This short article is an update on the previous article on this subject (See previous article) to cover the month of October.

The article continues to raise grave concerns over the present model of monetary policy as it is carried out only to fund wholesale money dealers seeking short-term profit as against a policy of wider credit distribution required across the sectors targeted to revive the economy.

The target group of the article is the economists conversant with new concepts and practices on the monetary policy.

What are the present monetary operations in Sri Lanka?

Monetary operations are the money printing operations carried out by the CB on a daily basis for the purpose of keeping the inter-bank daily liquidity conditions consistent with the monetary policy decisions. Key monetary policy decision made in the present monetary model is the level of two policy interest rates, i.e., standing deposit facility rate (SDFR) and standing lending facility rate (SLFR) or policy interest rates corridor.

These are the interest rates applied by the CB for its overnight financial operations with commercial banks. In addition, instruments such as SRR are used on need-basis to have further effect on bank liquidity conditions.

The prime objective of monetary operations is to limit the variability of overnight inter-bank interest rates within the policy interest rates corridor. Therefore, the monetary policy is a price control-based market intervention.

However, other central bank uses different policy models.

What are the present monetary operation instruments?

Standing facilities, reverse repo lending and direct purchase of Treasury bills have been the mostly used instruments in 2023 so far.

- Standing facilities – CB’s acceptance of deposits and lending on overnight basis at SDFR and SLFR with commercial banks and primary dealers. Since the middle of January 2023, the facility has been subject to caps for commercial banks, i.e., the deposit facility to any bank only five days a month and lending facility only to 90% of the SRR of a bank any day.

- Reverse repos – CB’s lending to banks and primary dealers against government securities on overnight or other terms through competitive auctions. Overnight and 7-day reverse repos are seen regularly.

- Direct purchase of Treasury bills – CB’s purchase of Treasury bills as and when necessary to control yield rates by providing funds directly to the government. This indirectly enhances the inter-bank market liquidity and reduces the pressure on interest rates.

- Intra-day liquidity facility – This facility provides funds free of interest charge banks and primary dealers against collateral of government securities for payment purposes, subject to repayment within the day. Therefore, it is a significant source of liquidity for funding their daily business needs. However, the CB does not release relevant data. In 2022, daily average use of funds was around Rs. 658 bn (total annual amount of Rs. 51 trillion) which is a huge sum of free funds.

What are the key monetary policy decisions taken in 2023?

- Policy interest rates – raised by 1% to 15.5%-16.5% in March and then reduced by 5.5% to 10%-11% so far from the end of May.

- SRR – cut by 2% to 2% to free nearly Rs. 200 bn of reserves to commercial banks.

- Stipulation of maximum interest rates on bank credit products – This is to require banks to reduce interest rates in line with the present easing cycle of the monetary policy.

Highlights of Monetary operations

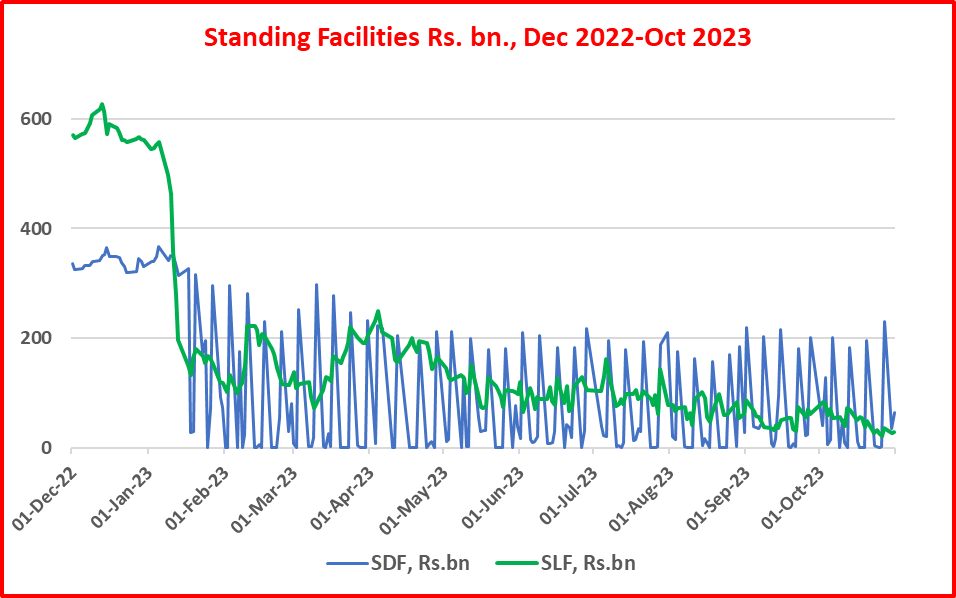

- Standing Facilities – SDF and SLF operations

Due to caps imposed with effect from 16 January 2023, this window has virtually collapsed (see Chart 1 below) as shown by highly irregular volatility of the facilities. This has led banks to resort to other options for daily liquidity management and confronted significant market volatilities. Further, policy interest rates corridor-based monetary policy concept also has collapsed due to caps/rationing of standing facilities.

