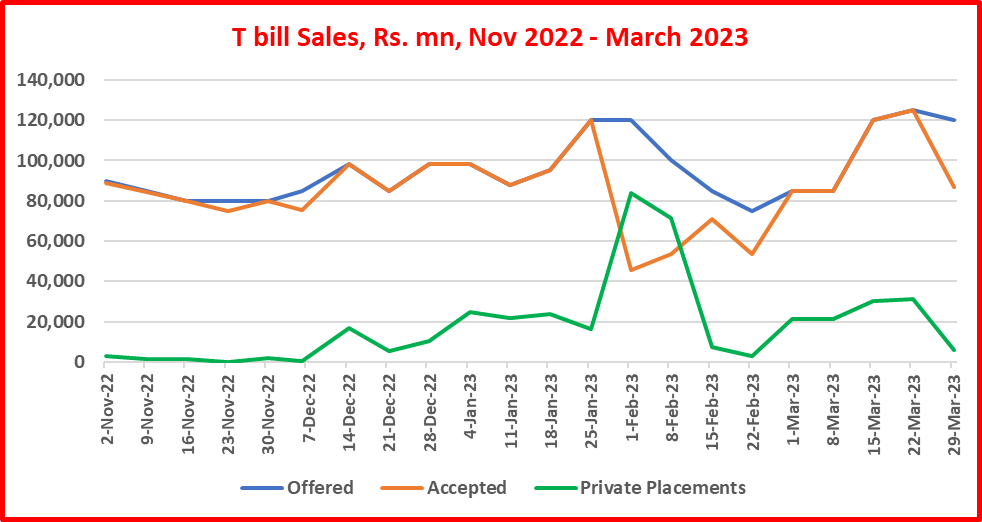

Treasury bill Market

- Post-auction private placements offered at auction weighted average without limit have been used, not only to fill the deficit but also to raise funds above the announced amount due to chronic shortage of funds.

- 91D bills and post-auction private placements (bill maturities not disclosed) have been the major funding categories of funding. However, in March, 182D and 364M bill maturities also have gained importance along with private placements.

Foreign Exchange Market

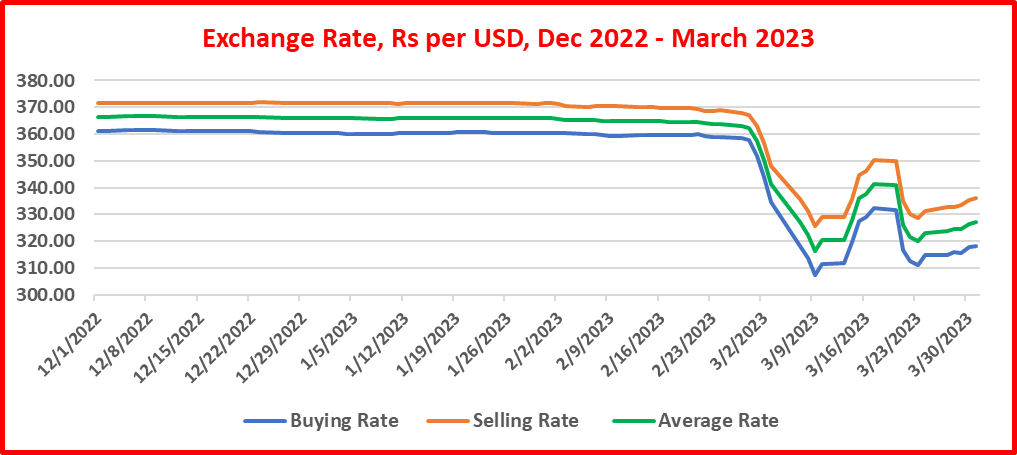

- In March, exchange rate has been unusually and unexpectedly volatile against prevailing fundamentals in the country’s crisis-hit foreign currency market prevailing since 2021.