Chart 1

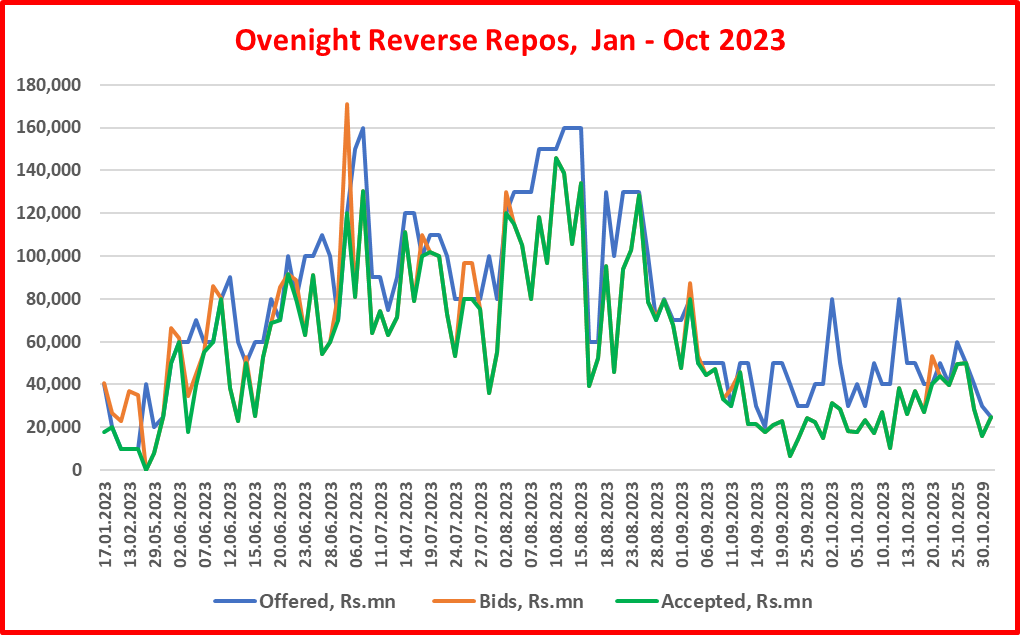

Reverse repo lending

This has become a regular event to prevent the rise in inter-bank interest rates above the policy rates corridor consequent to caps on the lending facility.

Accordingly, nearly 198 auctions offered Rs. 11,195 bn and accepted bids of Rs. 8,493 bn (76%) out of total demand for Rs. 10,537 bn.

- Overnight reverse repo auctions became a daily routine with 86 auctions offering Rs. 7,905 bn or 70% of all auctions (see Chart 2 below). Average overnight auction amount was Rs. 74 bn with the acceptance rate of 76.2%.

- A fast reduction in overnight volume is seen from the mid-August due to the reduction in funding requirements consequent to significant contraction in bank credit operations. Therefore, the significant volatility is a stability concern.

Chart 2

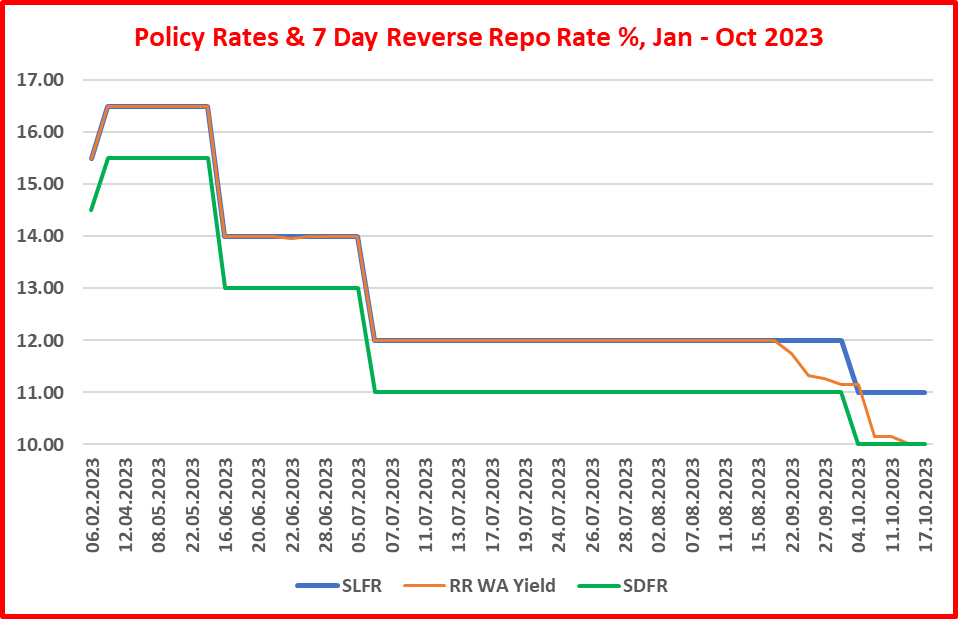

- The determination of rates at overnight auctions is questionable on several grounds (see Chart 3 below). First, rates have been lower than SLFR by about 40-90 basis points although credit quality is same for both types of lending. Second, rates have been mostly lower than overnight call money rates by about 10-40 basis points. Therefore, overnight reverse repo rate has become the de-facto policy interest rate used to drive the inter-bank market. This is because of the collapse of the policy rates corridor as stated above. Third, the overnight reverse repo rate has seen converging towards the SDFR, the lower bound of the corridor, in most part of October.

Chart 3

- 7-day reverse repo auctions also were used frequently to inject short-term funds so that the pressure on overnight inter-banks rates is held down (see Chart 4 below).

- Accordingly, 50 auctions offered Rs. 1,865 bn with the acceptance rate of 78.8% (Rs. 1,480 bn).

- The significantly higher demand/bids for 7-day funds has been a general feature. Therefore, the CB has misjudged the demand by offering lower amounts.

Chart 4

- Holding 7-day reverse repo rates at the level of or below the SLFR is highly questionable as to why banks were offered funds cheaper than the overnight SLFR while restricting the standing lending unnecessarily (see Chart 5 below). However, since the last week of September, 7-day reverse repo rates have been declining well below the SLFR and touching the SDFR, which has no rationale in economics of term premium.

Chart 5

- Long-term reverse repo auctions of several tenures from 10 days to 89 days also have been conducted in an irregular manner, probably targeting resolution of liquidity problems of identified dealers. Nearly 39 such long-term auctions offered Rs. 1,185 bn and accepted Rs. 1,010 bn (74%). The basis and levels of rates of these auctions are seen highly questionable as to what the monetary policy relevance is, given the fact that the monetary policy is exclusively driven for the target of overnight inter-bank rates.

- Direct purchase of Treasury bills

- It has been customary for the CB to subscribe to Treasury bill issuances in order to control short-term interest rates in line with the monetary policy. In fact, the Treasury bill auction yield has been a de-facto policy interest.

- Accordingly, the CB has been managing the monetary system broadly with a government securities portfolio in the range of Rs. 2,500 bn and Rs. 2,600 bn on a daily basis during the reference period. Several bumps above Rs. 2,500 bn to Rs. 2,800 bn were also reported (see Chart 6 below).

- The bump reported on 21 September is specific to the conversion of outstanding provisional advances (Rs. 344.7) made by the CB to the government into government securities under the domestic debt optimization concept. As a result, the CB’s holding of government securities rose to a historic high of Rs. 2,901 bn (face value). However, the reason for its decline to around Rs. 2,839 bn on 22 September is not known. As the CB has not subscribed to any Treasury bill issuances after 21 September, the portfolio remains unchanged at around Rs. 2,839 bn. As a result, the conversion is only a change in book entries.

Chart 6

- Overall outcome on liquidity

- Overall, the amount of net liquidity (injected or absorbed) resulting from monetary operations has been highly irregular (see Chart 7 below) on both overnight basis and outstanding basis. The injection on overnight basis has declined due to drastic restrictions/rationing on standing facilities.

- However, the injection on outstanding basis has remained higher due to the cumulative effect of term reverse repo auctions pursued to push the inter-bank interest rates artificially down.

- A drastic decline in injection is observed in September-October despite the monetary policy easing shown by the policy rates cut of 5.5% since the beginning of June. In fact, liquidity injection should rise in the monetary easing cycle if monetary principles are adhered to. Therefore, irregularities observed in the liquidity levels and interest rates raise concerns over the real motive behind monetary operations.