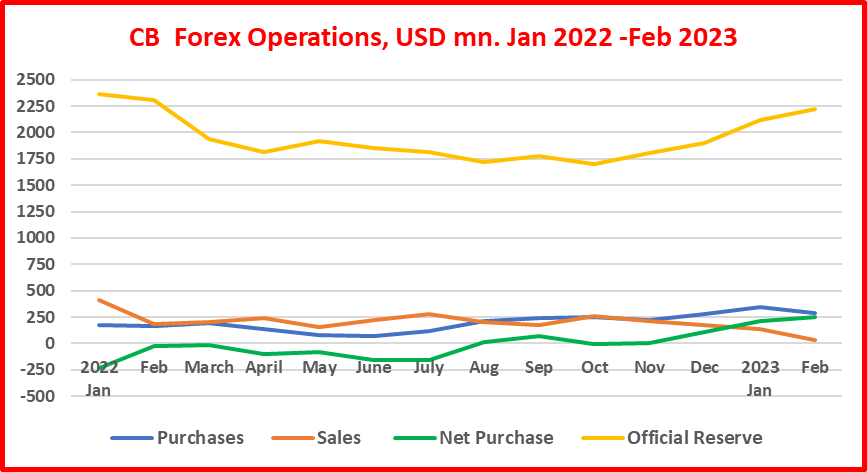

- The unusual degree of volatility and Rupee appreciation observed from the beginning of March is not supported by the CB’s foreign currency operations as reported. The improvement in net foreign purchase and official reserve in the quarter (information for March is not available) is still marginal and, therefore, market conditions behind such a cyclical change in the value of the Rupee are highly deceptive, given the country’s foreign currency crisis and the protracted delay in foreign debt restructuring despite ambitious public promises by the authorities.

- It is astonishing to hear the CB stating that the collapse of the US dollar in Sri Lanka was prevented by the CB through its purchase of about 308 mn of dollars at the dawn of March.

- Further, forex purchases and foreign reserve are seen highly temporary as they are operated largely on recently introduced currency swap auctions, which is the return to old swap game in a new clothe.

- The joint press release of the Treasury and the CB dated 30 March also accepts continued difficulties in foreign currency as noted below although the authorities’ purpose of telling this to the public is highly questionable, despite the God-given IMF macroeconomic rescue policy package.

“Despite the ambitious fiscal consolidation efforts, Sri Lanka’s public debt trajectory is set to remain unsustainable in the absence of a comprehensive debt treatment. Sri Lanka is also facing a significant external financing gap over the IMF program period. This financing gap will have to be covered through new external funding and external debt service relief.”

- As such, sources of bridging the external financing gap and gaining debt service relief due to chronic debt restructuring issues and international distrust in Sri Lanka are highly uncertain. Therefore, sustaining the forced currency appreciation or any exchange rate stability is seen very weak.

Concluding Remarks

- Developments in monetary operations, money market and foreign exchange market in the first quarter 2023 show highly irregular movements that cannot be supported by the standard tight monetary policy stance pursued by the CB since beginning 2022. Therefore, such irregularities could be outcomes of the CB’s undisclosed interventions outside the standard monetary policy.

- Market stability is the bread and butter sought by regulatory and supervisory authorities around the world for the financial stability. Therefore, unusual levels of volatilities and uncertainties in the money and foreign exchange markets are indicative of systemic risks of contagious liquidity distress, given the country’s real and financial sector problems. This could especially be exacerbated by the banking turmoil spread in advanced market economies beginning March consequent to significant interest rate risk on bank deposits and liquid assets in government securities caused by the red hot interest rate policy of the central banks.

- Therefore, monetary, regulatory and supervisory and fiscal authorities need to be of heightened alert and preparedness to counter any such liquidity issues before they pose systemic problems.

- However, the current stance of monetary and fiscal policies pursued om IMF requirements is highly inappropriate for forestalling possible triggers of any such systemic risks.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2023/04/monetary-manipulations-in-q1-2023-are.html