Chart 7

Money market outcomes of monetary operations

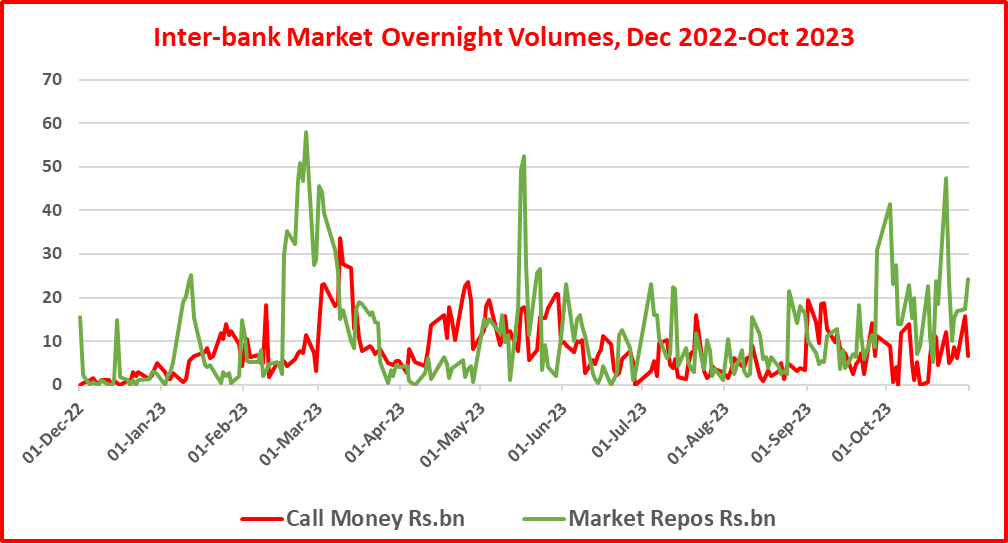

- Overnight inter-bank market (volumes and interest rates)

The data do not support the monetary policy hypothesis of restricting standing facilities in mid-January. i.e., to activate the inter-bank market (overnight call money and overnight repos) and drive down interest rates accordingly without policy interest rates cuts.

- First, inter-bank market volumes have not surged as expected (see Chart 8 below). Instead, market volumes have been highly volatile and remained at lower levels except few spikes.

Chart 8

- Second, inter-bank overnight rates (call money and repo rates) have been mostly around the SLFR, the upper bound of the policy rates corridor (see Chart 9 below). A downward movement is observed since August after 4.5% cumulative cut in policy rates since June. However, a parallel reduction is not observed from overnight market repo rates.

- The ease of the market liquidity due to a release of Rs. 200 bn consequent to the SRR cut by 2% in August could be an factor to push down call money rates, but this amount is not material enough to justify the fall of inter-bank market rates. However, a market aberration is seen as market repo rates have not declined parallelly.

Chart 9

- Treasury bill primary market

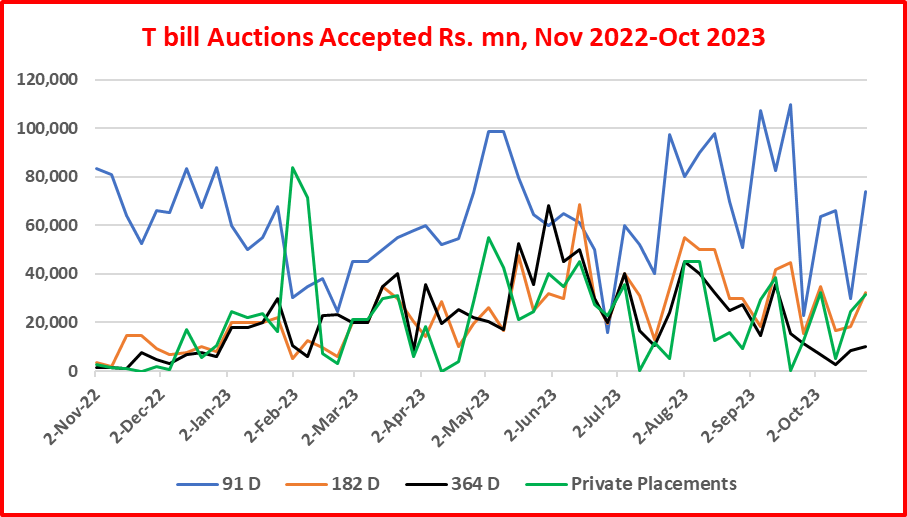

- The acceptance of bids in excess of offered amounts and rising access to post-auction private placements without exposing to bidding risk have been regular features of weekly auctions (see Chart 10 below).

- A significant reduction in the offer is observed after 21 September. The reason is the reduction in rollovers consequent to the conversion of the CB’s Treasury bill portfolio of around Rs. 2,556 bn (face value) into 10 new medium and long-term Treasury bonds (maturing from 15 March 2029 to 15 June 2038). Therefore, the government will have a significant fiscal space through borrowing from Treasury bill market.

Chart 10

- The market demand has been primarily for 91-D maturity, given significant uncertainties amidst the debt restructuring bottlenecks and debt sustainability concerns (see Chart 11 below). The significant volatility across accepted maturities is a grave concern over the market uncertainties.

Chart 11

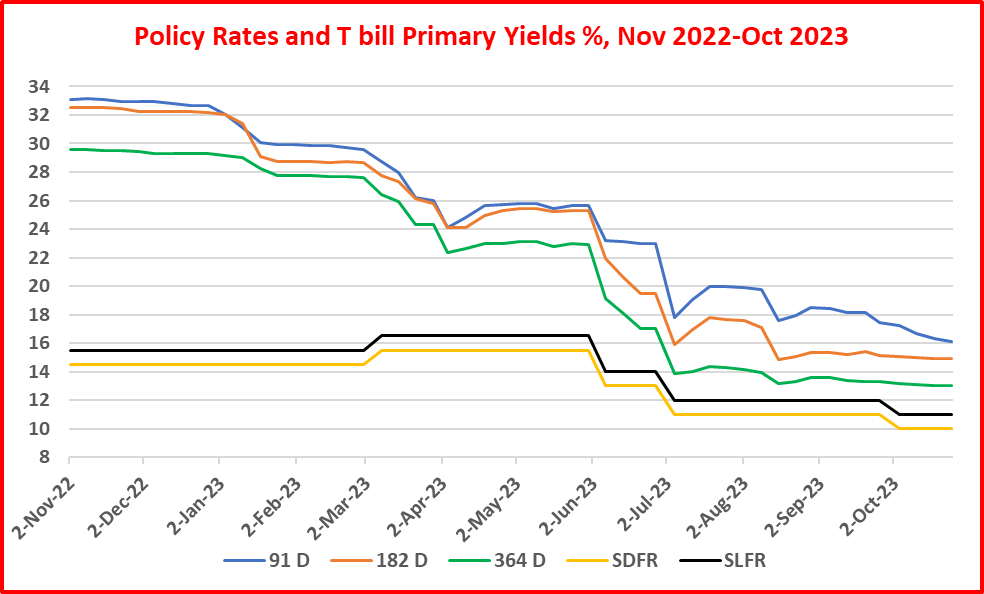

- As in the past, the manipulation of yield rates to serve the requirements of the monetary policy, given the limited scope available with policy interest rates-based monetary policy model, continued to be observed (see Chart 12 below). The conduct of auctions as well as underwiring by the CB have been instrumental in this manipulation.

- The CB’s reluctance to reduce Treasury bill yield rates during the last three months despite the monetary policy thrust on lower interest rates is questionable. Given the significant reduction in the offers in October, reduction in yield rates is seen too marginal and not commensurate.

Chart 12

- The new legislation permits the CB to subscribe to auctions up to the total outstanding of 10% of Treasury bill borrowing limit within a period of 18 months from 14 September. Therefore, the CB will continue to use Treasury bill auctions to manipulate short-term interest rates as usual without using monetary policy instruments.

Public Concerns

- Monetary operations to fund wholesale trades of short-term profit-seeking money dealers who does not pay any attention to financial stability and macroeconomic outcomes.

- Facilitating these dealers through reverse repo auctions that manipulate amounts and rates inconsistent with the present monetary policy model.

- Monetary system risks as private securities and shadow banks (finance and leasing companies) also are due to be covered soon in monetary operations consequent to new central bank legislation effective from 14 September 2023 while the purchase of government securities is prohibited after a period of 18 months from 14 September.

- Wholesale money dealers free to drive market interest rates as they wish because maximum interest rate regulation on bank credit products has now seized to operate consequent to the new central bank legislation.

- IMF 1st review concerns raised over financial stability requiring a roadmap for addressing banking system capital and liquidity shortfalls and improving the bank resolution framework which indicates no purpose of CB’s monetary/liquidity operations.

- Monetary operations not serving the recovery of the economy from the bankruptcy caused by the CB itself as monetary operations do not cover instruments to promote credit distribution across the needy sectors.

- Non-availability of audit and internal controls to guard against the loss to public funds arsing from such money printing carried out in arbitrary manner.

- National risk as no national leaders or economists are knowledgeable to voice concerns over the present monetary bureaucracy that has already bankrupted the economy.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Source: Economy Forward